Ameren Files for Rate Increase - Analyst Blog

February 06 2012 - 9:45AM

Zacks

Ameren Missouri, a utility company of Ameren

Corporation (AEE), has filed for an electric rate increase

of $376 million with the Missouri Public Service Commission

(“MPSC”) to recover the costs incurred in infrastructure

investment, to recover increase in net fuel costs due to fuel price

increase and get reimbursement for the costs incurred for the

energy efficiency programs.

The company’s request for a rate increase of $376 million mainly

comprises approximately $85 million for the investments made

primarily to improve the reliability of its aging infrastructure

and to abide by environmental and renewable energy regulations, and

about $103 million for higher net fuel costs incurred for running

power plants. Higher costs for the company's recently proposed

energy efficiency programs account for approximately $81 million of

the request. The rest is for the additional cost increases incurred

by the company, including those to meet renewable energy

requirements, material costs and employee benefits.

The rate increase request is based on a 10.75% return on equity,

a capital structure composed of 52% common equity, an aggregate

electric rate base of $6.8 billion, and a test year that ended

September 30, 2011. The company believes that if the rate increase

is approved, assuming 1,100 kilowatt-hours of usage per month, the

average residential electric bill would increase by about 46 cents

a day.

The review process of 11 months will be taken up by the MPSC,

staff, and many other parties. The company expects to hear a final

decision from the MPSC by December 2012.

Currently, Ameren Missouri has the lowest electric rate in

comparison to any investor-owned utility in Missouri, which is

approximately 25% below the national average rate. Ameren Missouri

aims to provide safe, affordable and environmentally responsible

energy to its customers. Therefore, in order to accomplish its aim,

the company has made significant investments in its energy

infrastructure and has focused on energy efficiency programs. In

fact, the rate increase request is due to these heavy spending made

by the company.

The company has been making significant infrastructure

investments. These investments include costs associated with the

Ameren Missouri Maryland Heights Renewable Energy Center which will

be the largest landfill gas-electric facility in Missouri. To

generate clean, renewable electricity, the Center will utilize

methane gas from decaying trash and meet the energy needs of about

10,000 homes.

Also, under the Missouri Energy Efficiency Investment Act, the

utility has focused on energy efficiency programs which will

provide approximately $500 million in total customer benefits over

the next 20 years. The company’s proposal includes investments of

approximately $145 million over three years, beginning January 1,

2013. Overall, the company expects these programs to provide annual

energy savings of approximately 800 million kilowatt-hours. This is

equal to the annual energy consumption of more than 60,000 average

Missouri homes.

In order to continue to meet customers' expectations, the

company is looking for reimbursement for more than $700 million of

investments which are not currently included in rates. The utility

is optimistic that under the regulatory framework, these

investments will be recovered in rates over the service life of the

investments.

Meanwhile, to compensate the customers, the company is taking

several steps to manage its costs in a disciplined fashion. It has

reduced its combined non-fuel related operating and capital

expenditures. In late 2011, the company made job cuts and reduced

approximately 340 employees through a voluntary separation program.

Moreover, the company has budget billing and supports energy

assistance programs for those customers who are least able to pay

their bills. Nearly all these costs are excluded from customers'

rates.

Ameren Corporation has a solid base of stable utility operations

in the Midwestern market. We believe its key growth drivers include

cost minimization and its strong balance sheet. However, we are

concerned about its predominantly coal-based generation assets and

pending regulatory cases. The company presently retains a

short-term Zacks #3 Rank (Hold) that corresponds with our long-term

Neutral recommendation on the stock.

The company mainly competes with CenterPoint Energy,

Inc. (CNP) and Exelon Corporation

(EXC).

AMEREN CORP (AEE): Free Stock Analysis Report

CENTERPOINT EGY (CNP): Free Stock Analysis Report

EXELON CORP (EXC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

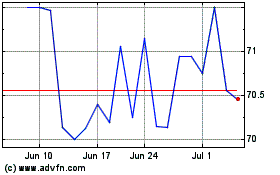

Ameren (NYSE:AEE)

Historical Stock Chart

From Mar 2024 to Apr 2024

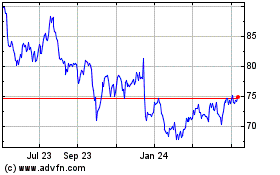

Ameren (NYSE:AEE)

Historical Stock Chart

From Apr 2023 to Apr 2024