UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2015 (December 19, 2014)

Global Cash Access Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware |

|

001-32622 |

|

20-0723270 |

|

(State or other Jurisdiction of |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

Incorporation) |

|

|

|

|

|

7250 S. Tenaya Way, Suite 100 |

|

|

|

Las Vegas, Nevada |

|

89113 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (800) 833-7110

|

|

(Former name or former address if changed since last

report.) |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

£ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

£ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

£ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

£ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.01. Completion of Acquisition or Disposition of Assets.

This Current Report on Form 8-K/A (“Form 8-K/A”) amends and supplements the Current Report on Form 8-K of Global Cash Access Holdings, Inc. (“GCA” or the “Company”) filed with the Securities and Exchange Commission (“SEC”) on December 22, 2014 (the “Original Form 8-K”) disclosing, among other things, the Company’s acquisition of Multimedia Games Holding Company, Inc. (“Multimedia Games”) on December 19, 2014 (the “Merger”). This Form 8-K/A includes the historical audited financial information of Multimedia Games and the unaudited pro forma financial information required by Item 9.01 of Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(a) Financial statements of businesses acquired.

The audited consolidated balance sheets of Multimedia Games as of September 30, 2014 and 2013, and the related consolidated statements of operations and other comprehensive income, stockholders’ equity, and cash flows for each of the three years in the period ended September 30, 2014, including the notes thereto, Schedule II, and the related reports of BDO USA, LLP, independent registered public accounting firm, which were included in Multimedia Games’ Annual Report on Form 10-K filed with the SEC on November 12, 2014, are incorporated herein by reference as Exhibit 99.1 to this Form 8-K/A.

(b) Pro forma financial information.

The unaudited pro forma condensed combined balance sheet as of September 30, 2014, the unaudited pro forma condensed combined statements of operations for the nine months ended September 30, 2014 and for the year ended December 31, 2013, and the accompanying notes, are attached as Exhibit 99.2 to this Form 8-K/A.

(d) Exhibits.

|

Exhibit

No. |

|

Description of Exhibit |

|

|

|

|

|

23.1 |

|

Consent of BDO US LLP. |

|

|

|

|

|

99.1 |

|

Audited consolidated balance sheets of Multimedia Games as of September 30, 2014 and 2013, and the related consolidated statements of operations and other comprehensive income, stockholders’ equity, and cash flows for each of the three years in the period ended September 30, 2014, including the notes thereto and Schedule II (incorporated herein by reference to Multimedia Games’ Annual Report on Form 10-K for the year ended September 30, 2014, filed with the SEC on November 12, 2014). |

|

|

|

|

|

99.2 |

|

Unaudited pro forma condensed combined balance sheet as of September 30, 2014, unaudited pro forma condensed combined statements of operations for the nine months ended September 30, 2014 and for the year ended December 31, 2013 and accompanying notes. |

Forward-Looking Statements

This Form 8-K/A, with respect to the pro forma financial information and notes thereto (and related assumptions and allocations) included as Exhibit 99.2 that reflect the Company’s financial condition and results of operations on a pro forma basis giving effect to its acquisition of Multimedia Games, contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements describe future expectations, plans, results or strategies and can often be identified by the use of terminology such as “may,” “will,” “estimate,” “project,” “assume,” “intend,” “continue,” “believe,” “expect,” “anticipate,” “should,” “could,” “potential,” “opportunity,” or similar terminology. These statements are based upon management’s current expectations, assumptions and estimates, including the estimates and assumptions related to the preparation of the pro forma financial information contained herein (including the preliminary purchase price allocation based on the estimated fair values of the assets acquired and liabilities assumed of Multimedia Games as of the date of acquisition), and are not guarantees of timing, future results or performance. Actual results may differ materially from those contemplated in the forward-looking statements due to a variety of risks and uncertainties and other factors, including adjustments to the fair values of the assets and liabilities of Multimedia Games once the related valuations have been finalized.

Additional information regarding risks and uncertainties and other factors that could cause actual results to differ materially from those contemplated in forward-looking statements is included from time to time in the Company’s filings with the SEC, including the Company’s most recent Quarterly Report on Form 10-Q filed with the SEC on November 4, 2014 (including under the heading “Risk Factors”) and other reports filed with the SEC. Forward-looking statements speak only as of the date they are made and, except for the Company’s ongoing obligations under the U.S. federal securities laws, the Company undertakes no obligation to publicly update any forward-looking statements whether as a result of new information, future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

GLOBAL CASH ACCESS HOLDINGS, INC. |

|

|

|

|

|

|

|

|

Date: February 27, 2015 |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Randy L. Taylor |

|

|

|

Randy L. Taylor |

|

|

|

Executive Vice President and Chief Financial Officer |

|

EXHIBIT INDEX

|

Exhibit

No. |

|

Description of Exhibit |

|

|

|

|

|

23.1 |

|

Consent of BDO US LLP. |

|

|

|

|

|

99.1 |

|

Audited consolidated balance sheets of Multimedia Games as of September 30, 2014 and 2013, and the related consolidated statements of operations and other comprehensive income, stockholders’ equity, and cash flows for each of the three years in the period ended September 30, 2014, including the notes thereto and Schedule II (incorporated herein by reference to Multimedia Games’ Annual Report on Form 10-K for the year ended September 30, 2014, filed with the SEC on November 12, 2014). |

|

|

|

|

|

99.2 |

|

Unaudited pro forma condensed combined balance sheet as of September 30, 2014, unaudited pro forma condensed combined statements of operations for the nine months ended September 30, 2014 and for the year ended December 31, 2013 and accompanying notes. |

EXHIBIT 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors and Stockholders

Global Cash Access, Inc.

Las Vegas, Nevada

We hereby consent to the incorporation by reference in the Registration Statements on Form S-8 (File Nos. 333-131904, 333-140878, 333-149496, 333-157512, 333-165264, 333-172358 333-187199 and 333-197860) of Global Cash Access, Inc. of our reports dated November 12, 2014, relating to Multimedia Games Holding Company, Inc.’s consolidated financial statements, financial statement schedules, and the effectiveness of Multimedia Games Holding Company, Inc.’s internal control over financial reporting, which is incorporated by reference in this Form 8-K/A.

Austin, Texas

February 27, 2015

Exhibit 99.2

UNAUDITED PRO FORMA CONDENSED COMBINED

FINANCIAL STATEMENTS

On December 19, 2014, GCA acquired Multimedia Games through the merger of a wholly owned subsidiary of GCA with and into Multimedia Games, with Multimedia Games surviving the merger as a wholly owned subsidiary of GCA. At the closing of the Merger, each outstanding share of Multimedia Games common stock, par value $0.001, was converted into the right to receive $36.50 per common share in cash, without interest. The total consideration paid in the Merger was approximately $1.2 billion.

The following unaudited pro forma combined financial information has been prepared to illustrate the effects of (i) the Merger, and (ii) in connection with the Merger, (A) GCA’s entry into a credit facility consisting of a $500.0 million senior secured term loan and a $50.0 million senior secured revolving credit facility (which was undrawn at the closing of the Merger) (together, the “Credit Facilities”), and (B) GCA’s issuance of $350.0 million of 7.75% Senior Secured Notes due 2021 and $350.0 million of 10.0% Senior Unsecured Notes due 2022 (collectively, the “Notes”). GCA used the net proceeds from the Credit Facilities, the net proceeds from the Notes offering, and cash on hand at GCA and Multimedia Games to pay the merger consideration in the Merger.

The unaudited pro forma condensed combined balance sheet set forth below combines the historical balance sheets of GCA and Multimedia Games as of September 30, 2014, and gives effect to the Merger as if it had occurred on September 30, 2014.

GCA and Multimedia Games had different fiscal year ends. Accordingly, the unaudited pro forma condensed combined statement of operations data for the nine-month period ended September 30, 2014 combines historical GCA consolidated statement of operations data for its nine-month period ended September 30, 2014 with historical Multimedia Games consolidated statement of operations data for its nine-month period ended June 30, 2014, giving effect to the Merger as if it had occurred on January 1, 2013. The unaudited pro forma condensed combined statement of operations data for the fiscal year ended December 31, 2013 combines the historical GCA consolidated statement of operations data for its fiscal year ended December 31, 2013 with the historical Multimedia Games consolidated statement of operations data for its fiscal year ended September 30, 2013, giving effect to the Merger as if had occurred on January 1, 2013.

The unaudited pro forma condensed combined financial information provided herein does not purport to represent the results of operations or financial position of GCA that would have actually resulted had the Merger been completed as of the dates indicated, nor should the information be taken as indicative of the future results of operations or financial position of the combined company. The unaudited pro forma condensed combined financial statements do not reflect the impacts of any potential operational efficiencies, cost savings or economies of scale that GCA may achieve with respect to the combined operations of GCA and Multimedia Games.

As of the date of this Current Report on Form 8-K/A, GCA has not completed the valuation analysis and calculations in sufficient detail necessary to arrive at the required estimates of the fair market value of the Multimedia Games assets to be acquired and liabilities to be assumed and the related allocations to such items, including goodwill, of the Merger consideration. The pro forma financial statements are presented for illustrative purposes only and are based on the estimates and assumptions set forth in the accompanying notes. Accordingly, the accompanying preliminary unaudited pro forma purchase price allocation is subject to further adjustments as additional information becomes available and as additional analyses are performed. There can be no assurance that such finalization will not result in material changes from the preliminary purchase price allocation.

The pro forma financial statements should be read in conjunction with:

|

· |

the accompanying notes to the pro forma financial statements; |

|

|

|

|

· |

the separate historical audited consolidated financial statements of GCA as of and for the year ended December 31, 2013, included in the Company’s Annual Report on Form 10-K; |

|

|

|

|

· |

the separate historical unaudited consolidated interim financial statements of GCA as of and for the nine months ended September 30, 2014, included in the Company’s Quarterly Report on Form 10-Q; |

|

|

|

|

· |

the separate historical audited consolidated financial statements of Multimedia Games as of and for the year ended September 30, 2014, included in Multimedia Games’ Annual Report on Form 10-K; and |

|

|

|

|

· |

the separate historical unaudited consolidated interim financial statements of Multimedia Games as of and for the nine months ended June 30, 2014, included in Multimedia Games’ Quarterly Report on Form 10-Q. |

GLOBAL CASH ACCESS HOLDINGS, INC.

Unaudited Pro Forma Condensed Combined Balance Sheets

As of September 30, 2014

(in thousands)

|

|

|

Global Cash

Access |

|

Multimedia

Games |

|

Pro Forma

Adjustments |

|

Note

References |

|

Pro Forma

Combined |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

106,499 |

|

$ |

138,086 |

|

$ |

(151,044) |

|

2A |

|

$ |

93,541 |

|

|

Settlement receivables |

|

27,372 |

|

- |

|

- |

|

|

|

27,372 |

|

|

Trade Receivables |

|

8,876 |

|

25,265 |

|

- |

|

|

|

34,141 |

|

|

Other receivables, net |

|

4,050 |

|

6,775 |

|

- |

|

|

|

10,825 |

|

|

Inventory |

|

10,905 |

|

12,412 |

|

- |

|

|

|

23,317 |

|

|

Prepaid expenses and other assets |

|

21,310 |

|

4,440 |

|

- |

|

|

|

25,750 |

|

|

Deferred tax asset |

|

3,102 |

|

5,886 |

|

- |

|

|

|

8,988 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets |

|

182,114 |

|

192,864 |

|

(151,044) |

|

|

|

223,934 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

|

|

|

|

|

|

Restricted cash and cash equivalents |

|

367 |

|

- |

|

- |

|

|

|

367 |

|

|

Property, equipment and leasehold improvements, net |

|

19,707 |

|

76,862 |

|

- |

|

|

|

96,569 |

|

|

Goodwill |

|

188,491 |

|

- |

|

917,275 |

|

1 |

|

1,105,766 |

|

|

Other intangible assets, net |

|

39,314 |

|

32,022 |

|

- |

|

|

|

71,336 |

|

|

Other receivables, net |

|

4,297 |

|

8,279 |

|

- |

|

|

|

12,576 |

|

|

Deferred tax asset |

|

76,726 |

|

1,348 |

|

4,325 |

|

2B |

|

82,399 |

|

|

Other assets, long-term |

|

7,094 |

|

3,637 |

|

38,112 |

|

2C |

|

48,843 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-current assets |

|

335,996 |

|

122,148 |

|

959,712 |

|

|

|

1,417,856 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

518,110 |

|

$ |

315,012 |

|

$ |

808,668 |

|

|

|

$ |

1,641,790 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

Settlement liabilities |

|

$ |

116,711 |

|

$ |

- |

|

$ |

- |

|

|

|

$ |

116,711 |

|

|

Accounts payable and accrued expenses |

|

66,256 |

|

34,445 |

|

(6,689) |

|

2D |

|

94,012 |

|

|

Debt, current portion |

|

954 |

|

3,700 |

|

5,346 |

|

2E |

|

10,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

183,921 |

|

38,145 |

|

(1,343) |

|

|

|

220,723 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

Deferred tax liability |

|

- |

|

9,838 |

|

- |

|

|

|

9,838 |

|

|

Debt, non-current portion |

|

94,789 |

|

22,200 |

|

1,061,734 |

|

2F |

|

1,178,723 |

|

|

Other accrued expenses and liabilities |

|

2,749 |

|

471 |

|

- |

|

|

|

3,220 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-current assets |

|

97,538 |

|

32,509 |

|

1,061,734 |

|

|

|

1,191,781 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

281,459 |

|

70,654 |

|

1,060,391 |

|

|

|

1,412,504 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

Common stock |

|

90 |

|

386 |

|

(386) |

|

2G |

|

90 |

|

|

Convertible preferred stock |

|

- |

|

- |

|

- |

|

|

|

- |

|

|

Additional paid-in capital |

|

244,247 |

|

148,828 |

|

(148,828) |

|

2H |

|

244,247 |

|

|

Retained earnings |

|

165,901 |

|

176,146 |

|

(183,511) |

|

2I |

|

158,536 |

|

|

Accumulated other comprehensive income |

|

2,370 |

|

- |

|

- |

|

|

|

2,370 |

|

|

Treasury stock |

|

(175,957) |

|

(81,002) |

|

81,002 |

|

2J |

|

(175,957) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders’ equity |

|

236,651 |

|

244,358 |

|

(251,723) |

|

|

|

229,286 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

518,110 |

|

$ |

315,012 |

|

$ |

808,668 |

|

|

|

$ |

1,641,790 |

|

See accompanying notes to unaudited pro forma condensed combined financial statements.

GLOBAL CASH ACCESS HOLDINGS, INC.

Unaudited Pro Forma Condensed Combined Statements of Operations

For the Nine Months Ended September 30, 2014

(in thousands, except per share data)

|

|

|

For the Nine

Months Ended

September 30,

2014 |

|

For the Nine

Months Ended

June 30, 2014 |

|

|

|

|

|

|

|

|

|

|

Global Cash

Access |

|

Multimedia

Games |

|

Pro Forma

Adjustments |

|

Note

References |

|

Pro Forma

Combined |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

440,998 |

|

$ |

167,606 |

|

$ |

- |

|

|

|

$ |

608,604 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues (exclusive of depreciation and amortization) |

|

331,181 |

|

37,871 |

|

- |

|

|

|

369,052 |

|

|

Operating expenses |

|

62,233 |

|

40,042 |

|

(953) |

|

2K |

|

101,322 |

|

|

Research and development expenses |

|

- |

|

12,351 |

|

- |

|

|

|

12,351 |

|

|

Depreciation |

|

5,702 |

|

26,971 |

|

- |

|

|

|

32,673 |

|

|

Amortization |

|

8,476 |

|

5,402 |

|

- |

|

|

|

13,878 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total costs and expenses |

|

407,592 |

|

122,637 |

|

(953) |

|

|

|

529,276 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

33,406 |

|

44,969 |

|

953 |

|

|

|

79,328 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net of interest income |

|

(5,625) |

|

(450) |

|

(70,610) |

|

2L |

|

(76,685) |

|

|

Loss on extinguishment of debt |

|

- |

|

- |

|

(5,648) |

|

2M |

|

(5,648) |

|

|

Other income, net of other expense |

|

- |

|

24 |

|

- |

|

|

|

24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total other income (expense) |

|

(5,625) |

|

(426) |

|

(76,258) |

|

|

|

(82,309) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income/(loss) from operations before tax |

|

27,781 |

|

44,543 |

|

(75,305) |

|

|

|

(2,981) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax provision/(benefit) |

|

9,892 |

|

16,400 |

|

(26,357) |

|

2N |

|

(65) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income/(loss) |

|

17,889 |

|

28,143 |

|

(48,948) |

|

|

|

(2,916) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation |

|

(457) |

|

- |

|

- |

|

|

|

(457) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income/(loss) |

|

$ |

17,432 |

|

$ |

28,143 |

|

$ |

(48,948) |

|

|

|

$ |

(3,373) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings/(loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.27 |

|

$ |

0.95 |

|

N/M |

(1) |

|

|

$ |

(0.04) |

|

|

Diluted |

|

$ |

0.27 |

|

$ |

0.91 |

|

N/M |

(1) |

|

|

$ |

(0.04) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

65,853 |

|

29,639 |

|

(29,639) |

|

|

|

65,853 |

|

|

Diluted |

|

67,051 |

|

30,971 |

|

(30,971) |

|

|

|

67,051 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Not meaningful. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to unaudited pro forma condensed combined financial statements.

GLOBAL CASH ACCESS HOLDINGS, INC.

Unaudited Pro Forma Condensed Combined Statements of Operations

For the Year Ended December 31, 2013

(in thousands, except per share data)

|

|

|

For the Year

Ended

December 31,

2013 |

|

For the Year

Ended

September 30,

2013 |

|

|

|

|

|

|

|

|

|

|

Global Cash

Access |

|

Multimedia

Games |

|

Pro Forma

Adjustments |

|

Note

References |

|

Pro Forma

Combined |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

582,444 |

|

$ |

189,366 |

|

$ |

- |

|

|

|

$ |

771,810 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues (exclusive of depreciation and amortization) |

|

439,794 |

|

36,946 |

|

- |

|

|

|

476,740 |

|

|

Operating expenses |

|

76,562 |

|

48,350 |

|

- |

|

|

|

124,912 |

|

|

Research and development expenses |

|

- |

|

16,842 |

|

- |

|

|

|

16,842 |

|

|

Depreciation |

|

7,350 |

|

28,805 |

|

- |

|

|

|

36,155 |

|

|

Amortization |

|

9,588 |

|

6,041 |

|

- |

|

|

|

15,629 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total costs and expenses |

|

533,294 |

|

136,984 |

|

- |

|

|

|

670,278 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

49,150 |

|

52,382 |

|

- |

|

|

|

101,532 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net of interest income |

|

(10,265) |

|

(648) |

|

(92,832) |

|

2L |

|

(103,745) |

|

|

Loss on extinguishment of debt |

|

- |

|

- |

|

(5,648) |

|

2M |

|

(5,648) |

|

|

Other income, net of other expense |

|

- |

|

33 |

|

- |

|

|

|

33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total other income (expense) |

|

(10,265) |

|

(615) |

|

(98,480) |

|

|

|

(109,360) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income/(loss) from operations before tax |

|

38,885 |

|

51,767 |

|

(98,480) |

|

|

|

(7,828) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax provision/(benefit) |

|

14,487 |

|

16,833 |

|

(34,468) |

|

2N |

|

(3,148) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income/(loss) |

|

24,398 |

|

34,934 |

|

(64,012) |

|

|

|

(4,680) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation |

|

269 |

|

329 |

|

- |

|

|

|

598 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income/(loss) |

|

$ |

24,667 |

|

$ |

35,263 |

|

$ |

(64,012) |

|

|

|

$ |

(4,082) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings/(loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.37 |

|

$ |

1.21 |

|

N/M |

(1) |

|

|

$ |

(0.07) |

|

|

Diluted |

|

$ |

0.36 |

|

$ |

1.14 |

|

N/M |

(1) |

|

|

$ |

(0.07) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

66,014 |

|

28,929 |

|

(28,929) |

|

|

|

66,014 |

|

|

Diluted |

|

67,205 |

|

30,677 |

|

(30,677) |

|

|

|

67,205 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Not meaningful. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to unaudited pro forma condensed combined financial statements.

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL

STATEMENTS

(in thousands, except per share data and as otherwise noted)

Note 1. Merger Consideration and Allocation Used in the Pro Forma.

GCA used the proceeds from its Notes offering, together with borrowings under the Credit Facilities and cash on hand at closing of the Merger, to fund the cash obligations of the Merger, to repay the then outstanding indebtedness of GCA and Multimedia Games, to pay related fees and expenses, and to provide cash for the combined company’s ongoing working capital and general corporate needs (see Note 2 below).

GCA has not completed the valuation analysis and calculations in sufficient detail necessary to arrive at the required estimates of the fair market value of the Multimedia Games assets to be acquired and liabilities to be assumed and the related allocations to such items, including goodwill, of the Merger consideration. Accordingly, assets and liabilities are presented in the pro forma financial information at their respective carrying amounts, which management believes is a reasonable estimate of fair value. The estimated goodwill included in the pro forma adjustments is calculated as the difference between the Merger consideration transferred to the Multimedia Games shareholders and the estimated fair values of the assets acquired and liabilities assumed. The following summarizes the estimated goodwill calculation as of September 30, 2014:

|

Merger consideration |

|

$ |

1,149,389 |

|

|

Less: Total assets acquired |

|

(315,012 |

) |

|

Plus: Total liabilities assumed |

|

70,654 |

|

|

Multimedia acquisition expenses paid at close |

|

12,244 |

|

|

|

|

|

|

|

Estimated goodwill |

|

$ |

917,275 |

|

The final allocations of the Merger consideration may include (i) changes in historical carrying values of property and equipment, (ii) allocations to intangible assets such as trademarks and trade names, in-process research and development, developed technology and customer-related assets, (iii) the recording of deferred tax assets and deferred tax liabilities, which are not reflected herein, and (iv) other changes to assets and liabilities. In connection with the amount ultimately allocated to goodwill, a deferred tax liability would generally be recorded to the extent that the book basis exceeds the tax basis of such asset, and a deferred tax asset would generally be recorded to the extent that the tax basis exceeds the book basis of such asset. As a result, actual results may differ from this unaudited pro forma condensed combined financial information once GCA has completed the detailed valuation analysis and calculations necessary to finalize the required purchase price allocations. The final purchase price allocations, which are expected to be determined subsequent to the filing of this Current Report on Form 8-K/A, may differ materially from the estimated allocations and unaudited pro forma condensed combined amounts included herein. These differences could materially increase the total amount of depreciation and amortization expense recognized, which could have a material impact on GCA’s net income.

Note 2. Pro Forma Adjustments.

Entries to record the cash consideration paid in the Merger and the reversal of Multimedia Games equity balances and the extinguishment of GCA’s and Multimedia Games’ outstanding debt held prior to the consummation of the Merger (collectively, the “Prior Credit Facilities”).

|

Item A - Cash and cash equivalents |

|

|

|

|

Gross proceeds from term loan |

|

$ |

500,000 |

|

|

Gross proceeds from secured notes |

|

350,000 |

|

|

Gross proceeds from unsecured notes |

|

350,000 |

|

|

|

|

|

|

|

Total gross proceeds |

|

1,200,000 |

|

|

|

|

|

|

|

Less: Merger consideration |

|

(1,149,389) |

|

|

Less: Transaction costs |

|

(80,012) |

|

|

Less: Prior Credit Facilities payoff(1) |

|

(121,643) |

|

|

|

|

|

|

|

Total cash and cash equivalents adjustment |

|

$ |

(151,044) |

|

|

|

|

|

|

|

Item B - Deferred tax asset, non-current portion |

|

|

|

|

Deferred tax impact from extinguishment of the Prior Credit Facilities debt issuance costs and payment of transaction costs |

|

$ |

4,325 |

|

|

|

|

|

|

|

Total deferred tax assets, non-current portion adjustment |

|

$ |

4,325 |

|

|

|

|

|

|

|

Item C - Other assets, long-term |

|

|

|

|

Debt issuance costs related to Credit Facilities and Notes(2) |

|

$ |

41,325 |

|

|

Extinguishment of the Prior Credit Facilities debt issuance costs |

|

(3,213) |

|

|

|

|

|

|

|

Total other assets, long-term adjustment |

|

$ |

38,112 |

|

|

|

|

|

|

|

Item D - Accounts payable and accrued expenses |

|

|

|

|

Multimedia Games transaction costs previously accrued |

|

$ |

(5,736) |

|

|

GCA accrued transaction costs previously accrued |

|

(953) |

|

|

|

|

|

|

|

Total accounts payable and accrued expenses adjustment |

|

$ |

(6,689) |

|

|

|

|

|

|

|

Item E - Debt, current portion |

|

|

|

|

Issuance of Credit Facilities and Notes, current portion |

|

$ |

10,000 |

|

|

Prior Credit Facilities payoff, current portion |

|

(4,654) |

|

|

|

|

|

|

|

Total debt, current portion adjustment |

|

$ |

5,346 |

|

|

|

|

|

|

|

Item F - Debt, non-current portion |

|

|

|

|

Issuance of Credit Facilities and Notes, non-current portion |

|

$ |

1,190,000 |

|

|

Prior Credit Facilities payoff, non-current portion |

|

(116,989) |

|

|

Original issue discounts on Credit Facilities and Notes, non-current portion(2) |

|

(11,277) |

|

|

|

|

|

|

|

Total debt, non-current portion adjustment |

|

$ |

1,061,734 |

|

|

|

|

|

|

|

Item G - Common stock |

|

|

|

|

Elimination of the Multimedia Games historical common stock |

|

$ |

(386) |

|

|

|

|

|

|

|

Total common stock adjustment |

|

$ |

(386) |

|

|

|

|

|

|

|

Item H - Additional paid-in-capital |

|

|

|

|

Elimination of the Multimedia Games historical additional paid-in capital |

|

$ |

(148,828) |

|

|

|

|

|

|

|

Total additional paid-in-capital adjustment |

|

$ |

(148,828) |

|

|

|

|

|

|

|

Item I - Retained earnings |

|

|

|

|

Elimination of the Multimedia Games historical retained earnings |

|

$ |

(176,146) |

|

|

GCA transaction costs paid at closing |

|

(8,477) |

|

|

Extinguishment of the Prior Credit Facilities debt issuance cost |

|

(3,213) |

|

|

Deferred tax impact from extinguishment of the Prior Credit Facilities debt issuance costs and payment of transaction costs |

|

4,325 |

|

|

|

|

|

|

|

Total retained earnings adjustment |

|

$ |

(183,511) |

|

|

|

|

|

|

|

Item J - Treasury stock |

|

|

|

|

Elimination of the Multimedia Games historical treasury stock |

|

$ |

81,002 |

|

|

|

|

|

|

|

Total treasury stock adjustment |

|

$ |

81,002 |

|

|

|

|

|

|

(1) |

Prior Credit Facilities consisted of outstanding balances of $95.7 million and $25.9 million for GCA and Multimedia Games, respectively, as of the nine months ended September 30, 2014 and June 30, 2014, respectively. |

|

|

|

|

(2) |

Capitalized costs related to the Credit Facilities and Notes included debt issuance costs that were recorded to other assets and original issue discounts that were recorded as contra-liabilities to the long-term debt. Both debt issuance costs and original issue discounts get amortized to interest expense. |

|

|

|

|

Unaudited Pro Forma Condensed Combined Statements of Operations(*),(**)

|

|

|

Nine Months Ended

September 30,

2014 |

|

Year Ended

December 31,

2013 |

|

|

|

|

|

|

|

|

|

Item K - Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

GCA previously accrued transaction costs |

|

$ |

953 |

|

$ |

- |

|

|

Multimedia Games previously accrued transaction costs |

|

- |

|

- |

|

|

|

|

|

|

|

|

|

Total operating expenses adjustment |

|

$ |

953 |

|

$ |

- |

|

|

|

|

|

|

|

|

There were no historical acquisition related expenses incurred for the year ended December 31, 2013.

On a pro forma basis giving effect to the Merger, these one-time expenses should be excluded from the pro forma financial statements.

|

|

|

Nine Months Ended

September 30,

2014 |

|

Year Ended

December 31,

2013 |

|

|

|

|

|

|

|

|

|

Item L - Interest expense, net of interest income |

|

|

|

|

|

|

|

|

|

|

|

|

|

Credit facilities and notes interest expense |

|

$ |

(69,574) |

|

$ |

(93,313) |

|

|

Amortization of Credit Facilities and Notes debt issuance costs and original issue discounts(1) |

|

(6,297) |

|

(8,396) |

|

|

Reduction of amortization fees related to the extinguishment of Prior Credit Facilities issuance costs(2) |

|

1,503 |

|

1,884 |

|

|

Prior Credit Facilities interest expense that would not have been incurred |

|

4,020 |

|

7,314 |

|

|

Prior Credit Facilities interest income that would not have been earned |

|

(262) |

|

(321) |

|

|

|

|

|

|

|

|

|

Total interest expense, net of interest income adjustment |

|

$ |

(70,610) |

|

$ |

(92,832) |

|

|

|

|

|

|

|

|

|

(1) |

The pro forma financial statements assume straight-line amortization of the fees over the respective terms of the Notes. |

|

|

|

|

(2) |

Represents the reduction in amortization of loan fees related to the GCA and Multimedia Games prior credit facilities as of the beginning of each period presented, which was extinguished upon consummation of the Merger and issuance of the Credit Facilities and Notes. |

|

|

|

Nine Months Ended

September 30,

2014 |

|

Year Ended

December 31,

2013 |

|

|

|

|

|

|

|

|

|

Item M - Loss on extinguishment of debt |

|

|

|

|

|

|

|

|

|

|

|

|

|

GCA loss on extinguishment of debt(1) |

|

$ |

(5,203) |

|

$ |

(5,203) |

|

|

Multimedia Games loss on extinguishment of debt(1) |

|

(445) |

|

(445) |

|

|

|

|

|

|

|

|

|

Total loss on extinguishment of debt adjustment |

|

$ |

(5,648) |

|

$ |

(5,648) |

|

|

|

|

|

|

|

|

|

(1) |

Represents the debt issuance costs that would be extinguished on the Prior Credit Facilities as of January 1, 2013 for both periods presented; therefore the outstanding balance of such costs would be the same. |

To pay the Merger consideration, to repay the then existing indebtedness of GCA and Multimedia Games and to pay related fees and expenses, we incurred $1.2 billion of debt, with maturities ranging from five to seven years yielding a weighted average annual interest rate of approximately 7.75%.

|

|

|

Nine Months Ended

September 30,

2014 |

|

Year Ended

December 31,

2013 |

|

|

|

|

|

|

|

|

|

Item N - Income tax provision/(benefit) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses adjustment |

|

$ |

953 |

|

$ |

- |

|

|

Interest expense, net of interest income adjustment |

|

(70,610) |

|

(92,832) |

|

|

Loss on extinguishment of debt adjustment |

|

(5,648) |

|

(5,648) |

|

|

|

|

|

|

|

|

|

Total loss from operations before tax |

|

(75,305) |

|

(98,480) |

|

|

|

|

|

|

|

|

|

Statutory tax rate |

|

35.0% |

|

35.0% |

|

|

|

|

|

|

|

|

|

Total income tax benefit |

|

(26,357) |

|

(34,468) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The estimated tax effect of all pro forma adjustments was calculated using the statutory tax rate as set forth in Regulation S-X Article 11-01 and 11-02.

|

(*) |

GCA’s results are for its fiscal year ended December 31, 2013, while the Multimedia Games results are for its fiscal year ended September 30, 2013. |

|

|

|

|

(**) |

GCA’s results are for its fiscal nine months ended September 30, 2014, while the Multimedia Games results are for its fiscal nine months ended June 30, 2014. |

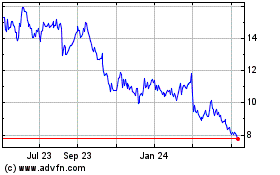

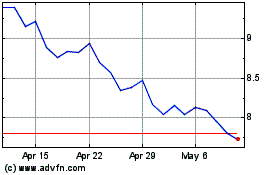

Everi (NYSE:EVRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Everi (NYSE:EVRI)

Historical Stock Chart

From Apr 2023 to Apr 2024