TIDMAPH

RNS Number : 4699Y

Alliance Pharma PLC

09 September 2015

For immediate release 9 September 2015

ALLIANCE PHARMA PLC

("Alliance" or the "Company")

Interim Results for the six months ended 30 June 2015

Alliance Pharma plc (AIM: APH), the speciality pharmaceutical

company, is pleased to announce its interim results for the six

months ended 30 June 2015.

Highlights:

-- Half year revenue of GBP22.8m (H1 2014: GBP21.4m)

o Year on year revenue growth of 6.5%

-- Hydromol(TM) continues to grow well, with sales up 11% to GBP3.3m (H1 2014: GBP3.0m)

-- Acquisition of MacuShield(TM) in February 2015 contributing sales of GBP1.4m

-- Half year profit before tax GBP5.5m (H1 2014: GBP5.4m)

-- Basic earnings per share 1.65p (H1 2014: 1.68p)

-- Interim dividend up 10% to 0.366p (H1 2014: 0.333p)

-- Net bank debt GBP26.5m (31 December 2014: GBP21.1m)

o GBP5.5m was drawn down in the first half to fund the

MacuShield acquisition

-- Licensing agreement signed with Duchesnay Inc in January 2015 for the product Diclectin

Commenting on the results, Andrew Smith, Alliance Pharma's

Chairman, said:

"Alliance has made a positive start to 2015 with growth in both

revenue and profits. We see good growth potential from MacuShield,

Hydromol and other key products in our portfolio, and also from

potential acquisitions. With some GBP18m of our acquisition bank

facility still undrawn we have ample headroom for deals and are

seeing an attractive pipeline of opportunities. Current trading is

in line with management forecasts and we expect full year results

to be in line with market expectations."

For further information:

Alliance Pharma plc + 44 (0) 1249 466966

John Dawson, Chief Executive

Buchanan + 44 (0) 20 7466 5000

Mark Court / Sophie Cowles / Jane Glover

Numis Securities Limited + 44 (0) 20 7260 1000

Nominated Adviser: Michael Meade / Freddie

Barnfield

Corporate Broking: David Poutney

Notes to editors:

About Alliance

Alliance, founded in 1998, is an AIM listed speciality

pharmaceutical company based in Chippenham, Wiltshire, UK. The

Company has a strong track record of acquiring the rights to

established niche products and owns or licenses the rights to more

than 60 pharmaceutical products and continues to explore

opportunities to expand the range.

Alliance joined the AIM market of the London Stock Exchange in

December 2003 and trades under the symbol APH.

Chairman's and Chief Executive's Statement

It is pleasing to report that Alliance has returned to growth

this year as expected. First-half sales and profits have benefited

from the February acquisition of MacuShield, as well as the

continuing success of our dermatology range. In the second half we

can look forward to further progress, aided by continued growth in

major products and the renewed availability of our ImmuCyst(TM)

bladder cancer treatment.

Trading performance

Excluding our share of joint ventures, first-half sales totalled

GBP22.8m (H1 2014: GBP21.4m). This 6.5% increase was achieved

despite the hand-back in 2014 of nine products, which we had been

distributing for Novartis since 1998. These products contributed

GBP959,000 to first-half sales last year, although their profit

contribution was relatively modest.

The loss of these sales was more than offset by MacuShield,

which brought in just over GBP1.4m of sales in less than five

months following the completion of the acquisition in early

February.

Further significant growth came from our Hydromol dermatology

range, up 11% to GBP3.3m, and Gelclair(TM) , our treatment for oral

mucositis, up 8% on modest promotional support.

Sales of Ashton & Parsons Infants' Powders(TM) rose sharply

last year as we overcame earlier production constraints. Sales in

the first half of 2015 were GBP717,000, which represents a 19%

increase on the second half of 2014 and is similar to that achieved

in the first half of 2014, when sales benefited from the build-up

of stocks by distributors and retailers.

Our TV advertising tests have proved encouraging, and research

shows that Ashton & Parsons is achieving higher repeat sales

than any other teething product. However, before increasing our

investment in promoting the brand we intend to ensure that it is

sufficiently available across retail outlets to satisfy the

resulting uplift in awareness and demand. We are therefore giving

priority to widening distribution of this resurgent brand.

We are also preparing to put increased backing in 2016 behind

Lypsyl(TM) , a somewhat neglected brand prior to its acquisition by

Alliance. In the meantime it has been delivering useful growth - up

6% to GBP523,000 (H1 2014: GBP492,000).

Anbesol(TM) has had a particularly strong six months, with sales

growing by 33% to GBP784,000 this year (H1 2014: GBP591,000). We

believe a principal driver for this has been customer support on

social media.

Offsetting some of the growth across our portfolio, Nu-Seals(TM)

continued its downward trend with Irish sales of GBP1.0m (H1 2014:

GBP1.3m) as increased generic competition put further pressure on

volumes. This pressure will be intensified if the Irish regulator

goes ahead with proposals to include Nu-Seals on the list of

interchangeable medicines for which pharmacists can dispense

generic substitutes. We have appealed against this and are still

awaiting a final adjudication.

Supplies of Quinoderm(TM) Cream were halted in the prior year

when a key active ingredient supplier ceased production. Sales fell

to GBPNil (H1 2014: GBP301,000) and custom synthesising the

ingredient by a new manufacturer is underway, although we do not

expect supplies to be restored until the end of 2016. Brand

presence is being maintained by Quinoderm Facewash, which is

unaffected by this issue.

Sales of our Opus(TM) stoma care products, acquired in 2012,

have remained stable at GBP1.8m with minimal promotional

support.

In our French and German businesses, the value of continuing

sales growth was diminished by the weakening euro exchange rate.

Translated into sterling, sales remained level in both

countries.

In China, the Synthasia International business in which we

bought an initial 20% stake has started to grow. Sales were

disrupted by a government review of the infant milk market last

year, but this had the beneficial effect of driving some

competitors out of the market. In the first half of this year total

sales grew 18% to pass GBP1m, taking our share of sales to

GBP215,000 (H1 2014: GBP182,000). Our other business in China has

been faring less well than in 2014. While the market for Forceval

remains fairly static, sales volumes have been lower - due mainly

to the timing of destocking and restocking in the distribution

chain.

Financial performance

Pre-tax profits grew 1.4% to GBP5.5m (H1 2014: GBP5.4m), and

earnings per share were virtually unchanged at 1.65p (H1 2014:

1.68p).

Gross profit was up 15.7% to GBP13.8m, reflecting a more

favourable product mix following the hand-back of the lower-margin

Novartis distribution products. This raised gross margin to 61% (H1

2014: 56%), although we expect to maintain margins in the 55-60%

range going forward.

The increase in gross profit was partially absorbed by higher

operating costs of GBP7.6m, up from GBP6.1m in the first half of

2014 and GBP7.0m in the second half. Over the past year we have

strengthened our supply chain management function, and this has led

to a modest increase in staff numbers and costs. The MacuShield

acquisition resulted in a further increase this year. In addition

legal costs have been higher, associated with other acquisition

activity.

We also increased our investment in product promotion by some

GBP300,000 compared with H1 2014. This reflects the addition of

MacuShield and a modest increase in support for over-the-counter

consumer brands as we increase the weighting of these products in

our portfolio.

Despite these increased costs, operating profit grew by 2.2% to

GBP6.1m (H1 2014: GBP6.0m). As a percentage of sales, it reduced

from 27.9% in H1 2014 to 26.8% in H1 2015, still comfortably within

our target range of 25-30%.

Cash generation remains strong, but has been impacted this year

by an increase in stockholding - with total inventory up from

GBP5.6m in H1 2014 to GBP7.3m in H1 2015. This results from a

strategic increase in inventories to reduce the risk of stockouts,

and buffer stocks held during the transfer of some product

manufacturing to alternative suppliers. We anticipate some further

stockbuilding in the second half, but at a lower level, to further

strengthen security of supply. In the first half of this year free

cash flow was GBP2.0m, compared with GBP4.4m in the first half of

last year due to a GBP1.7m increase in inventory to strengthen our

supply chain, plus some timing differences on payments.

Interest costs have increased by GBP0.2m following the

acquisition of MacuShield in February 2015. This has been offset by

a foreign exchange gain of GBP0.1m resulting in total finance costs

being GBP0.6m (H1 2014 GBP0.5m).

The GBP5.5m drawdown from our revolving credit facility for the

MacuShield acquisition resulted in an increase in net debt from

GBP21.1m at the start of the period to GBP26.5m at the end. This

raised the bank debt/EBITDA ratio from 1.6 times at the end of 2014

to a still-comfortable 2.0 times; and the unutilised credit

facility of GBP18.3m (end-2014: GBP23.8m) still leaves ample

headroom for further acquisitions.

Dividend

We are maintaining our progressive dividend policy with an

interim payment of 0.366p per ordinary share (H1 2014: 0.333p).

This provides an increase of 10% on last year's figure while

ensuring that dividends continue to be covered more than three

times by earnings. The interim dividend will be paid on 14 January

2016 to shareholders on the register on 21 December 2015.

Strategy

(MORE TO FOLLOW) Dow Jones Newswires

September 09, 2015 02:01 ET (06:01 GMT)

Our business model is based on a well diversified and growing

portfolio of products and brands, in which currently no single

brand represents more than around 13% of total sales.

This portfolio balances two elements. We have a bedrock of

brands that are well established in their market niches and will

maintain their sales for many years with little or no promotion;

and we have a segment of brands in which we invest for growth. By

balancing the two, we can invest in targeted marketing to grow

sales while maintaining good cash generation and profitability.

Under our long-established 'buy and build' strategy we

supplement organic growth with acquisitions that allow us to

accelerate expansion and adjust the balance of our portfolio.

In recent years we have been broadening the growth element of

our portfolio to include consumer healthcare products. Our growing

experience in this area enables us to identify products that offer

substantial organic growth potential in return for relatively

modest promotional investment. These consumer products also help to

balance margin risk across the portfolio because they are not

exposed to government price controls.

In 2010, promoted products producing organic growth accounted

for some 18% of our portfolio. Today that proportion has more than

doubled to about 40% - largely through our expansion in consumer

healthcare.

MacuShield was acquired in February this year. This is a

once-a-day supplement in capsule form to combat age related macular

degeneration, a major cause of sight loss in the elderly. Its

acquisition has further boosted our offer to both healthcare

professionals and the retail trade. It utilises both sides of our

promotional capabilities, being promoted to eyecare clinicians who

recommend the product to suitable patients, who subsequently

purchase it over the counter in a consumer setting.

We have in-licensed Diclectin for the UK market from Duchesnay

Inc of Canada. Diclectin is a well proven product to treat nausea

and vomiting in pregnancy. Currently in the UK there is no licensed

treatment for this condition that affects 70% to 80% of pregnant

women, with severe symptoms occurring in 30% of them. This

condition can cause extreme distress and it is estimated that 35%

of pregnant women need time off work as a result. Diclectin has a

well-established efficacy and safety profile and is regarded as the

standard of care for this condition in Canada, where it has been

used for over 30 years and has been prescribed for more than 30

million women. In 2013, it was approved in the United States with

an FDA Category A safety rating for drugs used in pregnancy. Its

uptake there has been very satisfactory.

We submitted Diclectin for UK registration in the second quarter

of this year with a view to launching it sometime during 2016,

depending on the timing of regulatory processing and approval. If

approved, Diclectin will fulfill a much needed gap in the treatment

of nausea and vomiting in pregnancy with a licensed medicine and

represents a significant growth opportunity for us.

Our preparation for launch is ongoing, involving considerable

market access activities throughout the NHS and while we anticipate

significant pre-marketing costs in the second half of 2015, this

should not prevent us from meeting profit expectations for the

year. From early 2016 onwards, we will be in a state of readiness

to implement our launch activities. As the first licensed product

to treat this condition, we expect Diclectin to generate

significant interest.

After an absence of three years, we expect to be able to bring

ImmuCyst back to the market in the fourth quarter of this year.

Although supplies are likely to be constrained in the near term, we

are anticipating strong demand. Many clinicians have expressed a

firm preference for ImmuCyst over the currently available

alternative; and as this product is itself facing production

constraints, ImmuCyst is returning to a market that is currently

undersupplied.

It is three years since our supplier, Sanofi, suspended

production of ImmuCyst - which had been one of our lead products.

As previously reported, discussions for compensation are

ongoing.

Team

As announced in the annual report, there were two changes to

board membership in the first half of 2015. Non-executive Director

Nigel Clifford joined in January and Finance Director Richard

Wright left at the end of May. As previously announced, at the end

of September we will welcome Andrew Franklin as our new Finance

Director. Andrew brings extensive experience of the pharmaceutical

sector gained over many years at Wyeth and more recently at Genzyme

Corporation's UK and Ireland subsidiary, where he was Finance

Director and Company Secretary.

Charity

We continue to donate products regularly to International Health

Partners, which distributes medicines to doctors in the world's

neediest areas. We also support employee fundraising for local

causes including Wiltshire Air Ambulance, our chosen charity for

2015.

Outlook

Having returned to growth in sales and profits we look forward

to further progress in the second half of 2015. We will benefit

from the continuing organic growth of our consumer healthcare

portfolio, a full six-month contribution from MacuShield, and the

return of ImmuCyst in the fourth quarter. We can expect additional

impetus to come from the launch of Diclectin in 2016, depending

upon regulatory approval.

We also remain very active on the M&A front. We have ample

financing headroom and are experiencing an encouraging flow of

opportunities both large and small. We are particularly keen to

maintain the momentum of international expansion, and are

benefiting from having managers on the ground in France, Germany

and China. As a result, some three quarters of the opportunities

that we have reviewed over the past twelve months have had an

international dimension.

Consolidated Income Statement

For the six months ended 30 June 2015

6 months Year to

6 months to to 31 December

30 June 2015 30 June 2014 2014

Note GBP 000s GBP 000s GBP 000s

Revenue 22,795 21,425 43,536

Cost of sales (8,996) (9,502) (18,493)

Gross profit 13,799 11,923 25,043

Administration and marketing

expense (7,232) (5,754) (12,510)

Amortisation of intangible

assets (99) (179) (488)

Share-based employee remuneration (385) (350) (571)

Share of joint venture

profits 26 335 319

Operating profit excluding

exceptional item 6,109 5,975 11,793

Exceptional item: impairment - - (622)

Operating profit 6,109 5,975 11,171

Finance costs

Interest payable and similar

charges (722) (545) (1,090)

Interest income 35 24 48

Other finance income/(charges) 102 (6) 28

(585) (527) (1,014)

-------------- -------------- -------------

Profit on ordinary activities

before taxation 5,524 5,448 10,157

Taxation 4 (1,152) (999) (1,772)

Profit for the period attributable

to equity shareholders 4,372 4,449 8,385

-------------- -------------- -------------

Earnings per share

Basic (pence) 8 1.65 1.68 3.17

============== ============== =============

Diluted (pence) 8 1.64 1.67 3.16

============== ============== =============

Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2015

6 months

to 6 months Year to

30 June to 31 December

2015 30 June 2014 2014

GBP 000s GBP 000s GBP 000s

Profit for the period 4,372 4,449 8,385

Other items recognised directly

in equity:

Items that may be reclassified

to profit or loss:

Interest rate swaps - cash flow

hedge 80 (47) (572)

Deferred tax on interest rate swap (16) 14 119

Foreign exchange translation differences (3) - 7

Share of joint venture other comprehensive

loss - - (8)

Total comprehensive income for

the period 4,433 4,416 7,931

--------------------------------------------- --------- -------------- -------------

Consolidated Balance Sheet

(MORE TO FOLLOW) Dow Jones Newswires

September 09, 2015 02:01 ET (06:01 GMT)

At 30 June 2015

30 June 31 December

30 June 2015 2014 2014

Note GBP 000s GBP 000s GBP 000s

Assets

Non-current assets

Intangible fixed assets 5 100,772 89,762 88,875

Property, plant and equipment 508 524 396

Joint venture investment 10 1,297 1,367 1,271

Joint venture receivable 1,462 1,462 1,462

Derivative financial instruments - 396 -

Deferred tax asset 297 - 194

104,336 93,511 92,198

-------------- --------- -------------

Current assets

Inventories 7,283 5,580 5,914

Trade and other receivables 6 9,090 10,721 8,322

Cash and cash equivalents 499 430 1,434

16,872 16,731 15,670

-------------- --------- -------------

Total assets 121,208 110,242 107,868

============== ========= =============

Equity

Ordinary share capital 2,644 2,641 2,641

Share premium account 29,482 29,388 29,388

Share option reserve 2,380 1,774 1,995

Reverse takeover reserve (329) (329) (329)

Other reserve (39) 317 (103)

Retained earnings 38,914 33,253 37,188

Total equity 73,052 67,044 70,780

-------------- --------- -------------

Liabilities

Non-current liabilities

Long-term financial liabilities 23,287 22,183 19,235

Other liabilities 1,352 - -

Deferred tax liability 8,408 6,425 6,309

Provisions for other liabilities

and charges - 99 -

Derivative financial instruments 49 - 129

-------------- --------- -------------

33,096 28,707 25,673

Current liabilities

Cash and cash equivalents 810 855 414

Financial liabilities 2,895 2,895 2,895

Corporation tax 914 875 959

Trade and other payables 7 10,285 9,679 6,920

Provisions for other liabilities

and charges 156 187 227

-------------- --------- -------------

15,060 14,491 11,415

Total liabilities 48,156 43,198 37,088

Total equity and liabilities 121,208 110,242 107,868

============== ========= =============

Consolidated Statement of Cash Flows

For the six months ended 30 June 2015

6 months Year to

6 months to to 31 December

30 June 2015 30 June 2014 2014

GBP 000s GBP 000s GBP 000s

Operating activities

Result for the period before

tax 5,524 5,448 10,157

Interest payable 722 545 1,098

Interest receivable (35) (24) (48)

Other finance costs (102) 6 (28)

Depreciation of property,

plant and equipment 136 152 307

Amortisation of intangible

assets 99 179 1,110

Share-based employee remuneration 385 350 571

Change in inventories (1,369) (112) (446)

Change in investments (26) (335) (312)

Change in trade and other

receivables (768) 424 2,823

Change in trade and other

payables (815) (535) (1,781)

Tax paid (964) (1,133) (2,028)

Cash flows from operating

activities 2,787 4,965 11,423

-------------- -------------- -------------

Investing activities

Interest received 35 24 48

Dividend received - - 72

Payment of deferred consideration - (20) -

Development costs capitalised (7) (13) (58)

Purchase of property, plant

and equipment (248) (84) (111)

Purchase of other intangible

assets (6,500) (2,817) (2.817)

Investment in joint venture - (1,003) (499)

Net cash used in investing

activities (6,720) (3,913) (3,365)

-------------- -------------- -------------

Financing activities

Interest paid and similar

charges (588) (491) (986)

Loan to joint venture - - 503

Proceeds from exercise of

share options 97 8 8

Dividend paid (880) (800) (2,398)

Receipt from borrowings 5,500 2,750 2,750

Repayment of borrowings (1,500) (1,500) (4,500)

Net cash used in financing

activities 2,629 (33) (5,629)

-------------- -------------- -------------

Net movement in cash and

cash equivalents (1,304) 1,019 2,429

Cash and cash equivalents

at beginning of period 1,020 (1,438) (1,438)

Exchange losses on cash and

cash equivalents (27) (6) 29

Cash and cash equivalents

at end of period (311) (425) 1,020

============== ============== =============

Consolidated Statement of Changes in Equity

At 30 June 2015

Ordinary Share Share Reverse

share premium option takeover Other Retained Total

capital account reserve reserve reserve earnings equity

GBP

GBP 000s GBP 000s GBP 000s GBP 000s 000s GBP 000s GBP 000s

Balance 1 January

2014 2,641 29,380 1,424 (329) 350 31,202 64,668

--------- --------- --------- --------- -------- --------- ---------

Issue of shares - 8 - - - - 8

Dividend paid - - - - - (2,398) (2,398)

Share-based employee

remuneration - - 571 - - - 571

-------------------------- --------- --------- --------- --------- -------- --------- ---------

Transactions with

owners - 8 571 - - (2,398) (1,819)

Profit for the period - - - - - 8,385 8,385

Other comprehensive

income

Interest rate swaps

- cash flow hedge

net of deferred tax - - - - (453) - (453)

Foreign exchange

translation differences - - - - - (1) (1)

-------------------------- --------- --------- --------- --------- -------- --------- ---------

Total comprehensive

income for the period - - - - (453) 8,384 7,931

Balance 31 December

2014 2,641 29,388 1,995 (329) (103) 37,188 70,780

Balance 1 January

2014 2,641 29,380 1,424 (329) 350 31,202 64,668

(MORE TO FOLLOW) Dow Jones Newswires

September 09, 2015 02:01 ET (06:01 GMT)

--------- --------- --------- --------- -------- --------- ---------

Issue of shares - 8 - - - - 8

Dividend payable/paid - - - - - (2,398) (2,398)

Share-based employee

remuneration - - 350 - - - 350

-------------------------- --------- --------- --------- --------- -------- --------- ---------

Transactions with

owners - 8 350 - - (2,398) (2,040)

Profit for the period - - - - - 4,449 4,449

Other comprehensive

income

Interest rate swaps

- cash flow hedge

net of deferred tax - - - - (33) - (33)

Total comprehensive

income for the period - - - - (33) 4,449 4,416

Balance 30 June 2014 2,641 29,388 1,774 (329) 317 33,253 67,044

--------- --------- --------- --------- -------- --------- ---------

Balance 1 January

2015 2,641 29,388 1,995 (329) (103) 37,188 70,780

--------- --------- --------- --------- -------- --------- ---------

Issue of shares 3 94 - - - - 97

Dividend payable/paid - - - - - (2,643) (2,643)

Share-based employee

remuneration - - 385 - - - 385

-------------------------- --------- --------- --------- --------- -------- --------- ---------

Transactions with

owners 3 94 385 - - (2,643) (2,161)

Profit for the period - - - - - 4,372 4,372

Other comprehensive

income

Interest rate swaps

- cash flow hedge

net of deferred tax - - - - 64 - 64

Foreign exchange

translation differences - - - - - (3) (3)

Total comprehensive

income for the period - - - - 64 4,369 4,433

Balance 30 June 2015 2,644 29,482 2,380 (329) (39) 38,914 73,052

--------- --------- --------- --------- -------- --------- ---------

Notes to the Half Yearly Report

For the six months ended 30 June 2015

1 Nature of operations

Alliance Pharma plc ("the company") and its subsidiaries

(together "the Group") acquire, market and distribute

pharmaceutical products. The company is a public limited company

incorporated and domiciled in England. The address of its

registered office is Avonbridge House, Bath Road, Chippenham,

Wiltshire, SN15 2BB.

The company is listed on the London Stock Exchange, Alternative

Investment Market (AIM).

2 General information

The information in these financial statements does not

constitute statutory accounts as defined in section 434 of the

Companies Act 2006 and is un-audited. A copy of the Group's

statutory accounts for the period ended 31 December 2014, prepared

under International Financial Reporting Standards as adopted by the

European Union, has been delivered to the Registrar of Companies.

The auditors' report on those accounts was unqualified and did not

contain statements under section 498(2) or section 498(3) of the

Companies Act 2006.

The interim financial report for the six month period ended 30

June 2015 (including comparatives for the six months ended 30 June

2014) was approved by the Board of Directors on 8 September

2015.

The current rate of cash generation by the Group comfortably

exceeds the capital and debt servicing needs of the business

(though there cannot, of course, be absolute certainty that the

rate of cash generation will be maintained). The Board remains

confident that all the bank covenants will continue to be met. The

Group has a GBP5m Working Capital Facility of which GBP4.2m is

undrawn at the balance sheet date and which the Board believes

should comfortably satisfy the Group's working capital needs for at

least the next 12 months.

3 Accounting policies

The same accounting policies and methods of computation are

followed in the interim financial report as published by the

company in its 31 December 2014 Annual Report. The Annual report is

available on the company's website at www.alliancepharma.co.uk.

4 Taxation

Analysis of charge in period.

30 June 30 June 31 December

2014 2014 2014

GBP 000s GBP 000s GBP 000s

United Kingdom corporation

tax at 22%/23.5%/23.25%

In respect of current

period 920 854 1,870

Adjustment in respect

of prior periods - - (38)

Current tax 920 854 1,832

Deferred tax 232 145 (60)

Taxation 1,152 999 1,772

========= ========= =============

Notes to the Half Yearly Report (continued)

For the six months ended 30 June 2015

5. Intangible assets

Technical

know-how,

trademarks

Goodwill Purchased and distribution Development

on consolidation Goodwill rights costs Total

The Group GBP 000s GBP 000s GBP 000s GBP 000s GBP 000s

Cost

At 1 January 2015 1,144 2,449 88,504 431 92,528

Additions - 1,748 10,241 7 11,996

At 30 June 2015 1,144 4,197 98,745 438 104,524

---------------------------- ----------------- --------- ----------------- ----------- --------

Amortisation and impairment

At 1 January 2015 - - 3,653 - 3,653

Amortisation for the

period - - 99 - 99

At 30 June 2015 - - 3,752 - 3,752

---------------------------- ----------------- --------- ----------------- ----------- --------

Net book amount

At 30 June 2015 1,144 4,197 94,993 438 100,772

---------------------------- ----------------- --------- ----------------- ----------- --------

At 1 January 2015 1,144 2,449 84,851 431 88,875

---------------------------- ----------------- --------- ----------------- ----------- --------

The following acquisition activities took place in the year:

-- On 2 February 2015, the Group completed the acquisition of

MacuVision Europe Limited ("MacuVision") for initial consideration

of GBP5.5 million plus the net asset value of MacuVision at

completion (GBP0.5m) and deferred contingent consideration of up to

GBP6.0 million (estimated at GBP3.2m). MacuVision sells MacuShield,

an eye care treatment designed to be taken by sufferers of dry

age-related macular degeneration and other eye conditions. The fair

value of the intangible asset acquired was GBP8.7m included within

technical know-how, trademarks and distribution rights. Goodwill of

GBP1.7m arose on the acquisition of MacuVision.

-- On 29 January 2015, the Group entered a Licence and Supply

Agreement for the product Diclectin with Duchesnay Inc. The

consideration recognised in relation to this is GBP1.5m. Diclectin

is a product to treat nausea and vomiting of pregnancy and is

anticipated to launch in the second half of 2016.

6 Trade and other receivables

30 June 30 June 31 December

2015 2014 2014

GBP 000s GBP 000s GBP 000s

Trade receivables 7,710 8,684 6,645

Other receivables 278 654 669

Prepayments and accrued

income 530 561 453

Amounts owed by joint

venture 572 822 555

9,090 10,721 8,322

========= ========= =============

7 Trade and other payables

30 June 30 June 31 December

2015 2014 2014

GBP 000s GBP 000s GBP 000s

Trade payables 237 2,611 1,693

Other taxes and social

security costs 1,191 832 969

Accruals and deferred

income 4,330 4,407 4,065

Other payables 285 231 193

Deferred consideration 2,478 - -

Dividend payable 1,764 1,598 -

10,285 9,679 6,920

========= ========= =============

(MORE TO FOLLOW) Dow Jones Newswires

September 09, 2015 02:01 ET (06:01 GMT)

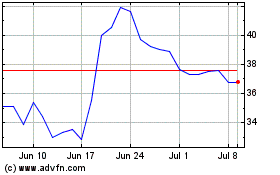

Alliance Pharma (LSE:APH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alliance Pharma (LSE:APH)

Historical Stock Chart

From Apr 2023 to Apr 2024