Amended Statement of Beneficial Ownership (sc 13d/a)

March 03 2015 - 11:36AM

Edgar (US Regulatory)

|

|

SECURITIES AND EXCHANGE COMMISSION |

|

|

|

Washington, D.C. 20549 |

|

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

Under the Securities Exchange Act of 1934

(Amendment No. 3)*

(Name of Issuer)

Common Stock, par value $1.00 per share

(Title of Class of Securities)

(CUSIP Number)

Remy W. Trafelet

c/o 734 Investors, LLC

410 Park Avenue, 17th Floor

New York, New York 10022

(212) 201-7800

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box. o

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are sent.

* The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the "Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

(Continued on following pages)

|

|

1 |

Name of Reporting Person

734 Investors, LLC |

|

|

|

|

2 |

Check the Appropriate Box if a Member of a Group |

|

|

|

(a) |

o |

|

|

|

(b) |

x |

|

|

|

|

3 |

SEC Use Only |

|

|

|

|

4 |

Source of Funds

BK, WC |

|

|

|

|

5 |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e) o |

|

|

|

|

6 |

Citizenship or Place of Organization

Delaware |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7 |

Sole Voting Power

3,725,457 |

|

|

|

8 |

Shared Voting Power

-0- |

|

|

|

9 |

Sole Dispositive Power

3,725,457 |

|

|

|

10 |

Shared Dispositive Power

-0- |

|

|

|

|

11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

3,725,457 |

|

|

|

|

12 |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares o |

|

|

|

|

13 |

Percent of Class Represented by Amount in Row (11)

44.92% (1) |

|

|

|

|

14 |

Type of Reporting Person

OO (Limited Liability Company) |

|

|

|

|

|

|

(1) Based on 7,370,223 shares of Common Stock outstanding as of January 16, 2015, plus 923,257 shares of Common Stock issued pursuant to the Merger Agreement.

(Page 2 of 9 Pages)

|

|

1 |

Name of Reporting Person

734 Agriculture, LLC |

|

|

|

|

2 |

Check the Appropriate Box if a Member of a Group |

|

|

|

(a) |

o |

|

|

|

(b) |

x |

|

|

|

|

3 |

SEC Use Only |

|

|

|

|

4 |

Source of Funds

Not Applicable |

|

|

|

|

5 |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e) o |

|

|

|

|

6 |

Citizenship or Place of Organization

Delaware |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7 |

Sole Voting Power

4,416,885(1) |

|

|

|

8 |

Shared Voting Power

-0- |

|

|

|

9 |

Sole Dispositive Power

4,416,885(1) |

|

|

|

10 |

Shared Dispositive Power

-0- |

|

|

|

|

11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

4,416,885(1) |

|

|

|

|

12 |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares o |

|

|

|

|

13 |

Percent of Class Represented by Amount in Row (11)

53.26%(2) |

|

|

|

|

14 |

Type of Reporting Person

OO (Limited Liability Company) |

|

|

|

|

|

|

(1) 3,725,457 of these shares of Common Stock are held solely in its capacity as the managing member of 734 Investors, LLC. 734 Agriculture, LLC disclaims beneficial ownership except to the extent of its pecuniary interest therein.

(2) Based on 7,370,223 shares of Common Stock outstanding as of January 16, 2015, plus 923,257 shares of Common Stock issued pursuant to the Merger Agreement.

(Page 3 of 9 Pages)

|

|

1 |

Name of Reporting Person

Remy W. Trafelet |

|

|

|

|

2 |

Check the Appropriate Box if a Member of a Group |

|

|

|

(a) |

o |

|

|

|

(b) |

x |

|

|

|

|

3 |

SEC Use Only |

|

|

|

|

4 |

Source of Funds

Not Applicable |

|

|

|

|

5 |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e) o |

|

|

|

|

6 |

Citizenship or Place of Organization

USA |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7 |

Sole Voting Power

3,891 |

|

|

|

8 |

Shared Voting Power

4,532,115(1) |

|

|

|

9 |

Sole Dispositive Power

3,891 |

|

|

|

10 |

Shared Dispositive Power

4,532,115(1) |

|

|

|

|

11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

4,536,006 |

|

|

|

|

12 |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares o |

|

|

|

|

13 |

Percent of Class Represented by Amount in Row (11)

54.69% (2) |

|

|

|

|

14 |

Type of Reporting Person

IN |

|

|

|

|

|

|

(1) 4,416,885 of these shares of Common Stock may be deemed to be beneficially owned by Mr. Trafelet solely in his capacity as one of two controlling persons of 734 Agriculture, LLC. Mr. Trafelet disclaims beneficial ownership of any shares of Common Stock held by 734 Investors, LLC and 734 Agriculture, LLC except to the extent of his pecuniary interest therein. The beneficial ownership numbers for Mr. Trafelet also include 115,230 shares held by accounts (including third-party accounts) of which Mr. Trafelet may be considered to be the indirect beneficial owner by virtue of his position with Trafelet Brokaw Capital Management, L.P. (“TBCM”), which manages such accounts. Mr. Trafelet disclaims beneficial ownership of such shares of Common Stock except to the extent of his pecuniary interest therein.

(2) Based on 7,370,223 shares of Common Stock outstanding as of January 16, 2015, plus 923,257 shares of Common Stock issued pursuant to the Merger Agreement.

(Page 4 of 9 Pages)

|

|

1 |

Name of Reporting Person

George R. Brokaw |

|

|

|

|

2 |

Check the Appropriate Box if a Member of a Group |

|

|

|

(a) |

o |

|

|

|

(b) |

x |

|

|

|

|

3 |

SEC Use Only |

|

|

|

|

4 |

Source of Funds

Not Applicable |

|

|

|

|

5 |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e) o |

|

|

|

|

6 |

Citizenship or Place of Organization

USA |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7 |

Sole Voting Power

4,149 |

|

|

|

8 |

Shared Voting Power

4,507,950(1) |

|

|

|

9 |

Sole Dispositive Power

4,149 |

|

|

|

10 |

Shared Dispositive Power

4,507,950(1) |

|

|

|

|

11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

4,512,099 |

|

|

|

|

12 |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares o |

|

|

|

|

13 |

Percent of Class Represented by Amount in Row (11)

54.41% (2) |

|

|

|

|

14 |

Type of Reporting Person

IN |

|

|

|

|

|

|

(1) Of these shares of Common Stock, 20,000 shares are held directly by Mr. Brokaw and 4,396,885 shares may be deemed to be beneficially owned by Mr. Brokaw solely in his capacity as one of two controlling persons of 734 Agriculture, LLC. Mr. Brokaw disclaims beneficial ownership of any shares of Common Stock held by 734 Investors, LLC and 734 Agriculture, LLC except to the extent of his pecuniary interest therein. Mr. Brokaw has entered into an agreement with 734 Investors, LLC to vote his shares as directed by 734 Investors, LLC. The agreement also restricts Mr. Brokaw’s ability to sell his shares except pro rata with sales by 734 Investors, LLC. The beneficial ownership numbers for Mr. Brokaw also include 91,065 shares held by accounts of which Mr. Brokaw may be considered to be the indirect beneficial owner by virtue of his position with TBCM, which manages such accounts. Mr. Brokaw disclaims beneficial ownership of such shares of Common Stock except to the extent of his pecuniary interest therein.

(2) Based on 7,370,223 shares of Common Stock outstanding as of January 16, 2015, plus 923,257 shares of Common Stock issued pursuant to the Merger Agreement.

(Page 5 of 9 Pages)

This Amendment No. 3 (this “Amendment No. 3”) amends and supplements the Schedule 13D originally filed with the Securities and Exchange Commission (the “SEC”) on November 29, 2013, as amended by Amendment No. 1 filed with the SEC on December 10, 2014, and Amendment No. 2 filed with the SEC on January 16, 2015, by 734 Investors, LLC, a Delaware limited liability company (“734 Investors”), 734 Agriculture, LLC, a Delaware limited liability company (“734 Agriculture”), Remy W. Trafelet and George R. Brokaw (as amended, the “Schedule 13D”). Except as indicated in this Amendment No. 3, all other information set forth in the Schedule 13D remains unchanged and capitalized terms used herein which are not defined herein have the same meanings set forth in the Schedule 13D.

ITEM 4. Purpose of Transaction.

Item 4 of the Schedule 13D is hereby amended and restated by adding the following paragraph before the end of the last paragraph in Item 4:

On February 28, 2015, 734 Agriculture received 691,428 shares of the Issuer’s Common Stock pursuant to the closing of the Issuer’s previously disclosed acquisition of 734 Citrus Holdings, LLC.

ITEM 5. Interest in Securities of the Issuer.

Item 5 of the Schedule 13D is hereby amended and restated as follows:

(a) and (b) Items 7 through 11 and 13 of each of the cover pages of this Amendment No. 3 are incorporated herein by reference.

(c) Transactions in respect of Messrs. Trafelet and Brokaw’s beneficial ownership of the Issuer’s Common Stock made in the past 60 days of the date of this Amendment No. 3 are set forth below.

All of the below reported transactions were open market purchases made by accounts managed by TBCM on The Nasdaq Global Select Stock Market where the Issuer’s Common Stock is publicly traded. All the transactions were made through a broker dealer.

|

Date of Transaction |

|

Number of Shares

Acquired |

|

Average Price Paid |

|

Transaction Cost |

|

1/2/2015 |

|

4,894 |

|

$ |

49.94 |

|

$ |

244,406.36 |

|

1/12/2015 |

|

5,116 |

|

$ |

52.24 |

|

$ |

267,259.84 |

|

1/13/2015 |

|

10,000 |

|

$ |

54.57 |

|

$ |

545,700 |

|

1/14/2015 |

|

17,444 |

|

$ |

57.23 |

|

$ |

998,320.12 |

|

2/13/2015 |

|

4,341 |

|

$ |

45.29 |

|

$ |

196,603.89 |

|

2/17/2015 |

|

3,872 |

|

$ |

46.37 |

|

$ |

179,544.64 |

|

2/23/2015 |

|

3,000 |

|

$ |

46.17 |

|

$ |

138,510 |

|

2/25/2015 |

|

4,216 |

|

$ |

45.84 |

|

$ |

193,261.44 |

|

2/26/2015 |

|

3,260 |

|

$ |

46.15 |

|

$ |

150,449 |

(Page 6 of 9 Pages)

On January 5, 2015 Mr. Trafelet received 562 shares, with a basis of $50.03 per share, under the Issuer’s 2013 Incentive Equity Plan and the Director Stock Compensation Plan pursuant to Mr. Trafelet’s election to receive shares in lieu of cash fees.

On January 5, 2015 Mr. Brokaw received 600 shares, with a basis of $50.03 per share, under the Issuer’s 2013 Incentive Equity Plan and the Director Stock Compensation Plan pursuant to Mr. Brokaw’s election to receive shares in lieu of cash fees.

Except as described in the Schedule 13D and herein, to the knowledge of any of the Reporting Persons, no other transactions in the Common Stock were effected by the Reporting Persons or any of the entities or persons named in Item 2 hereto during the 60 days prior to the date of this Amendment No. 3.

(d) To the knowledge of any of the Reporting Persons, no other person is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the securities reported in this Item 5.

(e) Not applicable.

ITEM 7. Material to be Filed as Exhibits.

Exhibit I — Agreement pursuant to Rule 13d-1(k)

(Page 7 of 9 Pages)

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

Date: March 3, 2015 |

734 INVESTORS, LLC |

|

|

By: 734 Agriculture, LLC |

|

|

Its: Managing Member |

|

|

|

|

|

|

|

|

By: |

/s/ Remy W. Trafelet |

|

|

Name: |

Remy W. Trafelet |

|

|

Title: |

Manager |

|

|

|

|

|

734 AGRICULTURE, LLC |

|

|

|

|

|

|

|

|

By: |

/s/ Remy W. Trafelet |

|

|

Name: |

Remy W. Trafelet |

|

|

Title: |

Manager |

|

|

|

|

|

Remy W. Trafelet |

|

|

|

|

|

|

|

|

By: |

/s/ Remy W. Trafelet |

|

|

|

|

|

George R. Brokaw |

|

|

|

|

|

|

|

|

By: |

/s/ George R. Brokaw |

(Page 8 of 9 Pages)

EXHIBIT INDEX

|

Exhibit |

|

Document Description |

|

|

|

|

|

I |

|

Agreement pursuant to Rule 13d-1(k) |

(Page 9 of 9 Pages)

Exhibit 99.(I)

EXHIBIT I

AGREEMENT PURSUANT TO RULE 13d-1(k)

The undersigned hereby agree as follows:

(i) Each of them is individually eligible to use the Schedule 13D/A to which this Exhibit is attached, and such Schedule 13D/A is filed on behalf of each of them; and

(ii) Each of them is responsible for the timely filing of such Schedule 13D/A and any amendments thereto, and for the completeness and accuracy of the information concerning such person contained therein; but none of them is responsible for the completeness or accuracy of the information concerning the other persons making the filing, unless such person knows or has reason to believe that such information is inaccurate.

|

Date: March 3, 2015 |

734 INVESTORS, LLC |

|

|

By: 734 Agriculture, LLC |

|

|

Its: Managing Member |

|

|

|

|

|

|

|

|

|

By: |

/s/ Remy W. Trafelet |

|

|

Name: |

Remy W. Trafelet |

|

|

Title: |

Manager |

|

|

|

|

|

734 AGRICULTURE, LLC |

|

|

|

|

|

|

|

|

By: |

/s/ Remy W. Trafelet |

|

|

Name: |

Remy W. Trafelet |

|

|

Title: |

Manager |

|

|

|

|

|

Remy W. Trafelet |

|

|

|

|

|

|

|

|

By: |

/s/ Remy W. Trafelet |

|

|

|

|

|

George R. Brokaw |

|

|

|

|

|

|

|

|

By: |

/s/ George R. Brokaw |

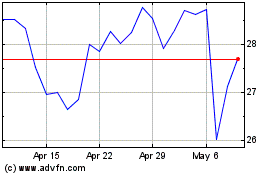

Alico (NASDAQ:ALCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

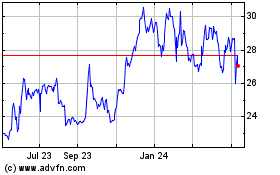

Alico (NASDAQ:ALCO)

Historical Stock Chart

From Apr 2023 to Apr 2024