TIDMALU

RNS Number : 8239D

Alumasc Group PLC

03 February 2015

IMMEDIATE RELEASE 3 February 2015

THE ALUMASC GROUP PLC - INTERIM RESULTS ANNOUNCEMENT

Alumasc (ALU.L), the premium building and engineering products

group, announces interim results for the six months ended 31

December 2014.

Half year to 31 December 2014 2013 % change

Continuing operations:

Revenue (GBPm) 49.0 45.2 +8%

Underlying profit before tax

(GBPm)* 4.0 3.5 +14%

Underlying earnings per share

(pence)* 8.9 7.6 +17%

Total group:

Profit before tax (GBPm) 3.0 2.4 +24%

Basic earnings per share (pence) 6.6 5.2 +27%

Dividends per share (pence) 2.5 2.2 +14%

Net debt at 31 December (GBPm) 7.7 7.7 -

(*) Underlying profits and earnings per share from continuing

operations are stated prior to the deduction of brand amortisation

charges of GBP0.1 million (2013: GBP0.1 million), IAS19 pension

costs of GBP0.7 million (2013: GBP0.5 million) and pre-tax losses

from discontinued operations of GBP0.2 million (2013: GBP0.5

million).

Key points

-- The group's best first half performance since 2008

-- Decision taken to focus the group's strategic development on

accelerating the growth of its Building Products activities.

Discussions with potential buyers of Alumasc Precision Components

in progress

-- All H1 growth driven by Building Products which increased

revenue by 11% to GBP45.2m and underlying operating profit by 22%

to GBP4.6m, outperforming UK Construction output growth of 6%.

-- Roofing & Walling operating profit doubled on revenue up

24% with performance benefiting from a widened product range and

increased sales in the South East. Facades experienced strong

demand in Scotland and for new products.

-- Solar Shadingprofit up 18% and Construction Products profit

down 37%, each mainly reflect timing of large contracts.

-- Revenue from Rainwater, Drainage and Housebuilding Products

up 17%. Capacity is being added to support growth.

-- H1 Building Products order intake up 30% on prior H1 to GBP48.9m.

-- 14% interim dividend increase reflects improved performance and prospects.

Paul Hooper, Chief Executive, commented:

"...the Board believes the group is well positioned to continue

to grow its Building Products business both in this financial year

and beyond."

Enquiries:

The Alumasc Group plc 01536 383844

Paul Hooper (Chief Executive)

Andrew Magson (Finance Director)

Glenmill Partners Limited

Simon Bloomfield 07771 758517

REVIEW OF INTERIM RESULTS

Overview

Alumasc is pleased to report its best first half year result

since 2008, with the strong performance attributable to ongoing

profitable growth in the Building Products division where revenues

again increased at a faster rate than the UK construction market as

a whole:

-- Group revenues from continuing operations increased by 8% to GBP49.0 million.

-- Underlying profit before tax from continuing operations advanced by 14% to GBP4.0 million.

-- Underlying earnings per share from continuing operations was

8.9 pence, some 17% ahead of a year ago.

-- Statutory profit before tax of GBP3.0 million was 24% up on

the prior year and basic earnings per share of 6.6p was 27% ahead.

A reconciliation of underlying profits and earnings to the

statutory figures is provided in note 5 to the interim financial

statements.

-- The Board has decided to increase the interim dividend by 14% to 2.5 pence.

As announced in October 2014, the Board has concluded that

Alumasc Precision Components ("APC") no longer fits the group's

strategy for growth. In line with this decision, the group is

currently discussing the sale of APC with a number of potential

trade buyers. The results of this business have therefore been

presented in the interim financial statements as a discontinued

operation. The net book value of APC, shown as a current asset

available for sale in the group balance sheet, is GBP6.5

million.

Strategic Developments

In our 2014 Annual Report we stated that the Board would refresh

its appraisal of how best to direct the group's resources in

building value for shareholders.

Following this review:

1. The Board has decided to focus the group's strategic

development on accelerating the growth of its Building Products

activities:

-- the combination of the strategic positioning of these

businesses in sectors that help manage the scarce resources of

energy and water with initiatives to increase our share of those

markets through new product development and geographic expansion

has begun to deliver an acceleration in revenue and profit

growth;

-- the group is more proactively seeking Building Products

acquisitions to complement organic growth opportunities; and

-- having sold the non-core Pendock Profiles business in

September 2014, the group does not intend to divest any other

Building Products businesses.

2. The Board has decided to divest APC, the larger of our two

engineering businesses and, as described above, is in discussions

with a number of potential acquirers of that business.

Operational review - continuing operations

Group revenues from continuing operations for the six months

ended 31 December 2014 increased by 8% to GBP49.0 million (2013:

GBP45.2 million), with underlying operating profits increasing by

12% to GBP4.3 million (2013: GBP3.8 million). Operating margins in

2014 improved to 8.8% from 8.5% in 2013. All of the growth came

from the Building Products division. Group interest costs on bank

borrowings were similar year on year, and the resultant group

underlying profit before tax of GBP4.0 million (2013: GBP3.5

million) was ahead of the prior year by 14%.

Building Products revenues grew by 11% to GBP45.2 million (2013:

GBP40.7 million) and divisional operating profits rose by 22% to

GBP4.6 million (2013: GBP3.7 million) at operating margins of 10.1%

(2013: 9.2%).

This improved performance was driven mainly by our Roofing and

Walling businesses, where actions taken over recent years to

strengthen management and sales resources, introduce new products,

and expand the product range and geographical reach are now bearing

fruit against a backdrop of an improving UK market place. The large

Kitimat smelter refurbishment contract is now very close to

completion and made only a modest contribution to first half

results in 2014.

Our Rainwater, Drainage and House Building Products businesses

continued the strong momentum of the previous year, growing

revenues by a further 17%. Investments in new product development

and in adding new capacity gave rise to some additional costs in

the transitional period, resulting in the generation of a similar

level of operating profit to that delivered in the first half of

the prior financial year.

In the Construction Products segment, Gatic had a satisfactory

first half, without the benefit of any individual large project in

the UK this year. The multi-million US Dollar project at Doha Port

won last summer is under way and will also benefit the second half

year. SCP, our scaffolding and related building products business,

performed well benefiting from a broadening of both product ranges

and routes to market.

Enquiry levels and order intake at Levolux is showing early

signs of improvement, indicative of some recovery in the UK new

build commercial market, particularly in London and the South East.

However, market activity in this segment remains around 30% below

its 2008 peak. Levolux's improved first half result benefited from

ongoing works, now close to complete, on the large commercial

building in London that commenced last year, and on the substantial

final project at Chiswick Park where the majority of the work is

now done. Steady progress continues in developing export markets,

with most success so far in North America.

Dyson Diecasting had a solid first half performance without

matching the record highs of the prior year which had benefited

from the initial stocking of some new product lines.

Operational review - discontinued operations

APC incurred a modest trading loss in the period, a much

improved performance compared with a year ago due to recovery plan

actions taken. These included exiting loss making work last year,

purchasing savings, operational efficiencies and strong overhead

control. However, we were notified in the Autumn that certain

export work to Europe would not be renewed as customer engine

variants were updated. Unexpectedly at that time APC also received

some significant retrospective claims for alleged quality and

delivery issues on the work that had come to an end. Some of these

claims have now been settled and we are in discussions to resolve

the remaining matters. Provisions against the expected value of the

settlement of the claims more than offset the improved trading

performance of the business, resulting in an increase in APC's

overall operating losses for the period to GBP1.1 million (2014:

loss of GBP0.7 million).

Pendock Profiles made a small trading profit prior to the sale

of this business in September 2014. The book gain made on the sale

was GBP0.8 million.

Cash flow, balance sheet, pensions and risk

The group's cash performance was in line with expectations, with

overall cash inflows and outflows balanced for the period as a

whole. Net debt at 31 December of GBP7.7 million therefore remained

unchanged compared to both 30 June 2014 and also 31 December 2013.

The average level of net debt on a cleared funds basis was also

similar to the prior half year, as was the net interest charge

relating to bank borrowings for the period of GBP0.3 million.

Close to record low corporate bond yields used to discount

pension liabilities to present values caused an increase in the

valuation of the pension deficit shown on the group balance sheet

to GBP21.4 million (30 June 2014: GBP17.9 million, 31 December

2013: GBP15.5 million). This in turn led to a reduction in

shareholders' funds to GBP15.0 million (30 June 2014: GBP17.0

million, 31 December 2013: GBP18.3 million). The valuation of

pension liabilities for accounting purposes has no direct impact on

the level of deficit repair contributions of GBP3.0 million per

annum (including scheme running expenses) that the company is

committed to pay into the pension schemes. The next full triennial

actuarial review is scheduled to take place in 2016. In the

meantime, further actions are being taken to reduce gross pension

liabilities and improve pension fund investment returns within an

acceptable level of risk.

The group's key business risks are as set out on pages 16 and 17

of the group's 2014 Annual Report, except as stated in note 3 to

the interim financial statements.

Outlook

Traditionally, Alumasc has experienced some seasonal bias in

favour of second half year results, but in the current year this is

expected to be offset by the timing of larger construction

projects, which are anticipated to make a more significant

contribution to the first half of the 2014/15 financial year.

This is reflected in order books, where Building Products order

intake in the period was up by 30% to GBP48.9 million (2013:

GBP37.5 million), some of this relating to projects scheduled

beyond this financial year. The value of the Building Products

order book of GBP19.2 million at 31 December 2014 was similar to

the prior financial year end, as billings during the period on

larger contracts offset the general growth in the order book.

More broadly, the Board believes the group is well positioned to

continue to grow its Building Products business both in this

financial year and beyond.

Dividend

In view of the strong first half performance and belief in the

improving medium to longer term prospects for the group, the Board

has decided to increase the interim dividend by 14% to 2.5 pence

per share (2013/14: 2.2 pence). This will be paid on 7 April to

shareholders on the register at 6 March.

Paul Hooper, Chief Executive

3 February 2015

CONDENSED CONSOLIDATED INTERIM STATEMENT OF COMPREHENSIVE

INCOME

for the half year to 31 December 2014

Year to

Half year to 31 December Half year to 31 December 30 June

2014 2013 2014

Non-underlying Non-underlying

Underlying Total Underlying Total Total

(Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Audited)

Continuing Notes GBP'000 GBP'000 GBP'000 GBP'000

operations GBP'000 GBP'000 GBP'000

Revenue 4 48,995 - 48,995 45,175 - 45,175 88,857

Cost of sales (34,289) - (34,289) (30,528) - (30,528) (59,249)

----------- -------------- ----------- ----------- -------------- ----------- ----------

Gross profit 14,706 - 14,706 14,647 - 14,647 29,608

Net operating

expenses

Net operating

expenses

before

non-underlying

items (10,397) - (10,397) (10,815) - (10,815) (21,843)

Brand

amortisation 5 - (134) (134) - (134) (134) (268)

IAS 19 pension

scheme

administration

costs 5 - (270) (270) - (200) (200) (452)

----------- -------------- ----------- ----------- -------------- ----------- ----------

Net operating

expenses (10,397) (404) (10,801) (10,815) (334) (11,149) (22,563)

Operating profit 4 4,309 (404) 3,905 3,832 (334) 3,498 7,045

Finance income 6 2 - 2 5 - 5 10

Finance expenses 5,6 (264) (400) (664) (279) (320) (599) (979)

----------- -------------- ----------- ----------- -------------- ----------- ----------

Profit before

taxation 4,047 (804) 3,243 3,558 (654) 2,904 6,076

Tax

(expense)/income 7,10 (890) 72 (818) (861) 214 (647) (1,287)

----------- -------------- ----------- ----------- -------------- ----------- ----------

Profit for the

period

from continuing

operations 3,157 (732) 2,425 2,697 (440) 2,257 4,789

Discontinued

operations

Loss after

taxation

for the period

from

discontinued

operations 5 - (58) (58) - (393) (393) (748)

Profit for the

period 3,157 (790) 2,367 2,697 (833) 1,864 4,041

=========== ============== =========== =========== ============== =========== ==========

Other

comprehensive

income

Items that will

not

be recycled to

profit

or loss:

Actuarial loss

on

defined

benefit

pensions 2 (4,334) (6,156) (9,350)

Tax on

actuarial loss

on defined

benefit

pensions 815 1,042 1,618

(3,519) (5,114) (7,732)

----------- ----------- ----------

Items that are or

may be recycled

subsequently

to profit or

loss:

Effective

portion

of changes in

fair

value of cash

flow

hedges 34 (75) (70)

Exchange

differences

on

retranslation

of

foreign

operations 20 (16) (19)

Tax on cash

flow hedge (5) 19 20

49 (72) (69)

----------- ----------- ----------

Other

comprehensive

loss for the

period,

net of tax (3,470) (5,186) (7,801)

----------- ----------- ----------

Total

comprehensive

loss for the

period,

net of tax (1,103) (3,322) (3,760)

=========== =========== ==========

Earnings per Pence Pence Pence

share

Basic earnings

per

share

- Continuing

operations 6.8 6.3 13.4

- Discontinued

operations (0.2) (1.1) (2.1)

10 6.6 5.2 11.3

=========== =========== ==========

Diluted earnings

per

share

- Continuing

operations 6.7 6.3 13.3

- Discontinued

operations (0.2) (1.1) (2.1)

10 6.5 5.2 11.2

=========== =========== ==========

CONDENSED CONSOLIDATED INTERIM STATEMENT OF FINANCIAL

POSITION

at 31 December 2014

31 December 31 December 30 June

2014 2013 2014

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 7,457 12,605 12,039

Goodwill 16,488 16,488 16,488

Other intangible assets 2,818 2,857 2,770

Financial asset investments 17 17 17

Deferred tax assets 4,285 3,256 3,584

--------- ------------- -----------

31,065 35,223 34,898

Current assets

Inventories 10,259 13,170 12,523

Biological assets 144 170 171

Trade and other receivables 18,468 19,568 23,693

Cash and cash equivalents 3,205 6,179 2,224

Derivative financial assets 29 50 40

Assets classified as held for

sale 9,799 - -

--------- ------------- -----------

41,904 39,137 38,651

Total assets 72,969 74,360 73,549

--------- ------------- -----------

Liabilities

Non-current liabilities

Interest bearing loans and borrowings (10,918) (13,862) (9,890)

Employee benefits payable (21,418) (15,504) (17,922)

Provisions (954) (628) (1,047)

Deferred tax liabilities (1,267) (1,435) (1,220)

--------- ------------- -----------

(34,557) (31,429) (30,079)

Current liabilities

Trade and other payables (18,966) (23,720) (25,694)

Provisions (681) (366) (221)

Income tax payable (417) (521) (445)

Derivative financial liabilities (34) (73) (68)

Liabilities classified as held

for sale (3,346) - -

--------- ------------- -----------

(23,444) (24,680) (26,428)

Total liabilities (58,001) (56,109) (56,507)

--------- ------------- -----------

Net assets 14,968 18,251 17,042

========= ============= ===========

Equity

Called up share capital 4,517 4,517 4,517

Share premium 445 445 445

Capital reserve - own shares (618) (618) (618)

Hedging reserve (33) (68) (62)

Foreign currency reserve 52 35 32

Profit and loss account reserve 10,605 13,940 12,728

--------- ------------- -----------

Total equity 14,968 18,251 17,042

========= ============= ===========

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CASH FLOWS

for the half year to 31 December 2014

Half year

Half year to to Year to

31 December 31 December 30 June

2014 2013 2014

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Operating activities

Operating profit 3,905 3,498 7,045

Adjustments for:

Depreciation 525 545 1,175

Amortisation 184 238 381

Gain on disposal of property, plant

and equipment (4) - (3)

Increase in inventories (943) (788) (344)

Decrease/(increase) in biological

assets 27 (7) (8)

(Increase)/decrease in receivables (510) 3,775 306

Decrease in trade and other payables (1,191) (3,273) (1,461)

Movement in provisions 367 (106) 168

Cash contributions to retirement

benefit schemes (1,250) (1,034) (1,992)

Share based payments 27 21 34

------------- ------------- -----------

Cash generated from continuing

operations 1,137 2,869 5,301

Cash generated from discontinued

operations (110) (143) (160)

Tax paid (456) (544) (1,114)

Net cash inflow from operating

activities 571 2,182 4,027

------------- ------------- -----------

Investing activities

Purchase of property, plant and

equipment (587) (738) (1,319)

Payments to acquire intangible

fixed assets (232) (119) (175)

Proceeds from sales of property,

plant and equipment 4 - 10

Acquisition of subsidiary, net

of cash and deferred consideration - (150) (320)

Proceeds from sale of business

activity 1,408 - -

Interest received 2 5 10

Net cash inflow/(outflow) from

investing activities 595 (1,002) (1,794)

------------- ------------- -----------

Financing activities

Interest paid (207) (241) (465)

Equity dividends paid (998) (891) (1,675)

Draw down/(repayment) of amounts

borrowed 1,000 (3,000) (7,000)

Net cash outflow from financing

activities (205) (4,132) (9,140)

------------- ------------- -----------

Net increase/(decrease) in cash

and cash equivalents 961 (2,952) (6,907)

============= ============= ===========

Net cash and cash equivalents brought

forward 2,224 9,147 9,147

Effect of foreign exchange rate

changes 20 (16) (16)

Net cash and cash equivalents carried

forward 3,205 6,179 2,224

============= ============= ===========

Cash and cash equivalents comprise:

Cash and cash equivalents 3,205 6,179 2,224

============= ============= ===========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the half year to 31 December 2014

Capital Hedging Foreign Profit

reserve currency and loss

Share Share - account

capital premium own shares reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2014 4,517 445 (618) (62) 32 12,728 17,042

Profit for the period - - - - - 2,367 2,367

Exchange differences on retranslation

of foreign operations - - - - 20 - 20

Net gain on cash flow hedges - - - 34 - - 34

Tax on derivative financial liability - - - (5) - - (5)

Actuarial loss on defined benefit

pension schemes, net of tax - - - - - (3,519) (3,519)

Dividends - - - - - (998) (998)

Share based payments - - - - - 27 27

At 31 December 2014 4,517 445 (618) (33) 52 10,605 14,968

======= ======= ========== ======== ========== ========== =========

Capital Hedging Foreign Profit

reserve currency and loss

Share Share - account

capital premium own shares reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2013 4,517 445 (618) (12) 51 18,060 22,443

Profit for the period - - - - - 1,864 1,864

Exchange differences on retranslation

of foreign operations - - - - (16) - (16)

Net loss on cash flow hedges - - - (75) - - (75)

Tax on derivative financial liability - - - 19 - - 19

Actuarial loss on defined benefit

pension schemes, net of tax - - - - - (5,114) (5,114)

Dividends - - - - - (891) (891)

Share based payments - - - - - 21 21

At 31 December 2013 4,517 445 (618) (68) 35 13,940 18,251

======= ======= ========== ======== ========== ========== =========

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

for the half year to 31 December 2014

1. Basis of preparation

The condensed consolidated interim financial statements of The

Alumasc Group plc and its subsidiaries have been prepared on the

basis of International Financial Reporting Standards (IFRS), as

adopted by the European Union, that are effective at 31 December

2014.

The condensed consolidated interim financial statements have

been prepared using the accounting policies set out in the

statutory accounts for the financial year to 30 June 2014 and in

accordance with IAS34 "Interim Financial Reporting".

The consolidated financial statements of the group as at and for

the year ended 30 June 2014 are available on request from the

company's registered office at Burton Latimer, Kettering,

Northants, NN15 5JP or at the website www.alumasc.co.uk.

The comparative figures for the financial year ended 30 June

2014 are not the company's statutory accounts for that financial

year but have been extracted from those accounts. Those accounts

have been reported on by the company's auditors and delivered to

the registrar of companies. The report of the auditors was (i)

unqualified, (ii) did not include a reference to any matters to

which the auditors drew attention by way of emphasis without

qualifying their report, and (iii) did not contain a statement

under section 498 (2) or (3) of the Companies Act 2006.

The comparative figures for the financial year ended 30 June

2014 and the six month period ended 31 December 2013 have been

re-classified to show APC and Pendock Profiles as discontinued

operations.

The condensed consolidated interim financial statements for the

half year ended 31 December 2014 are not statutory accounts and

have been neither audited nor reviewed by the group's auditors.

They do not contain all of the information required for full

financial statements, and should be read in conjunction with the

consolidated financial statements of the group as at and for the

year ended 30 June 2014.

These condensed consolidated interim financial statements were

approved by the Board of Directors on

3 February 2015.

On the basis of the group's financing facilities and current

financial plans and sensitivity analyses, the Board is satisfied

that the group has adequate resources to continue in operational

existence for the foreseeable future and accordingly continues to

adopt the going concern basis in preparing these condensed

consolidated interim financial statements.

2. Estimates

The preparation of condensed consolidated interim financial

statements requires management to make judgements, estimates and

assumptions that affect the application of accounting policies and

the reported amount of assets and liabilities, income and expense.

Actual results may differ from these estimates.

Except as described below, in preparing these condensed

consolidated interim financial statements, the significant

judgements made by management in applying the group's accounting

policies and the key sources of estimation uncertainty were the

same as those that applied to the consolidated financial statements

as at and for the year ended 30 June 2014.

During the six months ended 31 December 2014, management

reassessed and updated its estimates in respect of retirement

benefit obligations based on market data available at 31 December

2014. The resulting impact was a GBP4.3 million pre-tax actuarial

loss, calculated using IAS19 conventions, recognised in the six

month period to 31 December 2014.

3. Risks and Uncertainties

A summary of the group's principal risks and uncertainties was

provided on pages 16 and 17 of Alumasc's Report and Accounts 2014.

The Board considers these risks and uncertainties remain relevant

to the current financial year.

As described earlier in the Review of Interim Results Alumasc is

in discussions with a number of trade buyers to sell the Alumasc

Precision Components business. Current expectations are that the

carrying value of the business will be more than recovered on sale.

However, depending on the final outcome agreed, sales proceeds

could potentially be either above or below the book value at 31

December 2014.

4. Segmental analysis

Inter-segment Revenue Segmental

Total Operating

External Result

GBP'000 GBP'000 GBP'000 GBP'000

Half Year to 31 December 2014

Solar Shading & Screening 8,159 - 8,159 386

Roofing & Walling 16,947 - 16,947 2,210

---------- -------------- ---------- -----------

Energy Management 25,106 - 25,106 2,596

Construction Products 8,081 2 8,083 556

Rainwater, Drainage & House Building

Products 11,992 5 11,997 1,416

---------- -------------- ---------- -----------

Water Management & Other 20,073 7 20,080 1,972

Building Products 45,179 7 45,186 4,568

---------- -------------- ---------- -----------

Dyson Diecasting 3,816 122 3,938 338

---------- -------------- ---------- -----------

Engineering Products 3,816 122 3,938 338

Elimination/Unallocated costs - (129) (129) (597)

Total 48,995 - 48,995 4,309

========== ============== ========== ===========

GBP'000

Segmental operating result 4,309

Brand amortisation (134)

IAS 19 pension scheme administration

costs (270)

Total operating profit from continuing

operations 3,905

===========

Inter-segment Revenue Segmental

Total Operating

External Result

GBP'000 GBP'000 GBP'000 GBP'000

Half Year to 31 December 2013 (Restated)

Solar Shading & Screening 9,152 - 9,152 328

Roofing & Walling 13,690 - 13,690 1,078

---------- -------------- ---------- -----------

Energy Management 22,842 - 22,842 1,406

Construction Products 7,618 2 7,620 882

Rainwater, Drainage & House Building

Products 10,203 28 10,231 1,454

---------- -------------- ---------- -----------

Water Management & Other 17,821 30 17,851 2,336

Building Products 40,663 30 40,693 3,742

---------- -------------- ---------- -----------

Dyson Diecasting 4,512 186 4,698 779

---------- -------------- ---------- -----------

Engineering Products 4,512 186 4,698 779

Elimination/Unallocated costs - (216) (216) (689)

Total 45,175 - 45,175 3,832

========== ============== ========== ===========

GBP'000

Segmental operating result 3,832

Brand amortisation (134)

IAS 19 pension scheme administration

costs (200)

Total operating profit from continuing

operations 3,498

===========

Inter-segment Revenue Segmental

Total Operating

External Result

Full Year to 30 June 2014 (Restated)

Solar Shading & Screening 16,339 - 16,339 507

Roofing & Walling 26,927 - 26,927 2,929

-------- -------------- -------- ----------

Energy Management 43,266 - 43,266 3,436

Construction Products 15,534 - 15,534 1,676

Rainwater, Drainage & House Building

Products 21,501 60 21,561 2,865

-------- -------------- -------- ----------

Water Management & Other 37,035 60 37,095 4,541

Building Products 80,301 60 80,361 7,977

-------- -------------- -------- ----------

Dyson Diecasting 8,556 322 8,878 1,120

-------- -------------- -------- ----------

Engineering Products 8,556 322 8,878 1,120

Elimination/Unallocated costs - (382) (382) (1,332)

Total 88,857 - 88,857 7,765

======== ============== ======== ==========

GBP'000

Segmental operating result 7,765

Brand amortisation (268)

IAS 19 pension scheme administration

costs (452)

Total operating profit from continuing

operations 7,045

==========

5. Discontinued operations

a) Results of discontinued operations

Alumasc Pendock Total

Precision Profiles

Components

GBP'000 GBP'000 GBP'000

Half Year to 31 December 2014

Revenue 10,269 785 11,054

------------ ---------- -------

Operating (loss)/profit (1,117) 55 (1,062)

Income tax 246 (12) 234

Gain on disposal of discontinued operation - 770 770

(871) 813 (58)

============ ========== =======

Alumasc Pendock Total

Precision Profiles

Components

GBP'000 GBP'000 GBP'000

Half Year to 31 December 2013

Revenue 10,359 1,688 12,047

------------ ---------- -------

Operating (loss)/profit (737) 218 (519)

Income tax 179 (53) 126

(558) 165 (393)

============ ========== =======

Alumasc Pendock Total

Precision Profiles

Components

GBP'000 GBP'000 GBP'000

Full Year to 30 June 2014

Revenue 21,420 3,125 24,545

------------ ---------- -------

Operating (loss)/profit (1,318) 331 (987)

Income tax 319 (80) 239

(999) 251 (748)

============ ========== =======

b) Effect of disposal on the financial position of the group

Half year

to

31 December

2014

GBP'000

Net consideration received, satisfied

in cash 1,408

Net assets and liabilities sold (638)

Gain on disposal of discontinued

operation 770

============

c) Underlying to statutory profit reconciliation

Continuing Discontinued Total

Operations Operations

GBP'000 GBP'000 GBP'000

Half Year to 31 December 2014

Underlying profit before tax 4,047 - 4,047

IAS19 pension costs (670) - (670)

Brand amortisation (134) - (134)

Alumasc Precision Components - (1,117) (1,117)

Pendock Profiles - 55 55

Pendock Profiles gain on disposal of

discontinued operation - 770 770

Statutory profit/(loss) before tax 3,243 (292) 2,951

Taxation (818) 234 (584)

Statutory profit/(loss) after tax 2,425 (58) 2,367

============ ============= =======

Continuing Discontinued Total

Operations Operations

GBP'000 GBP'000 GBP'000

Half Year to 31 December 2013

Underlying profit before tax 3,558 - 3,558

IAS19 pension costs (520) - (520)

Brand amortisation (134) - (134)

Alumasc Precision Components - (737) (737)

Pendock Profiles - 218 218

Statutory profit/(loss) before tax 2,904 (519) 2,385

Taxation (647) 126 (521)

Statutory profit/(loss) after tax 2,257 (393) 1,864

============ ============= =======

6. Net finance costs

Half year Half year

to to Year to

31 December 31 December 30 June

2014 2013 2014

GBP'000 GBP'000 GBP'000

Finance income - Bank interest (2) (5) (10)

------------ -------------- --------

Finance costs - Bank loans and overdrafts 24 35 68

- Revolving credit facility 240 244 463

264 279 531

- IAS19 net pension scheme finance

costs 400 320 448

664 599 979

------------ -------------- --------

7. Tax expense

Half year Half year

to to Year to

31 December 31 December 30 June

2014 2013 2014

GBP'000 GBP'000 GBP'000

Current tax:

UK corporation tax - continuing

operations 657 602 1,210

- discontinued operations (208) (104) (197)

Overseas tax 2 4 30

Amounts over provided in previous years - - (26)

------------ ------------ ----------

Total current tax 451 502 1,017

Deferred tax:

Origination and reversal of temporary

differences:

* continuing operations 159 120 249

* discontinued operations (26) (22) (42)

Rate change adjustment - (79) (176)

------------ ------------ ----------

Total deferred tax 133 19 31

Total tax expense 584 521 1,048

------------ ------------ ----------

Tax charge on continuing operations 818 647 1,287

Tax credit on discontinued operations (234) (126) (239)

------------ ------------ ----------

Total tax expense 584 521 1,048

------------ ------------ ----------

Tax recognised in other comprehensive

income

Deferred tax:

Actuarial losses on pension schemes (815) (1,042) (1,618)

Cash flow hedges 5 (19) (20)

------------ ------------ ----------

Tax credited to other comprehensive

income (810) (1,061) (1,638)

Total tax credit in the statement of

comprehensive income (226) (540) (590)

------------ ------------ ----------

8. Dividends

The directors have approved an interim dividend per share of

2.5p (2013: 2.2p) which will be paid on 7 April 2015 to

shareholders on the register at the close of business on 6 March

2015. The cash cost of the dividend is expected to be GBP0.9

million. In accordance with IFRS accounting requirements, as the

dividend was approved after the balance sheet date, it has not been

accrued in the interim consolidated financial statements. A final

dividend per share of 2.8p in respect of the 2013/14 financial year

was paid at a cash cost of GBP1.0 million during the six months to

31 December 2014.

9. Share Based Payments

During the period, the group awarded no options (2013: 170,000)

under the Executive Share Option Scheme ("ESOS"). 164,000 (2013:

136,000) existing ESOS options lapsed during the period.

No awards were granted under the group's Long Term Incentive

Plans ("LTIP") during the period (2013: 289,882). LTIP awards have

no exercise price but are dependent on certain vesting criteria

being met. During the period 259,328 (2013: 290,217) existing LTIP

awards lapsed.

10. Earnings per share

Basic earnings per share is calculated by dividing the net

profit for the period attributable to ordinary equity shareholders

of the parent by the weighted average number of ordinary shares in

issue during the period.

Diluted earnings per share is calculated by dividing the net

profit attributable to ordinary equity shareholders of the parent

by the weighted average number of ordinary shares in issue during

the period, after allowing for the exercise of outstanding share

options. The following sets out the income and share data used in

the basic and diluted earnings per share calculations:

Half year Half year Year to

to 31 December to 31 December 30 June

2014 2013 2014

GBP'000 GBP'000 GBP'000

Profit attributable to equity holders

of the parent - continuing 2,425 2,257 4,789

Loss attributable to equity holders

of the parent - discontinued (58) (393) (748)

Net profit attributable to equity

holders of the parent 2,367 1,864 4,041

---------------- ---------------- -------------

Half year Half year Year to

to 31 December to 31 December 30 June

2014 2013 2014

000s 000s 000s

Basic weighted average number of

shares 35,648 35,648 35,648

Dilutive potential ordinary shares

- employee share options 546 - 447

Diluted weighted average number of

shares 36,194 35,648 36,095

---------------- ---------------- -------------

Calculation of underlying earnings per share:

Half year Half year Year to

to 31 December to 31 December 30 June

2014 2013 2014

GBP'000 GBP'000 GBP'000

Reported profit before taxation from

continuing operations 3,243 2,904 6,076

Add: brand amortisation 134 134 268

Add: IAS19 pension scheme administration

costs 270 200 452

Add: IAS19 net pension scheme finance

costs 400 320 448

Underlying profit before taxation 4,047 3,558 7,244

Tax at underlying group rate of 22.0%

(2013: 24.2%; 2013/14: 24.2%) (890) (861) (1,753)

---------------- ---------------- -------------

Underlying earnings 3,157 2,697 5,491

---------------- ---------------- -------------

Underlying earnings per share 8.9p 7.6p 15.4p

---------------- ---------------- -------------

11. Related party disclosure

The group has a related party relationship with its directors

and with its UK pension schemes. There has been no material change

in the nature of the related party transactions described in the

Report and Accounts 2014. Related party information is disclosed in

note 30 of that document.

Responsibility Statement

The Directors confirm that, to the best of their knowledge:

a) the condensed consolidated interim financial statements have

been prepared in accordance with IAS34 "Interim Financial

Reporting" as adopted by the EU; and

b) the interim management report includes a fair review of the

information required by:

-- DTR 4.2.7R of the Disclosure and Transparency Rules, being an

indication of important events that have occurred during the first

six months of the financial year and their impact on the condensed

set of financial statements; and a description of the principal

risks and uncertainties for the remaining six months of the year;

and

-- DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the group during

that period; and any changes in the related party transactions

described in the last annual report that could do so.

On behalf of the Board

G P Hooper A Magson

Chief Executive Group Finance Director

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR QLLFBELFLBBB

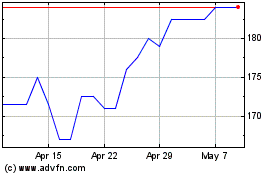

Alumasc (LSE:ALU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alumasc (LSE:ALU)

Historical Stock Chart

From Apr 2023 to Apr 2024