Alliance Pharma PLC Preliminary Results -4-

March 25 2015 - 3:01AM

UK Regulatory

income for the period - - - - (453) 8,384 7,931

-------------------------- --------- --------- --------- ---------- --------- ---------- --------

Balance 31 December

2014 2,641 29,388 1,995 (329) (103) 37,188 70,780

-------------------------- --------- --------- --------- ---------- --------- ---------- --------

Consolidated Cash Flow Statements

Year ended

Year ended 31 December

31 December 2013

2014 Restated*

Note GBP 000s GBP 000s

Cash flows from operating activities

Cash generated from operations 9 13,451 11,897

Tax paid (2,028) (2,516)

Cash flows from operating activities 11,423 9,381

---------------------------------------------- ------------ ------------

Investing activities

Interest received 48 50

Dividend received 72 420

Payment of deferred consideration - (20)

Development costs capitalised (58) (63)

Purchase of property, plant and equipment (111) (298)

Purchase of other intangible assets (2,817) (9,534)

Investment in joint venture (499) -

---------------------------------------------- ------------ ------------

Net cash used in investing activities (3,365) (9,445)

---------------------------------------------- ------------ ------------

Financing activities

Interest paid and similar charges (986) (1,232)

Loan issue costs - (500)

Loan to joint venture (503) -

Proceeds from exercise of share options 8 82

Dividend paid (2,398) (2,040)

Receipt from borrowings 2,750 28,500

Repayment of borrowings (4,500) (30,725)

Net cash used in financing activities (5,629) (5,915)

---------------------------------------------- ------------ ------------

Net movement in cash and cash equivalents 2,429 (5,979)

Cash and cash equivalents at the beginning

of the period (1,438) 4,613

Exchange gains / (losses)on cash and cash

equivalents 29 (72)

---------------------------------------------- ------------ ------------

Cash and cash equivalents at the end of

the period 10 (1,020) (1,438)

------------------------------------------ ------ ------------ ------------

*Restated due to the adoption of IFRS 11, please see note 11

1. Basis of preparation

The financial information set out in the announcement does not

constitute the Group's statutory accounts for the year ended 31

December 2014 or 31 December 2013. The auditors reported on those

accounts; their report was (i) unqualified, (ii) did not include

references to any matters to which the auditors drew attention by

way of emphasis without qualifying their report and (iii) did not

contain statements under section 498 (2) or (3) of the Companies

Act 2006. The statutory accounts for the year ended 31 December

2014 have not yet been delivered to the Registrar of Companies. The

statutory accounts for the year ended 31 December 2013 were

delivered to the Registrar of Companies as published on the Group's

website on 10 April 2014.

2. Finance costs

Year ended

Year ended 31 December

31 December 2013

2014 Restated

GBP 000s GBP 000s

----------------------------------------------------- ------------ ------------

Interest payable and similar charges

On loans and overdrafts (968) (1,222)

Amortised finance issue costs (104) (22)

Notional interest (18) (37)

----------------------------------------------------- ------------ ------------

(1,090) (1,281)

Interest income 48 50

Other finance income / (charges)

Foreign exchange movement on euro denominated

debt 28 (72)

28 (72)

Finance costs - net (1,014) (1,303)

----------------------------------------------------- ------------ ------------

Notional interest relates to the unwinding of the discount

applied to provisions.

3. Taxation

Analysis of charge in period.

Year ended Year ended

31 December 31 December

2014 2013

GBP 000s GBP 000s

---------------------------------------- ------------ ------------

United Kingdom corporation tax at 21.5%

(2013: 23.25%)

In respect of current period 1,870 2,242

Adjustment in respect of prior periods (38) 106

1,832 2,348

Deferred tax

Origination and reversal of temporary

differences (60) 77

Taxation 1,772 2,425

---------------------------------------- ------------ ------------

4. Dividends

Year ended Year ended

31 December 31 December

2014 2013

GBP

Pence/share 000s Pence/share GBP 000s

Amounts recognised as distributions

to owners in the year

Interim dividend for the prior financial

year 0.303 800 0.275 666

Final dividend for the prior financial

year 0.605 1,598 0.550 1,374

----------------------------------------- ----------- ----- ----------- ------------

2,398 2,040

Interim dividend for the current

financial year 0.333 880 0.303 800

----------------------------------------- ----------- ----- ----------- ------------

The proposed final dividend of 0.667 pence per share for the

current financial year was approved by the Board of Directors on 24

March 2015 and is subject to the approval of shareholders at the

Annual General Meeting. The proposed dividend has not been included

as a liability as at 31 December 2014 in accordance with IAS 10

Events After the Balance Sheet Date. The interim dividend for the

current financial year was paid on 15 January 2015. Subject to

shareholder approval, the final dividend will be paid on 15 July

2015 to shareholders who are on the register of members on 19 June

2015.

5. Earnings per share (EPS)

Basic EPS is calculated by dividing the earnings attributable to

ordinary shareholders by the weighted average number of ordinary

shares in issue during the year. For diluted EPS, the weighted

average number of ordinary shares in issue is adjusted to assume

conversion of all dilutive potential ordinary shares.

A reconciliation of the weighted average number of ordinary

shares used in the measures is given below:

Year ended Year ended

31 December 31 December

2014 2013

For basic EPS calculation 264,148,367 250,836,337

Employee share options 1,454,986 2,020,036

Conversion of Convertible Unsecured

Loan Stock (CULS) - 12,154,481

-------------------------------------- ------------ ------------

For diluted EPS calculation 265,603,353 265,010,854

-------------------------------------- ------------ ------------

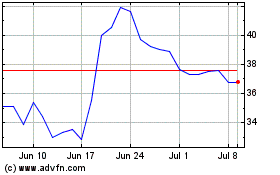

Alliance Pharma (LSE:APH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alliance Pharma (LSE:APH)

Historical Stock Chart

From Apr 2023 to Apr 2024