UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO Rule 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

Rule 13d-2(a)

(Amendment

No. 2)*

Insperity, Inc.

(Name

of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

45778Q107

(CUSIP Number)

JEFFREY C. SMITH

STARBOARD VALUE LP

777

Third Avenue, 18th Floor

New York, New York 10017

(212) 845-7977

JEFFREY

KOCHIAN, ESQ.

AKIN GUMP STRAUSS HAUER & FELD LLP

One Bryant Park

New

York, New York 10036

(212) 872-8069

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

April 21, 2015

(Date of Event Which Requires Filing of This Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ¨.

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7

for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be

deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act

(however, see the Notes).

CUSIP NO. 45778Q107

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON STARBOARD VALUE LP |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION DELAWARE |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

3,335,976 |

|

8 |

|

SHARED VOTING POWER

- 0 - |

|

9 |

|

SOLE DISPOSITIVE POWER

3,335,976 |

|

10 |

|

SHARED DISPOSITIVE POWER

- 0 - |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,335,976 (1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 13.1% (2) |

| 14 |

|

TYPE OF REPORTING PERSON

PN |

| (1) |

Each of the Reporting Persons other than Mr. Traub is a member of a “group” with the other Reporting Persons for purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, and

such group may be deemed to beneficially own 3,335,976 shares of common stock. |

| (2) |

Based on 25,499,429 shares of common stock outstanding as of March 17, 2015. |

CUSIP NO. 45778Q107

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

WC |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION CAYMAN ISLANDS |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

1,986,958 |

|

8 |

|

SHARED VOTING POWER

- 0 - |

|

9 |

|

SOLE DISPOSITIVE POWER

1,986,958 |

|

10 |

|

SHARED DISPOSITIVE POWER

- 0 - |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,986,958 (1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 7.8% (2) |

| 14 |

|

TYPE OF REPORTING PERSON

CO |

| (1) |

Each of the Reporting Persons other than Mr. Traub is a member of a “group” with the other Reporting Persons for purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, and

such group may be deemed to beneficially own 3,335,976 shares of common stock. |

| (2) |

Based on 25,499,429 shares of common stock outstanding as of March 17, 2015. |

CUSIP NO. 45778Q107

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON STARBOARD VALUE AND OPPORTUNITY S LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

WC |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION DELAWARE |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

444,820 |

|

8 |

|

SHARED VOTING POWER

- 0 - |

|

9 |

|

SOLE DISPOSITIVE POWER

444,820 |

|

10 |

|

SHARED DISPOSITIVE POWER

- 0 - |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

444,820 (1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 1.7% (2) |

| 14 |

|

TYPE OF REPORTING PERSON

OO |

| (1) |

Each of the Reporting Persons other than Mr. Traub is a member of a “group” with the other Reporting Persons for purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, and

such group may be deemed to beneficially own 3,335,976 shares of common stock. |

| (2) |

Based on 25,499,429 shares of common stock outstanding as of March 17, 2015. |

CUSIP NO. 45778Q107

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON STARBOARD VALUE AND OPPORTUNITY C LP |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

WC |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION DELAWARE |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

241,324 |

|

8 |

|

SHARED VOTING POWER

- 0 - |

|

9 |

|

SOLE DISPOSITIVE POWER

241,324 |

|

10 |

|

SHARED DISPOSITIVE POWER

- 0 - |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

241,324 (1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) Less than 1% (2) |

| 14 |

|

TYPE OF REPORTING PERSON

PN |

| (1) |

Each of the Reporting Persons other than Mr. Traub is a member of a “group” with the other Reporting Persons for purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, and

such group may be deemed to beneficially own 3,335,976 shares of common stock. |

| (2) |

Based on 25,499,429 shares of common stock outstanding as of March 17, 2015. |

CUSIP NO. 45778Q107

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON STARBOARD VALUE R LP |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION DELAWARE |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

241,324 |

|

8 |

|

SHARED VOTING POWER

- 0 - |

|

9 |

|

SOLE DISPOSITIVE POWER

241,324 |

|

10 |

|

SHARED DISPOSITIVE POWER

- 0 - |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

241,324 (1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) Less than 1% (2) |

| 14 |

|

TYPE OF REPORTING PERSON

PN |

| (1) |

Each of the Reporting Persons other than Mr. Traub is a member of a “group” with the other Reporting Persons for purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, and

such group may be deemed to beneficially own 3,335,976 shares of common stock. |

| (2) |

Based on 25,499,429 shares of common stock outstanding as of March 17, 2015. |

CUSIP NO. 45778Q107

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON STARBOARD VALUE R GP LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION DELAWARE |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

241,324 |

|

8 |

|

SHARED VOTING POWER

- 0 - |

|

9 |

|

SOLE DISPOSITIVE POWER

241,324 |

|

10 |

|

SHARED DISPOSITIVE POWER

- 0 - |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

241,324 (1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) Less than 1% (2) |

| 14 |

|

TYPE OF REPORTING PERSON

OO |

| (1) |

Each of the Reporting Persons other than Mr. Traub is a member of a “group” with the other Reporting Persons for purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, and

such group may be deemed to beneficially own 3,335,976 shares of common stock. |

| (2) |

Based on 25,499,429 shares of common stock outstanding as of March 17, 2015. |

CUSIP NO. 45778Q107

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON STARBOARD VALUE GP LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION DELAWARE |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

3,335,976 |

|

8 |

|

SHARED VOTING POWER

- 0 - |

|

9 |

|

SOLE DISPOSITIVE POWER

3,335,976 |

|

10 |

|

SHARED DISPOSITIVE POWER

- 0- |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,335,976 (1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 13.1% (2) |

| 14 |

|

TYPE OF REPORTING PERSON

OO |

| (1) |

Each of the Reporting Persons other than Mr. Traub is a member of a “group” with the other Reporting Persons for purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, and

such group may be deemed to beneficially own 3,335,976 shares of common stock. |

| (2) |

Based on 25,499,429 shares of common stock outstanding as of March 17, 2015. |

CUSIP NO. 45778Q107

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON STARBOARD PRINCIPAL CO LP |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION DELAWARE |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

3,335,976 |

|

8 |

|

SHARED VOTING POWER

- 0 - |

|

9 |

|

SOLE DISPOSITIVE POWER

3,335,976 |

|

10 |

|

SHARED DISPOSITIVE POWER

- 0 - |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,335,976 (1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 13.1% (2) |

| 14 |

|

TYPE OF REPORTING PERSON

PN |

| (1) |

Each of the Reporting Persons other than Mr. Traub is a member of a “group” with the other Reporting Persons for purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, and

such group may be deemed to beneficially own 3,335,976 shares of common stock. |

| (2) |

Based on 25,499,429 shares of common stock outstanding as of March 17, 2015. |

CUSIP NO. 45778Q107

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON STARBOARD PRINCIPAL CO GP LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION DELAWARE |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

3,335,976 |

|

8 |

|

SHARED VOTING POWER

- 0 - |

|

9 |

|

SOLE DISPOSITIVE POWER

3,335,976 |

|

10 |

|

SHARED DISPOSITIVE POWER

- 0 - |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,335,976 (1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 13.1% (2) |

| 14 |

|

TYPE OF REPORTING PERSON

OO |

| (1) |

Each of the Reporting Persons other than Mr. Traub is a member of a “group” with the other Reporting Persons for purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, and

such group may be deemed to beneficially own 3,335,976 shares of common stock. |

| (2) |

Based on 25,499,429 shares of common stock outstanding as of March 17, 2015. |

CUSIP NO. 45778Q107

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON JEFFREY C. SMITH |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION USA |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

- 0 - |

|

8 |

|

SHARED VOTING POWER

3,335,976 |

|

9 |

|

SOLE DISPOSITIVE POWER

- 0 - |

|

10 |

|

SHARED DISPOSITIVE POWER

3,335,976 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,335,976 (1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 13.1% (2) |

| 14 |

|

TYPE OF REPORTING PERSON

IN |

| (1) |

Each of the Reporting Persons other than Mr. Traub is a member of a “group” with the other Reporting Persons for purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, and

such group may be deemed to beneficially own 3,335,976 shares of common stock. |

| (2) |

Based on 25,499,429 shares of common stock outstanding as of March 17, 2015. |

CUSIP NO. 45778Q107

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON MARK R. MITCHELL |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION USA |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

- 0 - |

|

8 |

|

SHARED VOTING POWER

3,335,976 |

|

9 |

|

SOLE DISPOSITIVE POWER

- 0 - |

|

10 |

|

SHARED DISPOSITIVE POWER

3,335,976 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,335,976 (1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 13.1% (2) |

| 14 |

|

TYPE OF REPORTING PERSON

IN |

| (1) |

Each of the Reporting Persons other than Mr. Traub is a member of a “group” with the other Reporting Persons for purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, and

such group may be deemed to beneficially own 3,335,976 shares of common stock. |

| (2) |

Based on 25,499,429 shares of common stock outstanding as of March 17, 2015. |

CUSIP NO. 45778Q107

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON PETER A. FELD |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION USA |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

- 0 - |

|

8 |

|

SHARED VOTING POWER

3,335,976 |

|

9 |

|

SOLE DISPOSITIVE POWER

- 0 - |

|

10 |

|

SHARED DISPOSITIVE POWER

3,335,976 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,335,976 (1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 13.1% (2) |

| 14 |

|

TYPE OF REPORTING PERSON

IN |

| (1) |

Each of the Reporting Persons other than Mr. Traub is a member of a “group” with the other Reporting Persons for purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, and

such group may be deemed to beneficially own 3,335,976 shares of common stock. |

| (2) |

Based on 25,499,429 shares of common stock outstanding as of March 17, 2015. |

CUSIP NO. 45778Q107

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON KENNETH H. TRAUB |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

PF |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION USA |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

4,000 |

|

8 |

|

SHARED VOTING POWER

- 0 - |

|

9 |

|

SOLE DISPOSITIVE POWER

4,000 |

|

10 |

|

SHARED DISPOSITIVE POWER

- 0 - |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,000 |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) Less than 1% (1) |

| 14 |

|

TYPE OF REPORTING PERSON

IN |

| (1) |

Based on 25,499,429 shares of common stock outstanding as of March 17, 2015. |

The following constitutes Amendment No. 2 to the Schedule 13D filed by the undersigned (“Amendment

No. 2”). This Amendment No. 2 amends the Schedule 13D as specifically set forth herein. All capitalized terms contained herein but not otherwise defined shall have the meanings ascribed to such terms in the Schedule 13D.

Item 2. Identity and Background.

Item 2 is hereby amended to add the following:

Pursuant to the Termination of Group Agreement (the “Termination of Group Agreement”), dated April 24, 2015, by and among

(1) Starboard and (2) Kenneth H. Traub (“Mr. Traub,” and together with Starboard, the “Parties”), the Parties agreed to terminate the previously disclosed Group Agreement, dated as of January 20, 2015, among the

Parties. As a result of the Termination of Group Agreement, Mr. Traub is no longer a member of the Section 13(d) group and shall cease to be a Reporting Person immediately after the filing of this Amendment No. 2. The remaining

Reporting Persons will continue filing as a group statements on Schedule 13D with respect to their beneficial ownership of securities of the Issuer to the extent required by applicable law. Each of the remaining Reporting Persons is party to the

Joint Filing Agreement, as further described in Item 6 below.

The foregoing description of the Termination of Group Agreement does

not purport to be complete and is qualified in its entirety by reference to the full text of the Termination of Group Agreement, which is filed as Exhibit 99.1, and is incorporated herein by reference.

Item 4. Purpose of Transaction.

Item 4 is hereby amended to add the following:

Pursuant to the previously disclosed Settlement Agreement, the Issuer agreed that in addition to the Current Starboard Nominees (as defined in

the Settlement Agreement), Starboard would have the right to nominate an additional nominee to serve as a Class I director of the Issuer with a term expiring at the 2017 annual meeting of stockholders (such director, the “Additional Starboard

Nominee”). Starboard nominated Michelle McKenna-Doyle as the Additional Starboard Nominee and on April 21, 2015, the Issuer’s Board of Directors (the “Board”) appointed Ms. McKenna-Doyle as a Class I director with a

term expiring at the 2017 annual meeting of stockholders.

Item 5. Interest in Securities of the Issuer.

Item 5 is hereby amended to add the following:

Each Reporting Person other than Mr. Traub, as a member of a “group” with the other Reporting Persons for purposes of

Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, may be deemed the beneficial owner of the Shares directly owned by the other Reporting Persons. Such group may be deemed to beneficially own 3,335,976 Shares. Each Reporting

Person disclaims beneficial ownership of such Shares, and this Schedule 13D shall not be deemed an admission that any of the Reporting Persons is the beneficial owner of such Shares for purposes of Schedule 13(d) or for any other purpose, except to

the extent any such Reporting Person actually exercises voting or dispositive power with respect to such securities.

Item 6. Contracts,

Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

Item 6 is amended to add the following:

On April 24, 2015, Starboard and Mr. Traub entered into the Termination of Group Agreement defined and described in Item 2

above. The Termination of Group Agreement is attached as Exhibit 99.1 and is incorporated by reference herein.

On April 24, 2015,

the Reporting Persons entered into a Joint Filing Agreement in which the Reporting Persons who will remain Reporting Persons subsequent to this Amendment No. 2 agreed to the joint filing on behalf of each of them of statements on Schedule 13D

with respect to the securities of the Issuer to the extent required by applicable law. A copy of this agreement is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

Item 7. Material to be Filed as Exhibits.

|

|

|

|

|

| 99.1 |

|

Termination of Group Agreement by and among Starboard Value and Opportunity Master Fund Ltd, Starboard Value and Opportunity S LLC, Starboard Value and Opportunity C LP, Starboard Value LP, Starboard Value GP LLC, Starboard

Principal Co LP, Starboard Principal Co GP LLC, Starboard Value R LP, Starboard Value R GP LLC, Jeffrey C. Smith, Mark R. Mitchell, Peter A. Feld and Kenneth H. Traub, dated April 24, 2015. |

|

|

| 99.2 |

|

Joint Filing Agreement by and among Starboard Value and Opportunity Master Fund Ltd, Starboard Value and Opportunity S LLC, Starboard Value and Opportunity C LP, Starboard Value R LP, Starboard Value R GP LLC, Starboard Value LP,

Starboard Value GP LLC, Starboard Principal Co LP, Starboard Principal Co GP LLC, Jeffrey C. Smith, Mark R. Mitchell, and Peter A. Feld, dated April 24, 2015. |

SIGNATURES

After reasonable inquiry and to the best of his knowledge and belief, each of the undersigned certifies that the information set forth in this statement is

true, complete and correct.

Dated: April 24, 2015

|

|

|

| STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD |

|

STARBOARD VALUE GP LLC |

|

|

| By: Starboard Value LP, |

|

By: Starboard Principal Co LP, |

| its investment manager |

|

its member |

|

|

| STARBOARD VALUE AND OPPORTUNITY S LLC |

|

STARBOARD PRINCIPAL CO LP |

|

|

| By: Starboard Value LP, |

|

By: Starboard Principal Co GP LLC, |

| its manager |

|

its general partner |

|

|

| STARBOARD VALUE AND OPPORTUNITY C LP |

|

STARBOARD PRINCIPAL CO GP LLC |

|

|

| By: Starboard Value R LP, |

|

|

| its general partner |

|

STARBOARD VALUE R GP LLC |

|

|

| STARBOARD VALUE R LP |

|

|

|

|

| By: Starboard Value R GP LLC, |

|

|

| its general partner |

|

|

|

|

| STARBOARD VALUE LP |

|

|

|

|

| By: Starboard Value GP LLC, |

|

|

| its general partner |

|

|

|

|

|

| By: |

|

/s/ Jeffrey C. Smith |

|

|

Name: Jeffrey C. Smith |

|

|

Title: Authorized Signatory |

|

| /s/ Jeffrey C. Smith |

| JEFFREY C. SMITH |

| Individually and as attorney-in-fact for Mark R. Mitchell, Peter A. Feld, and Kenneth H. Traub |

Exhibit 99.1

TERMINATION OF GROUP AGREEMENT

This Termination (this “Termination”) of the Group Agreement (as defined below) is by and among (1) Starboard Value and

Opportunity Master Fund Ltd, a Cayman Islands exempted company, Starboard Value and Opportunity S LLC, a Delaware limited liability company, Starboard Value and Opportunity C LP, a Delaware limited partnership, Starboard Value LP, a Delaware limited

partnership, Starboard Value GP LLC, a Delaware limited liability company, Starboard Principal Co LP, a Delaware limited partnership, Starboard Principal Co GP LLC, a Delaware limited liability company, Starboard Value R LP, a Delaware limited

partnership, Starboard Value R GP LLC, a Delaware limited liability company, Jeffrey C. Smith, Mark R. Mitchell and Peter A. Feld (together, “Starboard”) and (2) Kenneth H. Traub (“Mr. Traub” and together with

Starboard, each a “Party” to this Agreement, and collectively, the “Parties” or the “Group”). Capitalized terms used but not defined herein shall have the meanings ascribed to them in the Group Agreement.

WHEREAS, Starboard and Mr. Traub have entered into that certain Group Agreement, dated as of January 20, 2015 (as amended,

restated, amended and restated, supplemented or otherwise modified from time to time, the “Group Agreement”); and

WHEREAS, the Parties have agreed, subject to the terms and conditions set forth herein, to terminate the Group Agreement as provided for

herein.

NOW, IT IS AGREED, as of the date and time hereof, by the Parties hereto:

1. The Group Agreement is hereby automatically terminated without any further action by the Parties and will have no further force or effect;

provided, however that Section 7 of the Group Agreement shall survive and continue in full force and effect

[Signature page

follows]

IN WITNESS WHEREOF, the Parties hereto have caused this Agreement to be executed as of 4:01 p.m.

EDT of this 24th day of April, 2015.

|

|

|

| STARBOARD VALUE AND OPPORTUNITY |

|

STARBOARD VALUE LP |

| MASTER FUND LTD |

|

By: Starboard Value GP LLC, |

| By: Starboard Value LP, |

|

its general partner |

| its investment manager |

|

|

|

|

| STARBOARD VALUE AND OPPORTUNITY S LLC |

|

STARBOARD VALUE GP LLC |

| By: Starboard Value LP, |

|

By: Starboard Principal Co LP, |

| its manager |

|

its member |

|

|

| STARBOARD VALUE AND OPPORTUNITY C LP |

|

STARBOARD PRINCIPAL CO LP |

| By: Starboard Value R LP |

|

By: Starboard Principal Co GP LLC, |

| its general partner |

|

its general partner |

|

|

| STARBOARD VALUE R LP |

|

STARBOARD PRINCIPAL CO GP LLC |

| By: Starboard Value R GP LLC,

its general partner |

|

STARBOARD VALUE R GP LLC |

|

|

|

|

|

| By: |

|

/s/ Jeffrey C. Smith |

|

|

Name: Jeffrey C. Smith |

|

|

Title: Authorized Signatory |

|

| /s/ Jeffrey C. Smith |

| JEFFREY C. SMITH |

| Individually and as attorney-in-fact for Mark R.

Mitchell and Peter A. Feld |

[Signature page to Termination of Group Agreement]

|

|

|

| By: |

|

/s/ Kenneth H. Traub |

|

|

Name:Kenneth H. Traub |

[Signature page to Termination of Group Agreement]

Exhibit 99.2

JOINT FILING AGREEMENT

In accordance with Rule 13d-1(k)(1) under the Securities Exchange Act of 1934, as amended, the persons named below agree to the joint filing

on behalf of each of them of Amendment No. 2 to Schedule 13D (including additional amendments thereto) with respect to the shares of Common Stock, par value $0.01 per share, of Insperity, Inc. This Joint Filing Agreement shall be filed as an

Exhibit to such Statement. The undersigned acknowledge that each shall be responsible for the timely filing of any amendments to such joint filing and for the completeness and accuracy of the information concerning him or it contained herein and

therein, but shall not be responsible for the completeness and accuracy of the information concerning the others.

Dated: April 24, 2015

|

|

|

| STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD |

|

STARBOARD VALUE GP LLC |

|

|

| By: Starboard Value LP, |

|

By: Starboard Principal Co LP, |

| its investment manager |

|

its member |

|

|

| STARBOARD VALUE AND OPPORTUNITY S LLC |

|

STARBOARD PRINCIPAL CO LP |

|

|

| By: Starboard Value LP, |

|

By: Starboard Principal Co GP LLC, |

| its manager |

|

its general partner |

|

|

| STARBOARD VALUE AND OPPORTUNITY C LP |

|

STARBOARD PRINCIPAL CO GP LLC |

|

|

| By: Starboard Value R LP, |

|

|

| its general partner |

|

STARBOARD VALUE R GP LLC |

|

|

| STARBOARD VALUE R LP |

|

|

|

|

| By: Starboard Value R GP LLC, |

|

|

| its general partner |

|

|

|

|

| STARBOARD VALUE LP |

|

|

|

|

| By: Starboard Value GP LLC, |

|

|

| its general partner |

|

|

|

|

|

| By: |

|

/s/ Jeffrey C. Smith |

|

|

Name: Jeffrey C. Smith |

|

|

Title: Authorized Signatory |

|

| /s/ Jeffrey C. Smith |

| JEFFREY C. SMITH |

| Individually and as attorney-in-fact for

Mark R. Mitchell, Peter A. Feld |

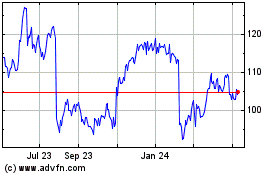

Insperity (NYSE:NSP)

Historical Stock Chart

From Mar 2024 to Apr 2024

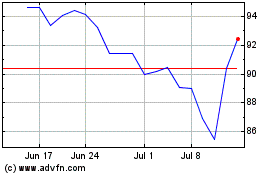

Insperity (NYSE:NSP)

Historical Stock Chart

From Apr 2023 to Apr 2024