TIDMAXM

RNS Number : 5401F

Alexander Mining PLC

23 February 2015

23 February 2015

Alexander Mining plc

("Alexander" or the "Company")

Agreement signed for an AmmLeach(R) Licence for Browns Project,

Northern Territory, Australia

-- Heads of Agreement signed with Compass Resources Limited

("Compass") for an AmmLeach(R) licence and certain technical and

management services.

-- Feasibility study planned for use of AmmLeach(R) at Compass'

treatment plant in Australia for copper, cobalt and nickel

production.

-- Alexander expects to form a strategic alliance in Australia

with Compass to investigate further outstanding copper

opportunities.

The Company is delighted to announce that it has signed a

non-binding Heads of Agreement ("HoA") with Compass, a listed

Australian public company (ASX:CMR), for executing a definitive

agreement ("Agreement") covering an AmmLeach(R) licence and certain

technical management services for Compass in the Northern

Territory, Australia. These arrangements should significantly

accelerate the first commercial adoption of Alexander's proprietary

AmmLeach(R) technology.

Background on Compass

(website: www.compass-resources-limited.com )

Compass currently is a party to three commercial joint ventures

in the area north of Batchelor, approximately 100km from Darwin,

the capital of the Northern Territory, Australia. The joint

ventures are all with HNC (Australia) Resources Pty Limited

("HAR"). HNC (Australia) Exploration and Mining Pty Limited (wholly

owned by HAR) is the Joint Venture Operator for all three joint

ventures ("JVs"). The JVs are the Oxide JV, the Sulphide JV and the

Regional Exploration JV.

The Browns project includes a fully constructed 1.3 million

tonnes per annum design capacity oxide ore treatment plant

("Plant") and associated infrastructure. The Plant was originally

designed to produce 10,000t copper, 1,000t of contained cobalt and

700t contained nickel per annum.

The Plant operated for four months, starting in September 2008,

before shutting down due to mineral processing problems. Since then

the mine site and Plant have been subject to a care and maintenance

regime.

Martin Rosser, Chief Executive Officer, said:

"We greatly look forward to working closely together with

Compass under this transformative agreement. Based on the

completion of a positive AmmLeach(R) feasibility study and

production go-ahead, the Project would complement our AmmLeach(R)

technology with existing high quality mining assets.

The plan is to generate significant economic value from the

Project area. Australia is one of the world's leading mining

countries and together with Alexander's metallurgical team based in

Perth, Western Australia, it provides an exemplary project to work

on together with Compass Resources.

In addition, Compass and Alexander believe that market

conditions are the most favourable for several years for growth by

attractively priced corporate acquisitions. Accordingly, both

companies expect to form a strategic alliance in Australia to

investigate the acquisition by Compass of copper resources which

can be exploited using the Leaching Technologies. This will be on

terms to be agreed in respect of each such project."

The first step is the completion of an AmmLeach(R) feasibility

study, with a pilot plant programme, funded by Compass. This pilot

plant programme would be carried out at the independent commercial

facilities of Simulus Engineers, Perth, Western Australia, under

the supervision of Alexander's technical personnel. This would lead

to the completion of a feasibility study into commercial production

and is dependent upon statutory approval and obtaining all

necessary permits required to recommence production.

Compass is currently working to complete a financing facility

with sophisticated institutional investors as a first step in a

proposed major refinancing and relisting of the company. The

proceeds of the financing will be used for various purposes,

including payments due under the Agreement to Alexander and for the

third party AmmLeach(R) pilot plant and feasibility study

costs.

Compass and Alexander are currently working to finalise the

definitive Agreement, which will be conditional on completion of

Compass' proposed financing ("Condition"). The key commercial terms

agreed in the HoA are summarised below.

AmmLeach(R) Licence

On satisfaction of the Condition, the Company will grant to

Compass a non-transferable licence to use Alexander's leaching

technologies (AmmLeach(R)) for the sole purpose of extracting base

metals or value added metal containing products from ore mined at

or sourced from Compass properties. The licence will be granted on

the following terms:

I. Cash payment by Compass of A$825,000 to Alexander on commencement of the Agreement; and

II. A royalty of 2.6077% on saleable metal production after capped third party royalties.

Consultancy Services

Alexander will provide technical project management services

('Consultancy Services') to Compass as follows.

I. During the AmmLeach(R) pilot plant and feasibility study period

Alexander will provide Consultancy Services to Compass during

the period through to completion of the feasibility study and a

construction go-ahead decision point, whereby;

Compass will pay to Alexander:

-- an initial fee of A$275,000 on commencement of the Agreement;

-- A$400,000 three months after the initial fee payment; and

-- A$425,000 upon delivery of the feasibility study.

II. During construction and commissioning stage

There will be two A$275,000 payments made to Alexander, as

follows:

-- A$275,000 three months after delivery of the feasibility study; and

-- A$275,000 on plant commissioning in accordance with the

technical specifications set out in the Feasibility Study.

Granting of Alexander Share Options

Conditional upon the Agreement being executed, satisfaction of

the Condition and subject to Alexander shareholders' approval at

the 2015 AGM, the Company will grant to Compass the following share

options:

I. options over 5 million ordinary shares of 0.1p each at an

exercise price of 7.5p per share for 18 months from issue; and

II. options over 5 million ordinary shares of 0.1p each at an

exercise price of 10.0p per share for 24 months from issue.

Enquiries:

Martin Rosser Matt Sutcliffe

Chief Executive Officer Executive Chairman

Mobile: +44 (0) 7770 865 Mobile: +44 (0) 7887 930

341 758

Alexander Mining plc

1(st) Floor

35 Piccadilly

London

W1J 0DW

Tel: +44 (0) 20 7292 1300

Fax: +44 (0) 20 7292 1313

Email: mail@alexandermining.com

Website: www.alexandermining.com

Northland Capital Partners

Limited

Nominated Adviser and

Joint Broker

Matthew Johnson / Gerry

Beaney

+44 (0) 20 7382 1100

Hume Capital Securities

plc

Joint Broker

Guy Peters / Abigail Wayne

+44 (0) 20 3693 1470

This information is provided by RNS

The company news service from the London Stock Exchange

END

AGRPKBDNKBKBABB

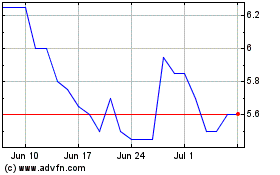

Eenergy (LSE:EAAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

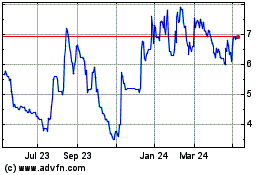

Eenergy (LSE:EAAS)

Historical Stock Chart

From Apr 2023 to Apr 2024