American Equity Announces Public Offering of Common Stock with a Forward Component

August 04 2015 - 4:00PM

Business Wire

American Equity Investment Life Holding Company (NYSE: AEL) (the

“Company”) announced today that it has commenced an underwritten

public offering of 8,600,000 shares of common stock, of which

4,300,000 will be subject to the forward sale agreement described

below. In conjunction with this offering, the underwriters will be

granted a 30-day option to purchase up to 1,290,000 additional

shares of common stock.

In connection with the offering of its common stock, the Company

expects to enter into a forward sale agreement (and, to the extent

that the underwriters exercise their option to purchase additional

shares, the Company will enter into an additional forward sale

agreement) with an affiliate of RBC Capital Markets, LLC (the

“Forward Counterparty”), under which the Forward Counterparty or

its affiliate is expected to, subject to the satisfaction of

certain conditions, borrow from third parties and sell to the

underwriters 4,300,000 shares of the Company’s common stock.

Settlement of the forward sale agreement will occur on one or

more dates specified by the Company within approximately 12 months

after the date of the prospectus supplement relating to the

offering. Pursuant to the terms of the forward sale agreement, and

subject to the Company’s right to elect cash or net share

settlement, the Company plans to issue and deliver, upon physical

settlement of such forward sale agreement, 4,300,000 shares of its

common stock to the Forward Counterparty at the then-applicable

forward sale price. The remaining shares of common stock in the

offering will be newly issued by the Company.

The Company intends to use the net proceeds from the offering

for general corporate purposes, including contributions to the

capital and surplus of its life insurance subsidiaries.

RBC Capital Markets, LLC and J.P. Morgan Securities LLC will act

as lead book-running managers for the offering. Citigroup Global

Markets Inc., FBR Capital Markets & Co., Raymond James &

Associates, Inc. and SunTrust Robinson Humphrey, Inc. will act

as joint book-running managers for the offering, and Sandler

O’Neill + Partners, L.P. will act as co-manager for the

offering.

The offering is being made pursuant to an effective shelf

registration statement, previously filed by the Company with the

Securities and Exchange Commission (the “SEC”), and is being made

solely by means of a prospectus supplement and accompanying base

prospectus. A copy of the prospectus supplement and related base

prospectus may be obtained on the SEC’s website at www.sec.gov.

Alternatively, the underwriters will provide copies upon request

to: RBC Capital Markets, LLC, 200 Vesey Street, 8th Floor, New

York, New York 10281, Attention: Equity Syndicate, by telephone at

877-822-4089 or by email at equityprospectus@rbccm.com, or J.P.

Morgan Securities LLC, Attention: Prospectus Department, 1155 Long

Island Avenue, Edgewood, New York 11717, at (866) 803-9204.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy the shares, and shall not

constitute an offer, solicitation or sale in any state or other

jurisdiction in which such an offer, solicitation or sale would be

unlawful.

Caution Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements relate to future operations,

strategies, financial results or other developments, and are

subject to assumptions, risks and uncertainties. Statements such as

“guidance”, “expect”, “anticipate”, “believe”, “goal”, “objective”,

“target”, “may”, “should”, “estimate”, “projects” or similar words

as well as specific projections of future results qualify as

forward-looking statements. Factors that may cause the Company’s

actual results to differ materially from those contemplated by

these forward-looking statements can be found in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2014

filed with the SEC. Forward-looking statements speak only as of the

date the statement was made and the Company undertakes no

obligation to update such forward-looking statements. There can be

no assurance that other factors not currently anticipated by the

Company will not materially and adversely affect its results of

operations. Investors are cautioned not to place undue reliance on

any forward-looking statements made by the Company or on its

behalf.

ABOUT AMERICAN EQUITY

American Equity Investment Life Holding Company, through its

wholly-owned operating subsidiaries, issues fixed annuity and life

insurance products, with a primary emphasis on the sale of fixed

index and fixed rate annuities. American Equity Investment Life

Holding Company, a New York Stock Exchange listed company (NYSE:

AEL), is headquartered in West Des Moines, Iowa.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150804006798/en/

American Equity Investment Life Holding

CompanyJohn M. Matovina, 515-457-1813Chief Executive

Officerjmatovina@american-equity.comorTed M. Johnson,

515-457-1980Chief Financial Officertjohnson@american-equity.com

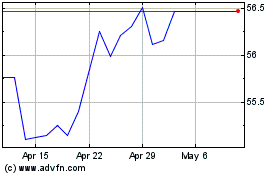

American Equity Investme... (NYSE:AEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

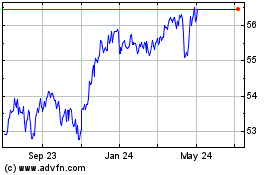

American Equity Investme... (NYSE:AEL)

Historical Stock Chart

From Apr 2023 to Apr 2024