Allstate Operating Profit Falls 15%

February 03 2016 - 6:20PM

Dow Jones News

Allstate Corp. said its fourth-quarter operating earnings fell

15% amid sharply higher catastrophe losses and elevated auto

claims.

Operating earnings are a widely watched benchmark for the

insurance industry because they exclude realized capital gains and

losses from companies' investment portfolios, among other items

that aren't considered recurring on a quarterly basis.

Allstate, one of the largest auto insurers in the U.S., has been

among the insurers that has reported an increase in the number of

auto claims in recent quarters as stronger economy has put more

cars on the road, resulting in more accidents.

The company has been implementing plans to improve the

performance of its auto segment, which includes raising prices,

tightening underwriting standards and managing loss costs. Allstate

is also among the insurers that is promoting plug-in devices and

smartphone applications, as well as cutting deals to piggyback on

auto makers' in-car computers.

In the latest quarter, Allstate brand auto losses remained

elevated, continuing trends seen throughout 2015. Property damage

frequency rose 7.5% and paid claim severities increased 4%.

Pretax catastrophe-related losses increased to $358 million from

$95 million a year earlier.

Insurers earn a substantial portion of their income by investing

customers' premiums until the money is needed to pay claims. Low

interest rates have pressured insurers' profitability for many

quarters, and analysts now also are paying close attention to

companies' exposure to high-yield bonds and energy stocks that have

suffered amid a slide in oil prices.

During the fourth quarter, Allstate reported realized capital

losses of $250 million, compared with gains of $106 million a year

earlier. Also in the latest period, investment write-downs were

$118 million and losses on sales were $75 million. The company's

energy-related investments had write-downs of $82 million and

losses on sales of $47 million.

Allstate reported an operating profit of $625 million, or $1.60

a share, down from $736 million, or $1.72 a share, a year

earlier.

Property-liability premiums written increased 3.6% to $7.55

billion amid policy growth of 1.3% and higher average premiums.

Analysts polled by Thomson Reuters expected a per-share

operating profit of $1.34 and net premiums written of $7.6

billion.

Over all, Allstate reported net income of $489 million, down

from $824 million, a year earlier. On a per-share basis, which

reflects preferred dividends, earnings fell to $1.18 from

$1.86.

The property-liability combined ratio—a measure of the portion

of premiums used to cover claims and expenses—rose to 92% from 90%.

However, excluding catastrophe losses and other items, the

underlying property-liability combined ratio decreased to 87.4%

from 89.5%.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

February 03, 2016 18:05 ET (23:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

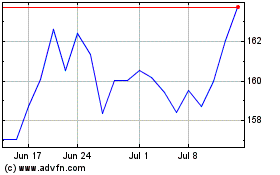

Allstate (NYSE:ALL)

Historical Stock Chart

From Mar 2024 to Apr 2024

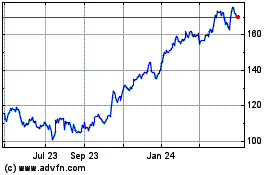

Allstate (NYSE:ALL)

Historical Stock Chart

From Apr 2023 to Apr 2024