Amended Statement of Beneficial Ownership (sc 13d/a)

August 14 2015 - 5:23PM

Edgar (US Regulatory)

|

|

SECURITIES AND EXCHANGE COMMISSION |

|

|

|

Washington, DC 20549 |

|

SCHEDULE 13D/A

(Amendment No. 3)

Under the Securities Exchange Act of 1934

LIVE NATION ENTERTAINMENT, INC.

(Name of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

(CUSIP Number)

Richard N. Baer, Esq.

Senior Vice President and General Counsel

Liberty Media Corporation

12300 Liberty Boulevard

Englewood, CO 80112

(720) 875-5400

(Name, Address and Telephone Number of Persons

Authorized to Receive Notices and Communications)

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ¨.

The information required in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (the “Act”), or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

1. |

Names of Reporting Persons.

I.R.S. Identification Nos. of Above Persons (Entities only)

Liberty Media Corporation |

|

|

|

|

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

3. |

SEC Use Only |

|

|

|

|

4. |

Source of Funds (See Instructions)

OO |

|

|

|

|

5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e) o |

|

|

|

|

6. |

Citizenship or Place of Organization

Delaware |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

53,745,033 (1), (2) |

|

|

|

8. |

Shared Voting Power

None |

|

|

|

9. |

Sole Dispositive Power

53,745,033 (1), (2) |

|

|

|

10. |

Shared Dispositive Power

None |

|

|

|

|

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

53,745,033 (1), (2) |

|

|

|

|

12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) x

Excludes shares beneficially owned by the executive officers and directors of the Reporting Person. |

|

|

|

|

13. |

Percent of Class Represented by Amount in Row (11)

26.6% (2)(3) |

|

|

|

|

|

|

14. |

Type of Reporting Person (See Instructions)

CO |

|

|

|

|

|

|

(1) Sole voting power and dispositive power of 310,828 of such shares is held indirectly through control of LMC Events, LLC, which is a wholly owned subsidiary of Liberty Media Corporation. Sole voting power and dispositive power of 12,075,000 of such shares is held indirectly through control of Liberty SIRI MarginCo, LLC, which is a wholly owned subsidiary of Liberty Media Corporation.

(2) Excludes in accordance with Rule 13d-3 shares that may be acquired by the Reporting Person pursuant to an open forward purchase contract entered into on September 4, 2014, by the Reporting Person with an unaffiliated counterparty, as described in Item 6 of Amendment No. 1 to the Liberty Schedule 13D.

(3) For purposes of calculating beneficial ownership of the Reporting Person, the total number of shares of Common Stock outstanding was 202,362,219 on August 4, 2015, as reported by the Issuer in its Quarterly Report on Form 10-Q for the quarter ended June 30, 2015, filed with the SEC on August 10, 2015.

2

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D/A

(Amendment No. 3)

Statement of

LIBERTY MEDIA CORPORATION

Pursuant to Section 13(d) of the

Securities Exchange Act of 1934

in respect of

LIVE NATION ENTERTAINMENT, INC.

This Report on Schedule 13D relates to the shares of common stock, par value $0.01 per share (the “Common Stock”), of Live Nation Entertainment, Inc., a Delaware corporation (“Live Nation” or the “Issuer”).

The Report on Schedule 13D originally filed with the Securities and Exchange Commission (the “Commission”) with respect to the Issuer by Liberty Media Corporation, a Delaware corporation (the “Reporting Person” or “Liberty”), on January 22, 2013, as amended by Amendment No. 1 filed with the Commission on September 16, 2014 and Amendment No. 2 filed with the Commission on November 3, 2014 (together, the “Liberty Schedule 13D”), is hereby amended and supplemented to include the information set forth herein. This amended Statement on Schedule 13D/A constitutes Amendment No. 3 to the Liberty Schedule 13D. Capitalized terms not defined herein have the meanings given to such terms in the Liberty Schedule 13D.

Item 2. Identity and Background

The response set forth in Item 2 of the Schedule 13D is hereby amended by deleting Schedule 1 in its entirety, and replacing it with Schedule 1 attached hereto.

Neither Liberty, nor, to the best knowledge of Liberty, any of its executive officers and directors named on Schedule 1, has, during the last five years, been convicted of a criminal proceeding (excluding traffic violations or similar misdemeanors) or been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction resulting in a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

Item 5. Interest in Securities of the Issuer

The information contained in Item 5 of the Liberty Schedule 13D is supplemented by adding the following thereto:

As of August 13, 2015, the Reporting Person beneficially owns 53,745,033 shares of Common Stock, which represent 26.6% of the shares of Common Stock deemed outstanding (as calculated pursuant to Rule 13d-3 of the Securities Exchange Act of 1934, as amended). The number of shares deemed outstanding is based upon 202,362,219 on August 4, 2015, as reported by the Issuer in its Quarterly Report on Form 10-Q for the quarter ended June 30, 2015, filed with the SEC on August 10, 2015. Gregory B. Maffei beneficially owns 53,074 shares of Common Stock as of the date hereof, of which 5,363 shares consist of unvested restricted shares. In addition, Brian Deevy, a member of the Reporting Person’s board of directors, owns 6,005 shares of Common Stock as of the date hereof.

3

Item 6. Contracts, Arrangements, Understandings of Relationships with Respect to Securities of the Issuer

The Information contained in Item 6 of the Liberty Schedule 13D is hereby amended and supplemented by adding the following information:

As previously disclosed in Amendment No. 1 to the Schedule 13D, on September 4, 2014, the Reporting Person entered into the Forward Contract to acquire up to a maximum of 15,900,000 notional shares of the Common Stock of the Issuer, subject to receipt of applicable governmental approvals. The Forward Contract has been amended to extend the initial hedging period to no later than October 15, 2015 and to modify the definition of “forward price” to include prices specified by the counterparty, with the consent of the Reporting Person, for a fixed number of shares, which shares will be added to the counterparty’s initial hedge. All other provisions of the Forward Contract remain the same.

4

Signature

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

Dated: August 14, 2015 |

LIBERTY MEDIA CORPORATION |

|

|

|

|

|

By: |

/s/ Richard N. Baer |

|

|

|

Richard N. Baer |

|

|

|

Senior Vice President and General Counsel |

5

SCHEDULE 1

DIRECTORS AND EXECUTIVE OFFICERS

OF

LIBERTY MEDIA CORPORATION

The name and present principal occupation of each director and executive officer of Liberty Media Corporation are set forth below. Unless otherwise noted, the business address for each person listed below is c/o Liberty Media Corporation, 12300 Liberty Boulevard, Englewood, Colorado 80112. All executive officers and directors listed are United States citizens, except for M. Ian G. Gilchrist, who is a citizen of the United States and Canada.

|

Name and Business Address

(if applicable) |

|

Principal Occupation and Principal Business

(if applicable) |

|

|

|

|

|

John C. Malone |

|

Chairman of the Board and Director of Liberty |

|

|

|

|

|

Gregory B. Maffei |

|

Chief Executive Officer, President and Director of Liberty |

|

|

|

|

|

Robert R. Bennett |

|

Director of Liberty; Managing Director of Hilltop Investments, LLC |

|

|

|

|

|

Brian Deevy |

|

Director of Liberty |

|

|

|

|

|

M. Ian G. Gilchrist |

|

Director of Liberty |

|

|

|

|

|

Evan D. Malone |

|

Director of Liberty; Owner and Manager of 1525 South Street LLC |

|

|

|

|

|

David E. Rapley |

|

Director of Liberty |

|

|

|

|

|

Larry E. Romrell |

|

Director of Liberty |

|

|

|

|

|

Andrea L. Wong |

|

Director of Liberty; President, International Production, Sony Pictures Television and President, International, Sony Picture Entertainment |

|

|

|

|

|

Richard N. Baer |

|

Senior Vice President and General Counsel of Liberty |

|

|

|

|

|

Albert E. Rosenthaler |

|

Senior Vice President of Liberty |

|

|

|

|

|

Christopher W. Shean |

|

Senior Vice President and Chief Financial Officer of Liberty |

6

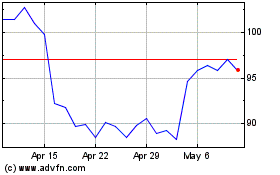

Live Nation Entertainment (NYSE:LYV)

Historical Stock Chart

From Mar 2024 to Apr 2024

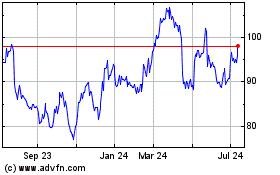

Live Nation Entertainment (NYSE:LYV)

Historical Stock Chart

From Apr 2023 to Apr 2024