– Launched “Alnylam 2020” Guidance for

Advancement and Commercialization of RNAi Therapeutics –

– Advanced Multiple Clinical Programs and

Presented Evidence for Potential Disease-Modifying Activity for

Patisiran in Familial Amyloidotic Polyneuropathy (FAP) and ALN-AT3

in Hemophilia –

– Plans to Present New Clinical Data for

ALN-AT3 and Initial Clinical Data for ALN-CC5 in Oral Presentations

at Medical Meetings in June –

– Maintained Strong Balance Sheet with $1.45

Billion in Cash and Expects to End 2015 with Greater than $1.2

Billion in Cash –

Alnylam Pharmaceuticals, Inc. (Nasdaq: ALNY), a leading RNAi

therapeutics company, today reported its consolidated financial

results for the first quarter 2015, and highlighted recent progress

in advancing its pipeline.

“These are exciting times for RNAi therapeutics and Alnylam’s

efforts to bring innovative medicines to patients. With our

‘Alnylam 2020’ strategy we aim to transition from a late-stage

clinical development company to a multi-product commercial-stage

company with a sustainable development pipeline – a profile that we

believe has rarely been achieved in the biopharmaceutical industry.

Amongst many achievements in the first quarter and recent period,

we reported promising data on potential disease modifying effects

for patisiran in Familial Amyloidotic Polyneuropathy (FAP) and

ALN-AT3 in hemophilia. Specifically, in our patisiran Phase 2

open-label extension – or ‘OLE’ – study, we generated what we

believe to be continued evidence for a possible halting of

neuropathy progression after the first 12 months of treatment, with

drug administration generally well tolerated out to 17 months.

Furthermore, recent results from our Phase 1 trial with ALN-AT3

provide initial evidence for potential correction of the hemophilia

phenotype with an encouraging tolerability profile. In aggregate,

we believe these results strengthen the bridge that we are building

between RNAi-mediated knockdown and potential clinical benefit for

patients,” said John Maraganore, Ph.D., Chief Executive Officer of

Alnylam. “We have also continued enrolling subjects in our

ALN-PCSsc Phase 1 study, and we initiated dosing in our Phase 1/2

trial with ALN-CC5. With these advancements we are now poised for a

very data-rich mid-year period, with confirmed oral presentations

of clinical results for ALN-AT3 and ALN-CC5 in June and initial

Phase 1 data for ALN-PCSsc expected in mid-2015. We look forward to

sharing these data in the weeks and months to come.”

First Quarter 2015 and Recent Significant Corporate

Highlights

- Launched “Alnylam 2020” Guidance for

advancement and commercialization of RNAi Therapeutics.

Specifically, by the end of 2020, Alnylam expects to achieve a

company profile with 3 marketed products, as well as 10 RNAi

therapeutic clinical programs – including 4 in late stages of

development – across its 3 Strategic Therapeutic Areas

(STArs).

- Advanced pipeline programs in Genetic

Medicine STAr.

- Advanced investigational RNAi

therapeutic programs for the treatment of transthyretin

(TTR)-mediated amyloidosis (ATTR amyloidosis).

- Continued enrollment in APOLLO Phase 3

study of patisiran in ATTR amyloidosis patients with Familial

Amyloidotic Polyneuropathy (FAP).

- Reported positive 12-month clinical

data from patisiran Phase 2 open-label extension (OLE) study,

showing sustained TTR knockdown of up to a mean 88% and continued

evidence for potential halting of neuropathy progression.

Specifically, a mean 2.5 point decrease in neuropathy impairment

score (mNIS+7) was observed after 12 months of patisiran

administration, comparing favorably to a 13-18 point increase in

untreated patients with similar baseline characteristics, as

estimated from published historical data sets. Patisiran was also

found to be generally well tolerated out to 17 months of drug

administration.

- Continued enrollment in ENDEAVOUR Phase

3 study of revusiran in ATTR amyloidosis patients with Familial

Amyloidotic Cardiomyopathy (FAC).

- Presented complete Phase 2 data with

revusiran in patients with TTR cardiomyopathy, showing tolerability

and an up to 98.2% knockdown of serum TTR.

- Continued dosing FAC patients in

revusiran Phase 2 OLE study designed to evaluate the tolerability

and clinical activity of revusiran with long-term dosing for up to

two years.

- Presented results from a retrospective

natural history study evaluating disease progression in ATTR

amyloidosis patients with FAC, showing a 140 meter decline in 6

minute walk distance (6MWD) at 18 months; the change in 6MWD at 18

months is a co-primary endpoint measure in ENDEAVOUR.

- Advanced ALN-AT3 for the treatment of

hemophilia and rare bleeding disorders (RBD).

- Reported positive initial results from

a small number of subjects in a Phase 1 trial of ALN-AT3, including

an up to 70% knockdown of antithrombin (AT) and initial evidence

for the potential correction of the hemophilia phenotype with an up

to 334% increase in thrombin generation and marked improvement in

whole blood clotting.

- The company announces today that it is

transitioning to once-monthly subcutaneous dose cohorts in its

ongoing Phase 1 study.

- The company also announces today that

it has completed its chronic GLP toxicology studies of ALN-AT3,

including a 9-month study in non-human primates and 6-month studies

in rat and hemophilia A mice, with No Adverse Effect Level (NOAEL)

doses that support further advancement of the program.

- Published pre-clinical study results in

Nature Medicine documenting safety, efficacy, and durability of

ALN-AT3 in rodent and non-human primate (NHP) models of

hemophilia.

- Initiated Phase 1/2 trial with ALN-CC5.

The trial is being conducted initially in normal human volunteers,

and then is expected to move to patients with paroxysmal nocturnal

hemoglobinuria (PNH).

- Advanced pipeline programs in

Cardio-Metabolic Disease STAr

- Continued dosing in Phase 1 trial with

ALN-PCSsc in normal human volunteers with elevated LDL-C at

baseline.

- The company announces today that it has

completed the single ascending dose (SAD) phase of the study and

has initiated the multi-dose (MD) phase with or without statin

co-administration.

- Formed new agreement with Isis

Pharmaceuticals, extending the companies’ decade-long alliance to

lead the development and commercialization of RNA

therapeutics.

- Completed successful public offering of

common stock, with concurrent private placements from Genzyme,

totaling $567 million in net proceeds.

- Signed a 295,000 square foot lease with

an affiliate of BioMed Realty for Class A laboratory and office

space in Cambridge for the company’s future corporate

headquarters.

- The company announces today that

Cynthia Clayton, Vice President of Investor Relations and Corporate

Communications, will be transitioning from Alnylam to pursue

personal interests. Michael Mason, Alnylam’s Vice President of

Finance, will lead the company’s investor relations area on an

interim basis. The company has initiated an external search to

identify a new person for this role. Joshua Brodsky, Senior

Manager, Investor Relations and Corporate Communications, will

report to Mr. Mason during the transition period.

“We want to thank Cynthia for her decade-long leadership of

Alnylam’s corporate communications team. We are very sad to see her

go, but are happy that she’ll have a chance to pursue her personal

interests,” said John Maraganore. “In the meanwhile, Mike Mason

will assume acting leadership of our investor relations team while

we conduct a search for Cynthia’s replacement.”

Upcoming Events in Mid-2015

- Alnylam announces today that it plans

to present additional data from its ALN-AT3 Phase 1 trial in

subjects with hemophilia at the International Society on Thrombosis

and Haemostasis (ISTH) 2015 Congress, being held June 20 – 25, 2015

in Toronto, in an oral presentation on Tuesday, June 23 at 2:30

p.m. ET.

- The company also announces today that

it plans to present initial single ascending dose (SAD) cohort data

from its ALN-CC5 Phase 1/2 trial in normal human volunteers at the

20th Congress of the European Hematology Association (EHA), being

held June 11 – 14, 2015 in Vienna, Austria, in an oral presentation

on Sunday, June 14 at 8:45 a.m. Central European Summer Time (2:45

a.m. ET).

- In addition, during mid-2015, Alnylam

plans to:

- Initiate Phase 1 trial with ALN-AS1 in

development for the treatment of hepatic porphyrias

- Present initial data from Phase 1 trial

of ALN-PCSsc in development for the treatment of

hypercholesterolemia

- File Clinical Trial Application (CTA)

for ALN-AAT in development for the treatment of alpha-1 antitrypsin

(AAT) deficiency-associated liver disease

- Select Development Candidate (DC) for

ALN-GO1 in development for the treatment of Primary Hyperoxaluria

Type 1 (PH1)

“Alnylam continues to maintain a very strong balance sheet, with

approximately $1.45 billion in cash as of the end of the

first quarter of 2015,” said Michael Mason, Vice President,

Finance & Treasurer. “Our cash balance was bolstered in the

quarter with net proceeds of approximately $567 million that

resulted from a public offering and concurrent private placements

from Genzyme. This financing resulted in a balance sheet that

allows us to invest in a broad pipeline of RNAi therapeutics across

all three Alnylam STArs, which we believe will enable us to realize

our ‘Alnylam 2020’ goals. As for financial guidance this year, we

remain on track to end 2015 with greater than $1.2 billion in

cash.”

Financials

Cash, Cash Equivalents and Total Marketable Securities

At March 31, 2015, Alnylam had cash, cash equivalents and total

marketable securities of $1.45 billion, as compared to $881.9

million at December 31, 2014.

In January 2015, Alnylam sold an aggregate of 5,447,368 shares

of its common stock through an underwritten public offering at a

price to the public of $95.00 per share. As a result of the

offering, Alnylam received aggregate net proceeds of $496.4

million.

In January 2015, in connection with our public offering

described above, Genzyme exercised its right under the investor

agreement between Alnylam and Genzyme, to purchase, in concurrent

private placements, 744,566 shares of common stock, at the public

offering price of $95.00 per share, resulting in proceeds to

Alnylam of $70.7 million.

Under the investor agreement, Genzyme also has the right each

January to purchase a number of shares of Alnylam’s common stock

based on the number of shares issued during the previous year for

compensation-related purposes. Genzyme exercised this right to

purchase 196,251 shares of our common stock on January 22, 2015 for

approximately $18.3 million.

The exercise of these rights allowed Genzyme to maintain its

current ownership level of Alnylam common stock of approximately

12%.

Non-GAAP Net Loss

The non-GAAP net loss for the first quarter of 2015 was $50.8

million, or $0.62 per share on both a basic and diluted basis as

compared to a non-GAAP net loss of $26.3 million, or $0.39 per

share on both a basic and diluted basis for the same period in the

previous year. The non-GAAP net loss for the first quarter of 2014

excludes the $224.7 million charge to in-process research and

development expense for the purchase of the Sirna RNAi assets from

Merck, described below, for which there is no corresponding expense

for the first quarter of 2015.

GAAP Net Loss

The net loss according to accounting principles generally

accepted in the U.S. (GAAP) for the first quarter of 2015 was $50.8

million, or $0.62 per share on both a basic and diluted basis

(including $8.2 million, or $0.10 per share of non-cash stock-based

compensation expense), as compared to a net loss of $250.9 million,

or $3.70 per share on both a basic and diluted basis (including

$5.6 million, or $0.08 per share of non-cash stock-based

compensation expense), for the same period in the previous

year.

Revenues

Revenues were $18.5 million for the first quarter of 2015, as

compared to $8.3 million for the first quarter of 2014. Revenues

for the first quarter of 2015 included $5.6 million of revenues

from the company’s collaboration with Monsanto, $5.5 million from

the company’s alliance with Takeda Pharmaceuticals Company Limited,

$2.0 million for the company’s alliance with The Medicines Company,

$1.8 million from the company’s alliance with Genzyme and $3.6

million from research reagent licenses and other sources. The

increase in revenues in the first quarter of 2015 compared to the

first quarter of the previous year was due primarily to revenue

recognized in connection with the September 2014 amendment of our

remaining performance obligations under the Monsanto agreement, as

well as services performed in connection with our performance

obligations under agreements with The Medicines Company and

Genzyme. In addition, net revenues from collaborators increased due

to the achievement of certain non-recurring milestones from other

sources. The company expects net revenues from collaborators to

decrease during the remainder of 2015 on a comparative basis due

primarily to the completion of our performance obligations under

the Monsanto agreement in February 2015 and the planned completion

of our revenue amortization under the Takeda agreement in May

2015.

Research and Development Expenses

Research and development (R&D) expenses were $58.0 million

in the first quarter of 2015 which included $5.3 million of

non-cash stock-based compensation, as compared to $43.8 million in

the first quarter of 2014, which included $3.7 million of non-cash

stock-based compensation. The increase in R&D expenses in the

first quarter of 2015 as compared to the first quarter of the prior

year was due primarily to additional expenses related to the

significant advancement of certain of our clinical and pre-clinical

programs. In addition, compensation, non-cash stock-based

compensation and related expenses increased during the first

quarter of 2015 as compared to the first quarter of 2014 due

primarily to a significant increase in headcount during the period

as we expand and advance our development pipeline. Offsetting these

increases was a decrease in license fees during the first quarter

of 2015 as compared to the first quarter of 2014. The company

expects that research and development expenses will increase for

the remainder of 2015.

In-Process Research and Development Expense

In the first quarter of 2014, the company incurred a $224.7

million charge to in-process research and development expense in

connection with the purchase of the Sirna RNAi assets from Merck.

Specifically, at the closing of the transaction, the company paid

Merck $25.0 million in cash and issued 2,142,037 shares of the

company’s common stock. The company issued an additional 378,007

shares of common stock to Merck upon the completion of certain

technology transfer activities, which was completed in the second

quarter of 2014.

General and Administrative Expenses

General and administrative (G&A) expenses were $12.7 million

in the first quarter of 2015, which included $2.9 million of

non-cash stock-based compensation, as compared to $8.9 million in

the first quarter of 2014, which included $1.9 million of non-cash

stock-based compensation. The increase in G&A expenses in the

first quarter of 2015 as compared to the first quarter of the prior

year was due primarily to an increase in consulting and

professional services related to an increase in general business

activities. In addition, compensation, non-cash stock-based

compensation and related expense increased during the first quarter

of 2015 as compared to the first quarter of 2014 due primarily to

an increase in headcount during the period as compared to the prior

year period. For the remainder of 2015, the company expects that

general and administrative expenses will remain consistent with the

first quarter of 2015.

Benefit from Income Taxes

The company had a benefit from income taxes of $0.4 million for

the first quarter of 2015 as compared to $17.9 million in the first

quarter of 2014. The decrease was due to the corresponding income

tax benefit associated with the sale of the company’s common stock

at execution of the 2014 Genzyme collaboration. In addition, the

company also recorded a reduced income tax benefit for the increase

in the value of the company’s investment in Regulus that the

company carried at fair market value during the same respective

period.

Conference Call InformationManagement will provide an

update on the company, discuss first quarter 2015 results, and

discuss expectations for the future via conference call on

Thursday, May 7, 2015 at 4:30 p.m. ET. To access the call, please

dial 877-312-7507 (domestic) or

631-813-4828 (international) five minutes prior to the start

time and refer to conference ID 38203671. A replay of the call will

be available beginning at 7:30 p.m. ET on May 7, 2015. To access

the replay, please dial 855-859-2056 (domestic) or

404-537-3406 (international), and refer to conference ID

38203671.

About RNAiRNAi (RNA interference) is a revolution in

biology, representing a breakthrough in understanding how genes are

turned on and off in cells, and a completely new approach to drug

discovery and development. Its discovery has been heralded as “a

major scientific breakthrough that happens once every decade or

so,” and represents one of the most promising and rapidly advancing

frontiers in biology and drug discovery today which was awarded the

2006 Nobel Prize for Physiology or Medicine. RNAi is a natural

process of gene silencing that occurs in organisms ranging from

plants to mammals. By harnessing the natural biological process of

RNAi occurring in our cells, the creation of a major new class of

medicines, known as RNAi therapeutics, is on the horizon. Small

interfering RNA (siRNA), the molecules that mediate RNAi and

comprise Alnylam's RNAi therapeutic platform, target the cause of

diseases by potently silencing specific mRNAs, thereby preventing

disease-causing proteins from being made. RNAi therapeutics have

the potential to treat disease and help patients in a fundamentally

new way.

About GalNAc Conjugates and Enhanced Stabilization Chemistry

(ESC) GalNAc ConjugatesGalNAc-siRNA conjugates are a

proprietary Alnylam delivery platform and are designed to achieve

targeted delivery of RNAi therapeutics to hepatocytes through

uptake by the asialoglycoprotein receptor. Alnylam’s Enhanced

Stabilization Chemistry (ESC) GalNAc-conjugate technology enables

subcutaneous dosing with increased potency, durability, and a wide

therapeutic index, and is being employed in several of Alnylam’s

genetic medicine programs, including programs in clinical

development.

About LNP TechnologyAlnylam has licenses to Tekmira LNP

intellectual property for use in RNAi therapeutic products using

LNP technology.

About Alnylam PharmaceuticalsAlnylam is a

biopharmaceutical company developing novel therapeutics based on

RNA interference, or RNAi. The company is leading the translation

of RNAi as a new class of innovative medicines. Alnylam’s pipeline

of investigational RNAi therapeutics is focused in 3 Strategic

Therapeutic Areas (STArs): Genetic Medicines, with a broad pipeline

of RNAi therapeutics for the treatment of rare diseases;

Cardio-Metabolic Disease, with a pipeline of RNAi therapeutics

toward genetically validated, liver-expressed disease targets for

unmet needs in cardiovascular and metabolic diseases; and Hepatic

Infectious Disease, with a pipeline of RNAi therapeutics that

address the major global health challenges of hepatic infectious

diseases. In early 2015, Alnylam launched its “Alnylam 2020”

guidance for the advancement and commercialization of RNAi

therapeutics as a whole new class of innovative medicines.

Specifically, by the end of 2020, Alnylam expects to achieve a

company profile with 3 marketed products, 10 RNAi therapeutic

clinical programs – including 4 in late stages of development –

across its 3 STArs. The company’s demonstrated commitment to RNAi

therapeutics has enabled it to form major alliances with leading

companies including Merck, Medtronic, Novartis, Biogen, Roche,

Takeda, Kyowa Hakko Kirin, Cubist, GlaxoSmithKline, Ascletis,

Monsanto, The Medicines Company, and Genzyme, a Sanofi company. In

addition, Alnylam holds an equity position in Regulus Therapeutics

Inc., a company focused on discovery, development, and

commercialization of microRNA therapeutics. Alnylam scientists and

collaborators have published their research on RNAi therapeutics in

over 200 peer-reviewed papers, including many in the world’s top

scientific journals such as Nature, Nature Medicine, Nature

Biotechnology, Cell, New England Journal of Medicine, and The

Lancet. Founded in 2002, Alnylam maintains headquarters in

Cambridge, Massachusetts. For more information about Alnylam’s

pipeline of investigational RNAi therapeutics, please visit

www.alnylam.com.

Alnylam Forward Looking StatementsVarious statements in

this release concerning Alnylam’s future expectations, plans and

prospects, including without limitation, Alnylam’s expectations

regarding its “Alnylam 2020” guidance, Alnylam’s views with respect

to the potential for RNAi therapeutics, including patisiran,

revusiran, ALN-AT3, ALN-CC5, ALN-PCSsc, ALN-AS1, ALN-AAT, and

ALN-GO1, its expectations with respect to the timing, execution,

and success of its clinical and pre-clinical trials, the expected

timing of regulatory filings, including its plan to file IND or IND

equivalent applications and/or initiate clinical trials for ALN-AAT

and ALN-AS1, its expectations regarding reporting of data from its

clinical and pre-clinical studies, including its studies for

patisiran, revusiran, ALN-AT3, ALN-CC5, and ALN-PCSsc, as well as

other research programs and technologies, its plans regarding

commercialization of RNAi therapeutics, and Alnylam’s expected cash

position as of December 31, 2015, constitute forward-looking

statements for the purposes of the safe harbor provisions under The

Private Securities Litigation Reform Act of 1995. Actual results

may differ materially from those indicated by these forward-looking

statements as a result of various important factors, including,

without limitation, Alnylam’s ability to manage operating expenses,

Alnylam’s ability to discover and develop novel drug candidates and

delivery approaches, successfully demonstrate the efficacy and

safety of its drug candidates, the pre-clinical and clinical

results for its product candidates, which may not be replicated or

continue to occur in other subjects or in additional studies or

otherwise support further development of product candidates,

actions of regulatory agencies, which may affect the initiation,

timing and progress of clinical trials, obtaining, maintaining and

protecting intellectual property, Alnylam’s ability to enforce its

patents against infringers and defend its patent portfolio against

challenges from third parties, obtaining regulatory approval for

products, competition from others using technology similar to

Alnylam’s and others developing products for similar uses,

Alnylam’s ability to obtain additional funding to support its

business activities and establish and maintain strategic business

alliances and new business initiatives, Alnylam’s dependence on

third parties for development, manufacture, marketing, sales and

distribution of products, the outcome of litigation, and unexpected

expenditures, as well as those risks more fully discussed in the

“Risk Factors” filed with Alnylam’s most recent Annual Report on

Form 10-K filed with the Securities and Exchange Commission (SEC)

and in other filings that Alnylam makes with the SEC. In addition,

any forward-looking statements represent Alnylam’s views only as of

today and should not be relied upon as representing its views as of

any subsequent date. Alnylam explicitly disclaims any obligation to

update any forward-looking statements.

Alnylam Pharmaceuticals, Inc. Unaudited Condensed

Consolidated Statements of Comprehensive Loss (In thousands,

except per share amounts)

Three Months Ended March 31,

2015 2014 Net revenues

from collaborators $ 18,537 $ 8,275

Operating expenses: Research and development (1) 58,035

43,758 In-process research and development — 224,656 General and

administrative (1) 12,724 8,925 Total

operating expenses 70,759 277,339 Loss

from operations (52,222 ) (269,064 )

Other income

(expense): Interest income 1,014 333 Other income (expense)

— (82 ) Total other income 1,014

251 Loss before income taxes (51,208 ) (268,813 )

Benefit from income taxes 431 17,870

Net loss $ (50,777 ) $ (250,943 )

Net loss per

common share - basic and diluted $ (0.62 ) $ (3.70 )

Weighted average common shares used to compute basic and diluted

net loss per common share 82,074 67,786

Comprehensive

loss Net loss $ (50,777 ) $ (250,943 ) Unrealized gain on

marketable securities, net of tax 3,622 5,313

Comprehensive loss $ (47,155 ) $ (245,630 ) (1)

Non-cash stock-based compensation expenses included in operating

expenses are as follows: Research and development $ 5,346 $ 3,681

General and administrative 2,890 1,910

Alnylam Pharmaceuticals, Inc.

Unaudited GAAP to Non-GAAP

Reconciliation: Net Loss and Net Loss Per Share

(In thousands, except per share

amounts)

For the Three Months Ended

March 31, 2015 2014 GAAP net loss $ (50,777)

$ (250,943) Adjustment: In-process research and development expense

—

224,656

Non-GAAP net loss $ (50,777)

$ (26,287) GAAP net loss per common share –

basic and diluted $ (0.62)

$ (3.70) Adjustment (as detailed above)

—

3.31

Non-GAAP net loss per common share – basic and diluted $ (0.62)

$ (0.39)

Use of Non-GAAP Financial MeasuresThe company supplements

its condensed consolidated financial statements presented on a GAAP

basis by providing additional measures that are considered

“non-GAAP” financial measures under applicable SEC rules. These

non-GAAP financial measures are not prepared in accordance with

generally accepted accounting principles in the United States

(GAAP) and should not be viewed in isolation or as a substitute for

GAAP net loss and basic and diluted net loss per common share.

The company evaluates items on an individual basis, and

considers both the quantitative and qualitative aspects of the

item, including (i) its size and nature, (ii) whether or not it

relates to the company’s ongoing business operations, and (iii)

whether or not the company expects it to occur as part of its

normal business on a regular basis. In the first quarter of 2014,

the company’s Non-GAAP net loss and Non-GAAP loss per common share

– basic and diluted financial measures excludes the in-process

research and development expense of $224.7 million related to the

purchase of the Sirna RNAi assets from Merck. The company believes

that the exclusion of this expense provides management and

investors with supplemental measures of performance that better

reflect the underlying economics of the company’s business. In

addition, the company believes the exclusion of this expense is

important in comparing current results with prior period results

and understanding projected operating performance. Management uses

these non-GAAP financial measures to establish budgets and

operational goals and to manage the company’s business.

ALNYLAM PHARMACEUTICALS, INC.

UNAUDITED CONDENSED CONSOLIDATED

BALANCE SHEETS

(In thousands, except share

amounts)

March 31, December 31,

2015 2014 Cash, cash equivalents

and total marketable securities $ 1,450,754 $ 881,929 Billed and

unbilled collaboration receivables 10,107 39,937 Prepaid expenses

and other current assets 13,206 9,739 Deferred tax assets 33,667

31,667 Property and equipment, net 21,166 21,740 Investment in

equity securities of Regulus Therapeutics Inc.

99,890 94,583

Total

assets $ 1,628,790 $

1,079,595 Accounts payable, accrued expenses and other liabilities

$ 31,917 $ 38,791 Deferred tax liabilities 33,667 31,667 Total

deferred revenue 60,665 66,854 Total deferred rent 6,031 6,016

Total stockholders’ equity (84.2 million

and 77.2 million commonshares issued and outstanding and at March

31, 2015 and December 31,2014, respectively)

1,496,510

936,267

Total liabilities and stockholders' equity

$ 1,628,790 $ 1,079,595

This selected financial information should be read in

conjunction with the consolidated financial statements and notes

thereto included in Alnylam’s Annual Report on Form 10-K which

includes the audited financial statements for the year ended

December 31, 2014.

Alnylam Pharmaceuticals, Inc.Michael Mason,

617-551-8327Vice President, Finance and TreasurerorJoshua Brodsky,

617-551-8276Senior Manager, Investor Relations andCorporate

Communications

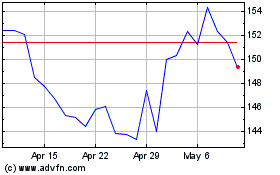

Alnylam Pharmaceuticals (NASDAQ:ALNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alnylam Pharmaceuticals (NASDAQ:ALNY)

Historical Stock Chart

From Apr 2023 to Apr 2024