Alkane Energy PLC Trading Update and Notice of Results (6842C)

January 21 2015 - 2:00AM

UK Regulatory

TIDMALK

RNS Number : 6842C

Alkane Energy PLC

21 January 2015

21 January 2015

Alkane Energy plc

("Alkane" or "the Group")

Trading Update and Notice of Results

Notice of Results

Alkane (AIM: ALK), the independent gas to power producer, today

announces an update on trading ahead of the results for the year

ended 31 December 2014 (the "period"), which Alkane will publish on

11 March 2015.

Trading Update

For the period, the Group expects power sales to have reached

close to 200GWh (2013: 192GWh) with an expected average base load

price of circa GBP52/MWh in the year to 31 December 2014 (2013:

GBP53/MWh). Alkane now has 27 sites with a combined operating

capacity of 145MW. The three power response sites acquired from

Carron Energy in July 2014 are now operating in line with

expectations and we have brought on upgraded capacity at both

Shirebrook and Wheldale just before the year end. We are pleased to

report that we have seen record levels of production for the Group

as we enter the new year.

As previously announced, there are a number of adjustable items

in the 2014 results including the exceptional profit from the

transfer of Alkane's shale interests to Egdon Resources plc, offset

by non-developed licence impairments and mark to market adjustments

at the year end. There were also the deal costs of this and the

Carron Energy transaction as well as a provision against the

remaining outstanding debt from the TEG Group. After accumulating

these adjustable items we are expecting a contribution of circa

GBP1.5m from these items in addition to the adjusted profit before

tax.

There were a number of operational issues in the last few months

of the year which have impacted on profit before tax. The upgraded

capacity at Wheldale and Shirebrook were commissioned two months

later than expected, and there were fewer than anticipated calls

from National Grid under the STOR programme. We had 29 calls under

STOR in the last quarter of 2014 (last quarter of 2013: 66 calls).

As a result adjusted profit before tax for the period is now

expected to be between GBP3.25 - GBP3.5m. Net debt is expected to

be circa GBP17m.

We have a prudent medium term power selling policy which we are

delighted to report has secured stable pricing in 2015 and into

2016. Alkane has contracted approximately 82% of the Group's

expected 2015 base load output at an average price of GBP52/MWh and

we have secured prices of GBP51/MWh on 30% of 2016 expected base

load output. Current market prices for the balance of 2016 are

around GBP45MW/h which we will continue to monitor. The drop in

selling prices has a negative impact on baseload margins but we are

seeing our power response activities benefiting from lower gas

prices to partially offset base load.

Looking forward, the coal mine methane ("CMM") project pipeline

is on schedule with a new drill starting in Stoke this year and the

build phase of the successfully drilled Markham Main site in

Yorkshire due to start during H2 2015. In addition, we have applied

for a number of new CMM licences as part of the 14(th) Onshore

Licensing Round. We are well placed to grow output during 2015.

On 5 January 2015 Alkane announced it had been awarded Capacity

Mechanism Agreements giving us visibility on over GBP14m of new

income from 2018 up to September 2033. The agreements are for 101MW

of capacity, of which 46MW is new build sites, and we have

commenced the process of procuring the new assets ahead of the

delivery date in 2018.

Commenting on the update, Chief Executive Officer, Neil O'Brien,

said:

"We have been busy integrating and upgrading sites in 2014,

which was another year of good solid progress for Alkane. We have

made a strong start to the new financial year with record

production and have secured stable pricing for 2015. We are well

placed to increase output in the coming year and are confident of

reporting further growth."

For more information please contact:

Alkane Energy plc

Neil O'Brien, Chief Executive

Officer

Steve Goalby, Finance Director 01623 827 927

Liberum Capital Limited

Clayton Bush

Joshua Hughes 020 3100 2000

VSA Capital Limited

Andrew Raca 020 3005 5000

Hudson Sandler

Nick Lyon

Alex Brennan 020 7796 4133

Background information

Alkane is one of the UK's fastest growing independent power

generators. The Company operates mid-sized "gas to power"

electricity plants providing both base load and fast response

capacity to the grid. Following the acquisition of three power

response sites from Carron Energy Limited and Dragon Generation

Limited, Alkane has a total installed generating capacity of 145MW

and an electricity grid capacity of 160MW.

Alkane's base load operations, where power is generated 24/7,

are centred on a portfolio of coal mine methane ("CMM") sites.

Alkane has the UK's leading portfolio of CMM licences, enabling the

Company to extract gas from abandoned coal mines.

As CMM declines at any one site, Alkane retains valuable

generating capacity and a grid connection which can be redeployed

to power response. Power response sites are connected to mains gas

and produce electricity at times of high electrical demand through

peak running, or in order to balance the electricity grid through

participation in the National Grid's short term operating reserve

programme ("STOR"). Participants in STOR are paid premium rates

when called upon by the Grid to meet temporary supply shortages.

Alkane now operates 93MW of power response, one of the UK's largest

power response businesses, with contracted STOR revenues extending

out to 2025.

The Group operates from 27 mid-size (up to 25MW) power plants

across the UK, 13 CMM only, 7 mains gas only, 6 using both fuel

sources and 1 using kerosene only. Alkane uses a combination of

standard modular reciprocating engines and gas turbines to generate

the electricity and sells this power through the electricity

network. The engine units and other plant are designed to be

flexible and transportable allowing additional capacity to be

brought onto growing sites and underutilised plant to be moved to

new sites to maximise efficiency.

Alkane transferred in June 2014 its shale gas interests to Egdon

Resources plc. Alkane received 40m Egdon shares making us the

largest shareholder in Egdon, a significant player within the UK

shale industry.

Alkane has a range of core skills encompassing the entire

project development cycle including planning and permitting,

sourcing plant and managing the build and commissioning stage. This

has enabled Alkane to establish a design, build and operate ("DBO")

business for third party clients in the biogas and oil & gas

industries.

The Group has circa 800km(2) of acreage under various onshore

Petroleum Exploration and Development Licences ("PEDLs").

More information is available on our website

www.alkane.co.uk

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTSEEFWSFISEDF

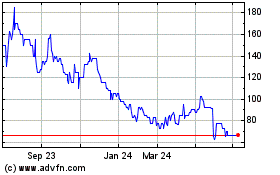

Alkemy Capital Investments (LSE:ALK)

Historical Stock Chart

From Mar 2024 to Apr 2024

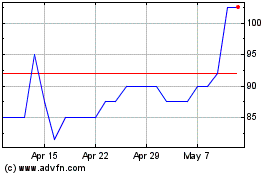

Alkemy Capital Investments (LSE:ALK)

Historical Stock Chart

From Apr 2023 to Apr 2024