Altria Group, Inc. (Altria) (NYSE:MO) is hosting an investor day

conference in New York City today. Marty Barrington, Altria’s

Chairman, Chief Executive Officer and President, and other members

of Altria’s senior management team will highlight Altria’s unique

capabilities, its companies’ strong brands and strategies to create

long-term value for shareholders.

2015 Full-Year Guidance

Altria reaffirms its guidance for 2015 full-year adjusted

diluted earnings per share (EPS), which excludes the special items

discussed in Schedule 1, to be in the range of $2.75 to $2.80,

representing a growth rate of 7% to 9% from an adjusted diluted EPS

base of $2.57 in 2014, as shown in Schedule 1.

The factors described in the Forward-Looking and Cautionary

Statements section of this release represent continuing risks to

Altria’s forecast.

Remarks and Presentation

The presentation is being webcast live at altria.com in a

listen-only mode, beginning at approximately 9:00 a.m. Eastern

Time. A copy of the prepared remarks and business presentation and

a replay of the audio webcast will be available at altria.com and

via the Altria Investor app.

Altria’s Profile

Altria’s wholly-owned subsidiaries include Philip Morris USA

Inc. (PM USA), U.S. Smokeless Tobacco Company LLC (USSTC), John

Middleton Co., Nu Mark LLC, Ste. Michelle Wine Estates Ltd. (Ste.

Michelle) and Philip Morris Capital Corporation. Altria holds a

continuing economic and voting interest in SABMiller plc

(SABMiller).

The brand portfolios of Altria’s tobacco operating companies

include Marlboro®, Black & Mild®,

Copenhagen®, Skoal®, MarkTen® and Green

Smoke®. Ste. Michelle produces and markets premium wines

sold under various labels, including Chateau Ste. Michelle®,

Columbia Crest®, 14 Hands® and Stag’s Leap Wine

Cellars™, and it imports and markets Antinori®,

Champagne Nicolas Feuillatte™, Torres® and Villa

Maria Estate™ products in the United States. Trademarks and

service marks related to Altria referenced in this release are the

property of Altria or its subsidiaries or are used with permission.

More information about Altria is available at altria.com and on the

Altria Investor app.

Forward-Looking and Cautionary

Statements

This press release contains projections of future results and

other forward-looking statements that involve a number of risks and

uncertainties and are made pursuant to the Safe Harbor Provisions

of the Private Securities Litigation Reform Act of 1995.

Important factors that may cause actual results and outcomes to

differ materially from those contained in the projections and

forward-looking statements included in this press release are

described in Altria’s publicly filed reports, including its Annual

Report on Form 10-K for the year ended December 31, 2014 and its

Quarterly Report on Form 10-Q for the period ended March 31,

2015.

These factors include the following: significant competition;

changes in adult consumer preferences and demand for Altria’s

operating companies’ products; fluctuations in raw material

availability, quality and price; reliance on key facilities and

suppliers; reliance on critical information systems, many of which

are managed by third-party service providers; fluctuations in

levels of customer inventories; the effects of global, national and

local economic and market conditions; changes to income tax laws;

federal, state and local legislative activity, including actual and

potential federal and state excise tax increases; increasing

marketing and regulatory restrictions; the effects of price

increases related to excise tax increases and concluded tobacco

litigation settlements on trade inventories, consumption rates and

consumer preferences within price segments; health concerns

relating to the use of tobacco products and exposure to

environmental tobacco smoke; privately imposed smoking

restrictions; and, from time to time, governmental

investigations.

Furthermore, the results of Altria’s tobacco businesses are

dependent upon their continued ability to promote brand equity

successfully; to anticipate and respond to evolving adult consumer

preferences; to develop, manufacture, market and distribute

products that appeal to adult tobacco consumers (including, where

appropriate, through arrangements with, and investments in, third

parties); to improve productivity; and to protect or enhance

margins through cost savings and price increases.

Altria and its tobacco businesses are also subject to federal,

state and local government regulation, including broad-based

regulation of PM USA and USSTC by the U.S. Food and Drug

Administration. Altria and its subsidiaries continue to be subject

to litigation, including risks associated with adverse jury and

judicial determinations, courts reaching conclusions at variance

with the companies’ understanding of applicable law, bonding

requirements in the limited number of jurisdictions that do not

limit the dollar amount of appeal bonds and certain challenges to

bond cap statutes.

Altria cautions that the foregoing list of important factors is

not complete and does not undertake to update any forward-looking

statements that it may make except as required by applicable law.

All subsequent written and oral forward-looking statements

attributable to Altria or any person acting on its behalf are

expressly qualified in their entirety by the cautionary statements

referenced above.

Schedule 1

ALTRIA GROUP, INC. and Subsidiaries

First Quarter 2015 Special Items and

Reconciliation of 2014 Adjusted Results

Altria’s First Quarter 2015 Special Items

Tobacco and health litigation items $ 0.01 SABMiller special

items 0.03 Loss on early extinguishment of debt 0.07

$

0.11

Reconciliation of Altria’s 2014 Adjusted Results

Full Year 2014 Reported diluted EPS

$ 2.56 NPM Adjustment Items (0.03 ) Asset impairment,

exit, integration and acquisition-related costs 0.01 Tobacco and

health litigation items 0.01 SABMiller special items 0.01 Loss on

early extinguishment of debt 0.02 Tax items (0.01 )

Adjusted

diluted EPS $ 2.57

Altria reports its financial results in accordance with U.S.

generally accepted accounting principles (GAAP). Altria’s

management reviews certain financial results, including diluted

EPS, on an adjusted basis, which exclude certain income and expense

items that management believes are not part of underlying

operations. These items may include, for example, loss on early

extinguishment of debt, restructuring charges, SABMiller special

items, certain tax items, charges associated with tobacco and

health litigation items, and settlements of, and determinations

made in connection with, certain non-participating manufacturer

(NPM) adjustment disputes (such settlements and determinations are

referred to collectively as NPM Adjustment Items). Altria’s

management does not view any of these special items to be part of

Altria’s sustainable results as they may be highly variable, are

difficult to predict and can distort underlying business trends and

results. Altria’s management believes that adjusted financial

measures provide useful insight into underlying business trends and

results and provide a more meaningful comparison of year-over-year

results. Altria’s management uses adjusted financial measures for

planning, forecasting and evaluating business and financial

performance, including allocating resources and evaluating results

relative to employee compensation targets. These adjusted financial

measures are not consistent with GAAP, and should thus be

considered as supplemental in nature and not considered in

isolation or as a substitute for the related financial information

prepared in accordance with GAAP.

Altria’s full-year adjusted diluted EPS guidance excludes the

impact of certain income and expense items, including those items

noted in the preceding paragraph. Altria’s management cannot

estimate on a forward-looking basis the impact of these items on

its reported diluted EPS because these items, which could be

significant, are difficult to predict and may be highly variable.

As a result, Altria does not provide a corresponding GAAP financial

measure for, or reconciliation to, its adjusted diluted EPS

guidance.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150623005794/en/

Altria Client ServicesInvestor Relations, 804-484-8222orMedia

Relations, 804-484-8897

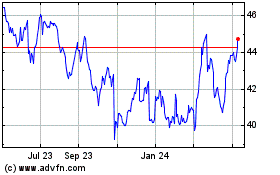

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

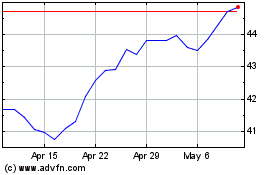

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024