Alphatec Holdings, Inc. (Nasdaq:ATEC), the parent company of

Alphatec Spine, Inc., a provider of spinal fusion technologies,

announced today financial results for the third quarter ended

September 30, 2016. Today the Company also announced that Donald

Williams, the Chairman of the Company’s Audit Committee, has been

named Lead Independent Director, effective immediately.

- Third quarter total net revenues of $26.7 million; revenue from

the Company’s U.S. commercial business of $25.2 million.

- Cash totaled $25.6 million at the end of the third

quarter.

Highlights of the Third quarter 2016 and

Recent Activities

Operational Activities

- Closed sale of international business to Globus Medical on

September 1, 2016 for $80 million in cash and $30 million, 5-year

term loan.

- New capital structure established – reduced overall Company

debt to $40.9 million at September 30, 2016.

- CEO search actively underway with a nationally recognized

executive search firm.

Products and Portfolio

- Actively developing and commercializing products in the

minimally invasive (MIS) and complex spine markets – two of the

fastest growth segments for spine.

- Arsenal™ Deformity – limited launch underway, including

the addition of the Adolescent Idiopathic Scoliosis (AIS) module in

Q4 2016.

- Battalion™ Lateral Spacer System and Squadron™ Lateral

Retractor – received FDA 510(k) market clearance; preparing for

limited market release in Q1 2017.

- XYcor® Expandable Spinal Spacer System – received FDA 510(k)

market clearance; introduced to surgeons at NASS; limited market

release anticipated in Q4 2016.

Supply Chain Operations

- Completed transition of international business to Globus

Medical; successfully operating supply chain model to support

ongoing supply agreement for international products.

- Completed corporate restructuring to align with the Company’s

targeted focus on the U.S. markets and reduced workforce by

20%.

- Suppliers are engaged and actively collaborating with the

Company to ensure the continuous flow of new and existing products

through the supply chain.

“We are in the process of building an exciting

new company, a new Alphatec, with a simplified operating model, new

senior leadership and a positive new culture for our employees and

our customers – all of which are supported by a broad portfolio of

innovative products,” said Leslie Cross, Chairman and Chief

Executive Officer of Alphatec Spine. “Strategically, our

focus for the new Alphatec is simple. We must excel at

managing our supply chain and we need to reinvigorate our sales

performance and grow our U.S. business. Today, we are

actively working on both initiatives with a collective passion and

sense of urgency. This journey will take time and we

anticipate both challenges and opportunities along the way. I

am confident that the leadership team has the skills and experience

to drive the change needed to improve our performance and deliver

enduring, profitable growth. We look forward to sharing

more details about our plans early in the new year.”

Mr. Cross added, “In addition, I am pleased to

announce that Don Williams has accepted to serve as the Company’s

Lead Independent Director. Don has been an Alphatec board

member since May 2015 and the Chairman of the Audit Committee since

October 2015. His experience in the public accounting

industry and his contributions as a director on our board have been

invaluable and we appreciate his continuing commitment to

Alphatec.”

Discontinued and Continuing

OperationsOn September 1, 2016, the Company completed the

sale of the Company’s international operations and distribution

channel to Globus Medical. Consequently, the Company’s

financial results from the international business, excluding

revenue and cost of sales with wholly owned subsidiaries, are

reflected within discontinued operations for all periods presented.

Going forward, the financial results from continuing operations

will consist of net product revenue for the U.S. commercial

business and the revenue associated with the supply agreement with

Globus Medical. For more information on the details related to

discontinued operations, please see the Company’s Form 10-Q filed

with the Securities and Exchange Commission on November 9,

2016.

Quarter Ended September 30,

2016

U.S. commercial revenues for the third quarter

of 2016 were $25.2 million, down 8%, compared to $27.4 million

reported for the third quarter of 2015. Within the

Company’s direct hospital business, implant unit volume has

increased over the prior year, however, this growth has been offset

by mid-single digit price decline consistent with the pricing

trends the Company has experienced for the past several

years. Revenue from the Company’s stocking business is down

approximately 50% from the prior year. The third quarter of

2016 was a difficult quarter for the Company given the distraction

related to the sale of the international business, which

contributed to a sequential decline in hospital implant unit

volumes from the second quarter of 2016. Today, with the

successful sale and transition of the international business

complete and an improved balance sheet, the Company is actively

engaging with surgeon and distributor customers and building a plan

to regain sales momentum and improve U.S. sales.

U.S. gross profit and gross margin for the third

quarter of 2016 were $15.2 million and 60.4%, respectively,

compared to $19.5 million and 71.3%, respectively, for the third

quarter of 2015.

Gross margin declined 10.9 percentage points

from the third quarter of 2016 primarily as a result of increased

inventory costs due to lower than anticipated purchase volume and

obsolete inventory reserve adjustments related to optimizing the

Company’s product portfolio through active product lifecycle

management.

Total operating expenses for the third quarter

of 2016, excluding charges for restructuring and intangible asset

impairment, were $17.1 million, reflecting a decrease of $4.6

million compared to the third quarter of 2015. The Company

has been actively monitoring its expenses and reducing costs across

the general and administrative (G&A), research and development

(R&D) and marketing and selling areas of the business, which

contributed to this 21% overall reduction in total operating

expenses. The Company is making steady progress on its goal

of reducing its operating expenses by $20 million and continues to

look for additional opportunities to improve its cost structure to

better align with its focus on the U.S. market going forward.

GAAP net loss for the third quarter of 2016 was

$13.7 million or ($1.18) per share (basic and diluted), compared to

a net loss of $160.3 million, or ($18.96) per share basic and

diluted for the third quarter of 2015. GAAP net loss for the

third quarter of 2015 was unfavorably impacted by $164.3 million of

non-cash impairment charges, as well as favorable $6.3 million of

warrant fair-value adjustments attributable to the Company’s

underlying stock price.

Adjusted EBITDA in the third quarter of 2016 was $709 thousand,

or 2.7% of revenues, compared to $3.5 million, or 11.0% of revenues

reported in the third quarter of 2015. Third quarter 2016

adjusted EBITDA represents net income excluding effects of

interest, taxes, depreciation, amortization, stock-based

compensation and restructuring expenses.

Cash and cash equivalents were $25.6 million at

September 30, 2016, compared to $9.5 million reported at June 30,

2016. The increase is primarily the result of the proceeds

from the sale of the international business and the associated

borrowing under the debt facility with Globus Medical.

Total Current and Long-term Debt, which includes

both MidCap Financial and Globus Medical, was $40.9 million at

September 30, 2016. This represents a decrease of $34.7

million from June 30, 2016 as a result of the Company applying a

significant portion of the net proceeds from the sale of the

international business to reduce the Company’s total debt and the

addition of the $25 million initial draw down from the credit

facility with Globus that occurred upon closing of the Globus

transaction.

Nine Months Ended September 30,

2016

U.S. net revenues for the nine months ended

September 30, 2016 were $82.4 million, down 3.1%, compared to $85.1

million reported for the nine months ended September 30,

2015. Sales in the Company’s direct hospital business

increased over the same period in the prior year, however, this

growth was partially offset by mid-single digit price declines

consistent with pricing trends the Company has experienced for the

past several years. Revenue from the Company’s stocking

business is down approximately 50% from the same period in the

prior year.

U.S. gross profit and gross margin for the nine

months ended September 30, 2016 were $56.4 million and 68.4%,

respectively, compared to $58.1 million and 68.3%, respectively,

for the nine months ended September 30, 2015.

Gross margin increased slightly from the prior

period primarily as a result of the absence of one-time charges

that were present during the nine months in 2015 that are not

present over the same period in 2016.

Total operating expenses for the nine months

ended September 30, 2016, excluding charges for restructuring and

intangible asset impairment, were $66.3 million, reflecting a

decrease of $3.8 million compared to the nine months ended

September 30, 2015. The 5.5% improvement from prior period is

primarily driven by expense reductions across R&D, marketing

and G&A.

GAAP net loss for the nine months ended

September 30, 2016 was $25.6 million or ($1.91) per share (basic

and diluted), compared to a net loss of $168.8 million, or ($19.92)

per share basic and diluted for the nine months ended September 30,

2015. GAAP net loss for the nine months ended September 30,

2015 was unfavorably impacted by $164.3 million of non-cash

impairment charges, as well as favorable $6.3 million of warrant

fair-value adjustments attributable to the Company’s underlying

stock price.

Adjusted EBITDA in the nine months ended September 30, 2016 was

$3.3 million, or 3.5% of revenues, compared to $7.1 million, or

7.1% of revenues reported in the nine months ended September 30,

2015. Nine months ended September 30, 2016 adjusted EBITDA

represents net income excluding effects of interest, taxes,

depreciation, amortization, stock-based compensation and

restructuring expenses.

Non-GAAP Information

Alphatec Spine reports certain non-GAAP

financial measures such as non-GAAP earnings and earnings per

share, adjusted for effects of amortization and other non-recurring

or expense items, such as impairments, loss on extinguishment of

debt, and restructuring expenses. Adjusted EBITDA included in

this press release is a non-GAAP financial measure that represents

net income (loss) excluding the effects of interest, taxes,

depreciation, amortization, stock-based compensation expenses, in

process research and development (IPR&D) expenses and other

non-recurring income or expense items, such as impairments,

restructuring expenses, severance expenses, litigation expenses,

damages associated with ongoing litigation and transaction-related

expenses. The Company believes that non-GAAP adjusted EBITDA

provides investors with an additional tool for evaluating the

Company's core performance, which management uses in its own

evaluation of continuing operating performance, and a base-line for

assessing the future earnings potential of the Company. For

completeness, management uses non-GAAP adjusted EBITDA in

conjunction with GAAP earnings and earnings per common share

measures. These non-GAPP financial measures should be

considered in addition to, and not as a substitute for, or superior

to, financial measures calculated in accordance with GAAP.

Included below are reconciliations of the non-GAAP

financial measures to the comparable GAAP financial measure.

About Alphatec Spine

Alphatec Spine, Inc., a wholly owned subsidiary

of Alphatec Holdings, Inc., is a medical device company that

designs, develops and markets spinal fusion technology products and

solutions for the treatment of spinal disorders associated with

disease and degeneration, congenital deformities and trauma. The

Company's mission is to improve lives by delivering advancements in

spinal fusion technologies. The Company markets products in the

U.S. via a direct sales force and independent distributors.

Additional information can be found at

www.alphatecspine.com.

Forward Looking Statements

This press release may contain "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995 that involve risks and uncertainty. Such

statements are based on management's current expectations and are

subject to a number of risks and uncertainties that could cause

actual results to differ materially from those described in the

forward-looking statements. Alphatec Spine cautions investors that

there can be no assurance that actual results or business

conditions will not differ materially from those projected or

suggested in such forward-looking statements as a result of various

factors. Forward looking statements include the references to the

success of the Company's initiatives to drive sales growth,

increase margins and increase operating efficiencies. The

important factors that could cause actual operating results to

differ significantly from those expressed or implied by such

forward-looking statements include, but are not limited to:

the uncertainty of success in developing new products or

products currently in Alphatec Spine's pipeline, including the

products discussed in this press release; the uncertainties in the

Company’s ability to execute upon its strategic operating plan; the

uncertainties regarding the ability to successfully license or

acquire new products, and the commercial success of such products;

failure to achieve acceptance of Alphatec Spine's products by the

surgeon community, including Battalion, Arsenal Deformity and

XYcor; the Company’s ability to meet the product supply obligations

set forth in the supply agreement with Globus Medical; failure to

obtain FDA clearance or approval or international regulatory

approvals for new products, including the products discussed in

this press release, or unexpected or prolonged delays in the

process; continuation of favorable third party payor reimbursement

for procedures performed using the Company’s products;

unanticipated expenses or liabilities or other adverse events

affecting cash flow or the Company’s ability to successfully

control its costs or achieve profitability; uncertainty of

additional funding; the Company’s ability to compete with other

competing products and with emerging new technologies; product

liability exposure; an unsuccessful outcome in any litigation in

which the Company is a defendant; patent infringement claims;

claims related to the Company’s intellectual property and the

Company’s ability to meet its financial obligations under its

credit agreements and the Orthotec settlement agreement. The words

“believe,” “will,” “should,” “expect,” “intend,” “estimate” and

“anticipate,” variations of such words and similar expressions

identify forward-looking statements, but their absence does not

mean that a statement is not a forward-looking statement.

Please refer to the risks detailed from time to time in Alphatec

Spine's SEC reports, including its Annual Report Form 10-K for the

year ended December 31, 2015, filed on March 15, 2016 with the

Securities and Exchange Commission, and its Amended Annual Report

Form 10-K/A filed on April 29, 2016, as well as other filings on

Form 10-Q and periodic filings on Form 8-K. Alphatec Spine

disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events, or otherwise, unless required by law.

| ALPHATEC HOLDINGS, INC. |

|

| CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

| (in thousands, except

per share amounts - unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended |

|

Nine Months Ended |

|

| |

|

|

September 30, |

|

September 30, |

|

|

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Revenues |

|

$ |

26,711 |

|

|

$ |

31,687 |

|

|

$ |

93,158 |

|

|

$ |

99,597 |

|

|

| |

Cost of revenues |

|

|

10,849 |

|

|

|

10,029 |

|

|

|

31,651 |

|

|

|

35,174 |

|

|

| |

Gross profit |

|

|

15,862 |

|

|

|

21,658 |

|

|

|

61,507 |

|

|

|

64,423 |

|

|

| |

|

|

|

59.4 |

% |

|

|

68.3 |

% |

|

|

66.0 |

% |

|

|

64.7 |

% |

|

| |

Operating

expenses: |

|

|

|

|

|

|

|

|

|

| |

Research and development |

|

|

1,087 |

|

|

|

1,850 |

|

|

|

6,799 |

|

|

|

9,538 |

|

|

| |

In-process research and

development |

|

|

- |

|

|

|

274 |

|

|

|

- |

|

|

|

274 |

|

|

| |

Sales and marketing |

|

|

11,764 |

|

|

|

12,774 |

|

|

|

39,498 |

|

|

|

37,864 |

|

|

| |

General and administrative |

|

|

4,136 |

|

|

|

6,541 |

|

|

|

19,760 |

|

|

|

21,579 |

|

|

| |

Amortization of acquired intangible

assets |

|

|

83 |

|

|

|

280 |

|

|

|

249 |

|

|

|

896 |

|

|

| |

Impairment of goodwill and

intangibles |

|

|

1,736 |

|

|

|

164,263 |

|

|

|

1,736 |

|

|

|

164,263 |

|

|

| |

Restructuring expenses |

|

|

1,605 |

|

|

|

351 |

|

|

|

1,778 |

|

|

|

351 |

|

|

| |

Total operating expenses |

|

|

20,411 |

|

|

|

186,333 |

|

|

|

69,820 |

|

|

|

234,765 |

|

|

| |

Operating income

(loss) |

|

|

(4,549 |

) |

|

|

(164,675 |

) |

|

|

(8,313 |

) |

|

|

(170,342 |

) |

|

| |

Interest and other income

(expense), net |

|

|

(10,511 |

) |

|

|

5,194 |

|

|

|

(12,870 |

) |

|

|

4,224 |

|

|

| |

Pretax net loss |

|

|

(15,060 |

) |

|

|

(159,481 |

) |

|

|

(21,183 |

) |

|

|

(166,118 |

) |

|

| |

Income tax (benefit) provision |

|

|

(4,997 |

) |

|

|

(2,483 |

) |

|

|

(4,962 |

) |

|

|

(1,328 |

) |

|

| |

Loss from continuing

operations |

|

|

(10,063 |

) |

|

|

(156,998 |

) |

|

|

(16,220 |

) |

|

|

(164,790 |

) |

|

| |

Loss from discontinued

operations |

|

|

(3,658 |

) |

|

|

(3,267 |

) |

|

|

(9,351 |

) |

|

|

(3,983 |

) |

|

| |

Net loss |

|

$ |

(13,721 |

) |

|

$ |

(160,265 |

) |

|

$ |

(25,571 |

) |

|

$ |

(168,773 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Net loss per share

continuing operations |

|

$ |

(1.18 |

) |

|

$ |

(18.96 |

) |

|

$ |

(1.91 |

) |

|

$ |

(19.92 |

) |

|

| |

Net loss per share

discontinued operations |

|

|

(0.43 |

) |

|

|

(0.39 |

) |

|

|

(1.10 |

) |

|

|

(0.48 |

) |

|

| |

|

|

$ |

(1.60 |

) |

|

$ |

(19.35 |

) |

|

$ |

(3.01 |

) |

|

$ |

(20.40 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Weighted-average shares

- basic and diluted |

|

|

8,560 |

|

|

|

8,281 |

|

|

|

8,505 |

|

|

|

8,272 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

ALPHATEC HOLDINGS, INC. |

|

| |

CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

| |

(in thousands -

unaudited) |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

|

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

|

ASSETS |

|

|

|

|

| |

Current assets: |

|

|

|

|

| |

Cash and cash equivalents |

$ |

25,598 |

|

|

$ |

6,295 |

|

|

| |

Restricted Cash |

|

- |

|

|

|

2,350 |

|

|

| |

Accounts receivable, net |

|

16,546 |

|

|

|

26,870 |

|

|

| |

Inventories, net |

|

27,661 |

|

|

|

32,424 |

|

|

| |

Prepaid expenses and other current

assets |

|

2,941 |

|

|

|

3,138 |

|

|

| |

Current assets of discontinued

operations |

|

2,828 |

|

|

|

30,418 |

|

|

| |

Total current

assets |

|

75,574 |

|

|

|

101,495 |

|

|

| |

|

|

|

|

|

| |

Property and equipment,

net |

|

13,712 |

|

|

|

16,067 |

|

|

| |

Intangibles, net |

|

6,152 |

|

|

|

8,806 |

|

|

| |

Other assets |

|

516 |

|

|

|

502 |

|

|

| |

Noncurrent assets of

discontinued operations |

|

71 |

|

|

|

19,471 |

|

|

| |

Total assets |

$ |

96,025 |

|

|

$ |

146,341 |

|

|

| |

|

|

|

|

|

| |

LIABILITIES AND STOCKHOLDERS' (DEFICIT)

EQUITY |

|

|

|

|

| |

Current

liabilities: |

|

|

|

|

| |

Accounts payable |

$ |

6,821 |

|

|

$ |

13,542 |

|

|

| |

Accrued expenses |

|

30,705 |

|

|

|

21,175 |

|

|

| |

Common stock warrant

liabilities |

|

- |

|

|

|

687 |

|

|

| |

Current portion of long-term

debt |

|

2,647 |

|

|

|

79,742 |

|

|

| |

Current liabilities of discontinued

operations |

|

2,207 |

|

|

|

9,891 |

|

|

| |

Total current

liabilities |

|

42,380 |

|

|

|

125,037 |

|

|

| |

|

|

|

|

|

| |

Total long term liabilities |

|

68,166 |

|

|

|

32,761 |

|

|

| |

Long term liabilities of

discontinued operations |

|

87 |

|

|

|

1,516 |

|

|

| |

Redeemable preferred stock |

|

23,603 |

|

|

|

23,603 |

|

|

| |

Stockholders' (deficit) equity |

|

(38,211 |

) |

|

|

(36,576 |

) |

|

| |

Total liabilities and

stockholders' (deficit) equity |

$ |

96,025 |

|

|

$ |

146,341 |

|

|

| |

|

|

|

|

|

| ALPHATEC HOLDINGS, INC. |

|

| RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES |

|

| (in thousands, except per share amounts -

unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30, |

|

|

September 30, |

|

| |

|

|

2016 |

|

|

|

2015 |

|

|

|

|

2016 |

|

|

|

2015 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Operating income

(loss), as reported |

$ |

(4,549 |

) |

|

$ |

(164,675 |

) |

|

|

$ |

(8,313 |

) |

|

$ |

(170,342 |

) |

|

| |

Add back: |

|

|

|

|

|

|

|

|

|

| |

Depreciation |

|

1,623 |

|

|

|

2,873 |

|

|

|

|

5,652 |

|

|

|

7,492 |

|

|

| |

Amortization of intangible

assets |

|

223 |

|

|

|

188 |

|

|

|

|

666 |

|

|

|

1,745 |

|

|

| |

Amortization of acquired intangible

assets |

|

83 |

|

|

|

280 |

|

|

|

|

249 |

|

|

|

896 |

|

|

| |

Total EBITDA |

|

(2,620 |

) |

|

|

(161,334 |

) |

|

|

|

(1,746 |

) |

|

|

(160,209 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Add back significant

items: |

|

|

|

|

|

|

|

|

|

| |

Stock-based compensation |

|

(12 |

) |

|

|

(78 |

) |

|

|

|

1,510 |

|

|

|

2,440 |

|

|

| |

In-process research and

development |

|

- |

|

|

|

274 |

|

|

|

|

- |

|

|

|

274 |

|

|

| |

Goodwill and intangible

impairment |

|

1,736 |

|

|

|

164,263 |

|

|

|

|

1,736 |

|

|

|

164,263 |

|

|

| |

Restructuring and other

charges |

|

1,605 |

|

|

|

351 |

|

|

|

|

1,778 |

|

|

|

351 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

EBITDA, as adjusted for

significant items |

$ |

709 |

|

|

$ |

3,476 |

|

|

|

$ |

3,278 |

|

|

$ |

7,119 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| ALPHATEC HOLDINGS, INC. |

|

| RECONCILIATION OF REVENUES AND GROSS

PROFIT |

|

| (in thousands, except percentages -

unaudited) |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Three Months Ended |

|

|

|

|

| |

|

September 30, |

|

|

|

|

| |

|

|

2016 |

|

|

|

2015 |

|

|

% Change |

|

|

| |

|

|

|

|

|

| |

Revenues by source |

|

|

|

|

| |

U.S. commercial

revenue |

$ |

25,189 |

|

|

$ |

27,385 |

|

|

|

-8.0 |

% |

|

|

| |

Other |

|

1,522 |

|

|

|

4,302 |

|

|

|

-64.6 |

% |

|

|

| |

Total revenues |

$ |

26,711 |

|

|

$ |

31,687 |

|

|

|

-15.7 |

% |

|

|

| |

|

|

|

|

|

|

|

| |

Gross profit by

source |

|

|

|

|

| |

U.S. |

$ |

15,206 |

|

|

$ |

19,512 |

|

|

| |

Other |

|

656 |

|

|

|

2,146 |

|

|

| |

Total gross profit |

$ |

15,862 |

|

|

$ |

21,658 |

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Gross profit margin by

source |

|

|

|

|

| |

U.S. |

|

60.4 |

% |

|

|

71.3 |

% |

|

| |

Other |

|

43.1 |

% |

|

|

49.9 |

% |

|

| |

Total gross profit

margin |

|

59.4 |

% |

|

|

68.3 |

% |

|

|

|

|

|

| |

|

Nine Months Ended |

|

|

|

|

| |

|

September 30, |

|

% Change |

|

|

| |

|

|

2016 |

|

|

|

2015 |

|

|

As Reported |

|

|

| |

|

|

|

|

|

| |

Revenues by source |

|

|

|

|

| |

U.S. base business |

$ |

82,445 |

|

|

$ |

85,099 |

|

|

|

-3.1 |

% |

|

|

| |

Other |

|

10,713 |

|

|

|

14,498 |

|

|

|

-26.1 |

% |

|

|

| |

Total revenues |

$ |

93,158 |

|

|

$ |

99,597 |

|

|

|

-6.5 |

% |

|

|

| |

|

|

|

|

|

|

|

| |

Gross profit by

source |

|

|

|

|

| |

U.S. |

$ |

56,430 |

|

|

$ |

58,092 |

|

|

| |

Other |

|

5,077 |

|

|

|

6,331 |

|

|

| |

Total gross profit |

$ |

61,507 |

|

|

$ |

64,423 |

|

|

| |

|

|

|

|

|

| |

Gross profit margin by

source |

|

|

|

|

| |

U.S. |

|

68.4 |

% |

|

|

68.3 |

% |

|

| |

Other |

|

47.4 |

% |

|

|

43.7 |

% |

|

| |

Total gross profit

margin |

|

66.0 |

% |

|

|

64.7 |

% |

|

|

|

CONTACT: Investor/Media Contact:

Christine Zedelmayer

Investor Relations

Alphatec Spine, Inc.

(760) 494-6610

czedelmayer@alphatecspine.com

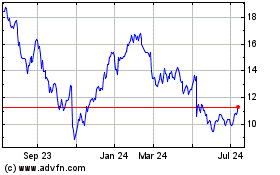

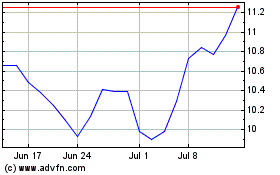

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

From Apr 2023 to Apr 2024