TIDMAPH

RNS Number : 3712I

Alliance Pharma PLC

25 March 2015

For immediate release 25 March 2015

ALLIANCE PHARMA PLC

("Alliance" or the "Group")

Results for the year ended 31 December 2014

Alliance Pharma plc (AIM: APH), the speciality pharmaceutical

company, is pleased to announce its results for the year ended 31

December 2014.

Financial Highlights

-- Revenue GBP43.5m (2013: GBP45.3m)

-- Pre-tax profit GBP10.8m* (2013: GBP12.0m)

-- Adjusted EPS 3.36p* (2013: 3.82p)

-- Free cash flow GBP10.3m (2013: GBP8.2m)

-- Net bank debt GBP21.1m (2013: GBP25.2m)

-- Low gearing with Debt to EBITDA ratio of 1.6 times

-- Proposed dividend:

o Final dividend up 10% to 0.667p per share (2013: 0.605p)

o Full year dividend up 10% to 1.000p per share (2013:

0.908p)

* Before exceptional item, being impairment of Pavacol-D

intangible

Note: 2013 figures restated for impact of adopting IFRS 11 Joint

Arrangements

Operational Highlights

-- Irenat(TM) acquisition in January 2014

-- MacuShield(TM) acquisition in February 2015

-- Hydromol(TM) continues to demonstrate good growth, achieving

year on year sales growth of 15%

-- Ashton & Parsons Infants' Powder(TM) sales achieve very

significant growth to GBP1.4m (2013: GBP0.4m) as a result of

product redesign and improved supply

Commenting on the results, Andrew Smith, Alliance's Chairman,

said: "In 2014 Alliance performed well, taking only a modest dip in

sales and profits in a challenging year, which underlines the

resilience of our business. We enter 2015 well placed for resumed

growth. The recent acquisition of the fast-growing MacuShield brand

together with the expected return of ImmuCyst(TM) in the second

half of this year add to the growth drivers of our portfolio."

For further information:

Alliance Pharma plc + 44 (0) 1249 466966

John Dawson, Chief Executive

Richard Wright, Finance Director

www.alliancepharma.co.uk

Buchanan + 44 (0) 20 7466 5000

Mark Court / Sophie Cowles / Jane

Glover

Numis Securities Limited + 44 (0) 20 7260 1000

Nominated Adviser: Michael Meade /

Freddie Barnfield

Corporate Broking: David Poutney

Notes to editors:

About Alliance

Alliance, founded in 1998, is an AIM listed speciality

pharmaceutical company based in Chippenham, Wiltshire, UK. The

Company has a strong track record of acquiring the rights to

established niche products and owns or licenses the rights to more

than 60 pharmaceutical products and continues to explore

opportunities to expand the range.

Alliance joined the AIM market of the London Stock Exchange in

December 2003 and trades under the symbol APH.

STRATEGIC AND BUSINESS REVIEW

In 2014 Alliance performed well, taking only a modest dip in

sales and profits in a challenging year, which underlines the

resilience of our business. We enter 2015 well placed for resumed

growth. While sales of our cyclical toxicology product reduced to a

minimal level and Nu-Seals(TM) continued its moderate decline

arising from the Irish government's moves on generic substitution,

much of the adverse impact was offset by further solid growth in

the rest of the portfolio. This growth will be augmented in 2015 by

the acquisition of MacuShield, completed in February 2015, and the

expected resumption of ImmuCyst sales in the second half of the

year.

Adoption of IFRS 11 Joint Arrangements

The Group was required to adopt International Financial

Reporting Standard 11 Joint Arrangements in 2014. Alliance's joint

ventures, both of which are in China, are now accounted for using

the equity method which only brings the net result into the

P&L. Previously they have been accounted for using proportional

consolidation which incorporated our share of sales and costs

separately. Prior year figures have been restated accordingly and

all references herein to prior year numbers are to the restated

figures. More details of the impact can be seen in Note 11.

Trading performance

Excluding joint ventures, revenue reduced by 4% to GBP43.5m

(2013: GBP45.3m). The decline was due to two products: sales of our

cyclical toxicology product fell in line with the low part of its 2

1/2 -year replacement cycle and the loss of the tender; and

Nu-Seals sales reduced to GBP2.5m under pressure from generic

competition. Together, these products accounted for a revenue

reduction totalling some GBP4.3m. This was substantially offset by

healthy revenue growth of GBP2.5m (11%) in the rest of our

portfolio.

The underlying growth was led by another double-digit

performance from Hydromol, with sales up 15%. We have grown annual

sales of this brand from just under GBP1m when we acquired it in

2006 to over GBP6m in 2014. Sales of the Opus(TM) stoma care

products grew by 10% to GBP4.3m.

With supplies of Ashton & Parsons Infants' Powders now free

of production constraints, sales are developing well - more than

tripling to GBP1.4m in 2014. Gelclair(TM), our treatment for oral

mucositis, continued to grow well, with sales up 10% to GBP1.3m and

MolluDab(TM), the molluscum contagiosum treatment that we launched

in 2013, made further good progress in this niche market.

We were also pleased with the performance in 2014 of our recent

acquisitions - Lypsyl(TM) in December 2013 and Irenat in Germany in

January 2014. With sales of GBP0.8m, Irenat continues to show the

stability that made it an attractive first product for our German

business. With Lypsyl we have halted the decline experienced under

its previous owners. To increase sales we have begun to capitalise

on its still-substantial consumer recognition and are currently

researching market perceptions and developing our strategy for

investment in order to breathe new life into this well-known

brand.

We have been unable to supply ImmuCyst, our bladder cancer

treatment, since production was halted at Sanofi's manufacturing

plant in Canada in mid-2012. ImmuCyst had peak sales of over GBP4m

per annum before production was suspended. Regulatory validation of

the refurbished production facility is taking significantly longer

than initially anticipated, and we now expect to resume sales in

the second half of 2015. Market feedback indicates continued demand

for the product, and we expect to rebuild substantial sales over

time as hospitals revert to ImmuCyst. Indeed we are aware that the

only licensed competitor is not currently able to supply the full

market demand. We will do all we can to bring ImmuCyst back as soon

as possible. In the meantime, we are at an advanced stage in the

process to consider our claim for profits lost during the extended

manufacturing hiatus.

Generic competition continues to erode Nu-Seals sales in

Ireland. The Irish regulator has still not adjudicated on which

low-dose aspirin products should be included on the list of

interchangeable medicines that would permit pharmacists to dispense

generic products against branded prescriptions. We have submitted a

strong case to the regulator for Nu-Seals to be kept off this list

but if Nu-Seals is eventually included, sales are likely to fall

substantially, which may well lead to a non-cash impairment charge

against the GBP9.1m intangible asset.

The planned hand-back of nine products to Novartis, which we had

been distributing since the origin of the company in 1998, was

completed in 2014. It had been phased over the past two years, and

the impact is low as these products generated only GBP0.3m of gross

margin for us in 2014.

Financial performance

Pre-exceptional pre-tax profit was GBP10.8m, down 10% from 2013.

However, excluding the cyclical toxicology product, underlying

profit from the rest of the portfolio showed a healthy increase of

15%. Adjusted earnings per share were 3.36 pence, down from 3.82

pence in 2013.

Gross margin for the full year was 57.5%. This was lower than

the 60.4% achieved in 2013, which was flattered by the peak sales

of the higher-margin toxicology product, but higher than the 56.9%

achieved in 2012. We expect to sustain margins at about the 2014

level going forward.

Operating costs were well contained at GBP13.1m (2013:

GBP13.5m). We made further modest savings on central overheads, but

most costs remained broadly stable. Marketing investment remained

broadly flat, although we continued to shift the emphasis gently

from our dermatology and secondary care products in favour of our

growing OTC consumer portfolio.

Production issues have halted the sales of Pavacol-D(TM), our

cough-suppressant medicine. We are currently looking at how to

bring this brand back to market but there is a significant risk

that it will not be economical to do so and therefore the related

GBP0.6m intangible asset has been written off in full. Apart from

this one-off non-cash impairment charge, the impact on profits is

not significant as sales of Pavacol-D have been very low for the

past few years as a result of various supply issues.

The reduced sales contribution from the cyclical toxicology

product resulted in a lower operating profit before exceptional

items of GBP11.8m (2013: GBP13.3m). This represented 27.1% of sales

(2013: 29.4%) - still a very healthy percentage.

Our financing costs reduced for the sixth consecutive year to

GBP1.0m (2013: GBP1.3m). This was as a result of the conversion of

the last of the convertible loan stock in 2013 and the reduction in

net bank debt from GBP25.2m at the start of the year to GBP21.1m at

the year-end. Year-end debt to EBITDA gearing remained flat at 1.6

times.

Alliance is a highly cash generative business, and 2014's free

cash flow of GBP10.3m was well ahead of the GBP8.2m achieved in

2013. GBP3.8m of this was reinvested in acquisitions during the

year and GBP2.4m was returned to shareholders via the

dividends.

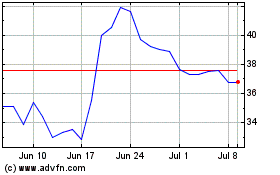

Alliance Pharma (LSE:APH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alliance Pharma (LSE:APH)

Historical Stock Chart

From Apr 2023 to Apr 2024