Amé rica Mó vil's Net Profit Falls as Mexico Weighs on Earnings

July 28 2016 - 9:20PM

Dow Jones News

MEXICO CITY—Mexican telecommunications company Amé rica Mó vil

SAB said Thursday that its net profit fell 45% in the second

quarter as operating gains declined, especially in Mexico, and

financial costs rose from a year before.

The company controlled by billionaire Carlos Slim reported net

profit of 7.7 billion Mexican pesos ($407.6 million), compared with

14 billion pesos in the second quarter of 2015.

Revenue in the April-June period was up 6.1% from the second

quarter of 2015 at 233.4 billion pesos, while operating cash flow

measured by earnings before interest, taxes, depreciation and

amortization, or Ebitda, fell 11% to 61 billion pesos.

"Substantially all our operations maintained their growth trends

in local currency terms," Amé rica Mó vil said. "In Mexico,

however, we saw a step down in revenues brought about mostly by

more aggressive commercial plans in the prepaid segment as a

greater part of our subscribers moved towards unlimited call

plans."

Amé rica Mó vil lost one million wireless subscribers in the

quarter, mostly in Brazil, and ended June with 282.9 million,

including 73.1 million in Mexico and 64.3 million in Brazil.

Disconnections of prepaid subscribers were partly offset by gains

in postpaid clients.

Subscriptions to fixed-line services including phone, broadband

internet and television rose by 334,000 to 81.7 million.

In Mexico, where wireless unit Telcel competes with AT&T

Inc. and Spain's Telefó nica SA, Amé rica Mó vil reported a 17%

drop in mobile service revenue, partly offset by higher equipment

revenue. Ebitda in Mexico fell 24%.

AT&T, which entered the Mexican wireless market last year

with a $4.4 billion acquisition of two smaller operators, said last

week it had close to 10 million mobile subscribers in Mexico at the

end of June after adding 779,000 in the second quarter. The U.S.

giant reported wireless revenue in Mexico of $606 million in the

quarter, but an operating loss of $225 million as it invests to

expand its high-speed mobile network to reach 100 million people by

2018.

Telefó nica reported 25.9 million wireless subscribers in Mexico

at the end of June, 12% more than a year earlier, and revenues of

$374 million in the quarter.

In Brazil, Amé rica Mó vil's second-quarter revenue was stable

against the year-earlier period as gains in fixed-line revenue

compensated for lower mobile service revenue. Ebitda in Brazil fell

4.5%.

Profits fell short of the median estimates of six analysts

polled by The Wall Street Journal, who expected net profit of 10.4

billion pesos and Ebitda of 64.9 billion pesos. Revenue was above

the estimate of 229.9 billion pesos.

Amé rica Mó vil's shares fell 2.7% Thursday on the Mexican stock

exchange ahead of the report, and are down 24% in the past

year.

Write to Anthony Harrup at anthony.harrup@wsj.com

(END) Dow Jones Newswires

July 28, 2016 21:05 ET (01:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

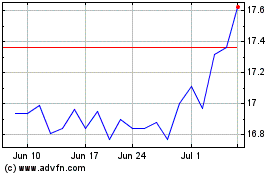

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Mar 2024 to Apr 2024

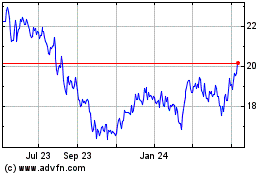

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Apr 2023 to Apr 2024