UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K/A

(Amendment No. 1)

|

| |

(Mark One) | |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2015

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to

Commission File Number 001-33117

GLOBALSTAR, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

| | |

Delaware | | 41-2116508 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

300 Holiday Square Blvd.

Covington, Louisiana 70433

(Address of Principal Executive Offices)

Registrant's Telephone Number, Including Area Code (985) 335-1500

|

| | |

Securities registered pursuant to section 12(b) of the Act: | | |

Title of each class | | Name of exchange on which registered |

Voting Common Stock | | NYSE MKT |

Securities registered pursuant to section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

Large accelerated filer x | | Accelerated filer ¨ | | Non-accelerated filer ¨ (Do not check if a smaller reporting company) | | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act)

Yes ¨ No x

The aggregate market value of the registrant's common stock held by non-affiliates at June 30, 2015, the last business day of the Registrant's most recently completed second fiscal quarter, was approximately $855.8 million.

As of February 22, 2016, 904,490,041 shares of voting common stock and 134,008,656 shares of nonvoting common stock were outstanding. Unless the context otherwise requires, references to common stock in this Report mean registrant's voting common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Proxy Statement for the 2016 Annual Meeting of Stockholders are incorporated by reference in Part III of this Report.

EXPLANATORY NOTE

The sole purpose of this Amendment No. 1 (this "Amendment") to the Form 10-K for the period ended December 31, 2015, filed with the Securities and Exchange Commission on February 26, 2016 (the “Original Filing”), is to remove the word "unaudited" that was incorrectly included in the column heading for 2015 in the Ratio of Earnings to Fixed Charges table in Exhibit 12.1 to the Original Filing.

Pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, as amended, this Amendment also contains new certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002, which are filed as Exhibits 31.1 and 31.2 to this Amendment.

Except for the change to the column heading in the table in Exhibit 12.1 as described above, no other changes have been made to the Original Filing, and no financial or other information included in the Original Filing is being modified, amended or updated in any way by this Amendment. This Amendment does not reflect events that may have occurred subsequent to the time of the Original Filing.

PART IV

|

| |

Item 15. | Exhibits, Financial Statements Schedules. |

| |

(a) | Documents filed as part of this Amendment: |

| |

(3) | Exhibits |

| |

| See exhibit index. |

EXHIBIT INDEX

|

| | |

| | Description |

12.1 | | Ratio of Earnings to Fixed Charges |

| | |

31.1 | | Section 302 Certification of the Chief Executive Officer |

| | |

31.2 | | Section 302 Certification of the Chief Financial Officer |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| | | |

| | | GLOBALSTAR, INC. |

| | | |

| | By: | /s/ James Monroe III |

Date: | February 26, 2016 | | James Monroe III |

| | | Chief Executive Officer |

Exhibit 12.1

RATIO OF EARNINGS TO FIXED CHARGES

Computation of Ratio of Earnings to Fixed Charges

(In thousands, except ratio)

|

| | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, |

| | | 2015 | 2014 | 2013 | 2012 | 2011 |

Earnings: | | | | | | |

| Pre-tax income (loss) from continuing operations | | $ | 73,714 |

| $ | (461,985 | ) | $ | (589,978 | ) | $ | (111,785 | ) | $ | (55,033 | ) |

| Fixed charges | | 46,122 |

| 51,301 |

| 85,046 |

| 61,802 |

| 59,171 |

|

| Amortization of capitalized interest | | 14,965 |

| 16,643 |

| 17,580 |

| 11,135 |

| 8,265 |

|

| Income tax expense (benefit) | | 1,392 |

| 881 |

| 1,138 |

| 413 |

| (109 | ) |

| Loss in equity investee | | — |

| — |

| 634 |

| 335 |

| 420 |

|

| Less: interest capitalized | | (10,140 | ) | (7,945 | ) | (17,097 | ) | (40,116 | ) | (54,139 | ) |

| | | | | | | |

Total earnings | | $ | 126,053 |

| $ | (401,105 | ) | $ | (502,677 | ) | $ | (78,216 | ) | $ | (41,425 | ) |

| | | | | | | |

Fixed Charges: | | | | | | |

| Interest expensed | | $ | 35,854 |

| $ | 43,233 |

| $ | 67,828 |

| $ | 21,506 |

| $ | 4,824 |

|

| Estimated interest component of rental expense (1) | | 128 |

| 123 |

| 122 |

| 180 |

| 208 |

|

| Interest capitalized | | 10,140 |

| 7,945 |

| 17,097 |

| 40,116 |

| 54,139 |

|

| | | | | | | |

Total Fixed Charges | | $ | 46,122 |

| $ | 51,301 |

| $ | 85,047 |

| $ | 61,802 |

| $ | 59,171 |

|

| | | | | | | |

Ratio of Earnings to Fixed Charges | | 2.73 |

| * |

| * |

| * |

| * |

|

| | | | | | | |

Excess of fixed charges over earnings | | $ | — |

| $ | 452,406 |

| $ | 587,724 |

| $ | 140,018 |

| $ | 100,596 |

|

* For these periods, earnings were inadequate to cover fixed charges.

(1) Represents our estimate of the interest component of noncancelable operating lease rental expense.

Exhibit 31.1

Certification of Principal Executive Officer of Globalstar, Inc.Pursuant to Rule 13a-14(a) and Rule 15d-14(a) of the Securities Exchange Act of 1934, as amended

I, James Monroe III, certify that:

1. I have reviewed this Amendment No. 1 to the Form 10-K of Globalstar, Inc.; and

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report.

Date: February 26, 2016

|

| |

|

| |

/s/ James Monroe III | |

James Monroe III | |

Chief Executive Officer (Principal Executive Officer) | |

Exhibit 31.2

Certification of Principal Financial Officer of Globalstar, Inc.Pursuant to Rule 13a-14(a) and Rule 15d-14(a) of the Securities Exchange Act of 1934, as amended

I, Rebecca S. Clary, certify that:

1. I have reviewed this Amendment No. 1 to the Form 10-K of Globalstar, Inc.; and

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report.

Date: February 26, 2016

|

| |

|

| |

/s/ Rebecca S. Clary | |

Rebecca S. Clary | |

Chief Financial Officer (Principal Financial Officer) | |

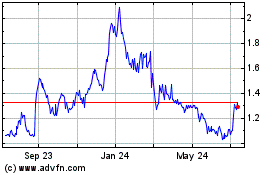

Globalstar (AMEX:GSAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

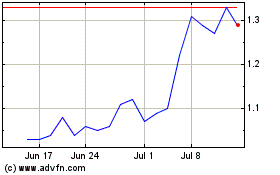

Globalstar (AMEX:GSAT)

Historical Stock Chart

From Apr 2023 to Apr 2024