Amended Statement of Beneficial Ownership (sc 13d/a)

September 30 2015 - 5:32PM

Edgar (US Regulatory)

|

|

SECURITIES AND EXCHANGE COMMISSION |

|

|

|

Washington, DC 20549 |

|

|

|

|

|

|

|

SCHEDULE 13D/A

(Amendment No. 4) |

|

Under the Securities Exchange Act of 1934

LIVE NATION ENTERTAINMENT, INC.

(Name of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

(CUSIP Number)

Richard N. Baer, Esq.

Senior Vice President and General Counsel

Liberty Media Corporation

12300 Liberty Boulevard

Englewood, CO 80112

(720) 875-5400

(Name, Address and Telephone Number of Persons

Authorized to Receive Notices and Communications)

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. o

The information required in the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 (the "Act"), or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

1. |

Names of Reporting Persons.

I.R.S. Identification Nos. of Above Persons (Entities only)

Liberty Media Corporation |

|

|

|

|

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

3. |

SEC Use Only |

|

|

|

|

4. |

Source of Funds (See Instructions)

WC |

|

|

|

|

5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e) o |

|

|

|

|

6. |

Citizenship or Place of Organization

Delaware |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

53,745,033 (1), (2) |

|

|

|

8. |

Shared Voting Power

None |

|

|

|

9. |

Sole Dispositive Power

53,745,033 (1), (2) |

|

|

|

10. |

Shared Dispositive Power

None |

|

|

|

|

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

69,645,033 (1), (3) |

|

|

|

|

12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) x

Excludes shares beneficially owned by the executive officers and directors of the Reporting Person. |

|

|

|

|

13. |

Percent of Class Represented by Amount in Row (11)

34.4% (3)(4) |

|

|

|

|

14. |

Type of Reporting Person (See Instructions)

CO |

|

|

|

|

|

|

(1) Sole voting power and dispositive power of 310,828 of such shares is held indirectly through control of LMC Events, LLC, which is a wholly owned subsidiary of Liberty Media Corporation. Sole voting power and dispositive power of 12,075,000 of such shares is held indirectly through control of Liberty SIRI MarginCo, LLC, which is a wholly owned subsidiary of Liberty Media Corporation.

(2) Does not include 15,900,000 shares of Common Stock that the Reporting Person has the right to acquire within 60 days pursuant to a forward purchase contract. See Item 6.

(3) Includes 15,900,000 shares of Common Stock that the Reporting Person has the right to acquire within 60 days pursuant to a forward purchase contract. See Item 6.

(4) For purposes of calculating beneficial ownership of the Reporting Person, the total number of shares of Common Stock outstanding was 202,362,219 on August 4, 2015, as reported by the Issuer in its Quarterly Report on Form 10-Q for the quarter ended June 30, 2015, filed with the SEC on August 10, 2015.

2

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D/A

(Amendment No. 4)

Statement of

LIBERTY MEDIA CORPORATION

Pursuant to Section 13(d) of the

Securities Exchange Act of 1934

in respect of

LIVE NATION ENTERTAINMENT, INC.

This Report on Schedule 13D relates to the shares of common stock, par value $0.01 per share (the “Common Stock”), of Live Nation Entertainment, Inc., a Delaware corporation (“Live Nation” or the “Issuer”).

The Report on Schedule 13D originally filed with the Securities and Exchange Commission (the “Commission”) with respect to the Issuer by Liberty Media Corporation, a Delaware corporation (the “Reporting Person” or “Liberty”), on January 22, 2013, as amended by Amendment No. 1 filed with the Commission on September 16, 2014, Amendment No. 2 filed with the Commission on November 3, 2014, and Amendment No. 3 filed with the Commission on August 13, 2015 (together, the “Liberty Schedule 13D”), is hereby amended and supplemented to include the information set forth herein. This amended Statement on Schedule 13D/A (this “Amendment”) constitutes Amendment No. 4 to the Liberty Schedule 13D. Capitalized terms not defined herein have the meanings given to such terms in the Liberty Schedule 13D.

Item 3. Source and Amount of Funds or Other Consideration

The information contained in Item 3 of the Liberty Schedule 13D is hereby amended and supplemented by adding the following information:

The Reporting Person has entered into the Forward Contract described in Item 6 of this Amendment, which description is incorporated herein by reference. The Reporting Person has used available cash on hand to make the approximately $160.3 million in prepayments referred to therein, and expects to use the same source of funds to pay the remaining purchase price for the shares of Common Stock described in Item 6 upon physical settlement.

Item 4. Purpose of Transaction

The information contained in Item 4 of the Liberty Schedule 13D is hereby restated in its entirety as follows:

The Reporting Person views the purchase of shares of Common Stock at the forward price as an attractive investment. The purchase of such shares would result in the Reporting Person beneficially owning a number of shares of Common Stock that is below the Applicable Percentage. The Reporting Person currently intends to elect physical settlement under the Forward Contract, subject to the trading price of the shares of Common Stock, alternative investment opportunities, market conditions and the outlook for the Issuer, in each case, on the expiration date of the Forward Contract, which is November 27, 2015.

Other than as provided herein, and except as contained in the agreements previously filed as exhibits to the Liberty Schedule 13D or as has been publicly announced by the Issuer or Liberty, Liberty does not have and, to the best of Liberty’s knowledge, none of the persons listed on Schedule 1 have, any plans or proposals that relate to or would result in any of the actions set forth in clauses (a) through (j) of Item 4.

3

The Reporting Person intends to continuously review its investment in the Issuer, and may in the future determine (i) to acquire, subject to applicable laws, orders and regulation, additional securities of the Issuer, through open market purchases, private agreements or otherwise, (ii) to dispose of all or a portion of the securities of the Issuer owned by it or (iii) to take any other available course of action, which could involve one or more of the types of transactions or have one or more of the results described in clauses (a) through (j) of Item 4. Notwithstanding anything contained herein, the Reporting Person specifically reserves the right to change its intention with respect to any or all of such matters. In reaching any decision as to its course of action (as well as to the specific elements thereof), the Reporting Person currently expects that it would take into consideration a variety of factors, including, but not limited to, the following: the Issuer’s business and prospects; other developments concerning the Issuer and its businesses generally; other business opportunities available to the Reporting Person; developments with respect to the business of the Reporting Person; changes in law and government regulations; general economic conditions; and money and stock market conditions, including the market price of the securities of the Issuer.

Item 5. Interest in Securities of the Issuer

The information contained in Item 5 of the Liberty Schedule 13D is hereby amended and supplemented by adding the following information:

The information contained in Item 6 of, and Rows (7) through (10) of the cover page to, this Amendment is incorporated herein by reference.

(a)-(b) The Reporting Person beneficially owns 69,645,033 shares of Common Stock (including the 15,900,000 shares that may be purchased upon physical settlement under the Forward Contract). The 69,645,033 shares represent approximately 34.4% of the outstanding shares of Common Stock, based on 202,362,219 shares of Common Stock reported as outstanding as of August 4, 2015 by the Issuer in its Quarterly Report on Form 10-Q for the quarter ended June 30, 2015, filed with the SEC on August 10, 2015. The Reporting Person has the sole power to vote or to direct the voting of 53,745,033 shares of Common Stock, and has the sole power to dispose or to direct the disposition of such number of shares. Prior to the expiration of the Forward Contract, the Reporting Person has no right to vote or direct the voting, and has no right to dispose or direct the disposition, of the 15,900,000 shares of Common Stock underlying the Forward Contract. Gregory B. Maffei beneficially owns 53,074 shares of Common Stock as of the date hereof, of which 5,363 shares consist of unvested restricted shares. In addition, Brian Deevy, a member of the Reporting Person’s board of directors, owns 6,005 shares of Common Stock as of the date hereof.

(c) Other than as stated herein, no transactions in the Common Stock were effected by the Reporting Person or, to the best of its knowledge, any of the persons listed on Schedule 1 to the Liberty Schedule 13D in the past 60 days.

Item 6. Contracts, Arrangements, Understandings of Relationships with Respect to Securities of the Issuer

The Information contained in Item 6 of the Liberty Schedule 13D is hereby amended and supplemented by adding the following information:

As previously disclosed in the Liberty Schedule 13D, on September 4, 2014, the Reporting Person entered into a forward purchase contract (the “Forward Contract”) with an unaffiliated counterparty covering up to a maximum of 15,900,000 notional shares of the Issuer’s Common Stock. The exact number of shares covered by the Forward Contract equals the number purchased by the counterparty to establish its initial hedge. The expiration of the Forward Contract is to occur on the 60th day following the determination of the final number of shares to be covered by the Forward Contract. During the initial hedging period, the Reporting Person was obligated to make prepayments to the unaffiliated counterparty based, in part, on a percentage of the cumulative notional amount of the Forward Contract (“Prepayment Amounts”).

4

The Forward Contract provides for physical settlement upon expiration, with the Reporting Person retaining the right to elect cash settlement instead. In the case of physical settlement, the “forward price” will equal the volume weighted average of the volume weighted average prices of the shares of Common Stock of the Issuer during the initial hedging period plus a commission plus an amount equal to the counterparty’s internal funding costs plus a spread. All Prepayment Amounts paid by the Reporting Person are to be applied against the aggregate forward price payable to the counterparty at settlement. If cash settlement is elected, (i) if the cash settlement price (which would be based on the price at which the counterparty unwinds its hedge) exceeds the forward price, then the counterparty will be obligated to pay the difference to the Reporting Person, and (ii) if the cash settlement price is less than the forward price, then the Reporting Person will be obligated to pay the difference to the counterparty. The Prepayment Amounts paid by the Reporting Person are to be applied against any cash settlement obligation the Reporting Person may have to the counterparty at settlement, with any excess to be returned to the Reporting Person.

On September 28, 2015, the unaffiliated counterparty completed its initial hedge, and the number of notional shares covered by the Forward Contract has been fixed at 15,900,000 shares. Under the Forward Contract, the expiration date is to be November 27, 2015, or 60 days after the completion of the counterparty’s initial hedge. The settlement date is scheduled for December 2, 2015. The forward price as of the end of the initial hedge period under the Forward Contract was $24.9063 per share.

The Reporting Person does not have the right to vote, or any investment power as to, the shares covered by the Forward Contract prior to the settlement date.

The information contained in Item 5 of this Amendment is incorporated herein by reference.

5

Signature

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

Dated: September 30, 2015 |

LIBERTY MEDIA CORPORATION |

|

|

|

|

|

By: |

/s/ Richard N. Baer |

|

|

|

Richard N. Baer |

|

|

|

Senior Vice President and General Counsel |

6

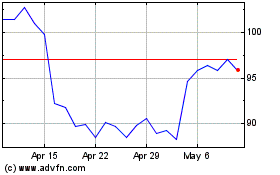

Live Nation Entertainment (NYSE:LYV)

Historical Stock Chart

From Mar 2024 to Apr 2024

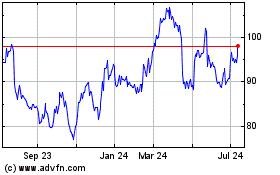

Live Nation Entertainment (NYSE:LYV)

Historical Stock Chart

From Apr 2023 to Apr 2024