ANNOUNCES EXECUTIVE

RETIREMENT

Amedisys, Inc. (NASDAQ:AMED), a leading home health and hospice

company, today reported its financial results for the three and

six-month periods ended June 30, 2016.

Three-Month Periods Ended June 30, 2016 and 2015

- Net service revenue increased $46.6 million to $360.7 million

compared to $314.1 million in 2015.

- Net income attributable to Amedisys, Inc. of $10.7 million

compared to $10.6 million in 2015.

- Net income attributable to Amedisys, Inc. per diluted share

remained at $0.32 per diluted share when compared to 2015.

Adjusted Results*

- Adjusted net service revenue of $361.7 million compared to

$314.1 million in 2015.

- Adjusted net income attributable to Amedisys, Inc. of $14.1

million compared to $14.5 million in 2015.

- Adjusted net income attributable to Amedisys, Inc. per diluted

share of $0.42 compared to $0.43 in 2015.

- Adjusted EBITDA (defined as net income (loss) attributable to

Amedisys, Inc. before provision for income taxes, net interest

expense and depreciation and amortization excluding certain items)

of $29.8 million compared to $31.7 million in 2015.

Six-Month Periods Ended June 30, 2016 and 2015

- Net service revenue increased $93.8 million to $709.5 million

compared to $615.7 million in 2015.

- Net income attributable to Amedisys, Inc. of $16.9 million

compared to $24.4 million net loss in 2015.

- Net income attributable to Amedisys, Inc. per diluted share

increased $1.24 to $0.50 compared to $0.74 net loss per diluted

share in 2015.

Adjusted Results*

- Adjusted net service revenue of $710.5 million compared to

$615.7 million in 2015.

- Adjusted net income attributable to Amedisys, Inc. of $25.0

million compared to $24.3 million in 2015.

- Adjusted net income attributable to Amedisys, Inc. per diluted

share of $0.74 compared to $0.73 in 2015.

- Adjusted EBITDA of $53.8 million compared to $58.0 million in

2015.

* See pages 11 and 12 for the reconciliations of non-GAAP

financial measures to GAAP measures.

Executive Retirement

On August 2, 2016, Ronald A. LaBorde, the Vice Chairman and

Chief Financial Officer of the Company, announced his intention to

retire from the Company and the Board of Directors as of January 2,

2017.

Paul B. Kusserow, President and Chief Executive Officer stated,

“I am proud of the strong results our team delivered in the second

quarter, even as we incurred deeper than anticipated software

implementation disruption costs. We delivered strong growth across

the board in all segments, drove improving clinical quality metrics

and saw reduced employee turnover. We are continuing to progress

successfully through our technology transformation and remain

confident in our ability to deliver on the efficiencies that we

have promised to our shareholders.”

Kusserow continued, “Lastly, while five months away, I would

like to thank Ronnie LaBorde for his contribution to Amedisys which

been invaluable, particularly during the turnaround in 2014. I

appreciate his contribution as a trusted colleague and friend. He

will leave the company in a strong and stable position with a great

future trajectory. You couldn’t ask for a better legacy.”

We urge caution in considering the current trends disclosed in

this press release. The home health and hospice industry is highly

competitive and subject to intensive regulations, and trends are

subject to numerous factors, risks, and uncertainties, some of

which are referenced in the cautionary language below and others

that are described more fully in our reports filed with the

Securities and Exchange Commission (“SEC”) including our Annual

Report on Form 10-K for the fiscal year ended December 31, 2015,

and subsequent Quarterly Reports on Form 10-Q, and current reports

on Form 8-K which can be found on the SEC’s internet website,

http://www.sec.gov, and our internet website,

http://www.amedisys.com. We disclaim any obligations to update

disclosed information on trends.

Earnings Call and Webcast Information

To participate on the conference call, please call a few minutes

before 11:00 a.m. ET to either (877) 524-8416 (Toll-Free)

or (412) 902-1028 (Toll). A replay of the conference call will

be available through September 3, 2016 by dialing (877) 660-6853

(Toll- Free) or (201) 612-7415 (Toll) and entering conference ID

#13641920.

A live webcast of the call will be accessible through our

website on our Investor Relations section at the following web

address: http://investors.amedisys.com.

Amedisys, Inc. (the “Company”) is headquartered in Baton Rouge,

Louisiana and our common stock trades on the NASDAQ

Global Select Market under the symbol “AMED”.

Additional information

Our company website address is www.amedisys.com. We use our

website as a channel of distribution for important company

information. Important information, including press releases,

analyst presentations and financial information regarding our

company, is routinely posted on and accessible on the Investor

Relations subpage of our website, which is accessible by clicking

on the tab labeled “Investors” on our website home page. We also

use our website to expedite public access to time-critical

information regarding our company in advance of or in lieu of

distributing a press release or a filing with the SEC disclosing

the same information. Therefore, investors should look to the

Investor Relations subpage of our website for important and

time-critical information. Visitors to our website can also

register to receive automatic e-mail and other notifications

alerting them when new information is made available on the

Investor Relations subpage of our website.

Forward-Looking Statements

When included in this press release, words like “believes,”

“belief,” “expects,” “plans,” “anticipates,” “intends,” “projects,”

“estimates,” “may,” “might,” “would,” “should” and similar

expressions are intended to identify forward-looking statements as

defined by the Private Securities Litigation Reform Act of 1995.

These forward-looking statements involve a variety of risks and

uncertainties that could cause actual results to differ materially

from those described therein. These risks and uncertainties

include, but are not limited to the following: changes in Medicare

and other medical payment levels, our ability to open care centers,

acquire additional care centers and integrate and operate these

care centers effectively, changes in or our failure to comply with

existing Federal and State laws or regulations or the

inability to comply with new government regulations on a timely

basis, competition in the home health industry, changes in the case

mix of patients and payment methodologies, changes in estimates and

judgments associated with critical accounting policies, our ability

to maintain or establish new patient referral sources, our ability

to attract and retain qualified personnel, changes in payments and

covered services due to the economic downturn and deficit spending

by Federal and State governments, future cost containment

initiatives undertaken by third-party payors, our access to

financing due to the volatility and disruption of the capital and

credit markets, our ability to meet debt service requirements and

comply with covenants in debt agreements, business disruptions due

to natural disasters or acts of terrorism, our ability to integrate

and manage our information systems, our ability to comply with

requirements stipulated in our corporate integrity agreement and

changes in law or developments with respect to any litigation

relating to the Company, including various other matters, many of

which are beyond our control.

Because forward-looking statements are inherently subject to

risks and uncertainties, some of which cannot be predicted or

quantified, you should not rely on any forward-looking statement as

a prediction of future events. We expressly disclaim any obligation

or undertaking and we do not intend to release publicly any updates

or changes in our expectations concerning the forward- looking

statements or any changes in events, conditions or circumstances

upon which any forward-looking statement may be based, except as

required by law.

Non-GAAP Financial

Measures

This press release includes the following non-GAAP financial

measures as defined under SEC rules: (1) EBITDA, defined as net

income (loss) attributable to Amedisys, Inc. before provision for

income taxes, net interest expense and depreciation and

amortization; (2) adjusted EBITDA, defined as EBITDA excluding

certain items; (3) adjusted net service revenue, defined as net

service revenue excluding certain items; (4) adjusted net income

attributable to Amedisys, Inc., defined as net income (loss)

attributable to Amedisys, Inc. excluding certain items; and (5)

adjusted net income attributable to Amedisys, Inc. per diluted

share, defined as net income (loss) attributable to Amedisys, Inc.

common stockholders per diluted share excluding certain items. In

accordance with SEC rules, we have provided herein a reconciliation

of these non-GAAP financial measures to the most

directly comparable measures under GAAP. Management believes

that these are useful gauges of our performance and are common

measures used in our industry to assess relative financial

performance among companies.

AMEDISYS, INC. AND

SUBSIDIARIESSELECT CONSOLIDATED FINANCIAL

STATEMENT DATA AND SUPPLEMENTAL INFORMATION (Amounts in thousands,

except share, per share data and statistical

information)

|

Balance Sheet Information |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

June

30, 2016 |

|

|

December 31, 2015 |

|

| |

|

(Unaudited) |

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

9,968 |

|

$ |

27,502 |

|

| Patient accounts receivable, net of

allowance for doubtful accounts of $15,950 and $16,526 |

|

152,213 |

|

|

125,010 |

|

| Prepaid expenses |

|

7,931 |

|

|

8,110 |

|

| Other current assets |

|

9,407 |

|

|

14,641 |

|

| Total current assets |

|

179,519 |

|

|

175,263 |

|

| Property and equipment, net of

accumulated depreciation of $139,433 and $141,793 |

|

44,617 |

|

|

42,695 |

|

| Goodwill |

|

280,349 |

|

|

261,663 |

|

| Intangible assets, net of

accumulated amortization of $26,525 and $25,386 |

|

47,728 |

|

|

44,047 |

|

| Deferred income taxes |

|

121,014 |

|

|

125,245 |

|

| Other assets, net |

|

37,875 |

|

|

32,802 |

|

| Total assets |

$ |

711,102 |

|

$ |

681,715 |

|

|

LIABILITIES AND EQUITY |

|

|

| Current liabilities: |

|

|

| Accounts payable |

$ |

35,070 |

|

$ |

25,682 |

|

| Payroll and employee benefits |

|

86,075 |

|

|

72,546 |

|

| Accrued expenses |

|

63,641 |

|

|

71,965 |

|

| Current portion of long-term

obligations |

|

5,000 |

|

|

5,000 |

|

| Total current liabilities |

|

189,786 |

|

|

175,193 |

|

| Long-term obligations,

less current portion |

|

89,500 |

|

|

91,630 |

|

| Other long-term

obligations |

|

3,991 |

|

|

4,456 |

|

| Total liabilities |

|

283,277 |

|

|

271,279 |

|

| Equity: |

|

|

|

|

|

|

| Preferred stock, $0.001 par value,

5,000,000 shares authorized; none issued or outstanding |

|

— |

|

|

— |

|

| Common stock, $0.001 par value,

60,000,000 shares authorized; 35,136,248 and 34,786,966 shares

issued; and 33,499,944 and 33,607,282 shares outstanding |

|

35 |

|

|

35 |

|

| Additional paid-in capital |

|

523,583 |

|

|

504,290 |

|

| Treasury stock at cost, 1,636,304

and 1,179,684 shares of common stock |

|

(45,829 |

) |

|

(26,966 |

) |

| Accumulated other comprehensive

income |

|

15 |

|

|

15 |

|

| Retained earnings |

|

(50,897 |

) |

|

(67,806 |

) |

| Total Amedisys, Inc. stockholders’

equity |

|

426,907 |

|

|

409,568 |

|

| Noncontrolling interests |

|

918 |

|

|

868 |

|

| Total equity |

|

427,825 |

|

|

410,436 |

|

| Total liabilities and equity |

$ |

711,102 |

|

$ |

681,715 |

|

| |

|

|

|

|

|

|

| Statement of Operations

Information (Unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three-Month

Periods Ended

June 30, |

|

|

For the

Six-Month Periods Ended June

30, |

|

| |

|

2016 |

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

| Net service

revenue |

$ |

360,746 |

|

$ |

314,152 |

|

$ |

709,563 |

|

$ |

615,724 |

|

| Cost of

service, excluding depreciation and amortization |

|

206,505 |

|

|

175,699 |

|

|

408,342 |

|

|

346,660 |

|

| General and

administrative expenses: |

|

|

|

|

| Salaries and

benefits |

|

77,343 |

|

|

71,249 |

|

|

154,060 |

|

|

139,804 |

|

| Non-cash

compensation |

|

3,736 |

|

|

2,193 |

|

|

7,806 |

|

|

4,577 |

|

| Other |

|

45,576 |

|

|

42,113 |

|

|

92,293 |

|

|

75,183 |

|

| Provision for

doubtful accounts |

|

4,253 |

|

|

2,756 |

|

|

8,193 |

|

|

5,732 |

|

| Depreciation

and amortization |

|

4,975 |

|

|

4,615 |

|

|

9,448 |

|

|

11,152 |

|

| Asset

impairment charge |

|

— |

|

|

— |

|

|

— |

|

|

75,193 |

|

| Operating

expenses |

|

342,388 |

|

|

298,625 |

|

|

680,142 |

|

|

658,301 |

|

| Operating

income (loss) |

|

18,358 |

|

|

15,527 |

|

|

29,421 |

|

|

(42,577 |

) |

| Other

(expense) income: |

|

|

|

|

| Interest income |

|

9 |

|

|

4 |

|

|

31 |

|

|

26 |

|

| Interest expense |

|

(1,303 |

) |

|

(2,416 |

) |

|

(2,415 |

) |

|

(4,842 |

) |

| Equity in earnings from

equity method investments |

|

363 |

|

|

4,826 |

|

|

358 |

|

|

6,777 |

|

| Miscellaneous, net |

|

658 |

|

|

498 |

|

|

1,393 |

|

|

2,632 |

|

| Total other (expense)

income, net |

|

(273 |

) |

|

2,912 |

|

|

(633 |

) |

|

4,593 |

|

| Income (loss)

before income taxes |

|

18,085 |

|

|

18,439 |

|

|

28,788 |

|

|

(37,984 |

) |

| Income tax

(expense) benefit |

|

(7,242 |

) |

|

(7,566 |

) |

|

(11,630 |

) |

|

14,025 |

|

| Net income

(loss) |

|

10,843 |

|

|

10,873 |

|

|

17,158 |

|

|

(23,959 |

) |

| Net income

attributable to noncontrolling interests |

|

(147 |

) |

|

(236 |

) |

|

(249 |

) |

|

(413 |

) |

| Net income

(loss) attributable to Amedisys, Inc. |

$ |

10,696 |

|

$ |

10,637 |

|

$ |

16,909 |

|

$ |

(24,372 |

) |

| Basic earnings

per common share: |

|

|

|

|

| Net income (loss) attributable to

Amedisys, Inc. common stockholders |

|

$ |

0.32 |

|

$ |

0.32 |

|

$ |

0.51 |

|

$ |

(0.74 |

) |

| Weighted average shares outstanding

|

|

|

33,197 |

|

|

33,004 |

|

|

33,059 |

|

|

32,871 |

|

| Diluted

earnings per common share: |

|

|

|

|

| Net income (loss) attributable to

Amedisys, Inc. common stockholders |

|

$ |

0.32 |

|

$ |

0.32 |

|

$ |

0.50 |

|

$ |

(0.74 |

) |

| Weighted average shares

outstanding |

|

|

33,708 |

|

|

33,459 |

|

|

33,641 |

|

|

32,871 |

|

| |

|

|

|

|

|

| Cash

Flow and Days Revenue Outstanding, Net Information |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three-Month

Periods Ended June 30, |

|

|

For the

Six-Month Periods Ended June

30, |

|

| |

|

2016 |

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

| Net cash provided by

operating activities |

$ |

14,651 |

|

$ |

42,554 |

|

$ |

26,895 |

|

$ |

57,037 |

|

| Net cash used in investing

activities |

|

(3,597 |

) |

|

(9,754 |

) |

|

(37,751 |

) |

|

(11,822 |

) |

| Net cash used in financing

activities |

|

(8,910 |

) |

|

(2,731 |

) |

|

(6,678 |

) |

|

(20,046 |

) |

| Net increase (decrease) in

cash and cash equivalents |

|

2,144 |

|

|

30,069 |

|

|

(17,534 |

) |

|

25,169 |

|

| Cash and cash equivalents

at beginning of period |

|

7,824 |

|

|

3,132 |

|

|

27,502 |

|

|

8,032 |

|

| Cash and cash equivalents

at end of period |

$ |

9,968 |

|

$ |

33,201 |

|

$ |

9,968 |

|

$ |

33,201 |

|

| Days revenue outstanding,

net (1) |

|

37.2 |

|

|

31.0 |

|

|

37.2 |

|

|

31.0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

(1) Our calculation of days revenue outstanding, net at June 30,

2016 and 2015 is derived by dividing our ending patient accounts

receivable (i.e., net of estimated revenue adjustments and

allowance for doubtful accounts) by our average daily net patient

revenue for the three-month period ended June 30, 2016 and 2015,

respectively.

|

Supplemental Information - Home Health |

|

| |

|

For the

Three-Month Periods Ended June 30, |

|

| Financial

Information (in millions): |

|

2016 |

|

|

2015 |

|

| Medicare |

$ |

208.4 |

|

$ |

188.3 |

|

| Non-Medicare |

|

67.1 |

|

|

59.5 |

|

| Net service revenue |

|

275.5 |

|

|

247.8 |

|

| Cost of service |

|

160.3 |

|

|

142.3 |

|

| Gross margin |

|

115.2 |

|

|

105.5 |

|

| Other operating

expenses |

|

77.4 |

|

|

67.1 |

|

| Operating income |

$ |

37.8 |

|

$ |

38.4 |

|

| Key Statistical

Data: |

|

|

|

|

|

|

|

Medicare: |

|

|

|

|

|

|

| Same Store Volume

(1): |

|

|

|

|

|

|

| Revenue |

|

4 |

% |

|

(1 |

%) |

| Admissions |

|

4 |

% |

|

0 |

% |

| Recertifications |

|

2 |

% |

|

(6 |

%) |

| Total (2): |

|

|

| Admissions |

|

48,982 |

|

|

44,188 |

|

| Recertifications |

|

26,020 |

|

|

24,607 |

|

| Completed episodes |

|

74,027 |

|

|

67,702 |

|

| Visits |

|

1,315,417 |

|

|

1,203,648 |

|

| Average revenue per

completed episode (3) |

$ |

2,850 |

|

$ |

2,828 |

|

| Visits per completed

episode (4) |

|

17.7 |

|

|

17.5 |

|

|

Non-Medicare: |

|

|

| Same Store Volume

(1): |

|

|

| Revenue |

|

13 |

% |

|

16 |

% |

| Admissions |

|

2 |

% |

|

15 |

% |

| Recertifications |

|

12 |

% |

|

8 |

% |

| Total (2): |

|

|

| Admissions |

|

24,237 |

|

|

23,792 |

|

| Recertifications |

|

9,640 |

|

|

8,637 |

|

| Visits |

|

515,062 |

|

|

482,689 |

|

| Total

(2): |

|

|

| Cost per Visit |

$ |

87.56 |

|

$ |

84.43 |

|

| Visits |

|

1,830,479 |

|

|

1,686,337 |

|

| |

|

|

| |

|

|

|

|

|

|

| |

|

For the Six-Month Periods

Ended June 30, |

|

| Financial

Information (in millions): |

|

2016 |

|

|

2015 |

|

| Medicare |

$ |

415.2 |

|

$ |

375.5 |

|

| Non-Medicare |

|

133.0 |

|

|

113.7 |

|

| Net service revenue |

|

548.2 |

|

|

489.2 |

|

| Cost of service |

|

321.1 |

|

|

281.0 |

|

| Gross margin |

|

227.1 |

|

|

208.2 |

|

| Other operating

expenses |

|

153.1 |

|

|

134.0 |

|

| Operating income |

$ |

74.0 |

|

$ |

74.2 |

|

| Key Statistical

Data: |

|

|

|

Medicare: |

|

|

| Same Store Volume

(1): |

|

|

| Revenue |

|

4 |

% |

|

2 |

% |

| Admissions |

|

4 |

% |

|

1 |

% |

| Recertifications |

|

3 |

% |

|

(3 |

%) |

| Total (2): |

|

|

| Admissions |

|

99,400 |

|

|

89,539 |

|

| Recertifications |

|

52,043 |

|

|

48,966 |

|

| Completed episodes |

|

146,059 |

|

|

133,013 |

|

| Visits |

|

2,626,788 |

|

|

2,371,898 |

|

| Average revenue per

completed episode (3) |

$ |

2,831 |

|

$ |

2,811 |

|

| Visits per completed

episode (4) |

|

17.6 |

|

|

17.4 |

|

|

Non-Medicare: |

|

|

| Same Store Volume

(1): |

|

|

| Revenue |

|

17 |

% |

|

18 |

% |

| Admissions |

|

6 |

% |

|

16 |

% |

| Recertifications |

|

17 |

% |

|

12 |

% |

| Total (2): |

|

|

| Admissions |

|

49,804 |

|

|

46,941 |

|

| Recertifications |

|

19,466 |

|

|

16,625 |

|

| Visits |

|

1,043,031 |

|

|

920,154 |

|

| Total

(2): |

|

|

| Cost per Visit |

$ |

87.51 |

|

$ |

85.36 |

|

| Visits |

|

3,669,819 |

|

|

3,292,052 |

|

| |

|

|

|

|

|

|

(1) Same store Medicare and Non-Medicare revenue, admissions or

recertifications growth (decline) is the percent increase

(decrease) in our Medicare and Non-Medicare revenue, admissions or

recertifications for the period as a percent of the Medicare and

Non-Medicare revenue, admissions or recertifications of the prior

period.(2) Total includes acquisitions.(3) Average Medicare revenue

per completed episode is the average Medicare revenue earned for

each Medicare completed episode of care which includes the impact

of sequestration.(4) Medicare visits per completed episode are the

home health Medicare visits on completed episodes divided by the

home health Medicare episodes completed during the period.

|

Supplemental Information - Hospice |

|

| |

|

For the Three-Month

Periods Ended June 30, |

|

| |

|

2016 |

|

|

2015 |

|

| Medicare |

$ |

71.3 |

|

$ |

62.5 |

|

| Non-Medicare |

|

4.5 |

|

|

3.8 |

|

| Net service revenue |

|

75.8 |

|

|

66.3 |

|

| Cost of service |

|

39.4 |

|

|

33.4 |

|

| Gross margin |

|

36.4 |

|

|

32.9 |

|

| Other operating

expenses |

|

18.4 |

|

|

16.0 |

|

| Operating income |

$ |

18.0 |

|

$ |

16.9 |

|

|

Key Statistical Data: |

|

|

|

|

|

|

| Same Store Volume

(1): |

|

|

|

|

|

|

| Medicare revenue |

|

14 |

% |

|

10 |

% |

| Non-Medicare revenue |

|

15 |

% |

|

5 |

% |

| Hospice admissions |

|

18 |

% |

|

11 |

% |

| Average daily census |

|

16 |

% |

|

7 |

% |

| Total (2): |

|

|

| Hospice admissions |

|

5,576 |

|

|

4,713 |

|

| Average daily census |

|

5,730 |

|

|

4,944 |

|

| Revenue per day, net |

$ |

145.40 |

|

$ |

147.53 |

|

| Cost of service per

day |

$ |

75.69 |

|

$ |

74.07 |

|

| Average length of

stay |

|

94 |

|

|

86 |

|

| |

|

|

|

|

|

|

| |

|

For the Six-Month Periods

Ended June 30, |

|

| |

|

2016 |

|

|

2015 |

|

| Financial

Information (in millions): |

|

|

|

|

|

|

| Medicare |

$ |

140.0 |

|

$ |

118.9 |

|

| Non-Medicare |

|

8.8 |

|

|

7.6 |

|

| Net service revenue |

|

148.8 |

|

|

126.5 |

|

| Cost of service |

|

78.2 |

|

|

65.7 |

|

| Gross margin |

|

70.6 |

|

|

60.8 |

|

| Other operating

expenses |

|

36.3 |

|

|

31.2 |

|

| Operating income |

$ |

34.3 |

|

$ |

29.6 |

|

|

Key Statistical Data: |

|

|

|

|

|

|

| Same Store Volume

(1): |

|

|

|

|

|

|

| Medicare revenue |

|

18 |

% |

|

6 |

% |

| Non-Medicare revenue |

|

15 |

% |

|

9 |

% |

| Hospice admissions |

|

19 |

% |

|

9 |

% |

| Average daily census |

|

19 |

% |

|

4 |

% |

| Total (2): |

|

|

| Hospice admissions |

|

11,006 |

|

|

9,277 |

|

| Average daily census |

|

5,618 |

|

|

4,744 |

|

| Revenue per day, net |

$ |

145.52 |

|

$ |

147.39 |

|

| Cost of service per

day |

$ |

76.51 |

|

$ |

76.47 |

|

| Average length of

stay |

|

95 |

|

|

88 |

|

| |

|

|

|

|

|

|

(1) Same store Medicare and Non-Medicare revenue, Hospice

admissions or average daily census growth (decline) is the percent

increase (decrease) in our Medicare and Non-Medicare revenue,

Hospice admissions or average daily census for the period as a

percent of the Medicare and Non-Medicare revenue, Hospice

admissions or average daily census of the prior period.(2) Total

includes acquisitions.

| |

Supplemental Information - Corporate |

| |

|

|

For the

Three-Month Periods Ended June 30, |

|

|

| |

|

|

2016 |

|

|

2015 |

|

|

| |

Other operating

expenses |

$ |

34.7 |

|

$ |

36.8 |

|

|

| |

Depreciation and

amortization |

|

3.1 |

|

|

3.0 |

|

|

| |

Total |

$ |

37.8 |

|

$ |

39.8 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| |

|

For the

Six-Month Periods Ended June 30, |

| |

|

2016 |

|

2015 |

| Financial Information (in

millions): |

|

|

|

|

| Other operating expenses |

$ |

73.7 |

$ |

63.6 |

| Depreciation and amortization |

|

6.0 |

|

7.6 |

| Total before impairment (1) |

$ |

79.7 |

$ |

71.2 |

| |

|

|

|

|

1) Total of $146.4 million on a GAAP basis for the six-month

period ended June 30, 2015 (including $75.2 million asset

impairment charge).

AMEDISYS, INC. AND

SUBSIDIARIESRECONCILIATION

OF NON-GAAP FINANCIAL MEASURES TO GAAP FINANCIAL STATEMENTS

(Amounts in thousands)(Unaudited)

Earnings Before Interest, Taxes,

Depreciation and Amortization (“EBITDA”) and Adjusted

EBITDA:

| |

|

For the Three-Month PeriodsEnded June

30, |

|

|

For the Six-Month

PeriodsEnded June 30, |

|

| |

|

2016 |

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

| Net income (loss)

attributable to Amedisys, Inc. |

$ |

10,696 |

|

$ |

10,637 |

|

$ |

16,909 |

|

$ |

(24,372 |

) |

| Add: |

|

|

|

|

| Income tax expense (benefit) |

|

7,242 |

|

|

7,566 |

|

|

11,630 |

|

|

(14,025 |

) |

| Interest expense, net |

|

1,294 |

|

|

2,412 |

|

|

2,384 |

|

|

4,816 |

|

| Depreciation and amortization |

|

4,975 |

|

|

4,615 |

|

|

9,448 |

|

|

11,152 |

|

| EBITDA (1)(7) |

|

24,207 |

|

|

25,230 |

|

|

40,371 |

|

|

(22,429 |

) |

| Add: |

|

|

|

|

| Certain items (2) |

|

5,636 |

|

|

6,427 |

|

|

13,402 |

|

|

80,467 |

|

| Adjusted EBITDA

(3)(7) |

$ |

29,843 |

|

$ |

31,657 |

|

$ |

53,773 |

|

$ |

58,038 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Net Service

Revenue Reconciliation:

| |

|

For the Three-Month PeriodsEnded June

30, |

|

|

For the Six-Month PeriodsEnded June

30, |

|

| |

|

2016 |

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

| Net service revenue |

$ |

360,746 |

|

$ |

314,152 |

|

$ |

709,563 |

|

$ |

615,724 |

|

| Add: |

|

|

|

|

| Certain items (2) |

|

948 |

|

|

— |

|

|

948 |

|

|

— |

|

| Adjusted net service

revenue (4)(7) |

$ |

361,694 |

|

$ |

314,152 |

|

$ |

710,511 |

|

$ |

615,724 |

|

| |

|

|

|

|

|

|

|

|

|

|

Adjusted Net Income

Attributable to Amedisys, Inc. Reconciliation:

| |

|

For the Three-Month PeriodsEnded June

30, |

|

|

For the Six-Month PeriodsEnded June

30, |

|

| |

|

2016 |

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

| Net income (loss)

attributable to Amedisys, Inc. |

$ |

10,696 |

|

$ |

10,637 |

|

$ |

16,909 |

|

$ |

(24,372 |

) |

| Add: |

|

|

|

|

|

|

| Certain items (2) |

|

3,410 |

|

|

3,888 |

|

|

8,108 |

|

|

48,682 |

|

| Adjusted net income

attributable to Amedisys, Inc. (5)(7) |

$ |

14,106 |

|

$ |

14,525 |

|

$ |

25,017 |

|

$ |

24,310 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Net Income

Attributable to Amedisys, Inc. per Diluted Share:

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three-Month

PeriodsEnded June 30, |

|

|

For the Six-Month

PeriodsEnded June 30, |

|

| |

|

2016 |

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

| Net income (loss)

attributable to Amedisys, Inc. common stockholders per diluted

share |

$ |

0.32 |

|

$ |

0.32 |

|

$ |

0.50 |

|

$ |

(0.74 |

) |

| Add: |

|

|

|

|

| Certain items

(2) |

|

0.10 |

|

|

0.12 |

|

|

0.24 |

|

|

1.48 |

|

| Adjusted

net income attributable to Amedisys, Inc. common stockholders per

diluted share (6)(7) |

$ |

0.42 |

|

$ |

0.43 |

|

$ |

0.74 |

|

$ |

0.73 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) EBITDA is defined as net income (loss) attributable to

Amedisys, Inc. before provision for income taxes, net interest

expense, and depreciation and amortization.

(2) The following details the certain items for the three and

six-month periods ended June 30, 2016 and 2015:

| |

|

For the Three-Month

PeriodEnded June 30, 2016 |

|

|

For the Six-Month

PeriodEnded June 30, 2016 |

|

| |

|

(Income)

Expense |

|

|

(Income)

Expense |

|

| HCHB implementation |

$ |

2,593 |

|

$ |

5,033 |

|

| Acquisition costs |

|

337 |

|

|

2,042 |

|

| Legal fees -

non-routine |

|

459 |

|

|

1,976 |

|

| Legal settlements |

|

(265 |

) |

|

(806 |

) |

| Restructuring

activity |

|

1,494 |

|

|

3,703 |

|

| Third party audit

reserve |

|

948 |

|

|

948 |

|

| Miscellaneous, other

(income) expense, net |

|

70 |

|

|

506 |

|

| Total |

$ |

5,636 |

|

$ |

13,402 |

|

| Net of tax |

|

3,410 |

|

|

8,108 |

|

| Diluted EPS |

|

0.10 |

|

|

0.24 |

|

| |

|

|

|

|

|

|

| |

|

For the Three-Month

PeriodEnded June 30, 2015 |

|

|

For the Six-Month

PeriodEnded June 30, 2015 |

|

| |

|

(Income)

Expense |

|

|

(Income)

Expense |

|

| Wage and Hour

litigation |

$ |

8,000 |

|

$ |

8,000 |

|

| Legal settlements |

|

(307 |

) |

|

(1,125 |

) |

| Inventory and Data

Security Reporting |

|

— |

|

|

2,121 |

|

| Asset impairment |

|

— |

|

|

75,193 |

|

| Restructuring

activity |

|

2,679 |

|

|

2,679 |

|

| Miscellaneous, other

(income) expense, net |

|

(3,945 |

) |

|

(6,401 |

) |

| Total |

$ |

6,427 |

|

$ |

80,467 |

|

| Net of tax |

$ |

3,888 |

|

$ |

48,682 |

|

| Diluted EPS |

$ |

0.12 |

|

$ |

1.48 |

|

| |

|

|

|

|

|

|

(3) Adjusted EBITDA is defined as EBITDA, as defined in footnote

1, excluding certain items as described in footnote 2. (4) Adjusted

net service revenue is defined as net service revenue plus certain

items as described in footnote 2.(5) Adjusted net income

attributable to Amedisys, Inc. is defined as net income (loss)

attributable to Amedisys, Inc. excluding certain other items as

described in footnote 2.(6) Adjusted net income attributable to

Amedisys, Inc. common stockholders per diluted share is defined as

diluted income (loss) per share excluding the earnings per

share effect of certain items as described in footnote 2.(7)

EBITDA, adjusted EBITDA, adjusted net service revenue, adjusted net

income attributable to Amedisys, Inc. and adjusted net income

attributable to Amedisys, Inc. common stockholders per diluted

share should not be considered as an alternative to, or more

meaningful than, income before income taxes, cash flow from

operating activities, or other traditional indicators of operating

performance. These calculations may not be comparable to a

similarly titled measure reported by other companies, since

not all companies calculate these non-GAAP financial measures in

the same manner.

Contact:

Investor Contact:

Amedisys, Inc.

David Castille

Managing Director, Treasury/Finance

(225) 299-3391

david.castille@amedisys.com

Media Contact:

Amedisys, Inc.

Kendra Kimmons

Managing Director, Marketing & Communications

(225) 299-3720

kendra.kimmons@amedisys.com

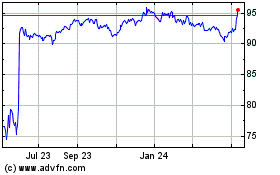

Amedisys (NASDAQ:AMED)

Historical Stock Chart

From Mar 2024 to Apr 2024

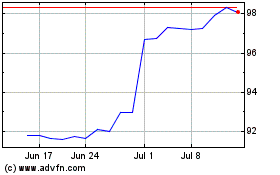

Amedisys (NASDAQ:AMED)

Historical Stock Chart

From Apr 2023 to Apr 2024