UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of earliest event reported: October 1, 2015

|

| | | | |

Commission File Number | | Exact name of registrant as specified in its charter, address of principal executive office and registrant's telephone number | | IRS Employer Identification Number |

001-36518 | | NEXTERA ENERGY PARTNERS, LP | | 30-0818558 |

| | 700 Universe Boulevard Juno Beach, Florida 33408 (561) 694-4000 | | |

State or other jurisdiction of incorporation or organization: Delaware

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

EXPLANATORY NOTE

On October 5, 2015, NextEra Energy Partners, LP (NEP) filed a Current Report on Form 8-K to report, among other things, the closing of its acquisition of 100% of the ownership interests in NET Holdings Management, LLC (NET Midstream), a developer, owner and operator of a portfolio of seven long-term contracted natural gas pipeline assets located in Texas. This amendment is being filed to include the financial statements of NET Midstream and its subsidiaries and the pro forma financial information required by Items 9.01(a) and 9.01(b), respectively, and to include the exhibits under Item 9.01(d) of this Form 8-K/A.

SECTION 9 - FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01 Financial Statements and Exhibits

(a) Financial Statements of Business Acquired

Audited consolidated financial statements of NET Midstream and its subsidiaries as of and for the years ended December 31, 2014 and 2013 were previously filed as Exhibit 99 to NEP's Current Report on Form 8-K filed on September 10, 2015. The unaudited condensed consolidated financial statements of NET Midstream and its subsidiaries as of June 30, 2015 and for the six months ended June 30, 2015 and 2014 are filed as Exhibit 99.1 to this Current Report on Form 8-K/A and are incorporated herein by reference.

(b) Pro Forma Financial Information

Unaudited pro forma consolidated statements of operations and balance sheet (pro forma financial statements) of NEP for the year ended December 31, 2014 and as of and for the six months ended June 30, 2015 are filed as Exhibit 99.2 to this Current Report on Form 8-K/A and are incorporated herein by reference.

(d) Exhibits.

The following exhibits are being filed herein.

|

| | | |

| Exhibit Number | | Description |

| 99.1 | | Unaudited condensed consolidated financial statements of NET Midstream and its subsidiaries as of June 30, 2015 and for the six months ended June 30, 2015 and 2014 |

| 99.2 | | Unaudited pro forma consolidated financial statements of NEP for the year ended December 31, 2014 and as of and for the six months ended June 30, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: November 5, 2015

|

| |

NEXTERA ENERGY PARTNERS, LP |

(Registrant) |

| |

By: | NextEra Energy Partners GP, Inc., its general partner |

| |

| |

CHRIS N. FROGGATT |

Chris N. Froggatt Controller and Chief Accounting Officer |

Exhibit 99.1

|

|

NET Holdings Management, LLC Consolidated Financial Statements Six Months Ended June 30, 2015

|

NET Holdings Management, LLC

Index

|

| |

| Page(s) |

Consolidated Financial Statements | |

| |

Balance Sheets | 2 |

| |

Statements of Income | 3 |

| |

Statements of Changes in Equity | 4 |

| |

Statements of Cash Flows | 5 |

| |

Notes to the Unaudited Consolidated Financial Statements | 6 - 18 |

NET Holdings Management, LLC

Consolidated Balance Sheets

June 30, 2015 and December 31, 2014

|

| | | | | | | | | | | | | |

| June 30, 2015 (unaudited) | | December 31, 2014 |

(in thousands) | | | |

Assets | | | | | | |

Current assets | | | |

| Cash and cash equivalents | $ | 3,519 |

| | $ | 1,877 |

|

| Margin deposits | 1,038 |

| | 1,392 |

|

| Accounts receivable | 35,106 |

| | 79,116 |

|

| Prepaid expenses and other current assets | 1,655 |

| | 1,209 |

|

| Assets from risk management activities | 2,840 |

| | 15,808 |

|

| | | | | Total current assets | 44,158 |

| | 99,402 |

|

Property, plant and equipment, net | 817,457 |

| | 789,224 |

|

Assets from risk management activities | 2,876 |

| | 2,510 |

|

Goodwill | | | 41,953 |

| | 41,953 |

|

Deferred financing fees | 17,168 |

| | 18,626 |

|

Other long term assets | 168 |

| | 242 |

|

| | | | | Total assets | $ | 923,780 |

| | $ | 951,957 |

|

Liabilities and Equity | | | |

Current liabilities | | | |

| Current portion of long-term debt | $ | 1,149 |

| | $ | 1,112 |

|

| Margin payable | — |

| | 1,832 |

|

| Accounts payable | 38,252 |

| | 105,050 |

|

| Accrued liabilities | 8,438 |

| | 3,969 |

|

| Liabilities from risk management activities | 8,772 |

| | 17,469 |

|

| | | | | Total current liabilities | 56,611 |

| | 129,432 |

|

Notes payable and long-term debt | 606,483 |

| | 574,318 |

|

Deferred revenue | 9,589 |

| | 6,529 |

|

Other long-term liabilities | 895 |

| | 895 |

|

Liabilities from risk management activities | 29,200 |

| | 34,659 |

|

| | | | | Total liabilities | 702,778 |

| | 745,833 |

|

Commitments and contingencies (Note 8) | | | |

Members’ equity | | | |

| NET Holdings Management, LLC members' equity | 227,195 |

| | 210,818 |

|

| Noncontrolling interest | (6,193 | ) | | (4,694 | ) |

| | | | | Total equity | 221,002 |

| | 206,124 |

|

| | | | | Total liabilities and equity | $ | 923,780 |

| | $ | 951,957 |

|

The accompanying notes are an integral part of these consolidated financial statements.

NET Holdings Management, LLC

Consolidated Statements of Income

Six Months Ended June 30, 2015 and 2014

|

| | | | | | | | | | | | | |

| Six Months Ended June 30, |

(in thousands) | 2015 | | 2014 |

| (unaudited) |

Revenues | | | |

Sales of natural gas, natural gas liquids, and other | $ | 211,351 |

| | $ | 601,094 |

|

Natural gas reservation and transportation | 40,468 |

| | 13,535 |

|

| | | | | Total revenues | 251,819 |

| | 614,629 |

|

Costs and expenses | | | |

Purchases of natural gas | 194,702 |

| | 567,381 |

|

Transportation and other fees | 4,395 |

| | 14,939 |

|

Operating, general and administrative | 11,695 |

| | 8,399 |

|

Depreciation expense | 13,271 |

| | 6,101 |

|

Impairment of fixed assets | — |

| | 8,712 |

|

| | | | | Total costs and expenses | 224,063 |

| | 605,532 |

|

| | | | | Operating income | 27,756 |

| | 9,097 |

|

Interest expense | 9,201 |

| | 5,733 |

|

Amortization of debt issuance costs | 1,459 |

| | 1,459 |

|

Unrealized (gain) loss on interest rate hedges | (241 | ) | | 21,999 |

|

| | | | | Income (loss) before income taxes | 17,337 |

| | (20,094 | ) |

Income tax expense | 164 |

| | 10 |

|

| | | | | Net income (loss) | 17,173 |

| | (20,104 | ) |

Net income (loss) attributable to noncontrolling interest | 796 |

| | (2,649 | ) |

| | | | | Net income (loss) attributable to controlling interest | $ | 16,377 |

| | $ | (17,455 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

NET Holdings Management, LLC

Consolidated Statements of Changes in Equity

June 30, 2015

|

| | | | | | | | | | | | | | | | | |

(in thousands) | Members’ Equity | | Non-controlling Interest | | Total Members’ Equity |

| (unaudited) |

Balances at December 31, 2013 | $ | 236,717 |

| | $ | (452 | ) | | $ | 236,265 |

|

Net Income | (17,455 | ) | | (2,649 | ) | | (20,104 | ) |

Distributions to Non-controlling interest | — |

| | — |

| | — |

|

Balances at June 30, 2014 | $ | 219,262 |

| | $ | (3,101 | ) | | $ | 216,161 |

|

| | | | | |

Balances at December 31, 2014 | $ | 210,818 |

| | $ | (4,694 | ) | | $ | 206,124 |

|

Net Income | 16,377 |

| | 796 |

| | 17,173 |

|

Distributions to Non-controlling interest | — |

| | (2,295 | ) | | (2,295 | ) |

Balances at June 30, 2015 | $ | 227,195 |

| | $ | (6,193 | ) | | $ | 221,002 |

|

The accompanying notes are an integral part of these consolidated financial statements.

NET Holdings Management, LLC

Consolidated Statements of Cash Flows

Six Months Ended June 30, 2015 and June 30, 2014

|

| | | | | | | | | | | | | |

(in thousands) | June 30, 2015 | | June 30, 2014 |

| (unaudited) |

Cash flows from operating activities | | | |

Net income (loss) | $ | 17,173 |

| | $ | (20,104 | ) |

Adjustments to reconcile net income to net cash provided by operating activities | | | |

| Depreciation | 13,271 |

| | 6,101 |

|

| Amortization of debt issue costs | 1,459 |

| | 1,459 |

|

| Asset Impairment | — |

| | 8,712 |

|

| Unrealized gain on commodity derivatives | (1,313 | ) | | (1,158 | ) |

| Unrealized (gain) loss on interest rate hedges | (241 | ) | | 21,999 |

|

| Changes in operating assets and liabilities | | | |

| | Margin Deposits | (1,478 | ) | | 481 |

|

| | Accounts receivable | 44,010 |

| | 7,397 |

|

| | Prepaid expenses and other assets | (373 | ) | | (183 | ) |

| | Other receivables | — |

| | 3,010 |

|

| | Accounts payable | (49,171 | ) | | (8,146 | ) |

| | Accrued liabilities | 3,607 |

| | 590 |

|

| | Other long-term liabilities | 3,060 |

| | (372 | ) |

| | | | | Net cash provided by operating activities | 30,004 |

| | 19,786 |

|

Cash flows from investing activities | | | |

Purchase of property, plant and equipment | (58,269 | ) | | (178,321 | ) |

| | | | | Net cash used in investing activities | (58,269 | ) | | (178,321 | ) |

Cash flows from financing activities | | | |

Payments of notes payable | (598 | ) | | (581 | ) |

Repayments of long-term borrowings under NETHM credit facility | (19,200 | ) | | (6,450 | ) |

Proceeds from NET Mexico credit facility, net of fees | 52,000 |

| | 165,000 |

|

Distributions to non-controlling interests | (2,295 | ) | | — |

|

| | | | | Net cash provided by financing activities | 29,907 |

| | 157,969 |

|

| | | | | Net change in cash and cash equivalents | 1,642 |

| | (566 | ) |

Cash and cash equivalents | | | |

Beginning of year | 1,877 |

| | 11,391 |

|

End of year | $ | 3,519 |

| | $ | 10,825 |

|

Supplemental disclosures of cash flow information | | | |

Cash paid for interest | $ | 9,125 |

| | $ | 7,328 |

|

Cash paid for income taxes, net of refunds | 46 |

| | 60 |

|

Noncash additions in accounts payable and accrued liabilities | 15,841 |

| | 79,381 |

|

The accompanying notes are an integral part of these consolidated financial statements.

NET Holdings Management, LLC

Notes to the Unaudited Consolidated Financial Statements

|

| | |

|

(all numbers presented in thousands except where otherwise stated) |

| |

1. | Organization and Nature of Operations |

NET Holdings Management, LLC (“NETHM” or the “Company”) began operations via predecessor entities in 1996. The Company was formed on March 7, 2007, and owns, manages and operates seven natural gas pipeline systems located principally in south Texas. The Company is owned 20% by Dearing Holdings, LP; 20% by Gutierrez Holdings, LP; 10% by Mission Pipeline Midstream, Inc., a Texas Subchapter S corporation which is owned 50% by Dearing Holdings, LP and 50% by Gutierrez Holdings, LP; and 50% by NET Investment Company, LLC, a wholly owned subsidiary of ArcLight Energy Partners Fund III, LP.

The Company, operating as NET Midstream, provides a broad spectrum of midstream natural gas products and services including intrastate natural gas transportation, gathering, marketing, treating, dehydration, and processing services to producers and wholesale end users. The Company has eight operating subsidiaries:

| |

• | NET Mexico Pipeline Partners, LLC (“NET Mexico”) - NET Mexico is a Texas limited liability company formed on May 17, 2013, to construct, own, and operate a natural gas transmission system located in South Texas, which transports natural gas from production areas in South Texas to the US/Mexico border and other customers located in South Texas. |

NET Mexico is owned 90% by NET Mexico Pipeline, LP the Managing Member, and 10% by MGI Enterprises US LLC (“MGI”), a Member and indirect wholly owned subsidiary of Pemex Gas y Petroquimica Basica, (“PGPB”) , which in turn is a subsidiary of the Mexican state-owned petroleum company Petroleos Mexicanos (“PEMEX”). NET Mexico Pipeline, LP is owned 100% by NET Holdings Management, LLC (“NETHM”). NET Mexico’s principle customer and anchor shipper is MexGas Supply, S.L. (“MGS” or the “Shipper”), also an indirect, wholly owned subsidiary of PGPB and PEMEX.

NET Mexico was placed in service on December 1, 2014 and is classified as an intrastate pipeline within the state of Texas. The Pipeline consists of the following components: (i) a 3 mile header system of high and low pressure 20” and 36” diameter pipelines which interconnect with nine interstate and intrastate pipeline systems located near Aqua Dulce, Texas (the “Header”); (ii) a compressor station with 50,000 hp of compression on the In-Service Date, increasing to 100,000 hp of compression by December 1, 2015 (the “Compressor Station”; together with the Header, the “Agua Dulce Hub”); (iii) a 120 mile 42” diameter mainline system (with a 48” diameter border crossing) interconnecting the Agua Dulce Hub with the US/Mexico Border; and (iv) by December 2015 and beyond, a number of lateral pipeline systems which will interconnect the mainline with various natural gas processing plants as well as other customers in South Texas.

On December 1, 2014 NET Mexico began service under a 20-year, firm natural gas transportation agreement (the “TSA”) with MGS. Pursuant to the TSA, NET Mexico provides MGS with 1 Bcf/day of firm natural gas transportation capacity through November 30, 2015, increasing to 2.1 Bcf/day of capacity beginning on December 1, 2015. The TSA provides for the receipt of natural gas at the Agua Dulce Hub in Nueces County, Texas and delivery to an interconnection point with the Los Ramones natural gas pipeline system (owned and operated by Gasoductos Del Norteste) at the US/Mexico border near Rio Grande City, Texas. In exchange for this transportation service, MGS provides NET Mexico with contractually fixed, “ship-or-pay” reservation payments for the duration of the agreement. In addition to the reservation charges, the TSA provides for volume-based payments from MGS over the 20 year life of the contract.

NET Holdings Management, LLC

Notes to the Unaudited Consolidated Financial Statements

|

| | |

|

(all numbers presented in thousands except where otherwise stated) |

| |

• | Eagle Ford Midstream, LP (“EFM”) - EFM owns and operates a natural gas transportation pipeline system in the Eagle Ford Shale located in south Texas. The 150-mile system was developed to connect gas processing plants and producers to downstream interstate and intrastate gas markets. The first phase of the pipeline went into service in September 2011 and delivers gas to LaSalle Pipeline and Transco’s McMullen Lateral. The second phase, which commenced initial operation in December 2012, and was fully operational in the second quarter of 2013, is a 105-mile, 30-inch diameter extension that receives volumes from the tailgate of the Western Gas Partners’ Brasada processing plant in LaSalle County with deliveries to interstate and intrastate gas pipelines at the Agua Dulce Hub. The second phase is anchored by a long-term, gas transportation agreement with an affiliate of Anadarko Petroleum Corporation. |

| |

• | Monument Pipeline, LP (“MON”) - MON is a 150-mile gathering and transportation pipeline that extends from Enstor’s Katy Hub to the Houston Ship Channel. MON serves residential customers in south Houston and industrial markets along the Houston Ship Channel. The southern portion of the pipeline gathers production in Brazoria, Ford Bend and Galveston Counties. |

| |

• | LaSalle Pipeline, LP (“LSP”) - LSP is a 52-mile pipeline system that delivers gas to a 202 MW natural gas fired power generation facility owned by the South Texas Electrical Cooperative (“STEC”). LSP receives its gas supply from EFM as well as from Transco’s McMullen Lateral. |

| |

• | South Shore Pipeline (“SSPL”) - SSPL is a 30-mile pipeline that has been the exclusive gas supplier of the City of Corpus Christi in Nueces County, Texas since 2001. |

| |

• | Mission Valley Pipeline (“MVPL”) - MVPL is located in Victoria County, Texas, and provides full requirements natural gas service to a 185MW generation facility owned by STEC. |

| |

• | Mission Natural Gas Company, LP (“MNGC”) - MNGC is located in West Feliciana Parish, Louisiana and is interconnected with, and supplies natural gas to, a barge terminal operator. |

| |

• | National Energy & Trade, LP (“NET”) - NET markets natural gas on behalf of the Company’s pipeline customers, providing gas supply for power plants and municipalities as well as marketing gas produced by shippers on the Company’s pipelines. NET also markets natural gas throughout the United States and owns transportation capacity on a variety of interstate and intrastate natural gas pipelines. |

| |

2. | Significant Accounting Policies |

Basis of Presentation

The accompanying consolidated financial statements of the Company were prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). All material intercompany transactions and balances have been eliminated in consolidation. Certain reclassifications have been made to prior period amounts to conform to the current period presentation. These reclassifications did not have an impact on our financial position, results of operations, or cash flows.

NET Holdings Management, LLC

Notes to the Unaudited Consolidated Financial Statements

|

| | |

|

(all numbers presented in thousands except where otherwise stated) |

Accounts Receivable

The Company’s accounts receivable balance relates primarily to sales of natural gas. The Company reviews the credit quality of potential customers prior to entering into sales transactions. The allowance for doubtful accounts is determined through specific identification of uncollectible accounts. The Company has no recorded allowance for doubtful accounts related as of June 30, 2015 or December 31, 2014.

Allocation of Profits and Losses

Profits and losses of the Company are allocated among the members based on their respective ownership percentages.

Cash and Cash Equivalents

Cash and cash equivalents include cash and money market funds. The Company considers all highly liquid investments with an original maturity of three months or less to be cash equivalents.

Debt Issuance Costs

Expenses incurred with the issuance of outstanding long-term debt are capitalized and amortized over the terms of the debt issued, using the straight-line method, which approximates the effective interest method. Debt issuance costs are recorded within other long term assets within the consolidated balance sheets.

Deferred Revenues

Amounts billed in advance of the period in which the service is rendered or product is delivered are recorded as deferred revenue.

Risk Management Activities

The Company uses derivative instruments to manage exposure to market risks from changes in certain commodity prices and interest rates and does not hold or issue derivative instruments for speculative or trading purposes. These derivative instruments are not designated as accounting hedges and changes in their fair values are recognized in the related revenue and expense line items on the statements of income.

Derivatives used in risk management activities are reflected on the consolidated balance sheets at their fair values and are classified as either current or noncurrent assets or liabilities based on their contract settlement date. The Company characterizes its commodity derivative instruments as either financial derivatives or physical forwards. Financial derivatives include fixed swaps, basis swaps and options, which are utilized to manage the risk associated with changes in commodity prices inherent in the Company’s marketing activities. Physical forwards represent contracts to buy or sell physical natural gas at a future date.

Effective January 1, 2014, the Company applied the Normal Purchase Normal Sale election to certain derivative contracts, which exempts qualifying contracts from fair value accounting and are instead accounted for using traditional accrual accounting.

Pursuant to the terms of NET Mexico’s Credit Agreement described in Note 7, the Company has entered into long-term, float-for-fixed interest rate swap agreements to hedge its exposure to changes in interest rates, which are recorded at fair value in the statement of financial position. The swaps were not designated as cash flow hedges and changes in the fair value of the swaps are recognized as interest expense in the period in which they occurred.

NET Holdings Management, LLC

Notes to the Unaudited Consolidated Financial Statements

|

| | |

|

(all numbers presented in thousands except where otherwise stated) |

Margin

Margin deposits constitute funds held on account with the Company’s financial clearinghouses as security for its outstanding derivative instruments. Margin payables constitute funds advanced by the financial clearinghouses to collateralize outstanding derivative instruments purchased on credit.

Fair Value of Financial Instruments

The estimated fair values of the Company’s financial instruments have been determined using available market information and appropriate valuation methodologies. Accordingly, the estimates are not necessarily indicative of the amounts that the Company can realize in a current-market exchange. The use of different market assumptions and/or estimation methodologies may have a material effect on the estimated fair values. Cash and cash equivalents, receivables, accounts payable and accrued liabilities approximate their fair values, given their short maturities. Assets and liabilities from risk management activities are stated at market value, which approximate their respective fair values.

Goodwill

Goodwill represents the excess of the cost of an acquisition over the fair value of the net identifiable assets acquired and liabilities assumed. Goodwill is tested for impairment at the reporting unit level at least annually, as of December 31, or more frequently when events occur and circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying amount. Accounting requirements provide that an entity may perform an optional qualitative assessment on an annual basis to determine whether events occurred or circumstances changed that would more likely than not reduce the fair value of a reporting unit below its carrying amount. If an initial qualitative assessment identifies that it is more likely than not that the fair value of a reporting unit is less than its carrying amount, or the optional qualitative assessment is not performed, a quantitative analysis is performed under a two-step impairment test to measure whether the fair value of the reporting unit is less than its carrying amount. If based upon a quantitative analysis the fair value of the reporting unit is less than its carrying amount, including goodwill, the Company performs an analysis of the fair value of all the assets and liabilities of the reporting unit. If the implied fair value of the reporting unit's goodwill is determined to be less than its carrying amount, an impairment loss is recognized for the difference.

Income Taxes

Income tax expense is primarily applicable to the Company’s state obligations under the Revised Texas Franchise Tax. The Company is not subject to federal income tax and the Company’s members are individually responsible for paying federal income taxes on their share of the Company’s taxable income.

Office and Computer Equipment

Office and computer equipment are recorded at cost. Expenditures for additions, improvements, and other enhancements are capitalized and minor replacements, maintenance, and repairs that do not extend asset life or add value are charged to expense as incurred. When office and computer equipment assets are retired or otherwise disposed of, the related cost and accumulated depreciation is removed from the accounts and any resulting gain or loss is included in the results of operations.

NET Holdings Management, LLC

Notes to the Unaudited Consolidated Financial Statements

|

| | |

|

(all numbers presented in thousands except where otherwise stated) |

Office and computer equipment are depreciated using the straight-line method, which results in depreciation expense being incurred evenly over the life of the assets. The Company’s estimate of depreciation incorporates assumptions regarding the useful economic lives and residual values of the assets. All office and computer equipment assets are estimated to have a five year economic useful life.

Pipeline Facilities

Pipeline facilities are recorded at cost. Expenditures for additions, improvements, and other enhancements are capitalized and minor replacements, maintenance, and repairs that do not extend asset life or add value are charged to expense as incurred. When pipeline facility assets are retired or otherwise disposed of, the related cost and accumulated depreciation is removed from the accounts and any resulting gain or loss is included in the results of operations. Interest costs incurred during the construction of an asset are capitalized as part of the pipeline facilities over the duration of the period activities are performed to get the asset ready for its intended use.

The pipeline facilities are depreciated using the straight-line method, which results in depreciation expense being incurred evenly over the life of the assets. The Company’s estimate of depreciation incorporates assumptions regarding the useful economic lives and residual values of the assets. All pipeline facilities are assumed to have a range of 20 to 30 year useful economic life.

Management reviews long-lived assets for impairment whenever events or changes in circumstances indicate that our carrying amount of an asset may not be recoverable. The Company recognizes impairment losses when estimated future cash flows expected to result from our use of the asset and its eventual disposition is less than its carrying amount.

Revenue Recognition

Revenues from the transportation and gathering of natural gas, reservation of pipeline capacity, natural gas demand payments, sales of natural gas, and sales of natural gas liquids are recognized when either the service is performed or upon physical delivery and passage of title to the customer. The Company’s commodity derivatives are accounted for on a mark-to-market basis with unrealized gains and losses recognized in the statement of income in each business period.

Use of Estimates

The preparation of a consolidated financial statement in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, and expenses and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Accordingly, actual results could differ from these estimates.

Noncontrolling Interests

Noncontrolling interests represent the outstanding ownership interests in our consolidated subsidiaries that are not wholly owned by the Company. In our accompanying consolidated income statements, the noncontrolling interest in the net income (or loss) of our consolidated subsidiaries is shown as an allocation of our consolidated net income and is presented separately as “Net income (loss) attributable to noncontrolling interests.” In our accompanying consolidated balance sheets, noncontrolling interests represents the ownership interests in our consolidated subsidiaries’ net assets held by parties other than us.

NET Holdings Management, LLC

Notes to the Unaudited Consolidated Financial Statements

|

| | |

|

(all numbers presented in thousands except where otherwise stated) |

| |

3. | Assets and Liabilities From Risk Management Activities |

The following table summarizes the fair market values of commodity related derivatives which qualify for derivative treatment used in risk management activities at June 30, 2015 and December 31, 2014:

|

| | | | | | | | | | | |

| Derivative Assets | | Derivative Liabilities |

| June 30, 2015 | | June 30, 2015 |

Derivatives | Balance Sheet Classification | | Fair Value | | Balance Sheet Classification | | Fair Value |

| | | | | | | |

Physical Forward | Assets from risk management activities - current | | $ | 259 |

| | Liabilities from risk management activities - current | | $ | — |

|

| | | | | | | |

| Assets from risk management activities - non current | | $ | 194 |

| | Liabilities from risk management activities - non current | | $ | — |

|

| | | | | | | |

Financial Derivatives | Assets from risk management activities - current | | $ | 2,581 |

| | Liabilities from risk management activities - current | | $ | 2,142 |

|

| | | | | | | |

| Assets from risk management activities - non current | | $ | — |

| | Liabilities from risk management activities - non current | | $ | 2 |

|

|

| | | | | | | | | | | |

| Derivative Assets | | Derivative Liabilities |

| December 31, 2014 | | December 31, 2014 |

Derivatives | Balance Sheet Classification | | Fair Value | | Balance Sheet Classification | | Fair Value |

| | | | | | | |

Physical Forward | Assets from risk management activities - current | | $ | 426 |

| | Liabilities from risk management activities - current | | $ | 301 |

|

| | | | | | | |

| Assets from risk management activities - non current | | $ | 322 |

| | Liabilities from risk management activities - non current | | $ | — |

|

| | | | | | | |

Financial Derivatives | Assets from risk management activities - current | | $ | 15,382 |

| | Liabilities from risk management activities - current | | $ | 16,251 |

|

| | | | | | | |

| Assets from risk management activities - non current | | $ | — |

| | Liabilities from risk management activities - non current | | $ | 2 |

|

Unrealized gains from commodity related derivatives included within the consolidated statements of income were $1.3 million and $1.2 million for the six months ended June 30, 2015 and 2014, respectively.

NET Holdings Management, LLC

Notes to the Unaudited Consolidated Financial Statements

|

| | |

|

(all numbers presented in thousands except where otherwise stated) |

The following table summarizes the fair market values of the Company’s interest rate swap agreements at June 30, 2015 and December 31, 2014:

|

| | | | | | | | | | | | |

| | Derivative Assets | | Derivative Liabilities |

| | June 30, 2015 | | June 30, 2015 |

Derivatives | | Balance Sheet Classification | | Fair Value | | Balance Sheet Classification | | Fair Value |

Interest Rate Hedges | | Assets from risk management activities - current | | $ | — |

| | Liabilities from risk management activities - current | | $ | 6,630 |

|

| | | | | | | | |

| | Assets from risk management activities - non current | | $ | 2,682 |

| | Liabilities from risk management activities - non current | | $ | 29,198 |

|

|

| | | | | | | | | | | | |

| | Derivative Assets | | Derivative Liabilities |

| | December 31, 2014 | | December 31, 2014 |

Derivatives | | Balance Sheet Classification | | Fair Value | | Balance Sheet Classification | | Fair Value |

Interest Rate Hedges | | Assets from risk management activities - current | | $ | — |

| | Liabilities from risk management activities - current | | $ | 917 |

|

| | | | | | | | |

| | Assets from risk management activities - non current | | $ | 2,188 |

| | Liabilities from risk management activities - non current | | $ | 34,657 |

|

| |

4. | Fair Value Measurements |

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The guidance requires disclosure that establishes a framework for measuring fair value and expands disclosure about fair value measurements. A three-tier fair value hierarchy, which prioritizes the inputs used to measure fair value, is as follows:

| |

• | Level 1: Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities. Included in this level are our broker-cleared natural gas commodity derivative contracts. |

| |

• | Level 2: Quoted prices in markets that are not active, or valuations based on pricing models with inputs derived from observable market data, either directly or indirectly, for substantially the full term of the asset or liability. Included in this level are our over the counter natural gas commodity derivative contracts and those natural gas physical forward contracts that are valued using primarily inputs that are derived from observable market data. |

| |

• | Level 3: Measured based on prices or valuation models that require at least one input that is both significant to the fair value measurement and unobservable. Unobservable inputs are based on the best information available in the circumstances, which might include the Company’s own data. Included in this level are certain natural gas physical forward contracts which are calculated using both observable market data and unobservable data compiled by the Company. |

NET Holdings Management, LLC

Notes to the Unaudited Consolidated Financial Statements

|

| | |

|

(all numbers presented in thousands except where otherwise stated) |

Financial assets and liabilities are classified based on the lowest level of input that is significant to the fair value measurements. The Company’s assessment of the significance of a particular input to the fair value measurement requires judgment, which may affect the valuation of the fair value of assets and liabilities and their placement within the fair value hierarchy levels. The determination of the fair values, stated below, takes into account the market for the Company’s financial assets and liabilities, the associated credit risk and other factors as required. The Company considers active markets as those in which transactions for the assets or liabilities occur in sufficient frequency and volume to provide pricing information on an ongoing basis.

The following tables summarize the valuation of the Company’s financial assets and liabilities as of June 30, 2015 and December 31, 2014:

|

| | | | | | | | | | | | | | | | | | | | | |

as of June 30, 2015 | Level 1 | | Level 2 | | Level 3 | | Fair Value Total |

|

Assets | | | | | | | | | | |

| Financial derivatives | $ | — |

| | $ | 2,581 |

| | $ | — |

| | $ | 2,581 |

|

| Physical forwards | — |

| | 453 |

| | — |

| | 453 |

|

| Interest rate hedges | — |

| | 2,682 |

| | — |

| | 2,682 |

|

| | | | | Total assets | $ | — |

| | $ | 5,716 |

| | $ | — |

| | $ | 5,716 |

|

Liabilities | | | | | | | | | |

| Financial derivatives | $ | — |

| | $ | 2,144 |

| | $ | — |

| | $ | 2,144 |

|

| Physical forwards | — |

| | — |

| | — |

| | — |

|

| Interest rate hedges | — |

| | 35,828 |

| | — |

| | 35,828 |

|

| | | | | Total liabilities | $ | — |

| | $ | 37,972 |

| | $ | — |

| | $ | 37,972 |

|

|

| | | | | | | | | | | | | | | | | | | | | |

as of December 31, 2014 | Level 1 | | Level 2 | | Level 3 | | Fair Value Total |

| | | | | | | | | | | | | |

Assets | | | | | | | | | | |

| Financial derivatives | $ | — |

| | $ | 15,382 |

| | $ | — |

| | $ | 15,382 |

|

| Physical forwards | — |

| | 748 |

| | — |

| | 748 |

|

| Interest rate hedges | — |

| | 2,188 |

| | — |

| | 2,188 |

|

| | | | | Total assets | $ | — |

| | $ | 18,318 |

| | $ | — |

| | $ | 18,318 |

|

Liabilities | | | | | | | | | |

| Financial derivatives | $ | — |

| | $ | 16,253 |

| | $ | — |

| | $ | 16,253 |

|

| Physical forwards | — |

| | 301 |

| | — |

| | 301 |

|

| Interest rate hedges | — |

| | 35,574 |

| | — |

| | 35,574 |

|

| | | | | Total liabilities | $ | — |

| | $ | 52,128 |

| | $ | — |

| | $ | 52,128 |

|

There have been no movements between the levels of the fair value hierarchy for the six months ended June 30, 2015.

NET Holdings Management, LLC

Notes to the Unaudited Consolidated Financial Statements

|

| | |

|

(all numbers presented in thousands except where otherwise stated) |

| |

5. | Property, Plant, and Equipment, net |

Major categories of the Company’s property, plant, and equipment were as follows at June 30, 2015 and December 31, 2014:

|

| | | | | | | | | | | | | |

| June 30, 2015 | | December 31, 2014 |

| | | |

Pipeline facilities | $ | 881,300 |

| | $ | 839,883 |

|

Office and computer equipment | 1,792 |

| | 1,705 |

|

| 883,092 |

| | 841,588 |

|

Less: Accumulated depreciation | (65,635 | ) | | (52,364 | ) |

| $ | 817,457 |

| | $ | 789,224 |

|

In August 2014 the Company completed a sale of its Mission Pipeline system located in Hidalgo County, Texas for proceeds of $0.6 million. Prior to the sale, the Company recognized an impairment charge of approximately $8.7 million, reflecting the net book value of the assets less the sales price.

|

| | | | | | | | | | | | | |

| | | | | | | June 30, 2015 | | December 31, 2014 |

| | | | | | | | | |

Professional fees | $ | 100 |

| | $ | 243 |

|

Ad Valorem Taxes | 2,827 |

| | — |

|

Construction related accruals | 4,634 |

| | 2,835 |

|

Deferred revenue - current | 536 |

| | 536 |

|

Other | | | | 341 |

| | 355 |

|

| | | | | Total accrued liabilities | $ | 8,438 |

| | $ | 3,969 |

|

NET Holdings Management, LLC

Notes to the Unaudited Consolidated Financial Statements

|

| | |

|

(all numbers presented in thousands except where otherwise stated) |

A summary of notes payable and long-term debt at June 30, 2015 and December 31, 2014 is as follows:

|

| | | | | | | | | | | | | |

| | | | | | | June 30, 2015 | | December 31, 2014 |

| | | | | | | | | |

NET Mexico credit facility - non-recourse | $ | 457,800 |

| | $ | 405,800 |

|

NETHM credit facility | 123,700 |

| | 142,900 |

|

LSP note payable - non-recourse | 24,609 |

| | 25,165 |

|

EFM note payable | 1,523 |

| | 1,565 |

|

| | | | | | | 607,632 |

| | 575,430 |

|

Less: Current portion | (1,149 | ) | | (1,112 | ) |

| | | | | Long-term debt less current portion | $ | 606,483 |

| | $ | 574,318 |

|

NET Mexico Credit Facility

On December 6, 2013, NET Mexico entered into a Credit Agreement with a syndicate of eight banks, led by The Bank of Toyko-Mitsubishi UFJ, LTD. (“BTMUFJ”) as Coordinating Lead Arranger and Administrative Agent (the “Credit Agreement”) with Credit Agricole Corporate and Investment Bank, BBVA Securities Inc., ING Capital LLC, Natixis, New York Branch, Norddeutsche Landesbank Girozentrale, New York Branch, Royal Bank of Canada Capital Markets, and Santander Bank, N.A. also participating. The loan commitments consist of a Construction Loan Commitment of up to $604 million (the “Construction Loan”) and a Letter of Credit Commitment providing for the issuance of letters of credit up to $60 million. The Construction Loan may be utilized to construct a portion of the Project, pay transaction fees and expenses, and reimburse NETHM for certain costs incurred to develop the Pipeline. As of June 30, 2015, outstanding borrowings and letters of credit issued under the Credit Agreement were $457.8 million and $10.5 million, respectively. As of December 31, 2014 outstanding borrowings and letters of credit issued under the Credit Agreement were $405.8 million and $7.7 million, respectively.

The Credit Agreement includes provisions that require the Construction Loans to be converted to a term loan (the “Term Loan”) in conjunction with the Company meeting certain conditions precedent as detailed in the Credit Agreement (the “Term Loan Conversion”). The Construction Loan matures on the earlier of the Term Loan Conversion or March 31, 2016. The Term Loan matures on the earlier of March 31, 2022 or the sixth anniversary of the Term Loan Conversion.

The Credit Agreement is collateralized by substantially all of NET Mexico’s assets, future revenues, and its members’ equity, and is nonrecourse to the Company and all of its other subsidiaries. The debt obligations are subject to certain restrictive covenants that, among other things, limit NET Mexico’s ability to incur additional indebtedness, release funds from reserve accounts, make distributions, create liens, and enter into any transaction of merger or consolidation. In addition, NET Mexico has provided general indemnities and tax indemnities in favor of the parties to the debt obligations for any losses incurred, as defined.

NET Holdings Management, LLC

Notes to the Unaudited Consolidated Financial Statements

|

| | |

|

(all numbers presented in thousands except where otherwise stated) |

Interest is determined, at the Company’s election, by reference to (a) the Alternate Base Rate which is the greater of (1) the prime rate, (2) the federal funds rate plus 0.50%, and (3) the one month London InterBank Offered Rate (“LIBOR”) rate plus 1.0%, plus an applicable margin, or (b) the Euro Dollar rate, which is the Adjusted LIBOR, plus an applicable margin. The Credit Agreement also provides for a quarterly commitment fee charged on the average daily unused amount of loan commitments of 0.5%. The effective interest rate was 2.7% as of June 30, 2015 and December 31, 2014.

In connection with the issuance of the Credit Agreement, NETHM, its owners, and certain lenders executed an agreement whereby NETHM would contribute equity to NET Mexico up to a maximum of $67.1 million (the “Equity Commitment”). The Equity Commitment is used to pay construction costs on a pro rata basis with the Construction Loan. For the six months ended June 30, 2015 and the year ended December 31, 2014, NETHM made contributions related to this Equity Commitment of $5.7 million and $27.9 million, respectively.

NETHM Credit Facility

On June 22, 2012, NETHM entered into a five-year fully committed $200 million secured credit facility with an accordion feature that allows for a maximum borrowing up to $250 million (the “Credit Facility”). The Credit Facility is a syndicated facility co-led by Wells Fargo Bank, N.A. and Citibank, N.A., with Amegy Bank National Association, Branch Banking and Trust Company, Capital One, National Association, IBERIABANK, SANTANDER Bank, N.A., Trustmark National Bank, and Encore Bank, N.A. also participating. The Credit Facility is collateralized by substantially all the assets of the Company, except for the assets of LaSalle Pipeline, LP, which are pledged under the Notes Payable and the assets of NET Mexico Pipeline Partners, LLC, which are pledged under the Credit Agreement described above. Under the Credit Facility, the Company is required to maintain certain financial covenants, including an interest coverage ratio and a leverage ratio.

The Credit Facility provides for the issuance of letters of credit up to $25 million. Fees and interest are based on outstanding letters of credit and loans and determined by pre-established amounts which vary in relation to the Company’s leverage ratio. The Company also pays a fee on the unutilized amount of the commitment. Interest on loans is calculated using LIBOR index rates plus an applicable margin. The effective interest rate was 3.4% and 3.3% as of June 30, 2015 and December 31, 2014, respectively.

At June 30, 2015 and December 31, 2014, there was $123.7 million and $142.9 million of outstanding indebtedness under the Credit Facility and the Previous Credit Facility, respectively. Outstanding letters of credit were $1.4 million and $2.0 million as of June 30, 2015 and December 31, 2014, respectively.

LSP Note Payable

On December 18, 2009, LSP entered into a 19 year, $30 million note purchase agreement with The Prudential Insurance Company of America and United of Omaha Life Insurance Company (the “Notes Payable”). The Notes Payable is collateralized by substantially all of LSP’s assets and future revenues, and is nonrecourse to the Company and all of its other subsidiaries. The Notes Payable have a fixed coupon rate of 6.30% and the principal amortizes quarterly over the term of the agreement. At June 30, 2015 and December 31, 2014, respectively, LSP had $24.6 million and $25.2 million of outstanding indebtedness under the Notes Payable.

NET Holdings Management, LLC

Notes to the Unaudited Consolidated Financial Statements

|

| | |

|

(all numbers presented in thousands except where otherwise stated) |

The Notes Payable include provisions that require LSP to post certain collateral over the life of the agreement. This provision can be met either through cash on deposit in a restricted debt service account with a third party bank, Deutsche Bank Trust Company Americas, or by posting a letter of credit for the required amount. The form of collateral is at the option of LSP. At June 30, 2015 and December 31, 2014, LaSalle met the requirement of this provision through a letter of credit in the amount of $1.4 million.

The terms of the Notes Payable require LSP to maintain a certain debt service coverage ratio.

EFM Note Payable

In October 2013, EFM entered into a $1.7 million note payable to finance the purchase of a natural gas treating facility (the “EFM Note”). The note does not have a stipulated maturity date or coupon rate, and is repayable in monthly installments based on the receipt of certain natural gas volumes multiplied by a fixed rate. The EFM Note is classified as long-term debt as of June 30, 2015 and December 31, 2014 on the basis of this variability. At June 30, 2015 and December 31, 2014, EFM had $1.5 million and $1.6 million of outstanding indebtedness under the EFM Note, respectively.

| |

8. | Commitments and Contingencies |

The Company is subject to a variety of federal, state and local environmental laws and regulations. The Company believes that its operations comply, in all material respects, with all applicable federal, state and local environmental laws and regulations.

The Company may become party to various legal actions that arise in the normal course of business. In addition, the Company is subject to audit by tax authorities in various federal, state, and local tax jurisdictions. It is not possible to determine the ultimate liabilities, if any, that the Company may incur resulting from any lawsuits, claims and proceedings, audits, commitments and contingencies and related matters or the timing of such liabilities, if any.

Commitments for Construction

The Company’s future capital commitments are comprised of binding commitments under purchase orders for materials ordered but not received and firm commitments under binding construction service agreements. The commitments as of June 30, 2015, were approximately $21.9 million, all of which are expected to be settled in 2015.

Operating Leases

The Company leases certain rights of way, office space and other facilities and equipment under operating leases. Certain lease agreements have escalating payments over the life of the lease. Rent expense is recognized on a straight line basis over the life of the lease for these arrangements. Certain lease agreements contain provisions that allow credits to monthly rent payments for any leasehold improvements made by the Company. These credits are recognized in the period incurred. Future minimum payments are as follows:

|

| | | | | | | | | |

Period Ending December 31, | |

2015 | | | | $ | 248 |

|

2016 | | | | | 456 |

|

2017 | | | | | 243 |

|

2018 | | | | | 192 |

|

2019 and thereafter | 2,970 |

|

NET Holdings Management, LLC

Notes to the Unaudited Consolidated Financial Statements

|

| | |

|

(all numbers presented in thousands except where otherwise stated) |

Rental expense for operating leases for the six months ended June 30, 2015 and 2014 was $321 and $361, respectively.

Events occurring after June 30, 2015 were evaluated as of November 5, 2015 to ensure any subsequent events that meet the criteria for recognition and/or disclosure in this report have been included.

On October 1, 2015, NextEra Energy Partners Ventures, LLC, a subsidiary of NextEra Energy Partners, LP (NEP) acquired 100% of the membership interests of NET Holdings Management, LLC.

Exhibit 99.2

Introduction

The unaudited pro forma consolidated statements of operations and balance sheet (pro forma financial statements) combine the historical consolidated financial statements of NextEra Energy Partners, LP (NEP) and the financial statements of NET Holdings Management, LLC (NET Midstream) and its subsidiaries to illustrate the potential effect of the October 1, 2015 acquisition by a subsidiary of NEP of 100% of the membership interests in NET Midstream (NET Midstream acquisition). The pro forma financial statements are based on, and should be read in conjunction with, the consolidated financial statements of NEP included in NEP's Annual Report on Form 10-K for the year ended December 31, 2014 filed with the Securities and Exchange Commission (SEC) on February 20, 2015, as amended, and retrospectively adjusted to reflect the acquisitions of entities under common control described in Note 1 to the consolidated financial statements of NEP and its subsidiaries in Exhibit 99 to NEP's Current Report on Form 8-K filed with the SEC on September 21, 2015. The pro forma financial statements are also based on, and should be read in conjunction with, the condensed consolidated financial statements of NEP included in NEP's Quarterly Report on Form 10-Q for the six months ended June 30, 2015 filed with the SEC on August 3, 2015, as well as the consolidated financial statements of NET Holdings Management, LLC and its subsidiaries previously filed as Exhibit 99 to NEP's Current Report on Form 8-K filed on September 10, 2015 and the condensed consolidated financial statements of NET Holdings Management, LLC and its subsidiaries included in Exhibit 99.1 to this Form 8-K/A.

The historical consolidated financial statements have been adjusted in the pro forma consolidated financial statements to give effect to pro forma events that are (1) directly attributable to the NET Midstream acquisition and the associated financing activities, (2) factually supportable and (3) with respect to the pro forma statements of operations, expected to have a continuing impact on the consolidated results. The pro forma financial statements have been derived by the application of pro forma adjustments to the historical consolidated financial statements of NEP. The pro forma consolidated statements of income for the years ended December 31, 2014 and for the six months ended June 30, 2015 give effect to the NET Midstream acquisition and the debt and equity financing transactions related to such acquisition as if they had occurred on January 1, 2014. The unaudited pro forma consolidated balance sheet as of June 30, 2015 gives effect to the NET Midstream acquisition and the debt and equity financing transactions related to such acquisition as if they had occurred on June 30, 2015.

The pro forma financial statements have been prepared using the acquisition method of accounting. The purchase price for the NET Midstream acquisition is allocated to the assets acquired and liabilities assumed based on their estimated fair values. The initial accounting for the NET Midstream acquisition is not complete because the evaluation necessary to assess the fair values of certain net assets acquired is still in process. Accordingly, the pro forma purchase price adjustments are preliminary, subject to future adjustments and have been made solely for the purpose of providing pro forma financial statements presented herewith. Differences between these preliminary estimates and the final acquisition accounting may occur and these differences could have a material impact on the accompanying pro forma financial statements and NEP's future results of operations and financial position.

The pro forma financial statements have been presented for informational purposes only and are not necessarily indicative of what the combined company's results of operations and financial position would have been had the NET Midstream acquisition been completed on the dates indicated. NEP incurred approximately $12 million in costs associated with the NET Midstream acquisition subsequent to June 30, 2015 and such costs are not included in the pro forma financial statements.

|

| | | | | | | | | | | | | | | |

NEXTERA ENERGY PARTNERS, LP UNAUDITED PRO FORMA CONSOLIDATED STATEMENT OF INCOME (millions, except per unit amounts) | | | | |

| | | | | | | |

Six months ended June 30, 2015 | | | | | | | |

| NEP Historical | | NET Midstream Historical | | Pro Forma Adjustments | | Pro Forma Combined |

OPERATING REVENUES | $ | 194 |

| | $ | 252 |

| | $ | (200 | ) | (a)(b) | $ | 246 |

|

OPERATING EXPENSES | | | | | | | |

Operations and maintenance | 43 |

| | 12 |

| | (5 | ) | (a)(c)(d) | 50 |

|

Purchases of natural gas | — |

| | 195 |

| | (195 | ) | (a) | — |

|

Transportation and other fees | — |

| | 4 |

| | (4 | ) | (b) | — |

|

Depreciation and amortization | 60 |

| | 13 |

| | 4 |

| (e) | 77 |

|

Transmission | 1 |

| | — |

| | — |

| | 1 |

|

Taxes other than income taxes and other | 7 |

| | — |

| | 3 |

| (c) | 10 |

|

Total operating expenses | 111 |

| | 224 |

| | (197 | ) | | 138 |

|

OPERATING INCOME | 83 |

| | 28 |

| | (3 | ) | | 108 |

|

OTHER INCOME (DEDUCTIONS) | | | | | | | |

Interest expense | (51 | ) | | (11 | ) | | (9 | ) | (f)(g) | (71 | ) |

Benefits associated with differential membership interests—net | 7 |

| | — |

| | — |

| | 7 |

|

Equity in earnings of equity method investees | (1 | ) | | — |

| | — |

| | (1 | ) |

Other—net | — |

| | — |

| | — |

| | — |

|

Total other deductions—net | (45 | ) | | (11 | ) | | (9 | ) | | (65 | ) |

INCOME BEFORE INCOME TAXES | 38 |

| | 17 |

| | (12 | ) | | 43 |

|

INCOME TAXES | 8 |

| | — |

| | — |

| | 8 |

|

NET INCOME | 30 |

| | 17 |

| | (12 | ) | | 35 |

|

Less net income attributable to noncontrolling interest | 26 |

| | 1 |

| | (1 | ) | (i) | 26 |

|

NET INCOME ATTRIBUTABLE TO NEXTERA ENERGY PARTNERS, LP | $ | 4 |

| | $ | 16 |

| | $ | (11 | ) | | $ | 9 |

|

| | | | | | |

|

Weighted average number of common units outstanding - basic and assuming dilution | 19.4 |

| |

| |

| (j) | 27.8 |

|

Earnings per common unit attributable to NextEra Energy Partners, LP - basic and assuming dilution | $ | 0.24 |

| | | | | | $ | 0.32 |

|

|

| | | | | | | | | | | | | | | |

NEXTERA ENERGY PARTNERS, LP UNAUDITED PRO FORMA CONSOLIDATED STATEMENT OF INCOME (millions, except per unit amounts) | | | | |

| | | | | | | |

Year ended December 31, 2014 | | | | | | | |

| NEP Historical | | NET Midstream Historical | | Pro Forma Adjustments | | Pro Forma Combined |

OPERATING REVENUES | $ | 348 |

| | $ | 1,030 |

| | $ | (983 | ) | (a)(b) | $ | 395 |

|

OPERATING EXPENSES | | | | | | | |

Operations and maintenance | 74 |

| | 17 |

| | (3 | ) | (a)(c) | 88 |

|

Purchases of natural gas | — |

| | 951 |

| | (951 | ) | (a) | — |

|

Transportation and other fees | — |

| | 20 |

| | (20 | ) | (b) | — |

|

Depreciation and amortization | 95 |

| | 13 |

| | 21 |

| (e) | 129 |

|

Transmission | 2 |

| | — |

| | — |

| | 2 |

|

Impairment | — |

| | 9 |

| | (9 | ) | (a) | — |

|

Taxes other than income taxes and other | 5 |

| | — |

| | 2 |

| (c) | 7 |

|

Total operating expenses | 176 |

| | 1,010 |

| | (960 | ) | | 226 |

|

OPERATING INCOME | 172 |

| | 20 |

| | (23 | ) | | 169 |

|

OTHER INCOME (DEDUCTIONS) | | | | | | | |

Interest expense | (100 | ) | | (50 | ) | | (22 | ) | (f) | (172 | ) |

Benefits associated with differential membership interests—net | — |

| | — |

| | — |

| | — |

|

Equity in earnings of equity method investees | (1 | ) | | — |

| | — |

| | (1 | ) |

Total other deductions—net | (101 | ) | | (50 | ) | | (22 | ) | | (173 | ) |

INCOME BEFORE INCOME TAXES | 71 |

| | (30 | ) | | (45 | ) | | (4 | ) |

INCOME TAXES | 18 |

| | — |

| | (5 | ) | (h) | 13 |

|

NET INCOME | 53 |

| | (30 | ) | | (40 | ) | | (17 | ) |

Less net income prior to Initial Public Offering for NEP's initial portfolio | 28 |

| | — |

| | — |

| | 28 |

|

Less net income attributable to noncontrolling interest | 22 |

| | (4 | ) | | (2 | ) | (i) | 16 |

|

NET INCOME ATTRIBUTABLE TO NEXTERA ENERGY PARTNERS, LP SUBSEQUENT TO INITIAL PUBLIC OFFERING | $ | 3 |

| | $ | (26 | ) | | $ | (38 | ) | | $ | (61 | ) |

| | | | | | | |

Weighted average number of common units outstanding - basic and assuming dilution | 18.7 |

| | | | | (j) | 27.1 |

|

Earnings per common unit attributable to NextEra Energy Partners, LP - basic and assuming dilution | $ | 0.16 |

| | | | | | $ | (2.25 | ) |

|

| | | | | | | | | | | | | | | |

NEXTERA ENERGY PARTNERS, LP UNAUDITED PRO FORMA CONSOLIDATED BALANCE SHEET (millions) | | | | | | |

| | | | | | | |

As of June 30, 2015 | | | | | | | |

| NEP Historical | | NET Midstream Historical | | Pro Forma Adjustments | | Pro Forma Combined |

ASSETS | | | | | | | |

Current assets: | | | | | | | |

Cash and cash equivalents | $ | 100 |

| | $ | 4 |

| | $ | 262 |

| (j) | $ | 366 |

|

Accounts receivable | 51 |

| | 35 |

| | (22 | ) | (a) | 64 |

|

Due from related parties | 38 |

| | — |

| | — |

| | 38 |

|

Restricted cash ($13 related to VIEs) | 23 |

| | — |

| | — |

| | 23 |

|

Prepaid expenses | 2 |

| | 2 |

| | — |

| | 4 |

|

Other current assets | 11 |

| | 4 |

| | (4 | ) | (a) | 11 |

|

Total current assets | 225 |

| | 45 |

| | 236 |

| | 506 |

|

Non-current assets: | | | | | | | |

Property, plant and equipment—net ($713 related to VIEs) | 3,199 |

| | 817 |

| | (12 | ) | (k) | 4,004 |

|

Construction work in progress | 1 |

| | — |

| | — |

| | 1 |

|

Deferred income taxes | 154 |

| | — |

| | (2 | ) | (h) | 152 |

|

Other investments | 45 |

| | — |

| | — |

| | 45 |

|

Intangible assets - customer relationships | — |

| | — |

| | 710 |

| (k) | 710 |

|

Goodwill | — |

| | 42 |

| | 546 |

| (a)(k) | 588 |

|

Other non-current assets | 95 |

| | 20 |

| | — |

| | 115 |

|

Total non-current assets | 3,494 |

| | 879 |

| | 1,242 |

| | 5,615 |

|

TOTAL ASSETS | $ | 3,719 |

| | $ | 924 |

| | $ | 1,478 |

| | $ | 6,121 |

|

LIABILITIES AND EQUITY | | | | | | | |

Current liabilities: | | | | | | | |

Accounts payable and accrued expenses | $ | 18 |

| | $ | 46 |

| | $ | (22 | ) | (a) | $ | 42 |

|

Short-term debt | 325 |

| | — |

| | (313 | ) | (j) | 12 |

|

Due to related parties | 24 |

| | — |

| | — |

| | 24 |

|

Current maturities of long-term debt | 89 |

| | 1 |

| | — |

| | 90 |

|

Accrued interest | 25 |

| | — |

| | — |

| | 25 |

|

Other current liabilities | 20 |

| | 10 |

| | (2 | ) | (a) | 28 |

|

Total current liabilities | 501 |

| | 57 |

| | (337 | ) | | 221 |

|

Non-current liabilities: | | | | | | | |

Long-term debt | 1,869 |

| | 607 |

| | 694 |

| (f)(k) | 3,170 |

|

Deferral related to differential membership interests—VIEs | 418 |

| | — |

| | — |

| | 418 |

|

Acquisition holdbacks | — |

| | — |

| | 372 |

| (k) | 372 |

|

Accumulated deferred income taxes | 59 |

| | — |

| | — |

| | 59 |

|

Asset retirement obligation | 29 |

| | — |

| | — |

| | 29 |

|

Non-current due to related party | 16 |

| | — |

| | — |

| | 16 |

|

Other non-current liabilities | 23 |

| | 39 |

| | (10 | ) | (k) | 52 |

|

Total non-current liabilities | 2,414 |

| | 646 |

| | 1,056 |

| | 4,116 |

|

TOTAL LIABILITIES | 2,915 |

| | 703 |

| | 719 |

| | 4,337 |

|

COMMITMENTS AND CONTINGENCIES | | | | | | | |

EQUITY | | | | | | | |

Limited partners (common units issued and outstanding - 21.3) | 688 |

| | — |

| | 211 |

| (j)(h) | 899 |

|

Members' equity | — |

| | 227 |

| | (227 | ) | (l) | — |

|

Accumulated other comprehensive loss | (3 | ) | | — |

| | — |

| | (3 | ) |

Noncontrolling interest | 119 |

| | (6 | ) | | 775 |

| (j)(k) | 888 |

|

TOTAL EQUITY | 804 |

| | 221 |

| | 759 |

| | 1,784 |

|

TOTAL LIABILITIES AND EQUITY | $ | 3,719 |

| | $ | 924 |

| | $ | 1,478 |

| | $ | 6,121 |

|

Notes to Pro Forma Financial Statements

Note 1. Preliminary Purchase Price Allocation

The pro forma adjustments include the preliminary allocation of the purchase price to the fair values of assets acquired and liabilities assumed. The final allocation of the purchase price could differ materially from the preliminary allocation used for the pro forma financial statements primarily because natural gas prices, interest rates and other valuation variables will fluctuate over time and be different at the time of completion of the NET Midstream acquisition compared to the amounts assumed for the pro forma adjustments. The following is a summary of the fair value of net assets acquired and liabilities assumed:

|

| | | |

| Preliminary Purchase Price Allocation |

| (millions) |

Cash | $ | 4 |

|

Accounts receivable and prepaid expenses | 15 |

|

Property, plant and equipment - net | 805 |

|

Intangible assets - customer relationships | 710 |

|

Goodwill | 588 |

|

Other non-current assets | 20 |

|

Total assets acquired | 2,142 |

|

| |

Accounts payable, accrued expenses and other current liabilities | 32 |

|

Long-term debt, including current portion | 702 |

|

Acquisition holdbacks | 372 |

|

Other non-current liabilities | 29 |

|

Total liabilities assumed | 1,135 |

|

Noncontrolling interests | 67 |

|

Total cash consideration | $ | 940 |

|

Note 2. Pro Forma Adjustments and Assumptions

The adjustments are based on currently available information and certain estimates and assumptions, and therefore the actual effects of these transactions will differ from the pro forma adjustments. A general description of these transactions and adjustments is provided as follows:

| |

(a) | Reflects the removal of the historical results and financial position of NET Midstream's commodities trading and other operations which were not acquired by NEP. |

| |

(b) | Reflects the reclassification of NET Midstream transportation and other fees to conform to NEP's financial reporting policies. |

| |

(c) | Reflects the reclassification of NET Midstream expenses to conform to NEP's financial reporting policies in the amounts of approximately $3 million for the six months ended June 30, 2015 and $2 million for the year ended December 31, 2014. |

| |

(d) | Reflects the removal of approximately $1 million of employee bonus at NET Midstream that was accelerated and paid out in the six months ended June 30, 2015 in anticipation of the closing of the NET Midstream acquisition. |

| |

(e) | Reflects the estimated depreciation and amortization expense based on the preliminary fair value of property, plant and equipment-net and intangible assets - customer relationships over useful lives ranging from 25 - 50 years and 38 - 40 years, respectively. |

| |

(f) | Reflects the $600 million NEP borrowed under several senior secured term loan agreements to fund the NET Midstream acquisition and the related fees and interest of approximately $11 million for the six months ended June 30, 2015 and $22 million for the year ended December 31, 2014. |

| |

(g) | Reflects the removal of interest expense related to the $313 million short-term loan repaid as discussed in (j). |

| |

(h) | Reflects the removal of a $2 million deferred tax asset related to the change in state apportionment due to the NET Midstream acquisition and related basis difference in NEP’s investment and the reduction of tax expense of $5 million for the year ended December 31, 2014 related to NET Midstream historical financial statements and pro forma adjustments. |

| |

(i) | Reflects adjustments to net income attributable to noncontrolling interest based on the allocation of the pro forma adjustments. |

| |

(j) | Reflects financing transactions NEP completed in the third quarter of 2015 that resulted in an increase in cash on hand used to fund the NET Midstream acquisition. NEP sold 8,375,907 common units representing limited partner interests in NEP in a public offering increasing limited partners' equity by approximately $213 million and sold 27,000,000 of NEP OpCo common units to NEE increasing noncontrolling interest by $702 million. A portion of the net proceeds of the equity transactions was used to repay a $313 million short-term loan. The remaining proceeds of $602 million resulted in cash on hand to fund $340 million of the cash consideration for the NET Midstream acquisition, with approximately $262 million remaining in cash and cash equivalents. |

| |

(k) | Reflects adjustments to record the preliminary purchase price allocation. See Note 1. |

| |

(l) | Reflects the removal of NET Midstream's historical members' equity. |

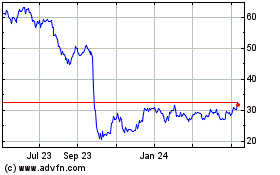

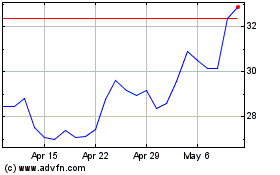

NextEra Energy Partners (NYSE:NEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

NextEra Energy Partners (NYSE:NEP)

Historical Stock Chart

From Apr 2023 to Apr 2024