UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

Under the Securities Exchange Act of 1934

(Amendment No.1)

AGREE REALTY CORP

(NAME OF ISSUER)

Common Stock (Par Value $0.0001)

(TITLE OF CLASS OF SECURITIES)

008492100

(CUSIP NUMBER)

December 31, 2016

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to designate the rule pursuant to which this Schedule

is filed:

|x| Rule 13d-1(b)

|_| Rule 13d-1(c)

|_| Rule 13d-1(d)

1. Names of Reporting Persons.

Deutsche Bank AG*

2. Check the Appropriate Box If a Member of a Group

(See Instructions)

(a) |_|

(b) |_|

3. SEC Use Only

4. Citizenship or Place of Organization

Federal Republic of Germany

5. SOLE VOTING POWER

1,171,916

-------------------------------------------------------------

6. SHARED VOTING POWER

NUMBER OF

SHARES 0

BENEFICIALLY -------------------------------------------------------------

OWNED BY EACH 7. SOLE DISPOSITIVE POWER

REPORTING

PERSON WITH 1,577,829

-------------------------------------------------------------

8. SHARED DISPOSITIVE POWER

0

--------------------------------------------------------------------------------

9. Aggregate Amount Beneficially Owned by Each Reporting Person

1,577,829

--------------------------------------------------------------------------------

|

10. Check if the Aggregate Amount in Row (9) Excludes Certain Shares

(See Instructions) |_|

11. Percent of Class Represented by Amount in Row (9)

6.02%

12. Type of Reporting Person

FI

* In accordance with Securities Exchange Act Release No. 39538 (January 12,

1998), this filing reflects the securities beneficially owned by the

Deutsche Asset Management business group (collectively, "DAM") of Deutsche Bank

AG and its subsidiaries and affiliates (collectively, "DBAG"). This filing does

not reflect securities, if any, beneficially owned by any other business group

of DBAG. Consistent with Rule 13d-4 under the Securities Exchange Act of 1934

"Act"), this filing shall not be construed as an admission that AWM is, for

purposes of Section 13(d) under the Act, the beneficial owner of any securities

covered by the filing.

1. Names of Reporting Persons.

Deutsche Investment Management Americas

2. Check the Appropriate Box If a Member of a Group

(See Instructions)

(a) |_|

(b) |_|

3. SEC Use Only

4. Citizenship or Place of Organization

Delaware

5. SOLE VOTING POWER

63,902

-------------------------------------------------------------

6. SHARED VOTING POWER

NUMBER OF

SHARES 0

BENEFICIALLY -------------------------------------------------------------

OWNED BY EACH 7. SOLE DISPOSITIVE POWER

REPORTING

PERSON WITH 194,202

-------------------------------------------------------------

8. SHARED DISPOSITIVE POWER

0

--------------------------------------------------------------------------------

9. Aggregate Amount Beneficially Owned by Each Reporting Person

194,202

--------------------------------------------------------------------------------

|

10. Check if the Aggregate Amount in Row (9) Excludes Certain Shares

(See Instructions) |_|

11. Percent of Class Represented by Amount in Row (9)

0.74%

12. Type of Reporting Person

IA, CO

1. Names of Reporting Persons.

RREEF America, L.L.C.

2. Check the Appropriate Box If a Member of a Group

(See Instructions)

(a) |_|

(b) |_|

3. SEC Use Only

4. Citizenship or Place of Organization

Delaware

5. SOLE VOTING POWER

1,037,682

-------------------------------------------------------------

6. SHARED VOTING POWER

NUMBER OF

SHARES 0

BENEFICIALLY -------------------------------------------------------------

OWNED BY EACH 7. SOLE DISPOSITIVE POWER

REPORTING

PERSON WITH 1,364,407

-------------------------------------------------------------

8. SHARED DISPOSITIVE POWER

0

--------------------------------------------------------------------------------

9. Aggregate Amount Beneficially Owned by Each Reporting Person

1,364,407

--------------------------------------------------------------------------------

|

10. Check if the Aggregate Amount in Row (9) Excludes Certain Shares

(See Instructions) |_|

11. Percent of Class Represented by Amount in Row (9)

5.21%

12. Type of Reporting Person

IA, CO

1. Names of Reporting Persons.

Deutsche Bank Trust Company Americas

2. Check the Appropriate Box If a Member of a Group

(See Instructions)

(a) |_|

(b) |_|

3. SEC Use Only

4. Citizenship or Place of Organization

Delaware

5. SOLE VOTING POWER

700

6. SHARED VOTING POWER

NUMBER OF

SHARES 0

BENEFICIALLY -------------------------------------------------------------

OWNED BY EACH 7. SOLE DISPOSITIVE POWER

REPORTING

PERSON WITH 700

-------------------------------------------------------------

8. SHARED DISPOSITIVE POWER

0

--------------------------------------------------------------------------------

9. Aggregate Amount Beneficially Owned by Each Reporting Person

700

--------------------------------------------------------------------------------

|

10. Check if the Aggregate Amount in Row (9) Excludes Certain Shares

(See Instructions) |_|

11. Percent of Class Represented by Amount in Row (9)

0.00%

12. Type of Reporting Person

BK, CO

1. Names of Reporting Persons.

Deutsche Asset Management Investment GmbH

2. Check the Appropriate Box If a Member of a Group

(See Instructions)

(a) |_|

(b) |_|

3. SEC Use Only

4. Citizenship or Place of Organization

Federal Republic of Germany

5. SOLE VOTING POWER

0

-------------------------------------------------------------

6. SHARED VOTING POWER

NUMBER OF

SHARES 0

BENEFICIALLY -------------------------------------------------------------

OWNED BY EACH 7. SOLE DISPOSITIVE POWER

REPORTING

PERSON WITH 6,170

-------------------------------------------------------------

8. SHARED DISPOSITIVE POWER

0

--------------------------------------------------------------------------------

9. Aggregate Amount Beneficially Owned by Each Reporting Person

6,170

--------------------------------------------------------------------------------

|

10. Check if the Aggregate Amount in Row (9) Excludes Certain Shares

(See Instructions) |_|

11. Percent of Class Represented by Amount in Row (9)

0.02%

12. Type of Reporting Person

IA, CO

1. Names of Reporting Persons.

Deutsche Asset Management Investment S.A.

2. Check the Appropriate Box If a Member of a Group

(See Instructions)

(a) |_|

(b) |_|

3. SEC Use Only

4. Citizenship or Place of Organization

Luxembourg

5. SOLE VOTING POWER

57,282

-------------------------------------------------------------

6. SHARED VOTING POWER

NUMBER OF

SHARES 0

BENEFICIALLY -------------------------------------------------------------

OWNED BY EACH 7. SOLE DISPOSITIVE POWER

REPORTING

PERSON WITH 0

-------------------------------------------------------------

8. SHARED DISPOSITIVE POWER

0

--------------------------------------------------------------------------------

9. Aggregate Amount Beneficially Owned by Each Reporting Person

57,282

--------------------------------------------------------------------------------

|

10. Check if the Aggregate Amount in Row (9) Excludes Certain Shares

(See Instructions) |_|

11. Percent of Class Represented by Amount in Row (9)

0.22%

12. Type of Reporting Person

IA, CO

1. Names of Reporting Persons.

Deutsche Asset Management (Japan) Limited

2. Check the Appropriate Box If a Member of a Group

(See Instructions)

(a) |_|

(b) |_|

3. SEC Use Only

4. Citizenship or Place of Organization

Japan

5. SOLE VOTING POWER

1,270

-------------------------------------------------------------

6. SHARED VOTING POWER

NUMBER OF

SHARES 0

BENEFICIALLY -------------------------------------------------------------

OWNED BY EACH 7. SOLE DISPOSITIVE POWER

REPORTING

PERSON WITH 1,270

-------------------------------------------------------------

8. SHARED DISPOSITIVE POWER

0

--------------------------------------------------------------------------------

9. Aggregate Amount Beneficially Owned by Each Reporting Person

1,270

--------------------------------------------------------------------------------

|

10. Check if the Aggregate Amount in Row (9) Excludes Certain Shares

(See Instructions) |_|

11. Percent of Class Represented by Amount in Row (9)

0.00%

12. Type of Reporting Person

IA, CO

1. Names of Reporting Persons.

DBX Advisors LLC

2. Check the Appropriate Box If a Member of a Group

(See Instructions)

(a) |_|

(b) |_|

3. SEC Use Only

4. Citizenship or Place of Organization

Delaware

5. SOLE VOTING POWER

105

6. SHARED VOTING POWER

NUMBER OF

SHARES 0

BENEFICIALLY -------------------------------------------------------------

OWNED BY EACH 7. SOLE DISPOSITIVE POWER

REPORTING

PERSON WITH 105

-------------------------------------------------------------

8. SHARED DISPOSITIVE POWER

0

--------------------------------------------------------------------------------

9. Aggregate Amount Beneficially Owned by Each Reporting Person

105

--------------------------------------------------------------------------------

|

10. Check if the Aggregate Amount in Row (9) Excludes Certain Shares

(See Instructions) |_|

11. Percent of Class Represented by Amount in Row (9)

0.00%

12. Type of Reporting Person

IA, CO

1. Names of Reporting Persons.

Deutsche Bank National Trust Company

2. Check the Appropriate Box If a Member of a Group

(See Instructions)

(a) |_|

(b) |_|

3. SEC Use Only

4. Citizenship or Place of Organization

Delaware

5. SOLE VOTING POWER

10,975

-------------------------------------------------------------

6. SHARED VOTING POWER

NUMBER OF

SHARES 0

BENEFICIALLY -------------------------------------------------------------

OWNED BY EACH 7. SOLE DISPOSITIVE POWER

REPORTING

PERSON WITH 10,975

-------------------------------------------------------------

8. SHARED DISPOSITIVE POWER

0

--------------------------------------------------------------------------------

9. Aggregate Amount Beneficially Owned by Each Reporting Person

10,975

--------------------------------------------------------------------------------

|

10. Check if the Aggregate Amount in Row (9) Excludes Certain Shares

(See Instructions) |_|

11. Percent of Class Represented by Amount in Row (9)

0.04%

12. Type of Reporting Person

BK, CO

Item 1.

(a) Name of Issuer:

AGREE REALTY CORP

(b) Address of Issuer's Principal Executive Offices:

70 E. Long Lake Road

Bloomfield Hills, MI 48034

United States

Item 2.

(a) Name of Person Filing:

This statement is filed on behalf of Deutsche Bank AG ("Reporting

Person").

(b) Address of the Principal Office or, if none, residence:

Taunusanlage 12

60325 Frankfurt am Main

Federal Republic of Germany

(c) Citizenship:

The citizenship of the Reporting Person is set forth on the cover page.

(d) Title of Class of Securities:

The title of the securities is common stock, $0.0001 par value

("Common Stock").

(e) CUSIP Number:

The CUSIP number of the Common Stock is set forth on the cover page.

Item 3. If this statement is filed pursuant to SS.240.13d-1(b) or 240.13d-2(b)

or (c), check whether the person filing is a:

(a) |_| Broker or dealer registered under section 15 of the Act

(15 U.S.C. 78o).

(b) |X| Bank as defined in section 3(a)(6) of the Act (15 U.S.C. 78c).

Deutsche Bank Trust Company Americas

Deutsche Bank National Trust Company

(c) |_| Insurance company as defined in section 3(a)(19) of the Act

(15 U.S.C. 78c).

(d) |_| Investment company registered under section 8 of the Investment

Company Act of 1940 (15 U.S.C 80a-8).

(e) |X| An investment adviser in accordance with S.240.13d-1(b)(1)(ii)(E);

Deutsche Investment Management Americas

RREEF America, L.L.C.

Deutsche Asset Management Investment GmbH

Deutsche Asset Management Investment S.A.

Deutsche Asset Management (Japan) Limited

DBX Advisors LLC

(f) |_| An employee benefit plan or endowment fund in accordance with

S.240.13d-1(b)(1)(ii)(F);

(g) |_| A parent holding company or control person in accordance with

S. 240.13d-1(b)(1)(ii)(G);

(h) |_| A savings associations as defined in Section 3(b) of the Federal

Deposit Insurance Act (12 U.S.C. 1813);

(i) |_| A church plan that is excluded from the definition of an investment

company under section 3(c)(14) of the Investment Company Act of

1940 (15 U.S.C. 80a-3);

(j) |X| A non-U.S. institution in accordance with Group, in accordance with

Rule 13d-1 (b)(1)(ii)(J).

Deutsche Bank AG

(k) |_| Group, in accordance with S.240.13d-1(b)(1)(ii)(J).

Item 4. Ownership.

(a) Amount beneficially owned:

The Reporting Person owns the amount of the Common Stock as set forth

on the cover page.

(b) Percent of class:

The Reporting Person owns the percentage of the Common Stock as set

forth on the cover page.

(c) Number of shares as to which such person has:

(i) Sole power to vote or to direct the vote

The Reporting Person has the sole power to vote or direct

the vote of the Common Stock as set forth on the cover page.

(ii) Shared power to vote or to direct the vote

The Reporting Person has the shared power to vote or direct

the vote of the Common Stock as set forth on the cover page.

(iii) Sole power to dispose or to direct the disposition of

The Reporting Person has the sole power to dispose or direct

the disposition of the Common Stock as set forth on the cover

page.

(iv) Shared power to dispose or to direct the disposition of

The Reporting Person has the shared power to dispose or direct

the disposition of the Common Stock as set forth on the cover

page.

Item 5. Ownership of Five Percent or Less of a Class.

If this statement is being filed to report the fact that as of the date hereof

the reporting person has ceased to be the beneficial owner of more than five

percent of the class of securities, check the following |_|.

Item 6. Ownership of More than Five Percent on Behalf of Another Person.

Not applicable.

Item 7. Identification and Classification of the Subsidiary Which Acquired the

Security Being Reported on By the Parent Holding Company or Control Person.

Subsidiary Item 3 Classification

Deutsche Investment Management Americas Investment Advisor

Deutsche Bank Trust Company Americas Bank

Deutsche Bank National Trust Company Bank

RREEF America, L.L.C. Investment Advisor

Deutsche Asset Management Investment GmbH Investment Advisor

Deutsche Asset Management Investment S.A. Investment Advisor

Deutsche Asset Management (Japan) Limited Investment Advisor

DBX Advisors LLC Investment Advisor

|

Item 8. Identification and Classification of Members of the Group

Not applicable.

Item 9. Notice of Dissolution of Group

Not applicable.

Item 10. Certification

By signing below I certify that, to the best of my knowledge and

belief, the foreign regulatory scheme applicable to a bank organized

under the laws of the Federal Republic of Germany is substantially

comparable to the regulatory scheme applicable to the functionally

equivalent U.S. institution. I also undertake to furnish to the

Commission staff, upon request, information that would otherwise be

disclosed in a Schedule 13D.

After reasonable inquiry and to the best of my knowledge and belief, I certify

that the information set forth in this statement is true, complete and correct.

Dated: February 13, 2017

Deutsche Bank AG

By: /s/ Daniela Pondeva

Name: Daniela Pondeva

Title: Vice President

|

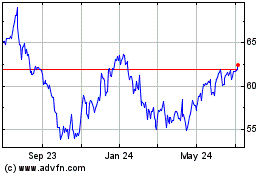

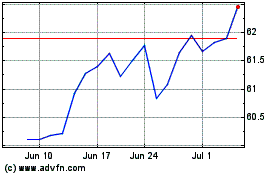

Agree Realty (NYSE:ADC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Agree Realty (NYSE:ADC)

Historical Stock Chart

From Apr 2023 to Apr 2024