UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

T-3/A

(Amendment No. 1)

FOR APPLICATIONS FOR QUALIFICATION OF INDENTURES

UNDER THE TRUST INDENTURE ACT OF 1939

CAESARS

ENTERTAINMENT CORPORATION

(Name of Applicant)

One Caesars

Palace Drive

Las Vegas, Nevada 89109

(Address of Principal Executive Offices)

Securities to be Issued Under the Indenture to be Qualified

|

|

|

|

|

Title of Class

|

|

Amount

|

|

5.00% Convertible Senior Notes due 2024

|

|

$1,119,060,000

|

Approximate date of proposed public offering:

On, or as soon as practicable following, the effective date (the “

Effective Date

”) under the Third Amended Joint Plan of

Reorganization of Caesars Entertainment Operating Company, Inc., et al. pursuant to Chapter 11 of the Bankruptcy Code (as amended or supplemented, the “

Plan of Reorganization

”).

Timothy R. Donovan, Esq.

Executive Vice President, General Counsel and Chief Regulatory and Compliance Officer

Caesars Entertainment Corporation

One Caesars Palace Drive

Las Vegas, Nevada 89109

(Name and Address of Agent for Service)

The Applicant hereby amends this application for qualification on such date or dates as may be necessary to delay its effectiveness until

(i) the 20th day after the filing of an amendment which specifically states that it shall supersede this application for qualification, or (ii) such date as the Securities and Exchange Commission, acting pursuant to section 307(c) of

the Trust Indenture Act of 1939, may determine upon the written request of the Applicant.

GENERAL

The form of organization of and the state or other sovereign power

under the laws of which Caesars Entertainment Corporation (the “

Applicant

”) is organized are as follows:

|

|

|

|

|

|

|

Name

|

|

Form of Organization

|

|

Jurisdiction

|

|

Caesars Entertainment Corporation

|

|

Corporation

|

|

Delaware

|

|

2.

|

Securities Act Exemption Applicable.

|

Prior to the Effective Date, the Applicant intends

to offer, under the terms and subject to the conditions set forth in the Disclosure Statement and the Plan of Reorganization, an aggregate principal amount of approximately $1,119.0 million of 5.00% Convertible Senior Notes due 2024 (the

“

Notes

”) to holders of claims under Caesars Entertainment Operating Company, Inc.’s (“

CEOC

”) 12.75% Second-Priority Senior Secured Notes due 2018, 10.00% Second-Priority Senior Secured Notes due

2018, 10.00% Second-Priority Senior Secured Notes due 2015, 6.5% Senior Notes due 2016, 5.75% Senior Notes due 2017 and 10.75% Senior Notes due 2016 as well as holders of other unsecured claims against CEOC (collectively, the

“

Claims

”). The Notes will be issued pursuant to the indenture to be qualified under this Form

T-3

(the “

Indenture

”), a copy of which is filed as Exhibit T3C

hereto.

Generally, Section 1145(a)(1) of the Bankruptcy Code exempts an offer and sale of securities under a plan of reorganization

from registration under the Securities Act of 1933, as amended (the “

Securities Act

”), and state securities laws if three principal requirements are satisfied: (i) the securities must be offered and sold under a plan of

reorganization and must be securities of the debtor, an affiliate participating in a joint plan of reorganization with the debtor or a successor to the debtor under the plan of reorganization; (ii) the recipients of the securities must hold a

prepetition or administrative expense claim against the debtor or an interest in the debtor; and (iii) the securities must be issued entirely in exchange for the recipient’s claim against or interest in the debtor, or principally in such

exchange and partly for cash or property. The Applicant believes that the offer of the Notes under the solicitation of acceptances for the Plan of Reorganization and the exchange of the Claims for Notes, together with certain other consideration,

under the Plan of Reorganization will satisfy the requirements of Section 1145(a)(1) of the Bankruptcy Code and, therefore, such offer and exchange is exempt from the registration requirements referred to above. To the extent that the

solicitation of acceptances of the Plan of Reorganization constitutes an offer of new securities not exempt from registration under Section 1145(a)(1) of the Bankruptcy Code, the Applicant will also rely on Section 4(a)(2) of the

Securities Act and, to the extent applicable, Regulation D promulgated thereunder.

AFFILIATIONS

The following diagram indicates the relationship of the Applicant to each

of its affiliates as of August 1, 2017. Connecting lines indicate 100% ownership of voting securities, unless otherwise stated.

|

(1)

|

For a list of subsidiaries of the Applicant, see Exhibit 99.1 hereto, which is incorporated herein by reference.

|

3

The following diagram indicates the expected relationship of the Applicant to each of its

affiliates as of the Effective Date. All of the entities appearing below are expected to exist as of the Effective Date. Connecting lines indicate 100% ownership of voting securities, unless otherwise stated.

|

(1)

|

On the Effective Date, Caesars Acquisition Company, an affiliate of the Applicant (“

CAC

”), will merge with and into the Applicant, with the Applicant surviving the merger. Stockholders of CAC

will receive common stock of the Applicant in connection with this merger. After completion of the merger and the restructuring, it is anticipated that creditors of CEOC will own approximately 59.2% of the Applicant, certain affiliates of Apollo

Global Management, LLC and TPG Capital, LP will own approximately 20.8% of the Applicant and public investors and management will own approximately 20.0% of the Applicant. These ownership percentages were calculated based on the number of shares of

common stock of the Applicant and CAC issued and outstanding as of June 30, 2017 and on a fully diluted basis (for outstanding options and stock awards of the Applicant and CAC) and assume the issuance of shares of common stock of the Applicant

to creditors of CEOC and a $1.0 billion repurchase of the Applicant’s common stock, pursuant to the Plan of Reorganization.

|

|

(2)

|

It is anticipated that, as of the Effective Date, the Applicant will own 100% of the limited liability company interests of CEOC LLC. For a list of the expected subsidiaries of the Applicant, see Exhibit 99.1 hereto,

which is incorporated herein by reference.

|

|

(3)

|

On the Effective Date, CEOC will merge with and into CEOC LLC, with CEOC LLC surviving the merger. It is anticipated that the subsidiaries of CEOC will continue to be subsidiaries of CEOC LLC upon the consummation of

the Plan of Reorganization.

|

Certain directors and executive officers of the Applicant may be deemed its

“affiliates” by virtue of their respective positions. See Item 4, “Directors and Executive Officers.” Certain persons may be deemed to be “affiliates” of the Applicant by virtue of their holdings of voting securities of

the Applicant. See Item 5, “Principal Owners of Voting Securities.”

4

MANAGEMENT AND CONTROL

|

4.

|

Directors and Executive Officers.

|

As of the date of this application, the executive

officers and directors of the Applicant are as set forth below. The mailing address and telephone number of each of them is c/o Caesars Entertainment Corporation, One Caesars Palace Drive, Las Vegas, Nevada 89109; telephone number (702)

407-6000.

|

|

|

|

|

Name

|

|

Position

|

|

Jeffrey Benjamin

|

|

Director

|

|

David Bonderman

|

|

Director

|

|

Mark P. Frissora

|

|

Director, Chief Executive Officer and President

|

|

Fred J. Kleisner

|

|

Director

|

|

Gary Loveman

|

|

Director, Chairman of the Board of Directors

|

|

Marc Rowan

|

|

Director

|

|

Eric Press

|

|

Director

|

|

David Sambur

|

|

Director

|

|

Richard Schifter

|

|

Director

|

|

Christopher J. Williams

|

|

Director

|

|

Bernard L. Zuroff

|

|

Director

|

|

Janis Jones Blackhurst

|

|

Executive Vice President, Public Policy and Corporate Responsibility

|

|

Richard D. Broome

|

|

Executive Vice President, Public Affairs and Communications

|

|

Timothy Donovan

|

|

Executive Vice President, General Counsel and Chief Regulatory and Compliance Officer

|

|

Eric Hession

|

|

Executive Vice President and Chief Financial Officer

|

|

Thomas Jenkin

|

|

Global President of Destination Markets

|

|

Robert Morse

|

|

President of Hospitality

|

|

Les Ottolenghi

|

|

Executive Vice President and Chief Information Officer

|

|

Marco Roca

|

|

President, Global Development

|

|

Christian Stuart

|

|

Executive Vice President, Gaming and Interactive Entertainment

|

|

Mary Thomas

|

|

Executive Vice President, Human Resources

|

|

Steven Tight

|

|

President, International Development

|

Thomas Benninger, John Boushy, John Dionne, Matthew Ferko, Mark Frissora, James Hunt, Don Kornstein, David

Sambur, Richard Schifter, Marilyn Spiegel and Christopher Williams have been designated as the initial directors of the Applicant following the Effective Date. The mailing address and telephone number of each of them will be c/o Caesars

Entertainment Corporation, One Caesars Palace Drive, Las Vegas, Nevada 89109; telephone number (702)

407-6000.

|

5.

|

Principal Owners of Voting Securities.

|

As of August 1, 2017, affiliates of Apollo

Global Management, LLC and TPG Capital, LP owned an aggregate 87,605,299 shares of common stock of the Applicant, representing 58.7% of the Applicant’s voting securities. All shares held by these entities are subject to the irrevocable proxy

granting Hamlet

5

Holdings LLC sole voting and sole dispositive power with respect to such shares. The members of Hamlet Holdings LLC are Leon Black, Joshua Harris and Marc Rowan, each of whom is affiliated with

Apollo Global Management, LLC, and David Bonderman and James Coulter, each of whom is affiliated with the TPG Capital, LP. The address of the affiliates of Apollo Global Management, LLC is c/o Apollo Management, LP, 9 West 57th Street, 43rd Floor,

New York, New York 10019. The address of the affiliates of TPG Capital, LP is c/o TPG Global, 301 Commerce Street, Suite 3300, Fort Worth, Texas 76102. As of the date of this application, no other person owned more than 10% of the voting securities

of the Applicant.

On the Effective Date, CAC will merge with and into the Applicant, with the Applicant surviving the merger.

Stockholders of CAC will receive common stock of the Applicant in connection with this merger. After completion of the merger and the restructuring, it is anticipated that creditors of CEOC will own approximately 59.2% of the Applicant, certain

affiliates of Apollo Global Management, LLC and TPG Capital, LP will own approximately 20.8% of the Applicant and public investors and management will own approximately 20.0% of the Applicant. These ownership percentages were calculated based on the

number of shares of common stock of the Applicant and CAC issued and outstanding as of June 30, 2017 and on a fully diluted basis (for outstanding options and stock awards of the Applicant and CAC) and assume the issuance of shares of common

stock of the Applicant to creditors of CEOC and a $1.0 billion repurchase of the Applicant’s common stock, pursuant to the Plan of Reorganization.

UNDERWRITERS

(a) No person has acted as an underwriter of any securities of the

Applicant in the last three years.

(b) No person is acting as a principal underwriter of the Notes proposed to be offered pursuant to the

Indenture.

CAPITAL SECURITIES

The following table sets forth information with respect to each authorized class of

securities of the Applicant as of August 1, 2017:

|

|

|

|

|

|

|

|

|

|

|

Title of Class

|

|

Amount

Authorized

|

|

|

Amount

Outstanding

|

|

|

Common Stock, par value $0.01 per share

|

|

|

1,250,000,000

|

|

|

|

149,146,067

|

|

|

Preferred Stock, par value $0.01 per share

|

|

|

125,000,000

|

|

|

|

—

|

|

At this time, it is not possible to determine the amount of the Applicant’s authorized and outstanding

voting securities following the Effective Date. On the Effective Date, CAC will merge with and into the Applicant, with the Applicant surviving the merger. Stockholders of CAC will receive common stock of the Applicant in connection with this

merger. The amount of voting securities held by particular parties cannot be determined until the merger of CAC into the Applicant is completed.

Each

holder of common stock of the Applicant has one vote on all matters to be voted upon by stockholders. The Applicant has not issued certificates of designations specifying, or otherwise amended the charter to specify, the voting rights of holders of

Preferred Stock.

6

INDENTURE SECURITIES

|

8.

|

Analysis of Indenture Provisions.

|

The Notes will be subject to the Indenture between

the Applicant and Delaware Trust Company, as trustee (the “

Trustee

”). The following is a general description of certain provisions of the Indenture, and the description is qualified in its entirety by reference to the form of

Indenture filed as Exhibit T3C herewith. Capitalized terms used below and not defined herein have the meanings ascribed to them in the Indenture.

Events of Default; Withholding of Notice of Default

.

The occurrence of any of the following events will constitute an Event of Default under the Indenture:

(i) there is a default in any payment of interest on any Note when the same becomes due and payable, and such default continues

for a period of 30 days;

(ii) there is a default in the payment of principal or premium, if any, of any Note when due at

its Stated Maturity, upon optional redemption, upon required repurchase, upon declaration or otherwise;

(iii) the failure

by the Issuer or any Restricted Subsidiary to comply (for 60 days following notice with respect to such failure to comply) with its other agreements and obligations contained in the Notes or the Indenture (other than a default referred to in clause

(i) or (ii) above);

provided

that in the case of a failure to comply with Section 4.02 of the Indenture, such period of continuation of such default or breach shall be 90 days following notice with respect to such failure to comply;

(iv) the failure by the Issuer or any Significant Subsidiary (or any group of Subsidiaries that together would constitute

a Significant Subsidiary) to pay any Indebtedness (other than Indebtedness owing to the Issuer or a Restricted Subsidiary) within any applicable grace period after final maturity or the acceleration of any such Indebtedness by the holders thereof

because of a default, in each case, if the total amount of such Indebtedness unpaid or accelerated exceeds $50.0 million or its foreign currency equivalent;

(v) either the Issuer or a Significant Subsidiary (or any group of Subsidiaries that together would constitute a Significant

Subsidiary), pursuant to or within the meaning of any Bankruptcy Law:

(1) commences a voluntary case;

(2) consents to the entry of an order for relief against it in an involuntary case;

(3) consents to the appointment of a Custodian of it or for any substantial part of its property; or

(4) makes a general assignment for the benefit of its creditors or takes any comparable action under any foreign laws relating

to insolvency;

(vi) a court of competent jurisdiction enters an order or decree under any Bankruptcy Law that:

7

(1) is for relief against either the Issuer or a Significant Subsidiary in an

involuntary case;

(2) appoints a Custodian of either the Issuer or a Significant Subsidiary or for any substantial part of

their property; or

(3) orders the winding up or liquidation of either the Issuer or a Significant Subsidiary;

or any similar relief is granted under any foreign laws and the order or decree remains unstayed and in effect for 60 days;

(vii) failure by the Issuer or any Significant Subsidiary (or any group of Subsidiaries that together would constitute a

Significant Subsidiary) to pay final judgments aggregating in excess of $50.0 million or its foreign currency equivalent (net of any amounts which are covered by enforceable insurance policies issued by solvent carriers), which judgments are

not discharged, waived or stayed for a period of 60 days;

(viii) the Issuer fails to satisfy its conversion obligations

upon exercise of holder’s conversion rights pursuant hereto (including the failure to pay the Make-Whole Consideration, if any, in connection with such conversion) or upon a Mandatory Conversion and such failure continues for a period of five

Business Days; or

(ix) the Issuer fails to timely provide a Fundamental Change Notice as required by the provisions of the

Indenture, or fails to timely provide any notice pursuant to, and in accordance with, Section 10.07(e) of the Indenture, and such failure continues for a period of five Business Days.

However, a default under clause (iii) above shall not constitute an Event of Default until the Trustee or the holders of 25% in principal

amount of outstanding Notes notify the Issuer of the default and the Issuer does not cure such default within the time specified in clause (iii) above after receipt of such notice. Such notice must specify the Default, demand that it be

remedied and state that such notice is a “

Notice of Default

.” The Issuer shall deliver to the Trustee, within five (5) Business Days after the occurrence thereof, written notice in the form of an Officer’s Certificate of

any event which is, or with the giving of notice or the lapse of time or both would become, an Event of Default, its status and what action the Issuer is taking or propose to take with respect thereto.

If an Event of Default occurs and is continuing, the Trustee or the holders of at least 25% in principal amount of outstanding Notes by notice

to the Issuer may declare the principal of, premium, if any, and accrued but unpaid interest on all the Notes to be due and payable. Upon such a declaration, such principal and interest shall be due and payable immediately. Under certain

circumstances, the holders of a majority in principal amount of outstanding Notes may rescind any such acceleration with respect to the Notes and its consequences.

In the event of any Event of Default specified in clause (iv) listed above, such Event of Default and all consequences thereof

(excluding, however, any resulting payment default) shall be annulled, waived and rescinded, automatically and without any action by the Trustee or the holders of the Notes, if within 20 days after such Event of Default arose the Issuer delivers an

Officer’s Certificate to the Trustee stating that (x) the Indebtedness or guarantee that is the basis for such Event of Default has been discharged or (y) the holders thereof have rescinded or waived the acceleration, notice or action

(as the case may be) giving rise to such Event of Default or (z) the default that is the basis for such Event of Default has been cured, it being understood that in no event shall an acceleration of the principal amount of the Notes as

described above be annulled, waived or rescinded upon the happening of any such events.

8

Provided the Notes are not then due and payable by reason of a declaration of acceleration, the

holders of a majority in principal amount of the Notes by written notice to the Trustee may waive an existing Default and its consequences except (a) a Default in the payment of the principal of or interest on a Note, (b) a Default arising

from the failure to redeem or purchase any Note when required pursuant to the terms of the Indenture or (c) a Default in respect of a provision that under Section 9.02 of the Indenture cannot be amended without the consent of each holder

affected. When a Default is waived, it is deemed cured and the Issuer, the Trustee and the holders will be restored to their former positions and rights under the Indenture, but no such waiver shall extend to any subsequent or other Default or

impair any consequent right.

If a Default occurs and is continuing and if it is actually known to the Trustee, the Trustee shall mail to

each holder notice of the Default within 90 days after it occurs or 30 days after it is actually known to a Trust Officer or written notice if it is received by the Trustee. Except in the case of a Default in the payment of principal of, premium (if

any) or interest on any Note, the Trustee may withhold the notice if and so long as a committee of its Trust Officers in good faith determines that withholding the notice is in the interests of the holders. The Issuer is required to deliver to the

Trustee, annually, a certificate indicating whether the signers thereof know of any Default that occurred during the previous year. The Issuer also is required to deliver to the Trustee, within 30 days after the occurrence thereof, written notice of

any event which would constitute certain Defaults, their status and what action the Issuer is taking or proposes to take in respect thereof.

(b)

Authentication and Delivery of the Notes; Application of Proceeds

.

The Notes to be issued under the Indenture may from time to time be executed on behalf of the Issuer by manual or facsimile signature by one of

its proper officers and delivered to the Trustee for authentication and delivery in accordance with the Issuer’s order and the Indenture. Each Note shall be dated the date of its authentication, and no Note shall be valid unless authenticated

by manual signature of the Trustee, and such signature shall be conclusive evidence that such Note has been duly authenticated under the Indenture. The Notes shall be issuable only in registered form without interest coupons and in denominations of

$2,000 and any integral multiples of $1,000 in excess thereof;

provided

that Notes may be issued in denominations of less than $2,000 solely to accommodate book-entry positions that have been created by the Depository in denominations of less

than $2,000.

The Trustee may appoint one or more authenticating agents to authenticate the Notes. An authenticating agent may

authenticate the Notes whenever the Trustee may do so unless limited by the appointment of such agent.

The Notes will be issued to

Holders of Claims. As a result, the Issuer will not realize any proceeds from such issuance.

Release of Collateral

.

N/A

(c)

Satisfaction and

Discharge

.

The Issuer may terminate its obligations under the Indenture when (i) either (a) all the Notes theretofore

authenticated and delivered (except lost, stolen or destroyed Notes which have been replaced or paid and Notes for whose payment money has theretofore been deposited in trust or segregated and

9

held in trust by the Issuer and thereafter repaid to the Issuer or discharged from such trust pursuant to the second paragraph of Section 8.04) have been delivered to the Trustee for

cancellation or (b) all of the Notes (x) have become due and payable, (y) will become due and payable at their stated maturity within one year or (z) if redeemable at the option of the Issuer, are to be called for redemption

within one year under arrangements satisfactory to the Trustee for the giving of notice of redemption by the Trustee in the name, and at the expense, of the Issuer and the Issuer has irrevocably deposited or caused to be deposited with the Trustee

funds in an amount sufficient to pay and discharge the entire Indebtedness on the Notes not theretofore delivered to the Trustee for cancellation, for principal of, premium, if any, and interest on the Notes to the date of deposit together with

irrevocable instructions from the Issuer directing the Trustee to apply such funds to the payment thereof at maturity or redemption, as the case may be; (ii) the Issuer has paid all other sums payable under the Indenture and (iii) the

Issuer has delivered to the Trustee an Officer’s Certificate and an Opinion of Counsel stating that all conditions precedent under the Indenture relating to the satisfaction and discharge of the Indenture have been complied with.

(d)

Evidence of Compliance with Conditions and Covenants

.

The Issuer shall deliver to the Trustee within 120 days after the end of each fiscal year of the Issuer, beginning with the fiscal year ending

on December 31, 2017, an Officer’s Certificate stating that in the course of the performance by the signer of his or her duties as an Officer of the Issuer he or she would normally have knowledge of any Default and whether or not the

signer knows of any Default that occurred during such period. If he or she does, the certificate shall describe the Default, its status and what action the Issuer is taking or proposes to take with respect thereto. The Issuer also is required to

deliver to the Trustee, within 30 days after the occurrence thereof, written notice of any event which would constitute certain Defaults, their status and what action the Issuer is taking or proposes to take in respect thereof.

Further, the Issuer is required to deliver to the Trustee promptly and in any event within ten days after any Officer becoming aware of any

Default or Event of Default, an Officer’s Certificate specifying such Default or Event of Default and what action the Issuer is taking or proposes to take with respect thereto.

N/A

Contents of application for qualification.

This application for qualification comprises:

(a) Pages numbered one to ten, consecutively.

(b) The statement of eligibility and qualification on Form

T-1

of the Trustee under the Indenture to be

qualified (filed as Exhibit T3G herewith).

(c) The exhibits listed on the Index to Exhibits attached hereto in addition to those filed as

part of the Form

T-1

statement of eligibility and qualification of the Trustee.

10

SIGNATURE

Pursuant to the requirements of the Trust Indenture Act of 1939, the applicant, Caesars Entertainment Corporation, a corporation organized and

existing under the laws of the State of Delaware, has duly caused this application to be signed on its behalf by the undersigned, thereunto duly authorized, and its seal to be hereunto affixed and attested, all in the City of Las Vegas, and State of

Nevada, on the 1

st

day of September, 2017.

|

|

|

|

|

|

|

|

|

|

|

(SEAL)

|

|

|

|

CAESARS ENTERTAINMENT CORPORATION

|

|

|

|

|

|

|

|

Attest:

|

|

/s/ Carla Matthews

|

|

|

|

By:

|

|

/s/ Eric Hession

|

|

|

|

Name: Carla Matthews

|

|

|

|

|

|

Name: Eric Hession

|

|

|

|

|

|

|

|

|

|

Title: Executive Vice President and Chief Financial Officer

|

INDEX TO EXHIBITS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Incorporated By Reference

|

|

Exhibit

|

|

Description

|

|

Filed

Herewith

|

|

Form

|

|

Period

Ending

|

|

Exhibit

|

|

Filing Date

|

|

Exhibit T3A

|

|

Second Amended and Restated Certificate of Incorporation of Caesars Entertainment Corporation.

|

|

—

|

|

10-K

|

|

12/31/2011

|

|

3.7

|

|

3/15/2012

|

|

|

|

|

|

|

|

|

|

Exhibit T3B

|

|

Amended Bylaws of Caesars Entertainment Corporation.

|

|

—

|

|

10-K

|

|

12/31/2011

|

|

3.8

|

|

3/15/2012

|

|

|

|

|

|

|

|

|

|

Exhibit T3C

|

|

Form of Indenture governing the Notes.

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit T3D

|

|

Not applicable.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit T3E-1

|

|

Disclosure Statement for the Second Amended Joint Plan of Reorganization of Caesars Entertainment Operating Company, Inc., et al., Chapter

11 of the Bankruptcy Code, dated June 28, 2016.

|

|

—

|

|

Form T-3

|

|

—

|

|

T3E-2

|

|

7/8/2016

|

|

|

|

|

|

|

|

|

|

Exhibit

T3E-2

|

|

Third Amended Joint Plan of Reorganization of Caesars Entertainment Operating Company, Inc., et al., under Chapter 11 of the Bankruptcy Code, dated January 13, 2017.

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit T3F

|

|

Cross-reference sheet (included in Exhibit T3C).

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit T3G

|

|

Form

T-1

qualifying the Trustee under the Indenture to be qualified pursuant to this Form

T-3.

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit 99.1

|

|

List of subsidiaries of Caesars Entertainment Corporation.

|

|

X

|

|

|

|

|

|

|

|

|

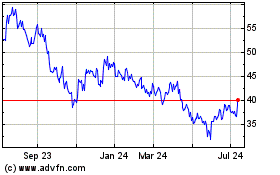

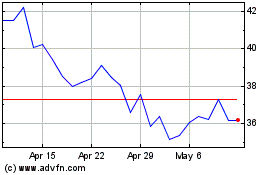

Caesars Entertainment (NASDAQ:CZR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Caesars Entertainment (NASDAQ:CZR)

Historical Stock Chart

From Apr 2023 to Apr 2024