Alkane Energy PLC Increased Loan Facilities (7676R)

July 01 2015 - 2:00AM

UK Regulatory

TIDMALK

RNS Number : 7676R

Alkane Energy PLC

01 July 2015

1 July 2015

Alkane Energy plc

("Alkane" or the "Group")

Increased Loan Facilities

Alkane Energy plc, (AIM: ALK), the independent gas to power

producer, is pleased to announce that it has agreed with its

bankers, Lloyds Bank plc ("Lloyds"), some amendments to the

existing loan facilities. The amendments, which include an

additional advance of GBP2m, will provide the Group with

flexibility in pursuing value enhancing projects and delivering

growth. The enhancements to the facility and Lloyds' continued

support reflect the Group's underlying financial strength. The

amendments are as follows:

-- An additional advance of GBP2m has been made against existing

assets under the asset finance loan taken out on 15 July 2014. The

principal on this loan was originally GBP5.5m with a repayment

period of five years ending 8 July 2019. The repayment profile of

the outstanding principal of GBP4.7m plus the additional advance of

GBP2m has been extended to seven years, with the final payment

being due in July 2022.

-- A capital repayment holiday has been agreed in respect of the

term loan of GBP3m taken out on 24 May

2013. The balance of GBP1.5m is now repayable on 31 May 2016.

-- The covenant in respect of quarterly EBITDA levels relative

to total net debt will be increased to 2.5 times (from the current

2 times) for the remainder of 2015, and to 2.25 times for the

quarter ended 31 March 2016.

The additional funds and the rescheduling of repayments will

enable a greater proportion of our cash generation to be used to

support the continued development and growth of the Group.

Trading conditions remain consistent with the trading update

announcement that was made on 30 April 2015 and expectations are

unchanged.

Neil O'Brien, Chief Executive Officer, commented:

"I am delighted with the continued support of Lloyds. These

amendments will enable the Group to continue to deliver growth

during a period when there is a general lack of investment in new

power stations and existing capacity is closing. Alkane is well

placed to benefit from the resulting tightening of supply margins

in the UK power market."

Notes to Editors

For more information please contact:

Alkane Energy plc

Neil O'Brien, Chief

Executive Officer

Carl Kameen, Finance

Director 01623 827927

Liberum

Clayton Bush 020 3200 2000

VSA Capital Limited

Andrew Raca 020 3005 5000

Hudson Sandler

Nick Lyon

Alex Brennan 020 7796 4133

Background information

Alkane is one of the UK's fastest growing independent power

generators. The Company operates mid-sized "gas to power"

electricity plants providing both base load and fast response

capacity to the grid. Alkane has a total installed generating

capacity of 145MW and an electricity grid capacity of 160MW.

Alkane's base load operations, where power is generated 24/7,

are centred on a portfolio of coal mine methane ("CMM") sites.

Alkane has the UK's leading portfolio of CMM licences, enabling the

Company to extract gas from abandoned coal mines.

Power response sites are connected to mains gas and produce

electricity at times of high electrical demand through peak

running, or in order to balance the electricity grid through

participation in the National Grid's short term operating reserve

programme ("STOR"). Participants in STOR are paid premium rates

when called upon by the Grid to meet temporary supply shortages.

Alkane now operates 98MW of power response, one of the UK's largest

power response businesses, with contracted STOR revenues extending

out to 2025.

Alkane has been awarded 101MW of Capacity Mechanism Agreements

starting from October 2018, with 55MW existing sites being secured

on one year agreements and 46MW new sites on 15 year agreements

over the period to September 2033.

The Group operates from 27 mid-size (up to 25MW) power plants

across the UK, 13 CMM only, seven mains gas only, six using both

fuel sources and one using kerosene only. Alkane uses a combination

of standard modular reciprocating engines and gas turbines to

generate the electricity and sells this power through the

electricity network. The engine units and other plant are designed

to be flexible and transportable allowing additional capacity to be

brought onto growing sites and underutilised plant to be moved to

new sites to maximise efficiency.

In June 2014 Alkane transferred its shale gas interests to Egdon

Resources plc. It received 40 million Egdon shares making it the

largest shareholder in Egdon, the UK's third largest shale

operator.

More information is available on our website

www.alkane.co.uk

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCPKKDNBBKBKAN

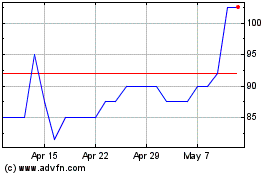

Alkemy Capital Investments (LSE:ALK)

Historical Stock Chart

From Mar 2024 to Apr 2024

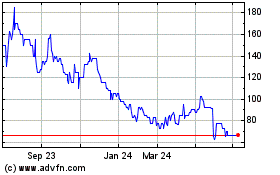

Alkemy Capital Investments (LSE:ALK)

Historical Stock Chart

From Apr 2023 to Apr 2024