Amazon's Shipping Costs Likely to Surge With Holiday Orders

October 28 2016 - 6:20PM

Dow Jones News

Amazon.com Inc.'s shipping costs are likely to spiral higher in

the fourth quarter because of the combination of more expensive

fast shipping and greater holiday-related volumes.

The online-retail firm has been rolling out free deliveries in

as fast as an hour to its Prime members, most of whom pay a $99

annual fee. But Amazon said on Thursday that the faster deliveries

are costing it a lot of money—and as online orders surge during the

holidays, its shipping costs could top the $3.9 billion it spent in

the third quarter.

Amazon's stock was trading down more than 5% Friday after the

company reported increased spending on shipping, opening warehouses

and other investments, and disappointed on its outlook for the

fourth quarter. Its wide guidance range on operating

income—forecast between zero and $1.25 billion—prompted concerns

about its spending. Its shipping costs jumped 43% in the third

quarter, Amazon said Thursday.

Amazon's spending on shipping will increase in the fourth

quarter in line with volume, Robert W. Baird & Co. analyst

Colin Sebastian said in an email. But Amazon is trying to drive

down those costs and better manage its volume through using its own

logistics network and the U.S. Postal Service for more deliveries,

he said.

Already, the company is leasing 40 planes and bought truck

trailers, and it is also delivering some of its own packages. "We

want to control our own destiny," Amazon Chief Financial Officer

Brian Olsavsky said on a media call Thursday.

Amazon is just one of the companies expecting a delivery rush

this holiday season. On Thursday, United Parcel Service Inc. said

it is gearing up for a 14% increase in packages to more than 700

million deliveries between Thanksgiving and New Year's Eve. FedEx

Corp. and the USPS haven't yet released their projections.

Mr. Olsavsky said that the company has been working with its

shipping partners globally to line up delivery capacity for the

holiday season, in addition to adding to its own delivery

capabilities.

"We feel very confident we're looking forward to a great

holiday," he added during an earnings call with analysts

Thursday.

"Amazon is a wild card" in its delivery needs, said Ivan

Hofmann, a former FedEx executive and transportation-industry

consultant. Its volume can fluctuate wildly and can be hard to

forecast.

Adobe Systems Inc.'s Digital Insights, which measures online

transactions from top retailers, is projecting holiday sales will

grow 11% year over year, reaching $91.6 billion overall in the

months of November and December.

Amazon is spending heavily to roll out services such as Prime

Now, Amazon's one-to-two hour delivery offering, which is now in 40

cities world-wide versus 17 a year ago, and could favor last-minute

holiday shopping. The service will offer deliveries until midnight

Christmas Eve, something the company dubs "procrastinator's

delight."

Fast, so-called last-mile deliveries for services such as Prime

Now are often the most expensive, according to industry experts, as

it eliminates the option of filling up a truck with packages and

running them along a more efficient route. Instead, drivers with a

handful of deliveries drive point-to-point, which adds miles and

time.

Amazon advertises on its site that drivers from its Flex

program, which relies on citizen couriers to make Prime Now

deliveries, can earn up to $25 an hour.

It still charges for some deliveries, as well as collecting the

fee for its Prime membership, so shipping revenues for that segment

will also increase and help recoup some of those costs. In the

third quarter, Amazon reported shipping revenue increased 44%, to

$2.15 billion.

Write to Laura Stevens at laura.stevens@wsj.com

(END) Dow Jones Newswires

October 28, 2016 18:05 ET (22:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

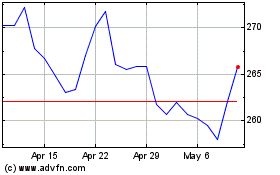

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

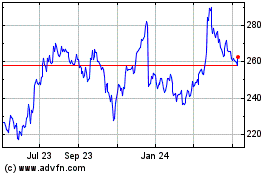

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024