American Financial Group, Inc. Announces Agreement to Sell Run-off Long-Term Care Business

April 14 2015 - 9:00AM

Business Wire

- Completes AFG’s exit from the

long-term care insurance market

- Estimated after-tax proceeds of

between $105 and $115 million, inclusive of tax benefit

- Estimated after-tax non-core GAAP

loss of between $105 and $115 million to be recorded in first

quarter 2015 results

American Financial Group, Inc. (NYSE/Nasdaq: AFG) today

announced that it has reached a definitive agreement to sell the

legal entities containing all of its run-off long-term care

insurance business to HC2 Holdings, Inc. (“HC2”) (NYSE MKT: HCHC)

for an initial payment of $7 million in cash and HC2 securities,

subject to adjustment based on certain items, including operating

results through the closing date. In addition, AFG may also receive

up to $13 million of additional proceeds from HC2 in the future

based on the release of certain statutory liabilities of the legal

entities sold by AFG.

The legal entities involved in the transaction, United Teacher

Associates Insurance Company and Continental General Insurance

Company, contain all of AFG’s $800 million in net GAAP long-term

care insurance reserves, as well as nearly $300 million of net GAAP

annuity and life insurance reserves. The transaction is expected to

close in the third quarter of 2015, subject to customary

conditions, including receipt of required regulatory approvals. In

accordance with generally accepted accounting principles, AFG will

record an estimated after-tax non-core loss on the sale in the

first quarter of 2015. Excluding the impact of potential future

proceeds, this loss is currently estimated to be between $105 and

$115 million, and may be adjusted based on final proceeds received

and final net assets disposed.

Due to a significant tax benefit from the sale, AFG expects to

receive after-tax proceeds of between $105 and $115 million from

the transaction (before any potential future proceeds). Similar to

above, the actual amount will be based on final proceeds received

and final net assets disposed. While the sale does not result in a

change to AFG’s 2015 core net operating earnings guidance,

management does expect the sale to be accretive to AFG’s earnings

and returns on equity over time as the proceeds are utilized.

The sale will have no financial or other impact on AFG’s primary

annuity subsidiaries, Great American Life Insurance Company and

Annuity Investors Life Insurance Company.

Craig Lindner, AFG’s Co-Chief Executive Officer and President of

AFG’s Annuity and Run-off Segments, stated: “This sale finalizes

AFG’s exit from supplemental medical insurance lines of business,

following the 2012 sale of AFG’s Medicare supplement and critical

illness businesses, where AFG recognized an after-tax gain of $114

million. The exit allows us to provide continued focus on our

annuity business, where we are a leading provider of fixed and

fixed-indexed annuities in the financial institutions and retail

markets. Furthermore, the sale is expected to create between $80

and $90 million of excess capital for AFG, in addition to the $810

million of excess capital reported at year end 2014. We are

confident that the sale will enable us to redeploy capital,

increase earnings and returns, and create long-term value for our

shareholders. We appreciate the hard work and dedication of the

individuals who have successfully managed our long-term care

insurance business.”

About American Financial Group,

Inc.

American Financial Group is an insurance holding company, based

in Cincinnati, Ohio with assets of over $45 billion. Through the

operations of Great American Insurance Group, AFG is engaged

primarily in property and casualty insurance, focusing on

specialized commercial products for businesses, and in the sale of

fixed and fixed-indexed annuities in the retail, financial

institutions and education markets. Great American Insurance

Group’s roots go back to 1872 with the founding of its flagship

company, Great American Insurance Company.

Forward Looking

Statements

This press release contains certain statements that may be

deemed to be “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. All statements in this press

release not dealing with historical results are forward-looking and

are based on estimates, assumptions and projections. Examples of

such forward-looking statements include statements relating to: the

Company’s expectations concerning market and other conditions and

their effect on future premiums, revenues, earnings and investment

activities; recoverability of asset values; expected losses and the

adequacy of reserves for long-term care, asbestos, environmental

pollution and mass tort claims; rate changes; and improved loss

experience.

Actual results and/or financial condition could differ

materially from those contained in or implied by such

forward-looking statements for a variety of reasons including but

not limited to: changes in financial, political and economic

conditions, including changes in interest and inflation rates,

currency fluctuations and extended economic recessions or

expansions in the U.S. and/or abroad; performance of securities

markets; AFG’s ability to estimate accurately the likelihood,

magnitude and timing of any losses in connection with investments

in the non-agency residential mortgage market; new legislation or

declines in credit quality or credit ratings that could have a

material impact on the valuation of securities in AFG’s investment

portfolio; the availability of capital; regulatory actions

(including changes in statutory accounting rules); changes in the

legal environment affecting AFG or its customers; tax law and

accounting changes; levels of natural catastrophes and severe

weather, terrorist activities (including any nuclear, biological,

chemical or radiological events), incidents of war or losses

resulting from civil unrest and other major losses; development of

insurance loss reserves and establishment of other reserves,

particularly with respect to amounts associated with asbestos and

environmental claims and AFG’s run-off long-term care business;

availability of reinsurance and ability of reinsurers to pay their

obligations; the unpredictability of possible future litigation if

certain settlements of current litigation do not become effective;

trends in persistency, mortality and morbidity; competitive

pressures, including those in the annuity distribution channels,

the ability to obtain adequate rates and policy terms; changes in

AFG’s credit ratings or the financial strength ratings assigned by

major ratings agencies to our operating subsidiaries; and other

factors identified in our filings with the Securities and Exchange

Commission.

The forward-looking statements herein are made only as of the

date of this press release. The Company assumes no obligation to

publicly update any forward-looking statements.

American Financial Group, Inc.Diane P. Weidner, Asst. Vice

President – Investor Relations, 513-369-5713Websites:www.AFGinc.comwww.GreatAmericanInsuranceGroup.com

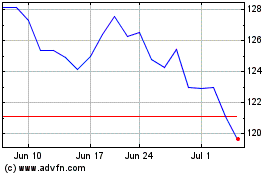

American Financial (NYSE:AFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

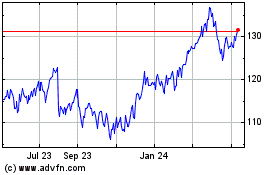

American Financial (NYSE:AFG)

Historical Stock Chart

From Apr 2023 to Apr 2024