Alliance Trust PLC Alliance Trust Plc : Circular - Response To Elliott Requisition

March 26 2015 - 11:36AM

UK Regulatory

TIDMATST

26 March 2015

Alliance Trust publishes Circular to shareholders and responds to

Elliott Advisors (UK) Ltd.'s requisitioned resolutions

Further to the announcement made by Alliance Trust PLC confirming

receipt of a requisition notice from Elliott Advisors (UK) Ltd. on 16

March 2015, the Company has today published a Circular containing both a

short, and more detailed letter from the Chair to shareholders and a

statement from Elliott which the Company is also required to send to

shareholders. The resolutions will be discussed and voted upon at the

Company's forthcoming Annual General Meeting in Dundee, on Wednesday 29

April 2015. The letter details the Board's response to Elliott's

resolutions and its voting recommendation.

Highlights from the Circular are as follows:

-- The Board believes that Elliott has plans for disruptive actions and that

Elliott's proposal is not just about nominating directors.

-- Elliott's interests are at odds with the Company's other shareholders -

the Board believes that Elliott is looking to exit their shareholding

quickly

-- The Board considers that the proposed directors are not independent

-- The Company already has a clear and differentiated strategy which

consistently delivers strong shareholder returns - this should not be

jeopardised.

Commenting on the Circular, Alliance Trust's Chair, Karin Forseke, said:

"We urge all of our shareholders to consider carefully the Circular that

we have published today and encourage them to play an active role in

protecting the future of Alliance Trust by voting against the

resolutions put forward by Elliott.

The Board is firm in its belief that this is about more than the

nomination of directors and that Elliott has plans for disruptive

actions that are at odds with the interests of other shareholders. The

directors proposed by Elliott, who have been identified on its

instruction, cannot be considered to be independent and we believe their

addition to the Board would allow Elliott to pursue its own agenda and

engineer a quick exit from its shareholding.

Alliance Trust is a company with a rich history and for whom the future

prospects are bright. We are asking our investors to stand behind us, as

they have before, to protect their company so we can continue to deploy

our differentiated strategy and deliver strong returns for all

shareholders for generations to come".

All terms used within this announcement will have the same meaning as

applied within the Circular.

- Ends -

Chair's Letter to Shareholders Extracted from Today's Circular

Dear Shareholder,

Who are Elliott and what do they really want?

Our Company has been requisitioned by Elliott Advisors (UK) Ltd. to

appoint three additional directors to the Board of Alliance Trust. Your

Board believes this is just the thin end of the wedge and they would

then pursue disruptive actions, to the detriment of other shareholders,

focused on helping them to sell their shareholding quickly. Elliott is

an affiliate of a U.S. based hedge fund manager with a controversial

track record and a number of recent regulatory sanctions. In the UK,

Elliott has had limited success in recent disruptive campaigns against

public companies, such as Morrisons Supermarkets and National Express

(which also included a requisition to appoint three additional

non-executive directors).

Elliott's interests are at odds with those of other shareholders

Elliott has previously made clear to us that they see little or no value

in the Company's dividend distributions, putting them at odds with the

objectives of the majority of our shareholders. Furthermore, we believe

that if these directors were appointed to your Board, Elliott would be

likely to pursue disruptive actions to allow them to sell their shares

quickly. In previous meetings with us, and as recently as last year,

Elliott proposed that the Company launch a tender offer for 40% of its

shares at a narrow discount. Such a tender may well engineer an exit for

Elliott, but would require a significant liquidation of our Company's

assets, jeopardising the Company's future and long-term value for

shareholders.

Our Company already has a clear and differentiated strategy which

consistently delivers strong shareholder returns

Our aim is to deliver strong and sustainable investment performance for

our shareholders over the longer term. Alliance Trust has delivered

above median Total Shareholder Return (TSR) since the appointment of its

new equities leadership 6 months ago. Our TSR ranks in the top half of

the Global sector a) for the last year (17%), b) since we became aware

of Elliott's shareholding four years ago (60%) and c) since Katherine

Garrett-Cox became CEO (92%). Alliance Trust has also delivered an

unbroken track record of dividend growth over the last 48 years,

including 14% growth in 2014, and our share price reached an all-time

high earlier this year. This should not be jeopardised.

Alliance Trust adheres to high standards of corporate governance

Alliance Trust has an experienced, diverse and dynamic Board with the

requisite skills, selected through a robust process. The Board has been

extensively renewed since my appointment and takes corporate governance

matters extremely seriously. The Board regularly reviews all aspects of

the Company's strategy, challenging the status quo and the management

team in the interests of all shareholders, which is why we believe the

independence of your non-executive directors is of paramount importance.

We do not believe that the proposed directors can be judged to be

independent

Elliott instructed the search firm and did not consult with the Company

on the brief for the search, or on the identities of the proposed

directors. Given that process, the Board is of the view that the

nominees cannot be judged to be independent and is concerned that

Elliott may seek to exert undue influence. Strong, independent

non-executive representation on the Board is key to good governance.

For these reasons, your Board unanimously recommends that you VOTE

AGAINST the Elliott Resolutions as they intend to do in respect of their

own shareholdings - and urges all shareholders to vote as every vote

counts.

Please read and consider the rest of this Circular before voting. I look

forward to seeing many of you at the forthcoming Annual General Meeting

in Dundee on 29 April 2015.

Yours sincerely

Karin Forseke

Chair

The Circular will be posted to shareholders and Alliance Trust Savings

investors today, 26 March 2015. It will also be available at

www.supportalliancetrust.com. A copy of the Circular has been submitted

to the National Storage Mechanism and will shortly be available for

inspection at: www.hemscott.com/nsm.do

The timetable for the Annual General Meeting is as follows:

Latest time and date for receipt of Form of Direction 11.00 a.m. on 23 April

from Alliance Trust Savings investors 2015

Latest time and date for receipt of Form of Proxy 11.00 a.m. on 27 April

from Shareholders 2015

Latest time and date for receipt of Supplemental Form 10.00 a.m. on 27 April

of Direction from Alliance Trust Savings investors 2015

Latest time and date for receipt of Supplemental Form 11.00 a.m. on 27 April

of Proxy from Shareholders 2015

Time and date of the General Meeting 11.00 a.m. on 29 April

2015

For more information please contact:

Finsbury

Conor McClafferty / Clare Dundas / Michael Turner

020 7251 3801

alliancetrust@finsbury.com

Alliance Trust

Evan Bruce-Gardyne, Director of Investor Relations

01382 321169

investor@alliancetrust.co.uk

Notes to editors

Alliance Trust PLC is a self-managed investment company with investment

trust status. It is one of the largest generalist UK investment trusts

by market value on the London Stock Exchange.

This press release contains "forward-looking statements" regarding the

belief or current expectations of Alliance Trust PLC, its Directors and

other members of its senior management about Alliance Trust PLC's

businesses, financial performance and results of operations. These

forward-looking statements are not guarantees of future performance.

Rather, they are based on current views and assumptions and involve

known and unknown risks, uncertainties and other factors, many of which

are outside the control of Alliance Trust PLC and are difficult to

predict, that may cause actual results, performance or developments to

differ materially from any future results, performance or developments

expressed or implied by the forward-looking statements. These

forward-looking statements speak only as at the date of this press

release. Except as required by applicable law, Alliance Trust PLC makes

no representation or warranty in relation to them and expressly

disclaims any obligation to update or revise any forward-looking

statements contained herein to reflect any change in Alliance Trust

PLC's expectations with regard thereto or any change in events,

conditions or circumstances on which any such statement is based. Any

information contained in this press release on the price at which shares

or other securities in Alliance Trust PLC have been bought or sold in

the past, or on the yield on such shares, should not be relied upon as a

guide to future performance.

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Alliance Trust PLC via Globenewswire

HUG#1906626

http://www.alliancetrusts.com

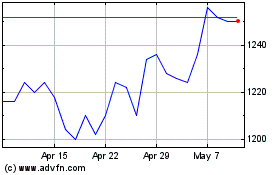

Alliance (LSE:ATST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alliance (LSE:ATST)

Historical Stock Chart

From Apr 2023 to Apr 2024