AllianzGI Diversified Income & Convertible Fund AllianzGI Equity & Convertible Income Fund

September 23 2015 - 4:00PM

Business Wire

Revisions to the Funds’ Non-Fundamental

Investment Policies Regarding Writing Call Options

The Boards of Trustees of AllianzGI Diversified Income &

Convertible Fund (NYSE:ACV) and AllianzGI Equity & Convertible

Income Fund (NYSE:NIE) (each a “Fund” and collectively, the

“Funds”) announced that, effective September 21, 2015, each Fund

has modified its non-fundamental policy to normally write call

options “with respect to approximately 70% of the value” of each

position in the equity portion of the respective Fund’s portfolio,

and adopted a revised non-fundamental policy to normally write call

options “with respect to up to approximately 70% of the value” of

each equity position in the equity portion of the respective Fund’s

portfolio.

The Funds are closed-end management investment companies. The

Funds’ investment objective is to provide total return through a

combination of capital appreciation and current income. There can

be no assurance that the Funds will achieve their stated

objectives.

Allianz Global Investors Fund Management LLC (“AGIFM”), an

indirect, wholly-owned subsidiary of Allianz Asset Management of

America, L.P., serves as the Funds’ investment manager and is a

member of Munich-based Allianz Group. Allianz Global Investors U.S.

LLC, an AGIFM affiliate, serves as the Funds’ sub-adviser.

The Funds’ daily New York Stock Exchange closing market prices,

net asset values per share, as well as other information, including

updated portfolio statistics and performance are available at

us.allianzgi.com/closedendfunds or by

calling the Funds’ shareholder servicing agent at (800)

254-5197.

Statements made in this release that look forward in time

involve risks and uncertainties and are forward looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. Such risks and uncertainties include, without limitation,

the adverse effect from a decline in the securities markets or a

decline in the Funds’ performance, a general downturn in the

economy, competition from other companies, changes in government

policy or regulation, inability to attract or retain key employees,

inability to implement its operating strategy and/or acquisition

strategy, and unforeseen costs and other effects related to legal

proceedings or investigations of governmental and self-regulatory

organizations. The Funds’ ability to pay dividends to common

shareholders is subject to the restrictions in their registration

statements, by-laws and other governing documents, as well as the

Investment Company Act of 1940.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150923006083/en/

For Information on Allianz Closed-End

Funds:Financial Advisors: 800-926-4456Shareholders:

800-254-5197Media Relations: 212-739-3501

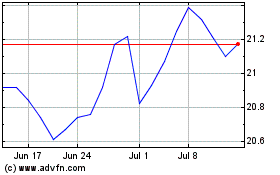

Virtus Diversified Incom... (NYSE:ACV)

Historical Stock Chart

From Mar 2024 to Apr 2024

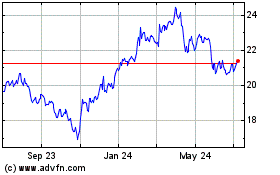

Virtus Diversified Incom... (NYSE:ACV)

Historical Stock Chart

From Apr 2023 to Apr 2024