América Móvil Swings to Fourth-Quarter Loss -- Update

February 02 2017 - 9:42PM

Dow Jones News

By Anthony Harrup

MEXICO CITY -- Telecommunications company América Móvil SAB said

it made a net loss in the fourth quarter despite higher sales, as a

weaker Mexican peso boosted revenue but also pushed up financial

costs.

Latin America's biggest telecommunications company, controlled

by billionaire Carlos Slim, swung to a net loss of 6.0 billion

pesos ($292 million) in the October-December period from a 15.7

billion-peso profit a year earlier.

Revenue rose 17% to 269.3 billion pesos, a combination of modest

gains in service revenues in local currency terms and the weakening

of the Mexican peso against the U.S. dollar and other Latin

American currencies.

Earnings before interest, taxes, depreciation and amortization,

or Ebitda, a measure of operating cash flow, rose 2.9% to 65.7

billion pesos.

Financial costs in the quarter, including the impact of the

weaker peso, nearly tripled from a year earlier to 28.2 billion

pesos.

The company had been expected to report a net profit of 4

billion pesos on revenue of 261.6 billion pesos, with Ebitda of

68.6 billion pesos, according to the median estimate of analysts

polled by The Wall Street Journal.

América Móvil said it reduced net debt last year by the

equivalent of $3.4 billion, although the 17% depreciation of the

Mexican currency meant that total debt in pesos rose to 630 billion

from 582 billion at the end of 2015.

The company ended last year with 281 million mobile subscribers,

down from 286 million at the end of 2015. Net disconnections in the

fourth quarter were 3.3 million, although the company added 1.3

million postpaid subscribers.

Fixed-line subscriptions rose 2.8% on the year to about 83

million.

The company added 213,000 mobile subscribers to end the year

with 73 million in Mexico, where for the past two years it has

faced competition from U.S. heavyweight AT&T Inc.

AT&T added 3.3 million wireless subscribers in Mexico in

2016, including more than 1.3 million in the fourth quarter,

bringing its total to 12 million.

The U.S. company's fourth-quarter wireless revenue in Mexico

grew 0.8% to $648 million, with gains from subscriber growth partly

offset by the weaker peso and strong competition. It continued to

make operating losses, however, as it invests in expanding its

high-speed mobile broadband network.

Competition among América Móvil, AT&T and Spain's Telefónica

SA have pushed Mexican telecommunications prices down sharply.

Asymmetric regulations on América Móvil, under which the dominant

carrier has to complete incoming calls from rivals without charge

but pay to connect outgoing calls, have cut into mobile unit

Telcel's profit margins.

Revenue in Mexico rose for the first time in more than a year,

although Ebitda fell 24% and was equivalent to 28% of revenue, down

from 36.7% in the fourth quarter of 2015.

América Móvil shares rose 1.6% Thursday on the Mexican stock

exchange to 13.22 pesos ahead of the earnings report.

The decline in the company's margins comes as Mexican regulators

are expected to rule this month on whether the dominance

regulations should be maintained, tightened or eased.

"Given material pricing reductions industrywide and the recent

rise in competition, we believe incremental asymmetric regulations

in the wireless arena seem less likely," Barclays said in a recent

report, adding that the regulatory burden could increase in

last-mile infrastructure sharing known as local loop

unbundling.

Mr. Slim criticized the regulations as "irrational" at a press

conference last week in Mexico City.

"I think it's the only country in the world where we compete

with the world's biggest player and the biggest player in

Iberoamerica, and being national leaders we have to subsidize them

with more than 300 million pesos a month," he said referring to

AT&T and Telefónica.

He also lamented the fact that América Móvil is still barred

from offering television service in Mexico.

That "puts the brakes on investment and puts the brakes on

competition," Mr. Slim said.

Write to Anthony Harrup at anthony.harrup@wsj.com

(END) Dow Jones Newswires

February 02, 2017 21:27 ET (02:27 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

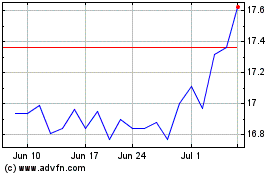

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Mar 2024 to Apr 2024

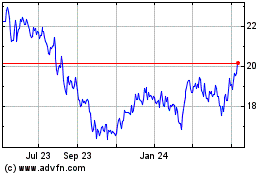

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Apr 2023 to Apr 2024