Altria Gets 2 Seats on AB InBev Board After Deal Closes -- Update

October 11 2016 - 4:30PM

Dow Jones News

By Tripp Mickle

Altria Group Inc. will receive a smaller share of the newly

enlarged Anheuser-Busch InBev NV than it had expected following the

Belgian brewer's just-completed $100 billion-plus takeover of rival

SABMiller PLC.

The U.S. tobacco company received a $5.3 billion in cash and a

9.6% share of the enlarged AB InBev in exchange for its 27% stake

in SABMiller. That was almost 1% less than the 10.5% stake it has

expected to receive. That is because more SAB Miller shareholders

than expected opted for a cash and share option as opposed to an

all cash offer.

Though its stake in the newly merged company is less than

expected, Altria said it would have two seats on AB InBev's board

of directors. That will allow it to continue using equity

accounting practices to report its share of the brewer's profits as

earnings.

Being able to count the beer business toward earnings helps

Altria diversify its balance sheet at a time when cigarette volumes

have been declining. The SABMiller business contributed at least a

third of Altria's goal of 7%-to-9% annual earnings growth since

2008, and the stake in AB InBev ensures the beer business will

continue to be a meaningful contributor to Altria's results, said

Nik Modi, an analyst with RBC Capital Markets.

Altria's announcement came on the same day AB InBev began

trading as a postmerger company. It is now the world's largest beer

company with an estimated 46% share of global beer profits and 27%

share of global beer volumes.

AB InBev said Tuesday that it completed its planned divestitures

of SABMiller's interest in several businesses, including

MillerCoors to Molson Coors Brewing Co., Peroni and Grolsch to

Asahi Group Holdings Ltd. and the joint venture known as CR Snow to

China Resources Beer Holdings.

The Belgian brewer's deal for SABMiller took roughly a year to

complete and required regulatory approval in the U.S., Europe,

China and South Africa. The deal had to be renegotiated in July

after the value of the British pound sank following the U.K.'s exit

from the European Union.

The fall deflated the value of AB InBev's cash offer for

SABMiller, intended for most shareholders, compared with the

separate cash-and-share offer designed for Altria and the Santo

Domingo family, which owned a combined 41% stake in the British

brewer.

The partial-share option rose in value because AB InBev shares

are priced in euros. The week before the deal closed, the partial

share alternative was worth about 18% more than the cash offer,

according to a financial adviser on the transaction.

As a result, more SABMiller shareholders opted for the

partial-share plan than expected, reducing Altria's and the Santo

Domingo family's expected interest in the postmerger AB InBev.

Although Altria wound up with about 1% less interest in the

Belgian brewer than the 10.5% it expected, the change isn't

significant enough to undermine its goal of 7%-to-9% annual

earnings growth, Mr. Modi said.

Altria said Chief Executive Marty Barrington and Chief Financial

Officer Billy Gifford would represent it on the AB InBev board.

Because of timing differences between Anheuser-Busch's and

Altria's financial reporting quarters, Altria will now record

Anheuser-Busch results on a one-quarter lag. Altria updated its

financial projections accordingly, and expects earnings per share

to be between $2.98 and $3.04, compared with $3.01 to $3.07

previously.

Altria expects to record a pretax gain in its reported earnings

of about $13.7 billion, or $4.55 per share, related to the

merger.

--Austen Hufford contributed to this article.

Write to Tripp Mickle at Tripp.Mickle@wsj.com

(END) Dow Jones Newswires

October 11, 2016 16:15 ET (20:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

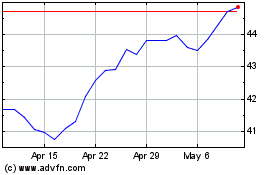

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

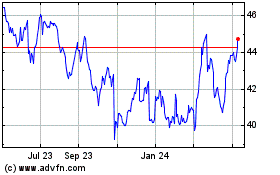

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024