TIDMAGY

RNS Number : 9714G

Allergy Therapeutics PLC

10 March 2015

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH

AFRICA, NEW ZEALAND OR ANY OTHER JURISDICTION IN WHICH SUCH

RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

10 March 2015

Allergy Therapeutics plc

("Allergy Therapeutics" or the "Company")

Proposed Placing and Notice of General Meeting

Placing to raise net proceeds of approximately GBP20 million to

be used to fund the clinical development of Pollinex(â) Quattro

Grass through to FDA regulatory approval

Allergy Therapeutics, the fully integrated specialty

pharmaceutical company specialising in allergy vaccines, is pleased

to announce a conditional placing of 94,117,650 Placing Shares at a

price of 22.1 pence per Placing Share to raise up to approximately

GBP20.0 million after expenses.

Highlights

-- 94,117,650 new ordinary shares of 0.1 pence each in the

capital of the Company (the "Placing Shares") conditionally placed

with institutional and other investors to raise proceeds of GBP20.8

million before expenses (the "Placing")

-- Placing price of 22.1 pence per Placing Share (the "Placing

Price"), representing a discount of 10.0 per cent. to the average

mid-market closing price over the previous 60 trading days up to

and including 5 March 2015

-- The net proceeds of the Placing will be used to fund the

clinical development of lead product Pollinex(â) Quattro Grass

through to a BLA to obtain FDA regulatory approval in the US

-- Pollinex Quattro Grass could become the first licensed

seasonal SCIT allergy vaccine authorised for marketing in the US,

with an estimated $2 billion market

-- Current timetable earmarks US Pollinex Quattro Grass launch during 2019

-- Panmure Gordon is acting as Financial Adviser, Nominated

Adviser and sole bookrunner to the Placing

The Placing is conditional, inter alia, on the approval by

Shareholders at a general meeting to be held at 9.30 a.m. on 30

March 2015 at the offices of Covington & Burling LLP, 265

Strand, London WC2R 1BH (the "General Meeting") and on the

Admission of the Placing Shares to trading on AIM.

The Circular to Shareholders, including a notice convening the

General Meeting, will be dispatched shortly and will also be

available on the Company's website at

www.allergytherapeutics.com/.

Manuel Llobet, Chief Executive Officer, said:

"With the funds raised from the Placing, we are now focused on

progressing the clinical development of Pollinex Quattro Grass

through to FDA approval and planned launch in the US in 2019. We

have the opportunity to be the first FDA-licensed seasonal

subcutaneous immunotherapy allergy vaccine, and so access an

estimated $2 billion market. We are confident that the potential

benefits of our treatment, which should result in a safe and

effective vaccine following only an ultra-short dosing schedule,

will be a key differentiator when compared with other treatments

available in the market. This would, in turn, allow us potentially

to bring significant relief to the many moderate to severe grass

allergy patients in the US and thereby enable us to generate

significant value for our shareholders."

+44 (0) 1903 845

Allergy Therapeutics 820

Manuel Llobet, Chief Executive Officer

Ian Postlethwaite, Finance Director

+44 (0) 20 7886

Panmure Gordon 2500

Freddy Crossley / Peter Steel / Duncan Monteith,

Corporate Finance

Tom Salvesen, Corporate Broking

+44 (0) 20 3727

FTI Consulting 1000

Simon Conway

Victoria Foster Mitchell

All defined terms used in this announcement are defined in the

appendix to this announcement.

Additional details of the Placing

Introduction

The Company is pleased to announce that it proposes to raise

approximately GBP20.0 million (after expenses) by way of the

Placing with existing and new institutional investors, conducted by

Panmure Gordon. The Company will, pursuant to the Placing, issue

94,117,650 Placing Shares at a Placing Price of 22.1 pence per

share. The Placing is conditional, among other things, upon the

approval of the Resolutions by the Shareholders at the General

Meeting for the purposes of authorising the Directors to allot the

Placing Shares and to disapply statutory pre-emption rights in

relation thereto. The formal Notice of General Meeting is set out

at the end of the Circular.

Background to and reasons for the Placing

Overview

Allergy Therapeutics is a European-based, fully-integrated

specialty pharmaceutical company with a global footprint focused on

the treatment and prevention of allergic rhinitis with aluminium

free immunotherapies. The Company's core strategy is to create a

sustainable, fast-growing and profitable global specialty

pharmaceutical business with a substantial franchise in the allergy

sector through the development of innovative, patented, registered

therapies for both the treatment and prevention of allergy-related

conditions.

Allergy Therapeutics' products are sold into the immunotherapy

sector of the allergy market, which is worth $1.3bn worldwide

(Europe and the US being the main markets), and is forecast to grow

by approximately 90 per cent. between 2015 and 2020 (Visiongain, AR

Forecast 2014), the fastest growth within the allergy market.

Allergy Therapeutics sells an established range of diagnostics

and aluminium-free allergy immunotherapy vaccines primarily in

injectable (subcutaneous) plus oral (sublingual) formats. The

Company's key products include Pollinex Quattro, a proven and

highly differentiated ultrashort SCIT for grass, ragweed and tree

allergy, which accounted for approximately 51 per cent. of the

Group's reported revenues in the year ended 30 June 2014. Pollinex

Quattro was launched in 1999, transforming immunotherapy by

introducing an allergy vaccination with a short treatment period of

only four injections per course. The short treatment period is due

to the use of an improved extract allergen, modified in order to

lower its allergenicity while keeping its immunogenicity, and the

innovative adjuvant MPL, a substance which has been documented to

improve the immune response to an antigen or allergen and to which

Allergy Therapeutics has certain exclusive rights.

The Company has undertaken clinical studies on Pollinex Quattro

Grass, Ragweed and Tree respectively in the US which, in 2007, were

put on clinical hold by the FDA. The clinical hold for Pollinex

Quattro Grass was lifted in August 2012. The FDA has since

confirmed that data from the Phase I, Phase II and Phase III

studies remain valid and sufficient for the purposes of a BLA for

regulatory approval of the product in the US, subject to completion

of the further studies required, as discussed below.

Growth Strategy

The Company's business plan is to build a strong, sound and

profitable European base as the platform for global expansion, in

particular into the US. The Board's strategy to achieve this

objective includes:

-- Accelerating organic growth by leveraging the Company's infrastructure, for example by:

o increasing product penetration and market share in existing

geographies;

o launching existing products into new European markets and

through distribution into selected emerging markets;

o product registration using a mutual recognition process in new

European markets;

o developing enhanced allergy vaccines with improved dosing

characteristics and new delivery formulations; and

o launching new products in areas such as probiotics.

-- As they arise, reviewing inorganic growth opportunities:

o that would augment the Company's existing product portfolio

through new product acquisitions and/or entry into further

in-licensing agreements leveraging the Company's existing routes to

market;

o that would improve margins through synergistic acquisitions,

extending Allergy Therapeutics' vertical integration; and

o that would diversify the Company's activities in the specialty

pharmaceuticals field.

-- Undertaking clinical trials and seeking FDA regulatory

approval for a number of existing products, with primary initial

focus on Pollinex Quattro Grass, to capitalise on opportunities in

the US market, leveraging the significant investment the Company

has already made in research and development to date.

The US Opportunity

It is estimated that US allergy immunotherapy total spend,

including preparation and administration costs, was $2 billion in

2008 (Piper Jaffrey Investment Research), with over 80 million

people in the US having some type of allergy. The main pollen

allergens - grass, ragweed and trees - have prevalence on the

population of approximately 50 per cent., 30 per cent. and 26 per

cent. respectively. The US market, like Germany, is predominately

SCIT focused, but currently has no registered SCIT products.

Following FDA approval, Pollinex Quattro Grass would be the

first licensed seasonal SCIT allergy vaccine authorised for

marketing in the US. The Board believes that the availability of

FDA-approved standard vaccines could potentially grow this market

further due to increasing treatment penetration rates and the

introduction of short course treatments.

The Board is therefore of the view that prospects for Pollinex

Quattro could be significant and transformational for the Company

and, following the anticipated launch in 2019, the Board will set a

target of a substantial share of the estimated $2 billion market

over a four to five year period. To capitalise on the opportunity

in the US market, the Company intends to progress the clinical

development of Pollinex Quattro Grass by way of a further Phase III

study and other related studies. Once complete, this will enable

the submission of a BLA to gain FDA regulatory approval for the

product in the US.

The FDA has agreed in principle the synopses and is now

reviewing the full protocol and statistical analysis to allow the

clinical development to start; this permission is expected to be

granted during March 2015. Based on the clinical development

programme remaining on the Company's anticipated timeline and

subject to the FDA's permission, the Company is seeking to launch

Pollinex Quattro Grass in the US during 2019.

Use of proceeds

The Directors intend that the net proceeds of the Placing, being

approximately GBP20.0 million, will be used by the Company

principally to fund the clinical development of Pollinex Quattro

Grass through to FDA approval by way of a BLA. In particular, the

net proceeds will fund the following key stages of the

programme:

-- undertaking a Safety Study on the planned dosage of Pollinex Quattro Grass;

-- performance of a Pilot Study to select the best cumulative dosage;

-- undertaking an Environmental Exposure Chamber Phase III

Efficacy Study, as required for the BLA; and

-- performance of a Patient Registry Study to provide a safety

data set, as currently required for the BLA.

Following the BLA submission, the Board anticipates that the

remainder of the programme financing requirement will be funded by

the Company's future cash generation.

Results and current trading

The Company announced its unaudited half yearly results for the

six month period ended 31 December 2014 on 2 March 2015 available

on the Company's website at

http://www.allergytherapeutics.com/investor-relations.aspx. As in

previous years, owing to the seasonality of the pollen allergy

market, approximately 60 to 70 per cent. of the Company's revenues

are generated in the first half of the financial year and, as a

consequence, the Company typically records profits in the first

half of the year and losses in the second half. While markets in

Europe are expected to remain flat in the near future, the Company

will continue to drive further market penetration with a portfolio

of short and ultrashort course aluminium free allergy vaccines,

which are increasingly becoming the treatment of choice with

prescribers. The Directors believe that this should allow the

Company to improve margins through leveraging the improved

manufacturing facilities that the Company has put in place, and

remain excited about the prospects for the future.

Details of the Placing

The Company is proposing to raise approximately GBP20.0 million

(after fees and expenses) by way of a conditional, non-pre-emptive

placing of 94,117,650 new Ordinary Shares at the Placing Price. The

Placing Price represents a discount of approximately 10.0 per cent.

to the closing mid-market price over the previous 60 trading days

up to and including 5 March 2015. The Placing Shares will represent

approximately 17.2 per cent. of the Enlarged Issued Share

Capital.

In order to broaden the Company's institutional shareholder base

and to minimise the time and transaction costs of the Placing, the

Placing Shares are only being placed by Panmure Gordon with a

limited number of existing and new institutional shareholders. The

Placing Shares are not being made available to the public.

The Board believes that raising equity finance using the

flexibility provided by a non-pre-emptive placing is the most

appropriate and optimal structure for the Company at this time.

This allows both existing institutional holders and new

institutional investors the opportunity to participate in the

Placing and avoids the requirement for a prospectus, which is a

costly and time-consuming process.

The Placing Agreement

In connection with the Placing, the Company has entered into a

Placing Agreement pursuant to which Panmure Gordon has agreed, in

accordance with its terms, to use reasonable endeavours to procure

subscribers for the Placing Shares at the Placing Price. The

Placing is not underwritten. In accordance with the terms of the

Placing Agreement, the Placing is conditional upon, amongst other

things, the passing of the Resolutions, Admission occurring on 1

April 2015 (or such later date as the Company and Panmure Gordon

may agree, not being later than 15 April 2015). The Placing

Agreement is terminable by Panmure Gordon in certain circumstances

up until the time of Admission

Application will be made to the London Stock Exchange for the

Placing Shares to be admitted to trading on AIM. Subject to the

passing of the Resolutions at the General Meeting, it is expected

that admission to AIM will become effective in respect of, and that

dealings on AIM will commence in, the Placing Shares, on or around

1 April 2015.

The Placing Shares will be issued credited as fully paid and

will be identical to and rank pari passu in all respects with the

Existing Ordinary Shares, including the right to receive all future

distributions declared, paid or made in respect of the Ordinary

Shares following the date of Admission.

Related Party Transaction

Where a company enters into a related party transaction, under

the AIM Rules the independent directors of the company are

required, after consulting with the company's nominated adviser, to

state whether, in their opinion, the transaction is fair and

reasonable in so far as its shareholders are concerned.

As at the date of the Circular, Beagle Partners LLP ("Beagle

Partners") has an interest in 112,289,283 Ordinary Shares (on

behalf of Southern Fox Investments Limited as its investment

manager), representing 27.4 per cent. of the issued share capital

of the Company. Beagle Partners has subscribed GBP2.8 million for

12,669,500 Ordinary Shares in the Placing. The issue of Ordinary

Shares to Beagle Partners constitutes a related party transaction

under Rule 13 of the AIM Rules for Companies.

The Directors, having consulted with Panmure Gordon, the

Company's nominated adviser, consider that the terms of Beagle

Partners' participation in the Placing are fair and reasonable

insofar as the shareholders are concerned.

Convertible Loan Notes

The Convertible Loan Notes are repayable in accordance with

their terms on 31 March 2015. On repayment, CFR International is

required to apply the principal sum repaid of GBP4,042,489 in

subscribing for 41,674,938 Conversion Shares at 9.7 pence per

share. CFR International and Yissum Holding are direct and indirect

wholly owned subsidiaries respectively of CFR Pharmaceuticals. On

26 September 2014, Abbott Laboratories, through a series of

controlled undertakings, acquired a 99.9 per cent. interest in the

shares of CFR Pharmaceuticals. The interests of Abbott Laboratories

(the ultimate owner of CFR International and Yissum Holding) in the

Existing Ordinary Shares and the Enlarged Issued Share Capital are

set out below:

% of % of Enlarged

No. Ordinary Existing No. Placing No. Conversion No. Ordinary Issued

Shares currently Ordinary Shares Shares Shares held Share

held Shares issued issued on Admission Capital

CFR International 61,417,845 14.98% - 41,674,938 103,092,783 18.89%

Yissum Holding 137,491,788 33.54% - - 137,491,788 25.19%

Total: 198,909,633 48.51% - 41,674,938 240,584,571 44.08%

On 30 March 2012, Allergy Therapeutics published a circular (the

"2012 Circular") convening a general meeting held on 19 April 2012

in which Shareholders approved the issue of the Convertible Loan

Notes and a waiver of the obligation that would otherwise arise on

CFR International, pursuant to Rule 9 of the Takeover Code, to make

a general offer to the shareholders of the Company at such time as

the Conversion Shares are issued to CFR International.

At the time of the issue of the Convertible Loan Notes, Manuel

Llobet and Alejandro Weinstein Jr, (Allergy Therapeutics' Chief

Executive Officer and a former non-executive Director of the

Company respectively) were, as described in the 2012 Circular,

deemed to be acting in concert with CFR International, CFR

Pharmaceuticals, Yissum Holding and certain other parties.

Following the sale of the Weinstein Family's controlling interest

in CFR Pharmaceuticals to Abbott Laboratories in September 2014,

Alejandro Weinstein Jr stepped down from the Board on 8 October

2014. As such, Mr Llobet and his associates, being Natacha Olarte,

Joshua Llobet, Antua Llobet and Wild Indigo, are no longer deemed

to be acting in concert with CFR International, CFR Pharmaceuticals

and Yissum Holding.

CFR International and Yissum Holding will, on Admission, be

interested in 240,584,571 Ordinary Shares, representing 44.1 per

cent. of the Company's Enlarged Issued Share Capital. Rule 9 of the

Takeover Code provides that, among other things, where any person

who, together with persons acting in concert with him, is

interested in securities which in aggregate carry not less than 30

per cent. but do not hold shares carrying more than 50 per cent. of

the voting rights of a company which is subject to the Takeover

Code, and such person, or any person acting in concert with him,

acquires an additional interest in securities which increases the

percentage of securities carrying voting rights in which he is

interested, then such person is normally required to make a general

offer to all the holders of any class of equity share capital or

other class of transferable securities carrying voting rights of

that company to acquire the balance of their interests in the

company. An offer under Rule 9 of the Takeover Code must be in cash

(or with a cash alternative) and at the highest price paid within

the preceding 12 months for any shares. On issue of the Conversion

Shares, no such obligations under Rule 9 shall become due.

Application will be made to the London Stock Exchange for the

Conversion Shares to be admitted to trading on AIM and it is

expected that admission will become effective in respect of, and

that dealings on AIM will commence in, the Conversion Shares, on 1

April 2015. The Conversion Shares will be issued credited as fully

paid and will be identical to and rank pari passu in all respects

with the Existing Ordinary Shares, including the right to receive

all future distributions declared, paid or made in respect of the

Ordinary Shares following the date of Admission.

General Meeting

A notice convening a General Meeting of Allergy Therapeutics

plc, to be held at the offices of Covington & Burling LLP, 265

Strand, London WC2R 1BH on 30 March 2015 at 9.30 a.m., for the

purpose of considering and, if thought fit, passing the proposed

resolutions, will be set out at the end of the Circular. At this

meeting, an ordinary resolution will be proposed to authorise the

Directors under section 551 of the Companies Act 2006 to allot

94,117,650 Ordinary Shares and a special resolution will be

proposed to authorise the Directors under section 570 of the

Companies Act 2006 to allot 94,117,650 Ordinary Shares pursuant to

the Placing on a non-pre-emptive basis.

Action to be taken

Shareholders will find enclosed with the Circular a form of

proxy for use at the General Meeting. It is important that you

complete and sign the enclosed form of proxy in accordance with the

instructions printed thereon.

Recommendation by the Directors and Irrevocable Undertakings

The Directors believe that the Placing is in the best interest

of the Company and its Shareholders as a whole. Accordingly, the

Directors unanimously recommend that Shareholders vote in favour of

the Resolutions to be proposed at the General Meeting as the

Directors have irrevocably undertaken to do in respect of their own

beneficial holdings amounting to, in aggregate, 5,381,513 Ordinary

Shares, representing approximately 1.3 per cent. of the Existing

Ordinary Shares.

In addition to the Directors, Abbott Laboratories (on behalf of

CFR International and Yissum Holding) and Beagle Partners (on

behalf of Southern Fox Investments Limited as its investment

manager) have irrevocably undertaken to vote in favour, or procure

the vote in favour, of the Resolutions in respect of the Existing

Ordinary Shares in which they are interested, amounting to

61,417,845 Ordinary Shares, 137,491,788 Ordinary Shares and

112,289,283 Ordinary Shares respectively, representing, in

aggregate, approximately 75.9 per cent. of the Existing Ordinary

Shares.

Panmure Gordon (UK) Limited, which is authorised and regulated

in the United Kingdom by the Financial Conduct Authority, is acting

exclusively for Allergy Therapeutics plc in relation to the

transaction referred to in this announcement. Panmure Gordon (UK)

Limited is not acting for, and will not be responsible to, any

person other than Allergy Therapeutics plc for providing the

protections afforded to customers of Panmure Gordon (UK) Limited or

for advising any other person on the contents of this announcement

or any transaction or arrangement referred to herein. Panmure

Gordon (UK) Limited has not authorised the contents of any part of

this announcement and neither accepts liability whatsoever for the

accuracy of any information or opinion contained in this

announcement or for the omission of any material information from

this announcement for which the Company is responsible. No

representation or warranty, express or implied, is made by Panmure

Gordon (UK) Limited as to any of the contents of this

announcement.

The distribution of this announcement in jurisdictions other

than the United Kingdom may be restricted by law and therefore

persons into whose possession this document and/or accompanying

documents come should inform themselves about and observe any such

restrictions. Any failure to comply with any such restrictions may

constitute a violation of the securities laws or regulations of

such jurisdictions. In particular, subject to certain exceptions,

this announcement should not be distributed, forwarded to or

transmitted in or into the United States (as defined in Regulation

S of the United States Securities Act of 1933, as amended

("Regulation S") or Australia, Canada, Japan, the Republic of South

Africa and New Zealand (the "Excluded Jurisdictions"). None of the

Placing Shares have been, nor will they be, registered in the

United States under the United States Securities Act of 1933 (the

"Securities Act"), as amended, or under the securities laws of any

of the Excluded Jurisdictions and, subject to certain exceptions,

they may not be offered or sold directly or indirectly within or

into the Excluded Jurisdictions or to, or for the account or

benefit of, any national, citizen or resident of the Excluded

Jurisdictions. Subject to certain exceptions, none of the Placing

Shares may be offered or sold, directly or indirectly, in the

United States or to, or for the account or benefit of, U.S. persons

(as such terms are defined in Regulation S under the Securities

Act). This announcement does not constitute an offer to sell or

issue or the solicitation of an offer to buy or subscribe for

Placing Shares in any jurisdiction in which such offer or

solicitation is unlawful.

DEFINITIONS

The following definitions apply throughout this announcement,

unless the context requires otherwise:

Abbott Laboratories Abbott Laboratories

Admission the admission of the Placing Shares and the

Conversion Shares to trading on AIM becoming

effective in accordance with the AIM Rules

AIM the AIM market operated by the London Stock

Exchange

AIM Rules the AIM Rules for Companies published by

the London Stock Exchange

BLA biological licence application

CFR International CFR International SpA, incorporated in Chile

and whose registered number is 76116262-4

and whose registered office address is Pedro

de Valdivia Av. Number 295, Providencia,

city of Santiago, Chile

CFR Pharmaceuticals CFR Pharmaceuticals S.A., incorporated in

Chile and whose registered office address

is de Valdina Av. Number 295, Providencia,

city of Santiago, Chile

Circular a circular to Shareholders to be sent on

10 March 2015, including a notice convening

the General Meeting

Company or Allergy Allergy Therapeutics plc whose registered

Therapeutics number is 05141592 and whose registered office

address is Dominion Way, Worthing, West Sussex

BN14 8SA

Conversion Shares the 41,674,938 new Ordinary Shares to be

issued to CFR International at the issue

price of 9.7 pence per share on redemption

of the Convertible Loan Notes

Convertible Loan Notes the 4,042,469 convertible loan notes of GBP1

each issued pursuant to the Convertible Loan

Note Instrument and held by CFR International

Convertible Loan Note the convertible loan note instrument executed

Instrument by the Company on 30 March 2012, as amended

CREST the relevant system (as defined in the Uncertificated

Securities Regulations 2001) in respect of

which Euroclear UK & Ireland Limited is the

operator (as defined in those regulations)

Directors or the Board the board of directors of the Company as

at the date of this announcement

Enlarged Issued Share the issued ordinary share capital of the

Capital Company immediately following Admission

Euroclear Euroclear UK & Ireland Limited, the operator

of CREST

Existing Ordinary the 410,055,331 Ordinary Shares in issue

Shares at the date of this announcement, all of

which are admitted to trading on AIM

FCA the Financial Conduct Authority

FDA Food and Drug Administration, the US governmental

agency responsible for the evaluation of

medicines

General Meeting the general meeting of the Company convened

for 9.30 a.m. on 30 March 2015 (or any adjournment

thereof), pursuant to the Notice of Meeting

Group the Company and its Subsidiaries

London Stock Exchange London Stock Exchange plc

MPL monophosphoryl-lipid A

Notice of Meeting the notice of the General Meeting

Ordinary Shares ordinary shares of 0.1 pence per share each

in the capital of the Company

Panmure Gordon Panmure Gordon (UK) Limited

Placing the placing of the Placing Shares at the

Placing Price pursuant to the Placing Agreement

Placing Agreement the conditional agreement dated 9 March 2015

and made between Panmure Gordon and the Company

in relation to the Placing

Placing Price 22.1 pence per Placing Share

Placing Shares the 94,117,650 new Ordinary Shares to be

issued pursuant to the Placing

GBP and pence respectively pounds and pence sterling, the

lawful currency of the United Kingdom

Resolutions the resolutions set out in the Notice of

Meeting

SCIT subcutaneous immunotherapy

Shareholder a holder of Ordinary Shares

Subsidiaries the subsidiaries of the Company

Takeover Code the City Code on Takeovers and Mergers

United Kingdom the United Kingdom of Great Britain and Northern

Ireland

US or United States the United States of America, each state

thereof, its territories and possessions,

and all areas subject to its jurisdiction

Yissum Holding Yissum Holding Limited, incorporated in Malta

and whose registered number is C50641 and

whose registered office address is Tower

Business Centre, Level 1, Suite 5, Tower

Street, Swatar, Birkirkara BKR 4013, Malta

This information is provided by RNS

The company news service from the London Stock Exchange

END

IOEXKLLBEXFBBBX

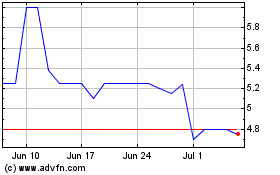

Allergy Therapeutics (LSE:AGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Allergy Therapeutics (LSE:AGY)

Historical Stock Chart

From Apr 2023 to Apr 2024