TIDMAGY

RNS Number : 3269R

Allergy Therapeutics PLC

08 March 2016

Allergy Therapeutics plc

("Allergy Therapeutics" or "the Company")

Interim Results for the six months ended 31 December 2015

Allergy Therapeutics plc (AIM:AGY), the fully integrated

specialty pharmaceutical company specialising in allergy vaccines,

announces unaudited interim results for the six months ended 31

December 2015.

Highlights

Financial highlights

-- Revenue increased by 12% at constant currency to GBP31.5m (H1

2015: GBP28.2m)* and reported revenue increased by 3% to GBP29.0m

(H1 2015: GBP28.2m)

-- R&D expenditure increased to GBP6.5m (H1 2015: GBP1.1m)

as the two Phase II studies in Germany and the US were successfully

progressed

-- Fundraising of GBP11.5m (gross) successfully completed with

placing of 41,005,500 ordinary shares in the Company to invest in

new product development, strengthen the balance sheet and

accelerate growth

-- Cash balance bolstered to GBP33.2m (H1 2015: GBP8.0m)

Products and pipeline highlights

-- Increasing market share in all major markets

-- Spanish Alerpharma acquisition fully integrated

-- US Phase II study for GrassMATAMPL (marketed in Europe as

Pollinex Quattro Grass product) initiated in December 2015 - on

track for data read out in H2 2016

-- PQ Birch204 Phase II study patient enrolment completed - results expected in H2 2016

-- Acquisition of Virus Like Particles ("VLP") technology

licence for the development of a potential new injectable vaccine

immunotherapy treatment for allergy sufferers, with peanut as the

lead project

-- Positive house dust mite study results for Acarovac - July 2015

Post period end highlights

-- US Grass MATAMPL study fully recruited according to plan in February 2016

Commenting on the interim results, Manuel Llobet, Chief

Executive Officer, said:

"The first half of this year has seen continued momentum with

our product sales continuing to outperform the market with further

market share gains across Europe. We delivered 12% revenue growth

at constant currency. This double-digit growth against a (broadly)

flat market has been driven by a combination of our winning

proposition of lifestyle enhancing short course aluminium-free

vaccines boosted by our successful sales strategy.

"Our business is gaining significant scale and momentum in

Europe through both organic and acquisitive growth and we expect

this to continue as we further invest in our commercial

infrastructure and prepare to take our products over to the US. We

eagerly await the data from two ongoing Phase 2 studies for

GrassMATAMPL and PQ Birch204 which are both due to report later in

2016. "

* Constant currency uses prior year weighted average exchange

rates to translate current year foreign currency denominated

revenue to give a year on year comparison excluding the effects of

foreign exchange movements. See table in financial review for an

analysis of revenue.

Joint Statement from the Chairman and Chief Executive

Officer

Operating Review

Overview

During the first six months of the year, the Company's revenues

grew 12% (at constant currency) compared to 11% at the end of June

2015, and against flat or low growth markets in Europe. Allergy

Therapeutics' robust level of double digit top line growth at

constant currency is due to the benefits offered to patients of a

short course, aluminium-free, therapy which is enabling the Company

to outperform its competitors and grow its market share in Europe.

Geographically, the major contributing markets to the Company's

growth have been Germany and Spain, followed by The Netherlands,

the UK and Austria.

Pollinex Quattro - increasing market share in Europe and paving

the way towards the US market

The success of Allergy Therapeutics' immunotherapy concept is a

key driver of shareholder value creation. Future sales growth will

further de-risk the Company's strategic objective of significantly

increasing its addressable market, as it prepares to replicate

Pollinex Quattro's commercial success in Europe through its launch

in the US market. Given that Pollinex Quattro is already

established in Europe, the Board and management team are confident

of commercial success in the US, where Pollinex Quattro will enjoy

first mover advantage in the seasonal segment, and high barriers to

entry, fulfilling a clearly defined market need.

The clinical development programme for Pollinex Quattro Grass in

the US is now progressing well. In December 2015, Allergy

Therapeutics announced the initiation of the Phase II study (G204)

for grass allergy and the Company continues to expect to file for

US FDA approval at the end of 2018. Following approval, the launch

of Pollinex Quattro Grass in the US would enable the Company to

enter into a market for specific immunotherapy potentially worth $2

billion. Like its core adoptive European markets, the US allergy

immunotherapy market has historically been serviced by subcutaneous

rather than sublingual compounded vaccines. Allergy Therapeutics is

therefore confident that the availability of an FDA-approved

subcutaneous vaccine will facilitate a fast penetration and broad

acceptance of the product among the prescriber base.

Regulatory affairs - moving the pipeline forward

Allergy Therapeutics' regulatory department has made good

progress throughout the period, including with the German TAV

(Therapy Allergy Ordinance) process for the Pollinex Quattro Birch

(PQB) vaccine clinical development programme. In November, the

Company announced completion of patient enrolment of the PQB 204

Phase II study with headline data expected in the second half of

2016. The target sample of 350 patients was successfully achieved

and the active phase of the study is now complete. The endpoint of

the trial is the change in total rhinoconjunctivitis symptoms score

after treatment relative to the placebo. The optimal dose

established from the trial will be selected and examined further in

the PQ Birch phase III study, due to start in the first quarter of

2017. The completion of the phase III study is expected to fulfil

the requirements for the initial clinical programme under the TAV

of the Paul Ehrlich Institute (PEI), the German Biologics Agency,

and lead to marketing authorisation approval of this subcutaneous

immunotherapy (SCIT) in 2019. Allergy to birch pollen is a

significant health issue with around 6 per cent of the population

in Europe being skin-prick positive for the allergen.

The Company has maintained a proactive dialogue with the

regulatory authorities in its key markets including Germany, Italy,

Spain and Austria.

Progress with new high value projects

Allergy Therapeutics' organic growth strategy has been enhanced

during the period by a number of high value projects which will

further leverage the Company's operational infrastructure and

scientific know-how. These projects seek to replicate the success

of the Company's short course and ultra-short course

immunotherapies in other related areas such as Perennial Allergic

Rhinitis and Food Allergies, and develop further vaccine

formulations using the Micro Crystalline Tyrosine (MCT) adjuvant

system. These projects will open up new areas of the immunotherapy

treatment market and increase the Company's total addressable

market, fivefold, to c. $15 billion p.a., including:

-- VLP - peanut allergy

Taking the newly-acquired Virus like Particles (VLP) technology

license for the development of Polyvac Peanut, a new potential

injectable vaccine immunotherapy treatment for allergy sufferers,

into Phase I clinical trials. As previously announced, food allergy

represents a significant and strategically important new area for

the Company, with peanut allergy treatments alone being an $8

billion p.a. addressable market, globally.

Peanut allergy affects an increasing number of sufferers with a

significant unmet need. Polyvac Peanut could be the first

subcutaneous vaccine to address this segment, delivering a

sustained immunological response and bringing relief to peanut

allergy sufferers around the world.

-- Acarovac Quattro - dust mite allergy

Progressing the in-house development of Acarovac Quattro, a

treatment for perennial dust mite allergy, through Phase I clinical

trials and to launch in Spain on a named patient basis targeted for

2017. Acarovac Quattro uses the same technological platform as

Pollinex Quattro and will bring to the perennial segment

unmatchable attributes in terms of patient convenience. The product

will reduce the current number of annual injections required

compared to current products in the market, providing a unique,

natural, biodegradable, alternative depot vaccine, boosted by the

MPL adjuvant Monophosphoryl Lipid A, which Allergy Therapeutics

holds exclusive rights to use in allergy vaccines. The development

of Acarovac Quattro builds on the success of the already launched

Acarovac Plus vaccine in the Spanish market as a Named Patient

Product (NPP).

In July, during the Adjuvants in Allergy Conference in

Amsterdam, Dr Albert Roger, Director of the Allergy Unit at

Hospital Germans Trias i Pujol, presented the results of a

prospective observational one-year follow-up study comparing the

safety, tolerability and long-term effectiveness of Acarovac Plus

using Dermatophagoides pteronyssinus (house dust mite) in 30

patients with allergic rhinitis and/or asthma. Tolerability was

demonstrated, along with a reduction in symptom scores of more than

50 per cent during follow up visits after one year. This novel

efficacious mite SCIT product underpins EU wide product development

plans for Acarovac Quattro. House Dust Mite is the world's most

common cause of allergy and is estimated to affect over 90 million

people in Europe, North America and Japan alone. With a $3-4

billion per annum global addressable market, house dust mite

represents another significant and strategically important area for

the Company.

-- Immunomodulators and adjuvants

(MORE TO FOLLOW) Dow Jones Newswires

March 08, 2016 02:01 ET (07:01 GMT)

Various feasibility studies are in progress in the fields of

immunomodulators and adjuvants; specifically including the use of

symbiotics in allergy response and MCT as an adjuvant system with

other vaccines for treating infection and illness. The Company

presented data relating to the use of this patented adjuvant

technology at the World Vaccine Congress in November 2015. The data

supported the use of depot adjuvant MCT in novel vaccine candidate

formulations including malaria and influenza. The data was

established following active collaboration with Oxford University,

The Jenner Institute and Public Health England.

Inorganic growth strategy and successful integration of

M&A

The Company's acquisitive growth strategy has continued to

progress on track, with the successful integration of the recently

acquired Spanish company, Alerpharma, into the Company's Spanish

Operations. Alerpharma is now fully integrated, and the optimal

operational platform has been established for Allergy Therapeutics

to become a leading company in the important specific immunotherapy

Spanish market.

The Company continues to assess a number of inorganic

opportunities against a rigid set of qualifying criteria.

Equity fundraising

In order to capitalise on the continued momentum across the

business, the successful organic and acquisitive growth strategies

and management's objective of further accelerating the pace of

increasing market share the Company completed a fundraise in

November 2015, raising GBP11.5m (before costs) by placing

41,005,500 New Shares, representing approximately 7.5 per cent of

the Company's existing ordinary share capital. The placing was

oversubscribed and will enable Allergy Therapeutics to capitalise

on growth opportunities and diversify into adjacent and

complementary areas, with the aim of achieving a five-fold

step-change in the Company's total addressable market to

approximately $15 billion p.a. as detailed above.

Increased manufacturing efficiencies and automation

Additionally, work has been ongoing in the Company's

manufacturing facilities to enhance processes for efficiency and

compliance. The use of bar codes to check and reconcile named

patient vaccines, controlled issue to packing lines and a

redesigned diagnostic despatch process have all been implemented.

Allergy Therapeutics also recorded its first successful batch

release by the PEI for machine-filled Pollinex Quattro Tree with

Grass. This enables the Company to transfer a large percentage of

manufacturing for Pollinex Quattro away from a manual process and

this switch will be made starting in autumn 2016.

Pride in patient care

The Company has worked to ensure as many of its diagnostic

licences as possible can be retained in Germany. This retains its

intellectual property and has enabled the Company to reintroduce 31

allergens during 2015 which are now available for all markets.

Having a broad range of well-standardised and characterised allergy

diagnostics has been a strategic priority for Allergy Therapeutics

in order to provide the best possible service to its customers.

Pioneering works on development of the proteomics and allergomics

concepts (published in the World Allergy Journal in August 2015)

underpins the Company's track record in the scientific advancement

of its product portfolio, reinforcing its focus on patient care and

commitment to invest both in existing and future products to ensure

patients receive the treatment they deserve.

Excellence in customer service

The Company's Supply Operations in Worthing have been working on

customer service to ensure the best possible response for

customers. This was one of the Company's key strategic objectives

in 2014-15 and it has culminated in 100 per cent customer service

satisfaction in November 2015, with an average customer service

achieved of 99 per cent for named patient vaccines delivered on

time. The Company has been servicing increased demand and has had

no out of stock allergens for vaccine manufacture during the first

half year. The Company has targeted on time delivery, which include

Pollinex or Venomil to affiliates/distributors, at 99-100 per cent

and is fulfilling this objective.

Financial Review

Reported revenues for the first half of the financial year were

GBP29.0m (H1 2015: GBP28.2m), representing a growth of 3 per cent,

despite low to flat markets in Europe, reported after taking into

account currency movements; the negative impact on revenues from

the weakening Euro being GBP2.5m. At constant currency, revenue

growth is 12 per cent for the period, with first half revenues of

GBP31.5m (H1 2015: GBP28.2m). This double digit sales growth has

been driven primarily by the Company's improving trading

performance as it continues to increase its market share in all of

its main markets, supported by the acquisition of Alerpharma in

June 2015 which added approximately 3 per cent of the reported

sales growth.

A reconciliation between reported revenues and revenues in

constant currency is provided in the table below:

6 months to 6 months to Increase Increase

31-Dec-15 31-Dec-14

GBPm GBPm GBPm %

Revenue 29.0 28.2 0.8 3%

Adjustment to retranslate to prior year foreign exchange 2.5 -

rate

------------------------------------------------------------ ------------ ------------------ ----------- ---------

Revenue at constant currency 31.5 28.2 3.3 12%

Add rebates at constant currency 2.6 2.0 0.6

------------------------------------------------------------ ------------ ------------------ ----------- ---------

Gross revenue at constant currency 34.1 30.2 3.9 13%

As in previous years, owing to the seasonality of the pollen

allergy market, between 60 per cent to 70 per cent of Allergy

Therapeutics' revenues are generated in the first half of the

financial year and, as a consequence, the Company typically records

profits in the first half of the year and losses in the second

half.

Cost of goods sold increased marginally in the period to GBP7.3m

(H1 2015: GBP6.8m), due mainly to inflationary increases and the

acquisition of Alerpharma. Gross profit improved to GBP21.6m (H1

2015: GBP21.4m), which represents a gross margin of 75 per cent (H1

2015: 76 per cent), a good result given the foreign exchange impact

on sales.

Distribution costs of GBP9.8m (H1 2015: GBP8.9m) were higher

than the previous period after taking into account impacts on

overseas costs as Alerpharma costs were included for the first time

and a number of sales representatives have been added throughout

Europe to help accelerate revenue growth, less the positive impact

of foreign exchange. Administration expenses of GBP3.9m (H1 2015:

GBP3.9m) remained the same, and included the benefit of the

stronger dollar revaluing US dollar deposits favourably by GBP1.1m,

less the negative impact of the fair valuation of Euro denominated

derivatives (GBP0.8m).

Research and development costs increased to GBP6.5m (H1 2015:

GBP1.1m), as the two Phase II studies in Germany and the US were

progressed within the period.

The tax charge in the period of GBP0.2m (H1 2015: GBP0.1m)

relates to overseas subsidiaries and the increase reflects the

growing profitability of the subsidiaries.

Property, plant and equipment increased by GBP2.0m to GBP8.8m as

a result of the acquisition of Alerpharma. Excluding this, the

depreciation charge for the period broadly equalled new equipment

purchases. Goodwill increased to GBP3.1m with the acquisition of

Alerpharma (H1 2015: GBP2.5m), whilst other intangible assets have

risen by GBP0.7m, again mainly as a result of the Alerpharma

purchase.

Total current assets excluding cash have increased by GBP0.3m to

GBP14.0m (H1 2015: GBP13.7m). This is mainly due to an increase in

inventory.

Retirement benefit obligations, which relate solely to the

German pension scheme, decreased slightly to GBP7.5m (H1 2015:

GBP7.6m) as a result of the movement in the GBP:EUR exchange

rate.

Net cash generated by operations remained positive, although was

significantly lower as a result of increased R&D spending, with

a reported inflow of GBP0.6m (H1 2015: GBP6.5m).

Financing

In November 2015, 41,005,500 new ordinary shares of 0.1 pence

each ("Ordinary Shares") were placed with investors raising

proceeds of GBP11.5m before expenses (GBP11.0m net). The Company

will use the placing proceeds to invest in new product development

with a view to achieving a step change in the size of its total

addressable markets, strengthen its balance sheet and accelerate

growth.

The Group had no debt on its balance sheet at the close of the

financial year other than the loans acquired as a result of the

Alerpharma acquisition (GBP1.6m). The seasonal overdraft had been

fully repaid in November 2015. The Company expects to renew its

banking facilities when they are due for review in April 2016.

The Directors believe that the Group will have adequate

facilities for the foreseeable future and accordingly they have

applied the going concern principle in preparing these interim

financial statements.

Movements in the currency markets between the respective values

of the Euro and Sterling have an effect on the Company's

operations. The Company manages its cash exposure in this respect

by foreign currency hedges. Over 90 per cent of our gross sales are

denominated in Euros whereas approximately 50 per cent of costs are

incurred in the United Kingdom and denominated in Sterling.

Other Matters

(MORE TO FOLLOW) Dow Jones Newswires

March 08, 2016 02:01 ET (07:01 GMT)

As disclosed in Note 4 (Contingent liabilities), on 23 February

2015, the Company received notification that The Federal Office for

Economics and Export ("BAFA") had made a decision to reverse their

preliminary exemption to the increased manufacturers rebate in

Germany for the period July to December 2012. The Company was

granted a preliminary exemption to the increased rebate for this

period by BAFA in 2013. The Company recognised revenue of EUR1.4m

(GBP1.1m) against this exemption in the year ended 30 June 2013.

All other preliminary exemptions (granted for periods up to 30 June

2012) have previously been ratified as final by BAFA. After taking

legal advice, the Company has lodged an appeal against this

decision and is confident that the exemption will be re-instated.

Therefore, as at 31 December 2015, no provision has been recognised

for the repayment of the rebate refund. This position will be kept

under review.

The European Commission has concluded its investigation into

whether the exemption of pharmaceutical manufacturers from the

increase in rebates in Germany constitutes state aid. The European

Commission has determined that the exemptions do not constitute

state aid. Subsequent to this announcement, the Group has been

advised that an appeal has been lodged at the EU Court against this

decision. If successful, and the exemptions are determined to be

illegal state aid, then the exemption refunds may have to be

repaid. The maximum sum to be repaid would be approximately GBP5m

(including the GBP1.1m referred to above); however, the Group

considers this to be an unlikely outcome and consequently has not

recognised any contingent liability.

Outlook

Allergy Therapeutics' lifestyle-enhancing short course and

ultra-short course products continue to gain market share in Europe

and the Company remains on course with its plan to become a leading

player in the global specific immunotherapy market. Whilst its main

markets are exhibiting flat or low growth, the Company believes it

can continue to outperform competitors and keep increasing market

share, aiming to grow its European business at low double digit

rate over the coming years, supported by an enhanced commercial

infrastructure and expanding product portfolio.

In the US, following the GBP20m (net of expenses) fundraising in

March 2015, the Company has restarted clinical development plans,

aiming to enter the US market following FDA approval in 2019,

thereby becoming the first company to launch a subcutaneous vaccine

in the seasonal segment of the US allergic rhinitis market.

The Company's US commercialisation strategy is where significant

growth potential lies and, with a reinforced balance sheet, the

Company is well placed to build a fast growing, profitable

international allergy solutions business.

We look forward to the future with confidence.

Peter Jensen

Chairman

Manuel Llobet

Chief Executive Officer

7 March 2016

ALLERGY THERAPEUTICS PLC

Consolidated income statement

Note 6 months 6 months 12 months

to to to

31 Dec 31 Dec 30 Jun

2015 2014 2015

GBP'000 GBP'000 GBP'000

2

unaudited unaudited audited

Revenue 28,959 28,183 43,230

Cost of sales (7,328) (6,796) (12,179)

---------- ---------- -------------

Gross profit 21,631 21,387 31,051

Sales, marketing and distribution

costs (9,842) (8,874) (17,060)

Administration expenses

- other (3,879) (3,926) (10,218)

Research and development

costs (6,537) (1,065) (3,121)

---------- ---------- -------------

Administration expenses (10,416) (4,991) (13,339)

Other income - - 73

Operating profit 1,373 7,522 725

Finance income 84 1 147

Finance expense (154) (110) (218)

---------- ---------- -------------

Profit before tax 1,303 7,413 654

Income tax (249) (108) (546)

---------- ---------- -------------

Profit for the period 1,054 7,305 108

========== ========== =============

Earnings per share 3

Basic (pence per share) 0.19p 1.62p 0.02p

Diluted (pence per share) 0.18p 1.54p 0.02p

Consolidated statement of

comprehensive income

6 months 6 months 12 months

to to to

31 Dec 31 Dec 30 Jun

2015 2014 2015

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Profit for the period 1,054 7,305 108

Items that will not be reclassified

subsequently to profit or

loss:

Remeasurement of net defined

benefit liability (255) (1,137) (932)

Remeasurement of investments-retirement

benefit

assets (51) 44 8

Items that will be reclassified

subsequently to profit or

loss:

Exchange differences on

translation of foreign operations 366 (35) (119)

Total comprehensive income/

(loss) 1,114 6,177 (935)

========== ========== ==========

Consolidated balance sheet

31 Dec 31 Dec 30 Jun

2015 2014 2015

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Assets

Non-current assets

Property, plant and equipment 8,787 6,785 8,750

Intangible assets - Goodwill 3,053 2,454 2,980

Intangible assets - Other 1,925 1,192 2,020

Investment - Retirement

benefit asset 3,451 3,348 3,160

Deferred taxation asset - 174 -

Total non-current assets 17,216 13,953 16,910

Current assets

Trade and other receivables 7,141 7,236 5,060

Inventory 6,826 6,318 6,747

Cash and cash equivalents 33,206 7,985 21,199

3 163 783

Derivative financial instruments

Total current assets 47,176 21,702 33,789

Total assets 64,392 35,655 50,699

---------- ---------- ---------

Liabilities

Current liabilities

Trade and other payables (7,906) (6,227) (7,169)

Current borrowings (262) (49) (251)

Total current liabilities (8,168) (6,276) (7,420)

Net current assets 39,008 15,426 26,369

---------- ---------- ---------

Non current liabilities

Retirement benefit obligation (7,465) (7,546) (6,755)

Deferred taxation (296) (128) (298)

Non current provisions (252) (217) (211)

Other non current liabilities (113) - (113)

Long term borrowings (1,378) - (1,433)

---------- ---------- ---------

Total non current liabilities (9,504) (7,891) (8,810)

Total liabilities (17,672) (14,167) (16,230)

Net assets 46,720 21,488 34,469

========== ========== =========

Equity

Capital and reserves

Issued capital 597 420 556

Share premium 102,389 67,750 91,463

Merger reserve - shares

issued by subsidiary 40,128 40,128 40,128

Reserve - shares held by

EBT 67 67 67

(MORE TO FOLLOW) Dow Jones Newswires

March 08, 2016 02:01 ET (07:01 GMT)

Reserve - share based payments 761 667 591

Reserve - convertible loan - 3,652 -

notes

Revaluation reserve 1,178 1,222 1,178

Foreign exchange reserve 226 (56) (140)

Retained earnings (98,626) (92,362) (99,374)

---------- ---------- ---------

Total equity 46,720 21,488 34,469

========== ========== =========

Consolidated statement of changes in equity

Issued Share Merger Reserve Reserve Reserve Foreign Retained Total

Capital premium reserve - - share - Revaluation exchange earnings equity

- shares shares based convertible reserve reserve

issued held payment loan

by in note

subsidiary EBT

--------- -------- ----------- -------- -------- ------------ ------------- --------- -------------------- --------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 December

2014 420 67,750 40,128 67 667 3,652 1,222 (56) (92,362) 21,488

--------- -------- ----------- -------- -------- ------------ ------------- --------- -------------------- --------

Exchange

differences

on

translation

of foreign

operations - - - - - - - (84) - (84)

Remeasurement

of net

defined

benefit

liability - - - - - - - - 205 205

Remeasurement

of

investments

- retirement

benefit

assets - - - - - - (44) - 8 (36)

--------- -------- ----------- -------- -------- ------------ ------------- --------- -------------------- --------

Total other

comprehensive

income - - - - - - (44) (84) 213 85

Loss for

the period

after tax - - - - - - - - (7,197) (7,197)

--------- -------- ----------- -------- -------- ------------ ------------- --------- -------------------- --------

Total

comprehensive

income - - - - - - (44) (84) (6,984) (7,112)

Transactions

with

shareholders

-Convertible

loan note - - - - - - - - (86) (86)

Conversion

of loan

note to

equity 42 3,832 - - - (3,652) - - (222) -

Share based

payments - - - - 204 - - - - 204

Shares

issued 94 19,881 - - - - - - - 19,975

Transfer

of lapsed

options

to retained

earnings - - - - (280) - - - 280 -

--------- -------- ----------- -------- -------- ------------ ------------- --------- -------------------- --------

At 30 June

2015 556 91,463 40,128 67 591 - 1,178 (140) (99,374) 34,469

--------- -------- ----------- -------- -------- ------------ ------------- --------- -------------------- --------

Exchange

differences

on

translation

of foreign

operations - - - - - - - 366 - 366

Remeasurement

of net

defined

benefit

liability - - - - - - - - (255) (255)

Remeasurement

of

investments

- retirement

benefit

assets - - - - - - - - (51) (51)

--------- -------- ----------- -------- -------- ------------ ------------- --------- -------------------- --------

Total other

comprehensive

income - - - - - - - 366 (306) 60

Profit for

the period

after tax - - - - - - - - 1,054 1,054

--------- -------- ----------- -------- -------- ------------ ------------- --------- -------------------- --------

Total

comprehensive

income - - - - - - - 366 748 1,114

Share based

payments - - - - 170 - - - - 170

Shares issued 41 10,926 - - - - - - - 10,967

At 31 December

2015 597 102,389 40,128 67 761 - 1,178 226 (98,626) 46,720

========= ======== =========== ======== ======== ============ ============= ========= ==================== ========

Condensed consolidated cash

flow statement

6 months 6 months 12 months

to to to

31Dec 31Dec 30Jun

2015 2014 2015

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

(as restated)

Cash flows from operating

activities

Profit before tax 1,303 7,413 654

Adjustments for:

Finance income (84) (1) (147)

Finance expense 154 110 218

Non cash movements on defined

benefit pension plan 148 143 290

Depreciation and amortisation 782 644 1,293

Charge for share based payments 170 202 406

Derivative financial instruments 781 183 (438)

Foreign exchange revaluation

on US Dollar cash deposits (1,087) - 1,118

(Increase)/decrease in trade

and other receivables (2,112) (1,922) (448)

Decrease/(increase) in inventories 2 90 (424)

Increase/(decrease) in trade

and other payables 550 (358) 1,079

---------- ---------- --------------

Net cash generated by operations 607 6,504 3,601

Interest paid (154) (111) (304)

Income tax received/(paid) 44 - (174)

Net cash generated by operating

activities 497 6,393 3,123

Cash flows from investing

activities

Interest received 11 1 65

Investments (128) (166) (275)

Acquisition of Alerpharma

Group - - (2,653)

Cash acquired on acquisition

of Alerpharma Group - - 1,301

Payments for intangible assets (142) (48) (13)

Payments for property plant

and equipment (335) (221) (1,091)

Net cash used in investing

activities (594) (434) (2,666)

Cash flows from financing

activities

Proceeds from issue of equity

shares (net of share issue

costs) 10,967 34 20,079

Repayment of borrowings (120) - -

Net cash generated by financing

activities 10,847 34 20,079

---------- ---------- --------------

Net increase in cash and cash

equivalents 10,750 5,993 20,536

Effects of exchange rates

(MORE TO FOLLOW) Dow Jones Newswires

March 08, 2016 02:01 ET (07:01 GMT)

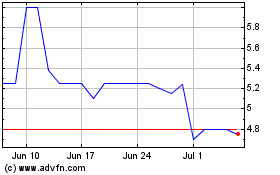

Allergy Therapeutics (LSE:AGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Allergy Therapeutics (LSE:AGY)

Historical Stock Chart

From Apr 2023 to Apr 2024