TIDMALT

RNS Number : 7739R

Altitude Group PLC

26 September 2017

Altitude Group plc

("Altitude", "Group" or the "Company")

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2017

Altitude Group plc (AIM: ALT), the operator of a leading

marketplace for personalised products, announces its interim

results for the six month period ended 30 June 2017.

Financial Highlights

-- Increased profitability in core business; encouraging

progress in the development of Channl business

-- Revenues of GBP3.0m (H1 2016: GBP3.0m) including a first time

revenue contribution of GBP0.3m following the acquisition of

AdProducts.comLimited ("ADP") in early June 2017

-- Gross margin maintained (excluding ADP) of 78.8% (H1 2016: 78.9%)

-- GBP0.3m of cost savings in adjusted administrative expenses* to GBP1.4m (H1 2016: GBP1.7m)

-- Adjusted operating profit* GBP0.8m (H1 2016: GBP0.7m) an increase of GBP0.1m or 20.6%

-- Profit before taxation GBP0.5m (H1 2016: GBP0.4m), an

increase of GBP0.1 or 20.5%, including first time contribution from

ADP of GBP47,000

-- GBP2.5m new equity raise (before expenses) to finance and

accelerate future growth of Channl in the US and UK, including the

GBP0.8m acquisition of the trade and certain assets of Ad

Products.com Limited a UK based supplier of promotional

products

-- Group remains free of bank borrowing, with net cash resources

of GBP2.1m (30 June 2016: GBP0.4m; 31 Dec 2016: GBP0.7m)

* before share-based payment charges, amortisation of intangible

assets and exceptional expenses.

Operational Highlights

-- Appointment to the Board of Nichole Stella as President of the US Operations

-- Channl revenue initiated in US and UK. Over 100,000 Channl US

sites and over 250 UK sites now created for distributors and their

end user customers with enhanced user experience

-- Acquisition of the trade and certain assets of Ad

Products.com Limited, a UK based supplier of promotional products,

for GBP0.8m

-- New suppliers to Channl added in both the US and UK -

Primeline (US), The Pen Warehouse and Snap Products (both UK) and

ADP (UK, in-house). Product range to be extended in 2017 to include

print services in partnership with major US tier one provider

-- Terms agreed for enhancing and extending our partnership with

AI Mastermind ("AIM"), the US based promotional products

distributor buying group. Channl will be combined with Altitude's

full cloud based CRM and order management system, providing the

c.1,400 AIM members, with a proven system, through which both

ecommerce and non ecommerce orders can be processed on a Channl

"throughput" pricing model

Webinar

The Company will be holding a webinar at 12.30 p.m. on Wednesday

27 September 2017 which all shareholders are invited to attend. In

order to join the webinar please register at the link below. After

registering you will receive a confirmation email containing

information about joining the webinar.

https://attendee.gotowebinar.com/register/1749159558187366401

Executive Chairman, Peter Hallett, commented:

"We have learned a great deal from the successful launch of

Channl earlier this year in the US and more recently in the UK,

which we believe has reaffirmed its attractiveness to distributors,

as a free, best in class online trading platform, and to end users

as the "easiest way to buy personalised promotional products".

The Board believes that the business is on the correct path in

the US and will deliver significant future revenue as we establish

our own permanent and scalable engagement team in the US under

Nichole's leadership. Channl will be marketed intensely to a

targeted number of distributors and will increase the potential

throughput from the existing $1.2 billion revenue AIM membership by

combining the Channl ecommerce platform with our full order

management and CRM system. In addition we will continue to progress

discussions with other potential enterprise level partners.

We are also encouraged by recent progress made by Channl in the

UK, a market of circa GBP1 billion of revenue, which represents a

major and immediate opportunity. Expanding our Channl product

offering with the addition of new suppliers - namely Primeline in

the US and Ad Products, The Pen Warehouse and Snap Products in the

UK - will increase the attraction of Channl to distributors and

their end user customers.

We are increasingly confident that Channl is a major conduit for

distributors and end users as the market inevitably migrates

transactions online and we look forward to updating shareholders on

future progress."

Enquiries:

Altitude Group plc

Peter Hallett, Executive

Chairman 07887 987469

finnCap 020 7220 0500

Jonny Franklin-Adams (Corporate

Finance)

Scott Mathieson (Corporate

Finance)

Richard Chambers (Corporate

Broking)

Chairman's Statement

I am pleased to present the interim results for the six months

ended 30 June 2017 during which the business has increased adjusted

operating profit* to GBP0.8m (H1 2016: GBP0.7m) and profit before

taxation to GBP0.5m (H1 2016: GBP0.4m). The results include a first

time profit contribution of GBP47,000 from the Ad Products business

("ADP") which we acquired in June 2017.

The business has continued to intensively focus on identifying

the best route to market for the Channl online trading platform, to

release the enormous potential we believe it has to disrupt the

personalised and promotional products, signage and printed

wearables markets in the US and the UK. I am pleased to report that

sales orders are now being transacted through the Channl platform

in both the US and UK, more details of which are outlined below. In

a progressive first six months of the year, the effort expended by

our small management team has been total and I begin my statement

by thanking them for their commitment.

We are delighted that Nichole Stella has joined us as a key

executive board director and President of US Operations. Nichole

will be based permanently in the US and will be singularly focussed

on driving significant revenue through the Channl platform.

I set out below a summary of our progress and improved strategic

direction during the current year. We believe the data is

supportive of the Board's initial optimism for the potential of

Channl, and market expectations for accelerating Channl revenue in

2018. As announced today, our efforts with our US partner AI

Mastermind ("AIM"), the 1,400 member promotional products

distributor buying group accounting for $1.2 billion of end-user

annual revenue, have culminated in an extension and expansion of

our partnership agreement which we believe will yield significant

Channl revenue to the Group in 2018.

During the period the Group successfully completed an equity

fund raise of GBP2.5 million, the proceeds of which are being used

to finance and accelerate the growth of Channl in the US and UK,

including the GBP0.8m acquisition of the trade and certain assets

of Ad Products.com Limited, a small UK based promotional product

supplier. The acquisition of ADP has facilitated the launch of

Channl to distributors in the UK as it has secured the Group's own

UK supply source and provides access to distributors at a trading

level.

* before share-based payments, amortisation of intangible assets and exceptional expenses

Channl US

We have continued to improve the functionality and user

experience of the Channl trading platform, and increase the

products available for personalisation and purchase on it. To this

end, we are delighted to announce that we have agreed a supply

partnership with Prime Resources Corp of Bridgeport, Connecticut,

USA, trading as Primeline, who will complement the current Aprinta

promotional products and print services offer in partnership with a

major US tier one provider.

Shareholders will be aware that at the end of February 2017 we

commenced the process of digital marketing engagement with

distributors for whom we have created free and live Channl web

sites, branded with their personal and unique logos. The process is

aimed at leading the distributor along a pathway to trading online

through the free Channl platform, and also creating individual

Channl web sites for their end user customers, pre-loaded with the

end user customer logos, for direct online ordering. This

ostensibly "push" approach is reliant on the cooperation and

engagement of the distributor.

We continued creating US Channl web sites through to early

summer 2017, and have currently created over 22,000 for

distributors and resellers, and more than 100,000 end user sites on

behalf of distributors. We have been steadily and commensurately

digitally marketing to these businesses, via our supply partner

Aprinta, and through our distributor buying group partner, AI

Mastermind ("AIM"). We are pleased to report that the total number

of visits to Channl websites has grown exponentially since March

2017 and during August increased by approximately 55% with an

average visit duration exceeding 37 minutes which demonstrates the

level of interest the sites are creating. In addition, the

important "bounce" rate (being the percentage of people who visit

the website and immediately leave having not gone beyond the home

page) for the period has been exceptionally low at 22.9% with the

average number of pages viewed per visit exceeding 35 pages.

Strategy development

Our initial marketing of Channl was conducted through a staged

high volume and high frequency acquisition email blast programme.

This strategy was based on tactics used by technology companies

such as Shopify and Uber to acquire merchants and drivers

respectively, where there is evidence of interest. Key performance

indicators highlighted good engagement with the target distributor

and reseller audience. Open rates ("OR") of our unsolicited emails

averaged 31% for AIM distributor members and 9% for Aprinta sourced

distributors. In addition, the click through rates ("CTR"),

calculated as a percentage of OR, were similarly strong at 23% for

AIM distributors and 4.2% for Aprinta distributors. These rates

compare favourably with similar ecommerce digital marketing success

rates and are especially strong in relation to AIM members,which

had the benefit of marketing support from the buying group.

These interactions took the distributor through to the Channl

distributor site engagement stage but did not extend the marketing

to the end user customer. The engagement of the end user customer

is reliant on an introduction of the Channl site to them by the

distributor as the "owner" of the customer relationship.

Our key learning here is that high volume digital marketing to,

and creation of sites for, the distributor alone is not sufficient

to drive the distributor to market the platform to their end user

customers, and could not be relied upon alone to generate

significant end user order volume. We therefore moved to a more

intensive marketing and support trial with a handful of

distributors where we provided:

-- on-site training of the Channl solution to distributor staff

-- on site distributor Q&A during launch

-- technical distributor support provided from the UK

The impact of this intensive marketing and support programme was

immediate and positive:

-- distributors were motivated to send out personalised sites to

end user customers as they became appreciative of the benefits that

Channl offered both them and their cutomers;

-- immediate 23% OR and 13% CTR on personalised end user customer marketing emails;

-- significant increases in page views by end users - over 5,000

page views to a single distributor website in one day; and

-- order intake was immediate and in one instance increased from

zero to an weekly average of 48 sustained over a 4 week period

-- generated an average order value of $300

These early results confirmed that the most effective way for

Channl to achieve end user engagement and transactional revenue is

by engaging more fully with distributors to encourage end user

engagement. The key to this improved distributor engagement is

education and technical support - ensuring the distributor

understands the benefits provided to all parties by Channl and

giving them the confidence and help to make the roll out of Channl

to their customer base as easy as possible.

As a result of these learnings we understand that our approach

in the US must behighly focussed:

-- We have held back on the number of sites being generated, and

are focussed on quality of engagement rather than quantity of sites

created; we have the ability to scale up at will

-- We are in the process of building our own high quality

engagement team, located in the US, which will provide the support

intensity required to engage targeted distributors

-- We have recruited a permanent high calibre US based business

leader, Nichole Stella, to drive the acceleration of engagement.

Nichole brings a huge amount of knowledge and experience of the US

market and will bring sector focus and expertise to our Channl

business

AI Mastermind

Today we have announced that we have agreed terms for an

enhanced and extended partnership agreement with AIM which provides

for the Channl ecommerce platform to be combined with the Group's

comprehensive CRM and sales order management system and in doing so

provide the 1,400 members of AIM with an industry specific and

proven cloud based order management system through which both

ecommerce and non ecommerce orders can be processed on a Channl

"throughput" pricing model. The platform will be provided to AIM

for free with Altitude taking a share of the throughput revenue.

This extended partnership agreement is exactly in line with our new

focussed strategy explained above and has come about as a result of

the intense marketing and support programme that we have undertaken

with AIM in recent months.

We have already created Channl web sites for virtually all the

1,400 AIM distributor members, each of whom are substantial

distributors across the US, with revenue ranging from $0.5 million

to $3million, and in total accounting for end user revenue of

c.$1.2 billion. The benefits provided by engaging with these Channl

websites will be promoted to AIM members by AIM directly through

the member's portal on an exclusive basis with comprehensive

support provided by Altitude.

The enhanced product will be available to members in early

2018.

Other US Channl opportunities

In addition to the above we are making good progress in

discussions with potential large US enterprise customers seeking

partnership deals, which would provide enterprise partners with

access to the Channl trading platform technology under a "White

Label" arrangement on a "share of throughput" pricing model. We are

confident of making progress in this area and are in active

discussions with a number of potential enterprise level

customers.

Finally, we will be actively targeting business start-ups,

taking a lead from the Shopify business model. Channl has huge

potential as an easy, low cost, start-up business for those seeking

a secondary source of income and looking for a home based

solution.

As a result of these positive early data points, the Board is

very confident for the potential of Channl to generate and

accelerate revenue in line with expectations for 2018.

UK Business

The business has a strong market position in the UK promotional

merchandise industry. The market, whilst smaller than the US, is

still estimated to be worth in excess of GBP960 million in 2016,

growing by approximately 6% annually .

It is estimated that the market comprises approximately 1,975

distributors and GBP720 million (74.4%) of the market revenue is

derived from the top 343 (17.4%) distributors.

The company delivers the National Show for the industry annually

in January, which welcomes over 2,000 distributor and reseller

delegates. We also produce the free monthly trade magazine "PPD"

with a circulation of approximately 9,000, and the two leading

trade catalogues each year "Envoy" and "Spectrum". In addition the

company provides its industry specific and unique ERP system

"Promoserve" to over 75 subscribers on a monthly recurring revenue

basis as "software as a service" ("SaaS"), along with other

numerous trade specific applications including web stores, search

engines and logo software.

Therefore the development of a UK Channl trading platform

represents a credible, natural and compelling progression and

business proposition for UK distributors, providing businesses, who

typically could not afford or do not wish to risk the required

investment, the ability for their customers to trade promotional

merchandise online.

We acquired the trade and certain assets of Ad Products.com

Limited ("ADP") in June of this year in order to facilitate the

creation of a UK Channl trading platform. The acquisition enables

us to manage and control the products we choose to curate on

Channl. We have also recently supplemented the Channl product

offerring by signing additional supply partnerships with The Pen

Warehouse, Snap Products and Pinpoint Badges.

Following the acquisition of ADP, we have developed a separate

UK Channl platform and commenced marketing to distributors in the

UK. Over 250 UK Channl sites have been created to date, each one

createdby the relevant distributor.

Average OR from the acquisition email campaign is circa 14.9% of

which the CTR is 4.7%, resulting in 236 distributors now currently

deemed as "acquired" as a Channl distributor. These rates are

commensurate with accepted ecommerce marketing campaign "norms".

However, similarly to the US, basic digital marketing engagement

with distributors alone is not sufficient to generate end user

engagement and revenue throughput. We therefore launched weekly

webinars, which quickly expanded to three times a week due to

demand, which also enable capture of contact details for subsequent

follow up. Supplemented by call centre support, the success of this

more intense approach has been evidenced through a 39% conversion

rate of "acquired" distributors to "marketing to end user" status

by the end of July, which in turn led to orders being generated

commencing in August. We also provide the distributor with weekly

email offers and content for them to access and send to their end

user customers.

It is early days, but we are greatly encouraged by the speed of

response of the end user customers and the generation of

orders.

It should be noted also that Channl can provide incremental

revenue and margin for ADP as a supplier, in addition to Channl

gross transactional revenue ("GTR" or share of throughput).

Results

Revenue was GBP3.0m (H1 2016: GBP3.0m) with a first time revenue

contribution of GBP0.3m from ADP.

Underlying revenue reduced by GBP0.3m in the existing business

due to the elimination of unprofitable activity in the exhibitions

business (GBP0.1m), a decline in advertising revenue in

publications of GBP0.1m, and a reduction of GBP0.1m due to the

rephasing of publication revenue into H2 as a result of migration

to a monthly recurring revenue package offer.

Growth in UK technology revenue was largely offset by erosion in

unsupported legacy US revenue, leaving revenue flat at GBP1.2m (H1

2016: GBP1.2m).

Gross profit of GBP2.2m (H1 2016: GBP2.4m) includes a first time

contribution from ADP of GBP0.1m. As stated above GBP0.1m of the

underlying decrease represents a rephasing into H2, and GBP0.2m

from reduced unprofitable exhibition activity and reduced

advertising revenue. Underlying margin, excluding ADP, was 78.8%

(H1 2016: 78.9%)

However, the reported net reduction in gross profit of GBP0.2m

has been offset by a reduction in administrative expenses (before

share based payment charges, amortisation of intangible assets and

exceptional expenses) of GBP0.3m, or 16.7% to GBP1.4m (H1 2016:

GBP1.7m). The underlying savings rise to GBP0.4m or 22.3% on

exclusion of ADP administrative expenses.

Adjusted operating profit* of GBP0.8m (H1 2016: GBP0.7m)

increased by GBP0.1m or 20.6%. Excluding the first time

contribution of ADP of GBP46,000, the underlying increase in

adjusted operating profit was 13.8%.

Exceptional charges of GBP0.1m relate to the completion of the

reorganisation of the UK business head office (H1 2016: GBP0.1m).

Share based payment charges of GBP27,000 (H1 2016: GBP28,000) and

amortisation charges of GBP161,000 (H1 2016: GBP143,000) were

largely unchanged.

Included within administrative costs are software maintenance

and development costs of GBP0.1m, (H1 2016: GBP0.1m), as the Group

has maintained its support and development of its proprietary

software assets. In addition, the Group capitalised GBP0.2m of

software development costs (H1 2016: GBP0.2m). The current level of

expensed and capitalised development costs is representative of an

adequate maintenance level of expenditure and continuous

improvement of proprietary software assets including Channl.com,

Promoserve and artworktool(tm) .

The resulting operating profit and profit before tax for the

period was GBP0.5m (H1 2016: GBP0.4m), an increase of 20.5%.

Basic earnings per share were 1.05p (H1 2016: 0.96p), an

increase of 9.4% and fully diluted earnings per share were 1.00p

(H1 2016: 0.87p) an increase of 13.8%.

Net cash outflow from operating activities was GBP0.7m (H1 2016:

inflow of GBP0.3m), of which GBP0.3m of outflow was attributable to

the build-up of working capital from trading the ADP assets

acquired. The underlying outflow of GBP0.4m was largely

attributable to a pay down of year end creditors, and deferment of

customer advance deposits taken on the 2018 show. This will be

recovered during H2.

Expenditure on the acquisition of ADP was GBP0.8m and the cash

outflow from investment in intangible assets was lower at GBP0.1m

(H1 2016: GBP0.2m).

Financing activities comprised GBP0.5m from the exercise of

share warrants by Zeus Capital on 30 January 2017 and GBP2.4m from

the share placing and exercise of share options on 17 May (net of

preliminary expenses of GBP0.1m). The share warrants were granted

to Zeus Capital Limited, the Company's Financial and Nominated

Adviser at the time of the Company's admission to trading on AIM in

November 2005. The Company has issued and allotted the requisite

1,500,060 shares at a price of 36p which were admitted to trading

on AIM on 3 February 2017.

The net cash increase in cash and cash equivalents was GBP1.4m

(H1 2016: GBP0.1m).

The Group remains debt free and had cash resources as at 30 June

2017 of GBP2.1m (H1 2016: GBP0.4m).

* before share-based payments, amortisation of intangible assets and exceptional expenses

Board and Senior Management Changes

On 25 January 2017 we announced several board changes. I became

Executive Chairman with immediate effect and the following

appointments effected from 1 February 2017:

-- Martin Varley appointed as President

-- Sanjay Lobo joined us and was subsequently appointed to the

Board as UK based Managing Director on 3 April 2017; and

-- Gellan Watt joined as Independent Non-Executive Director

In addition it was announced that Richard Sowerby would step

down from the Board with effect from 30 April 2017. We thank

Richard for his tremendous contribution to the business.

My appointment to part time Executive Chairman is intended to be

a temporary measure whilst we seek to appoint a full time Chief

Financial Officer.

More recently we announced the appointment of Nichole Stella as

President of USA Operations and as an Executive Director of the

board with effect from 25 September 2017. Nichole brings an

extensive industry network in the US and a vast amount of knowledge

and experience across all aspects of our business.

Throughout her career, Nichole has driven various organisations

to embrace change and implement new scaling strategies through

creative and innovative thinking. Nichole has been known to the

business for over six years and we are delighted that she is

joining the Board to accelerate Channl transactional revenue in the

USA.

Nichole was a leading force with the Promo Marketing Media

Group, a division of Napco Media (North American Publishing

Company), for the last 12 years and served as President and Chief

Revenue Officer of the group since 2013. Promo Marketing Media

Group is a leading source of services and information to the

promotional product and print distributor industries in the USA.

With a combined audience of nearly 40,000 distributors, the group

is the premiere source for industry news and produces two magazines

('Promo Marketing' and 'Print + Promo') as well as events,

newsletters, online search tools, marketing and lead generation

services, custom publishing and video production services.

Following the appointment of Nichole, and as announced on 13

September 2017, Sanjay Lobo has resigned from the business.

In addition to these board changes we were also delighted to

announce the appointment of Henry Joseph-Grant to our senior

management team in July. Henry has significant experience in

technology lead aggregator businesses having been a key member of

the Just Eat team from start-up to its $2.4 billion IPO. Henry will

have responsibility for building a high-performance sales team

focused on growing the number of merchants using Channl.

Outlook

We have learned a great deal from the successful launch of

Channl earlier this year in the US and more recently in the UK,

which we believe has reaffirmed its attractiveness to distributors,

as a free, best in class online trading platform, and to end users

as the "easiest way to buy personalised promotional products".

The Board believes that the business is on the correct path in

the US and will deliver significant future revenue as we establish

our own permanent and scalable engagement team in the US under

Nichole's leadership. Channl will be marketed intensely to a

targeted number of distributors and will increase the potential

throughput from the existing $1.2 billion revenue AIM membership by

combining the Channl ecommerce platform with our full order

management and CRM system. In addition we will continue to progress

discussions with other potential enterprise level partners.

We are also encouraged by recent progress made by Channl in the

UK, a market of circa GBP1 billion of revenue, which represents a

major and immediate opportunity. Expanding our Channl product

offering with the addition of new suppliers - namely Primeline in

the US and Ad Products, The Pen Warehouse and Snap Products in the

UK - will increase the attraction of Channl to distributors and

their end user customers.

We are increasingly confident that Channl is a major conduit for

distributors and end users as the market inevitably migrates

transactions online and we look forward to updating shareholders on

future progress.

Peter J Hallett

Executive Chairman

26 September 2017

Consolidated income statement for the six month period ended 30

June 2017

Unaudited Audited Unaudited

30 June 31 December 30 June

2017 2016 2016

GBP'000 GBP'000 GBP'000

Revenue - Continuing Operations 2,972 4,323 3,015

Cost of sales (739) (823) (636)

-------------------------------------- ---------- ---------------- ---------------------

Gross profit 2,233 3,500 2,379

Administrative expenses before

share based payment charges,

amortisation of intangible

assets and exceptional expenses (1,419) (2,935) (1,704)

-------------------------------------- ---------- ---------------- ---------------------

Operating profit before share

based payment charges, amortisation

of intangible assets and

exceptional expenses 814 565 675

Share based payment charges (27) (25) (28)

Amortisation of intangible

assets (161) (401) (143)

Exceptional expenses (131) (66) (94)

-------------------------------------- ---------- ---------------- ---------------------

Total administrative expenses (1,738) (3,427) (1,969)

-------------------------------------- ---------- ---------------- ---------------------

Operating profit 495 73 410

Finance expenses (1) - -

--------------------------------------

Profit before taxation 494 73 410

Taxation - - -

-------------------------------------- ---------- ---------------- ---------------------

Profit attributable to the

equity shareholders of the

Company 494 73 410

-------------------------------------- ---------- ---------------- ---------------------

Loss earnings per ordinary

share attributable to the

equity shareholders of the

Company :

- Basic (pence) 1.05P 0.17p 0.96p

- Diluted (pence) 1.00p 0.15p 0.87p

-------------------------------------- ---------- ---------------- ---------------------

Consolidated statement of changes in equity for the six month

period ended 30 June 2017

Share Share Retained Total

Capital Premium Earnings

GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2016 172 6,254 (5,433) 993

Profit for the period attributable

to equity shareholders - - 410 410

Foreign exchange differences - - 18 18

Total comprehensive income - - 428 428

Transactions with owners

recorded directly in equity:

Share based payment charges - - 28 28

Total transactions with owners - - 28 28

------------------------------------

At 30 June 2016 172 6,254 (4,977) 1,449

Loss for the period attributable

to equity shareholders - - (337) (337)

Foreign exchange differences - - (34) (34)

Total comprehensive income - - (371) (371)

Transactions with owners

recorded directly in equity:

Shares issued for cash 8 197 - 205

Share based payment charges - - (3) (3)

Total transactions with owners 8 197 (3) 202

------------------------------------

At 31 December 2016 180 6,451 (5,351) 1,280

Profit for the period attributable

to equity shareholders - - 494 494

Foreign exchange differences - - 57 57

Total comprehensive income - - 551 551

Transactions with owners

recorded directly in equity:

Shares issued for cash 23 3,059 - 3,082

Preliminary Expenses - (132) - (132)

Share based payment charges - - 27 27

Total transactions with owners 23 2,927 27 2,977

------------------------------------ --------- --------- ---------- ---------

At 30 June 2017 203 9,378 (4,773) 4,808

------------------------------------ --------- --------- ---------- ---------

Consolidated balance sheet as at 30 June 2017

Unaudited Audited Unaudited

30 June 31 December 30 June

2017 2016 2016

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant & equipment 81 22 32

Intangibles 803 818 990

Goodwill 564 564 564

Deferred tax 426 426 426

------------------------------ ---------- ------------- ----------

1,874 1,830 2,012

Current assets

Inventory 976 - -

Trade and other receivables 847 407 503

Cash and cash equivalents 2,093 741 415

------------------------------ ---------- ------------- ----------

Total current assets 3,916 1,148 918

------------------------------ ---------- ------------- ----------

Total assets 5,790 2,978 2,930

------------------------------ ---------- ------------- ----------

Current liabilities

Trade and other payables (982) (1,698) (1,481)

Total liabilities (982) (1,698) (1,481)

------------------------------ ---------- ------------- ----------

Net assets 4,808 1,280 1,449

------------------------------ ---------- ------------- ----------

Called up share capital 203 180 172

Share premium 9,378 6,451 6,254

Retained earnings (4,773) (5,351) (4,977)

------------------------------ ---------- ------------- ----------

Total equity 4,808 1,280 1,449

------------------------------ ---------- ------------- ----------

Consolidated cash flow statement for the six month period ended

30 June 2017

Unaudited Audited Unaudited

30 June 31 December 30 June

2017 2016 2016

GBP'000 GBP'000 GBP'000

Operating activities

Profit/(loss) for the period 495 73 410

Amortisation of intangible assets 161 401 143

Depreciation 7 26 20

Share based payment charges 27 25 28

------------------------------------------ ---------- ------------- --------------------

Operating cash flow before changes

in working capital 690 525 601

Movement in Inventory (248) - -

Movement in trade and other

receivables (386) 289 193

Movement in trade and other

payables (742) (355) (539)

------------------------------------------ ---------- ------------- --------------------

Operating cash flow from operations (686) 459 255

Interest expenses (1) - -

------------------------------------------ ---------- ------------- --------------------

Net cash flow from operating

activities (687) 459 255

Cash flows from investing activities

Purchase of certain assets and

business undertaking of Ad Products.Com

Limited (761) - -

Purchase of plant and equipment (7) (7) (6)

Purchase of intangible assets (144) (282) (200)

------------------------------------------ ---------- ------------- --------------------

Net cash flow from investing

activities (912) (289) (206)

Financing activities

Shares issued for cash (net

of preliminary expenses) 2,951 205 -

------------------------------------------ ---------- ------------- --------------------

Net cash flow from financing

activities 2,951 205

Net increase/(decrease) in cash

and cash equivalents 1,352 375 49

Cash and cash equivalents at

the beginning of the period 741 366 366

------------------------------------------ ---------- ------------- --------------------

Cash and cash equivalents at

the end of the period 2,093 741 415

------------------------------------------ ---------- ------------- --------------------

Notes to the half yearly financial information

1. Basis of preparation

This consolidated half yearly financial information for the half

year ended 30 June 2017 has been prepared applying the accounting

policies and presentation that were applied in the preparation of

the Group's published consolidated financial statements for the

year ended 31 December 2016. The Group's accounting policies are

based on the recognition and measurement principles of

International Financial Reporting Standards as adopted by the

EU.

The consolidated half yearly report was approved by the Board of

directors on 26 September 2017.

The consolidated financial information contained in the interim

report has not been reviewed or audited and does not constitute

statutory accounts within the meaning of section 434 of the

Companies Act 2006 and does not include all of the information and

disclosures required for complete financial statements.

The financial information relating to the year ended 31 December

2016 is an extract from the latest published financial statements

on which the auditor gave an unmodified report that did not contain

statements under Section 498 (2) or (3) of the Companies Act 2006

and which have been filed with the Registrar of Companies.

2. Accounting policies

The consolidated financial statements in this half-yearly

financial report for the six months ended 30 June 2017 have been

prepared in accordance with the AIM Rules for Companies and on a

basis consistent with the accounting policies and methods of

computation consistent with those set out in the Annual Report and

financial statements for the year ended 31 December 2016, except as

described below. The Group has chosen not to adopt IAS 34 'Interim

Financial Statements' in preparing these interim financial

statements and therefore the Interim financial information is not

in full compliance with International Financial Reporting

Standards.

In preparing the condensed, consolidated financial statements,

management are required to make accounting assumptions and

estimates. The assumptions and estimation methods are consistent

with those applied to the Annual Report and financial statements

for the year ended 31 December 2016. Additionally the principal

risks and uncertainties that may have a material impact on

activities and results of the Group remain materially unchanged

from those described in that Annual Report.

3. Operating Segments

Under IFRS 8 "Operating Segments" the Group has determined that

it has one reportable segment, Technology & Information.

IFRS 8 has been applied to aggregate operating segments on the

grounds of similar economic characteristics. This position will be

monitored as the Group develops.

4. Acquisition of certain assets and business undertaking of Ad Products.com Limited

On 2 June 2017 the Group completed the acquisition of the trade

and certain assets of Adproducts.com Limited, a small UK based

trade supplier of promotional products ("the Acquisition"). Richard

Sowerby, a director of the Group until 30 April 2017 , is a

director of Adproducts.com Limited. These assets were acquired to

help facilitate the launch of Channl to distributors in the UK by

supplementing our UK supply base. The impact of the Acquisition on

the results for the six months ended 30 June 2017 is summarised

below:

Unaudited

30 June

2017

GBP'000

Revenue 319

Cost of sales 176

------------------------- ----------

Gross profit 143

Administrative expenses (96)

------------------------- ----------

Operating profit 47

------------------------- ----------

Book Fair Value Unaudited

Value Adjustments Fair

Of Acquired Value

Assets of Acquired

GBP000 GBP000s Assets

GBP000

Plant & Machinery 31 29 60

Inventory 728 - 728

Accruals - (27) (27)

------------------------------- ------------- ------------- -------------

Total Assets acquired at fair

value 759 2 761

Cash Consideration (761)

------------------------------- ------------- ------------- -------------

5. Basic and diluted earnings per ordinary share

The calculation of earnings per ordinary share is based on the

profit or loss for the period divided by the weighted average

number of equity voting shares in issue.

Unaudited Audited Unaudited

30 June 31 December 30 June

2017 2016 2016

Earnings (GBP'000) 494 73 410

---------- ------------- ----------

Weighted average number of shares

(number '000) 47,216 43,252 42,908

---------- ------------- ----------

Fully diluted weighted average

number of shares (number '000) 49,269 47,252 47,378

---------- ------------- ----------

Basic earnings per ordinary share

(pence) 1.05P 0.17p 0.96p

Diluted earnings per ordinary

share (pence) 1.00P 0.15p 0.87p

---------- ------------- ----------

6. Interim Report

The Interim Report is available to download from the Company's

website at www.altitudeplc.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LFFVVASIEFID

(END) Dow Jones Newswires

September 26, 2017 02:01 ET (06:01 GMT)

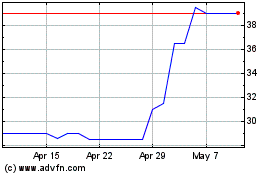

Altitude (LSE:ALT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Altitude (LSE:ALT)

Historical Stock Chart

From Apr 2023 to Apr 2024