At the year-end, our unused bank facility available to fund

acquisitions stood at GBP23.8m (2013: GBP25.0m). This was reduced

to GBP18.3m in February 2015, following the drawdown of GBP5.5m as

the initial payment for MacuVision Europe Ltd, which brought us the

MacuShield brand.

Earnings per share

Adjusted basic EPS was 3.36p (2013: 3.82p), and adjusted diluted

EPS was 3.34p (2013: 3.68p), the reduction mainly reflecting the

impact of the toxicology product dropping to the low point of its

cycle and the tender being lost. Including the Pavacol-D impairment

charge, basic EPS was 3.17p (2013: 3.82p). During the year the

number of shares in issue remained virtually unchanged at

264.1m.

Dividend

We are maintaining our progressive dividend policy, recommending

a final payment of 0.667 pence per ordinary share to give a total

for the year of 1.0 pence per share. This represents a 10% increase

on the previous year's dividend, while still maintaining ample

earnings cover of over three times. The final dividend will be paid

on 15 July 2015 to shareholders on the register on 19 June

2015.

Strategy

The essence of our model is our long-established 'buy and build'

strategy, which is underpinned by a well balanced portfolio. We

have a healthy segment of brands in which we invest for growth.

Conversely we also possess many brands that are well established in

their market niches and will maintain their sales for many years

with little or no promotion. This balance allows us to invest in

marketing to develop growth, whilst at the same time delivering

good cash generation and profitability. As examples, we purchased

Lypsyl in December 2013 for the turn-around opportunity to deliver

growth; Irenat in January 2014 for its stability and cash

generation without the need for promotion; and MacuShield in

February 2015 for its strong ongoing growth and the opportunity for

us to grow the brand further across many territories.

In recent years we have been broadening the growth element of

our portfolio to include consumer healthcare products. These

typically offer substantial organic growth, whilst only requiring

modest promotional investment. Our increasing experience in this

area indicates that certain types of consumer product can do well

without major marketing expenditure. And these consumer products

help to balance risk across the portfolio because they are not

exposed to government price controls.

In February 2015 we acquired MacuVision Europe Ltd, a UK-based

business selling MacuShield, a treatment for dry age-related

macular degeneration and other eye conditions. The initial

consideration was GBP5.5m plus the net asset value, with deferred

payments totalling up to GBP6.0m over the next two years dependent

on MacuShield's sales growth. The acquisition should bring an

initial gross profit contribution of about GBP1m a year and sales

are growing rapidly, up 51% in 2014.

MacuShield is a once-a-day capsule that contains

meso-zeaxanthin, lutein and zeaxanthin - three carotenoids, or

pigments. These three carotenoids are naturally present in the eye,

where together they are known as macular pigment. Macular pigment

helps to protect the eye by neutralising free radicals and

absorbing blue light, which can damage the retina. With age, and

particularly in dry age-related macular degeneration and other eye

conditions, the level of macular pigment is reduced creating the

need for a dietary supplement to boost the level of pigment in the

retina.

Around 75% of MacuShield sales are generated in the UK, with the

remainder being sales to international distributors, mainly in

Europe.

We continue to seek attractive acquisition opportunities across

a wide range of products and markets. Over time we would expect to

maintain a balance across the portfolio - between prescription and

consumer products, and between promoted and non-promoted

products.

Recently, we have increased the proportion in our portfolio of

both promoted content and consumer brands. Following the

integration of the MacuShield brand, promoted products will have

risen to about 40% of sales, being equally divided between

prescription and consumer.

There is likely to be to a measured increase in marketing

investment over the next few years, although this will not be at

the expense of profitability. In 2015 the focus will be on the

re-introduction of Immucyst; continuing the rapid growth of

MacuShield; the continuing growth of Hydromol; and the commencement

of promotion behind Ashton & Parsons Infants' Powders.

In the first half of the year we are testing both TV advertising

and direct mail campaign options for Ashton & Parsons Infants'

Powders so that we can maximise the return on the spend that is

scheduled for later in the year.

Extensive work on re-positioning the Lypsyl brand will continue

through 2015, with a view to increasing the marketing investment in

2016.

We have maintained our focus on M&A. In January 2014 we

acquired Irenat, a well-established prescription brand in Germany

used in thyroid conditions. This was our first acquisition in

Germany since placing a Country Manager there in 2012. It means

that our German business is now trading profitably.

Also in January 2014, we took a 20% minority stake in the

Shanghai based, Synthasia International, a company that markets a

high-quality Swiss infant milk formula product in China. This

transaction has a progressive arrangement whereby Alliance can

increase its share to 100% over several years at pre-determined

multiples. Progress at Synthasia was delayed initially by a Chinese

government review of all imported formula milk products, which,

whilst problematic in the short term, had the benefit of removing

many competitors from the market.

Our businesses in France and Germany are both progressing well

and we are seeing a good flow of acquisition opportunities.

Team

In May 2014 we welcomed Andrew Smith as our new Non-Executive

Chairman, following Michael Gatenby's retirement. Andrew knows the

business well, having been a Non-Executive Director since 2006.

Two new Non-Executive Directors have joined the board in the

past year. David Cook joined in April 2014, taking over the Chair

of our Audit Committee from Michael Gatenby, and Nigel Clifford

joined in January 2015 following the retirement of Paul Ranson in

December 2014. David is currently Chief Financial Officer and Chief

Business Officer of Biotie Therapies Corp. and brings extensive

knowledge and experience of the pharmaceutical industry. Nigel has

been Chief Executive of Procserve Holdings for the past three years

and is about to move to become Chief Executive of Ordnance Survey.

He brings broad business experience with significant exposure to

European and international markets.

Our Finance Director, Richard Wright, has indicated his

intention to leave Alliance at the end of May 2015. We are grateful

to Richard for his significant contribution to the business over

the past eight years and wish him well for the future. The process

to recruit a replacement is under way.

To manage the growing number of consumer products in our

portfolio, we appointed Alex Duggan in January 2015 as Head of

Consumer Healthcare. Alex has over 20 years of experience as an

entrepreneur in consumer healthcare and has launched several

leading products in the UK and internationally, including Snoreeze

and Wartner.

Charity

We continue to donate products regularly to International Health

Partners, a charity that distributes medicines to doctors in the

world's neediest areas.

Alliance also supports its employees in their fundraising

activities for local charities. In 2014 this included GBP9,000

raised by eight employees who cycled from Bristol to Bordeaux in

aid of PROPS, a charity supporting young people with special needs;

and GBP2,500 raised by employees for the Wiltshire Air

Ambulance.

Outlook

In 2015 and 2016 we expect to overcome the headwinds that have

beset us in recent years, namely: the suspension of ImmuCyst

production in 2012; the generic threats to Nu-Seals in Ireland as

part of the generic substitution initiative; and the emergence of

new competitors to our cyclical toxicology product.

ImmuCyst is expected to return in the second half of 2015 after

an absence of three years. Our market intelligence is that

clinicians eagerly await its resumed availability. Additionally in

the hospital sector we expect continuing good performance from

Gelclair in oral complications arising from cancer treatments and

we expect the Opus range of stoma products to continue to sell

well.

The long-running positive trend behind Hydromol, our favoured

range of emollients for patients requiring skin rehydration, is

also expected to continue.

In consumer healthcare, we have several growth initiatives. We

aim to develop further the strong franchise behind Ashton &

Parsons Infants' Powders, which is the number one pharmacy brand in

its sector. With Lypsyl, following brand re-positioning work being

undertaken this year, we plan to re-invigorate this well-known

brand in 2016. Finally we are very excited by the significant

potential afforded by MacuShield, which is recommended by eye

specialists for use in dry age-related macular degeneration.

On the M&A front we are encouraged by the deal flow we are

currently experiencing, for which we have ample financing

headroom.

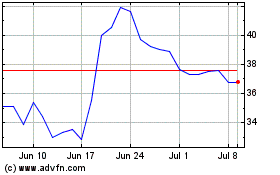

Alliance Pharma (LSE:APH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alliance Pharma (LSE:APH)

Historical Stock Chart

From Apr 2023 to Apr 2024