TIDMAXM

RNS Number : 8770R

Alexander Mining PLC

26 September 2017

26 September 2017

ALEXANDER MINING PLC

INTERIM REPORT FOR SIX MONTHSED 30 JUNE 2017

Alexander Mining plc ("Alexander" or "the Company"), the AIM

quoted mining and mineral processing technologies company,

announces its unaudited results for the six months ended 30 June

2017.

The Company's objective is to become a low cost, highly

profitable and diversified mining company that is focused on

leveraging its wholly owned innovations and patented technologies.

This will be achieved by the commercialisation of its proprietary

mineral processing technologies, partnerships with producing mines

and the acquisition of equity positions in advanced projects.

Highlights

* Successful placing to raise GBP750,000 to fund

working capital

* Accudo Metals Pty Ltd. commitment to proceed with a

detailed feasibility study ("DFS") on the potential

use of Alexander's leaching technology under the

existing licence agreement

* Continued granting of important patents in key mining

jurisdictions

* Continuing and increasingly broad mining industry

interest in using AmmLeach(R) for base metals

recovery from amenable deposits as focus on limiting

capital deployment and reduction in AISC ("All in

Sustaining Costs") for mines remains a priority for

the global mining industry

* Company investigating exciting potential to use its

leaching technologies for the recovery of cobalt, a

key component of most electric vehicle lithium ion

batteries

* New research and development ("R&D") initiatives for

the recovery of high technology metals lithium and

vanadium

Chairman's Review

Dear Shareholders and Investors, herewith I take pleasure on

behalf of your Board of Directors in presenting for your

consideration the Company's results for the six months operating

period ended 30 June 2017, along with commentary on the operating

environment and related outlook.

The period under review was filled with mixed sentiment in the

global mining sector and was compounded by resource nationalism in

some countries, in particular in Latin America and Africa.

Generally, though, the mining and natural resources investment

market remained positive. Even within the volatile economic and

political environment, with precious metal prices, including gold

and silver increasing on demand for risk hedging against government

and public debt levels, US dollar weakness and fear of Fiat

currency failure.

Base metals, Alexander's main area of activity and related base

metals equities continued to rise on LME stock depletion, stronger

than expected economic demand and continued significant capital

inflows. Increased exploration and development activity in the

infrastructure commodities and energy storage or battery metals

have underwritten this further.

Some key environmental features of our operating half-year that

are expected to impact in the second half and beyond are as

follows:

-- Junior mining company valuations are generally positive, in

particular in the precious metals, infrastructure commodities,

energy fuels and battery metals

-- AISC improvements, ongoing productivity initiatives and

capital investment in technologies is also a continuing global

trend of management teams

-- Exploration programmes, project developments, and old mines

are being restarted, in particular in the base & precious

metals commodities, but also in energy fuels (uranium & coal)

or related energy storage metals (cobalt) & mineral salts

(lithium)

Regardless of sentiment in general, at Alexander we have

remained focussed on our core activity of seeking and/or acquiring

commercialisation opportunities for our technologies to release the

embedded value in your Company.

During the period, the Company continued to add granted patents

to its portfolio of intellectual property, as well as continuing

with its research and development activities under various

agreements and, where appropriate, make additional

applications.

The Company broadened its range of metals of interest with its

joint venture ("JV") project for the recovery of lithium from hard

rock sources. This has generated significant industry interest,

including the provision of samples, from several companies in the

mining industry. Pursuant to this interest, the JV agreement

between Alexander and Dr. Nicholas Welham was varied to include the

testing of the potential process on a wider range of lithium

bearing minerals, ores and concentrates.

With the receipt of suitable samples, the research and

development laboratory work has started.

In February 2017, the Company's joint broker Turner Pope

Investments released a comprehensive research note on Alexander for

the general market which is to be found on the Company website.

This was key as we seek to broaden and deepen the understanding of

investors to the potential embedded within the Company's

intellectual property and business in general.

The Company was granted in March an important patent for the

leaching of zinc in Canada, one of the world's foremost mining

sector jurisdictions. The patent, the Australia and USA equivalent

of which was granted on 30 August 2012 and 3 February 2015

respectively, describes a method for leaching zinc from

zinc-bearing carbonate ore.

Accudo's commitment in June to proceed with a DFS on the

potential use of our leaching technology under the existing licence

agreement between us is highly significant. We look forward to

working together closely on this first copper project opportunity

in Australia.

Post period, in September, Alexander announced that it had

agreed a significant new R&D joint venture project ("Project")

to investigate the potential recovery of vanadium from amenable

ores ("Vanadium Leaching Technology"). The Project is between

Alexander, Australian company Multicom Resources Pty Ltd

("Multicom"), and John Webster Innovations Proprietary Limited.

If the JV is successful, the potential use of a new Vanadium

Leaching Technology would initially be focused on Multicom's Saint

Elmo vanadium project in North Queensland, Australia.

Financial

The Company has been assiduous in keeping its overheads to the

minimum necessary, whilst maintaining required expenditure on

business development and intellectual property protection.

In February, the Company raised GBP750,000 in a placing (the

"Placing"). The net proceeds of the Placing were for general

working capital purposes and also for a potential strategic mining

corporate investment opportunity.

With the net proceeds from the Placing, the Company should have

adequate working capital through until the end of June 2018.

Outlook

Alexander will, we believe, begin to benefit significantly from

its technological and market positioning as we move into 2018 and

beyond. In our view, there is a clear investment trend in physical

and tradeable commodities. This includes infrastructure and energy

related commodities, i.e. copper and zinc, both of which are

already in or close to supply/demand deficit, battery metals

(cobalt and lithium) and/or the junior mining equities that hold

such assets or the technologies to enhance them, like Alexander.

This therefore continues to offer you, our shareholders and

potential investors strong fundamentals in the Alexander business

and in the progressive project developments we are engaging.

Your Board has remained focussed in executing its clearly

defined investment plans at all levels. However, we have remained

cautious with regards to the deployment of the Company's financial

resources.

Post the reporting period, the Board of Alexander announced the

resignation of Matt Sutcliffe from his position as Executive

Chairman and director with immediate effect due to health

reasons.

Matt founded Alexander and has been a valued member of the board

since the Company's admission to AIM in 2005. The board expresses

its sincere appreciation to him for his tremendous contribution

over the years, and wishes him all the very best. Matt remains a

supportive shareholder of the Company.

Given the background of the Company's directors and senior

employees, we are also actively reviewing several complementary

opportunities of interest in the mining sector.

Finally, I would like to thank you, Alexander's valued

shareholders, for your continuing support and our employees,

directors, consultants and advisers for their commitment during

difficult times past and for the bright future we see ahead.

Alan M. Clegg Pr. Eng

Non-Executive Chairman

26 September 2017

For further information, please contact:

Martin Rosser Alan M. Clegg

------------------------ ------------------------

Chief Executive Officer Non-Executive Chairman

------------------------ ------------------------

Mobile: + 44 (0) 7770 Mobile: +27 82 469 8378

865 341

------------------------ ------------------------

Northland Capital Partners Limited

Matthew Johnson / Gerry Beaney

+44 (0) 20 3861 6625

(Corporate Finance)

John Howes

(Corporate Broking)

Turner Pope Investments (TPI) Limited

James Pope / Ben Turner

+44 (0) 20 3621 4120

Consolidated income statement

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2016

2017 2016

GBP'000 GBP'000 GBP'000

------------------------------ ----------- ----------- -------------

Continuing operations

Revenue - - -

Cost of sales - - -

------------------------------ ----------- ----------- -------------

Gross profit - - -

Administrative expenses (196) (189) (435)

Research and development

expenses (65) (89) (144)

Operating loss (261) (278) (579)

Finance income - - -

Finance cost - 46 (4)

------------------------------ ----------- ----------- -------------

Loss before taxation (261) (324) (583)

Income tax expense - - -

------------------------------ ----------- ----------- -------------

Loss for the period from

continuing operations (261) (324) (583)

Loss for the period from

discontinued operations - - -

------------------------------ ----------- ----------- -------------

Loss for the period (261) (324) (583)

------------------------------ ----------- ----------- -------------

Basic and diluted (loss)

per share (pence) (0.02)

from continuing operations: p (0.07)p (0.08)p

All components of profit or loss are attributable

to equity holders of the parent.

Consolidated statement of comprehensive income

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2016

2017 2016

GBP'000 GBP'000 GBP'000

------------------------------ ----------- ----------- -------------

Loss for the period (261) (324) (583)

Other comprehensive income: - - 4

Total comprehensive loss

for the period attributable

to equity holders of the

parent (261) (324) (579)

------------------------------ ----------- ----------- -------------

Consolidated balance sheet

As at As at As at

30 June 30 June 31 December

2017 2016 2016

GBP'000 GBP'000 GBP'000

------------------------------ --------- --------- -------------

Assets

Property, plant & equipment - - -

Total non-current assets - - -

------------------------------ --------- --------- -------------

Trade and other receivables 36 50 39

Cash and cash equivalents 672 415 259

------------------------------ --------- --------- -------------

Total current assets 708 465 298

------------------------------ --------- --------- -------------

Total assets 708 465 298

------------------------------ --------- --------- -------------

Equity attributable to

owners of the parent

Issued share capital 14,951 14,325 14,404

Share premium 13,932 13,780 13,772

Translation reserve - - -

Accumulated losses (28,749) (28,260) (28,501)

------------------------------ --------- --------- -------------

Total equity 134 (155) (325)

------------------------------ --------- --------- -------------

Liabilities

Current liabilities

Trade and other payables 574 620 623

Provisions - - -

------------------------------ --------- --------- -------------

Total current liabilities 574 620 623

Total liabilities 574 620 623

------------------------------ --------- --------- -------------

Total equity and liabilities 708 465 298

------------------------------ --------- --------- -------------

Consolidated statement of cash flows

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2016

2017 2016

GBP'000 GBP'000 GBP'000

--------------------------------- ----------- ----------- -------------

Cash flows from operating

activities

Operating loss - continuing

operations (261) (278) (579)

(Increase) / decrease in

trade and other receivables 2 (9) (14)

Increase / (decrease) in

trade and other payables (50) 91 93

Increase / (decrease) in - -

provisions -

Shares issued in payment - -

of expenses -

Share option & Warrant

charge 12 26 49

Net cash outflow from operating

activities (297) (170) (451)

--------------------------------- ----------- ----------- -------------

Cash flows from investing

activities

Interest received - - -

Net cash inflow from investing - -

activities -

--------------------------------- ----------- ----------- -------------

Cash flows from financing

activities

Proceeds from the issue

of share capital 710 466 549

Proceeds from issue of - -

share options -

--------------------------------- ----------- ----------- -------------

Net cash inflow from financing

activities 710 466 549

--------------------------------- ----------- ----------- -------------

Net increase / (decrease)

in cash and cash equivalents 413 296 98

Cash and cash equivalents

at beginning of period 259 165 165

Exchange differences - (46) (4)

--------------------------------- ----------- ----------- -------------

Cash and cash equivalents

at end of period 672 415 259

--------------------------------- ----------- ----------- -------------

Consolidated statement of changes in equity

Share Share Shares Translation Accumulated Total

capital premium to be reserve losses equity

issued

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January

2016 13,825 13,822 - - (27,971) (324)

---------------------- ---------------- --------- -------- ------------ ------------ --------

Accumulated

loss for period - - - - (324) (324)

Total comprehensive

loss for the

period attributable

to equity

holders of

the parent - - - - (324) (324)

---------------------- ---------------- --------- -------- ------------ ------------ --------

Share option

costs - - - - 35 35

Shares issued 500 (8) - - - 492

Share issue

costs (34) (34)

At 30 June

2016 14,325 13,780 - - (28,260) (155)

---------------------- ---------------- --------- -------- ------------ ------------ --------

Accumulated

loss for period - - - - (259) (259)

Translation

Difference 4 4

---------------------- ---------------- --------- -------- ------------ ------------ --------

Total comprehensive

loss for the

period attributable

to equity

holders of

the parent - - - - (255) (255)

---------------------- ---------------- --------- -------- ------------ ------------ --------

Share option

and Warrant

costs - - - - 14 14

Shares issued 79 (8) - - - 71

Share issue

costs

At 31 December

2016 14,404 13,772 - - (28,501) (325)

---------------------- ---------------- --------- -------- ------------ ------------ --------

Accumulated

loss for period - - - - (261) (261)

Translation - -

Difference

---------------------- ---------------- --------- -------- ------------ ------------ --------

Total comprehensive

loss for the

period attributable

to equity

holders of

the parent - - - - (261) (261)

---------------------- ---------------- --------- -------- ------------ ------------ --------

Share option

and Warrant

costs - - - - 12 12

Shares issued 547 214 - - - 761

Share issue

costs - (54) - - - (54)

At 30 June

2017 14,951 13,932 - - 28,749 134

---------------------- ---------------- --------- -------- ------------ ------------ --------

Notes to the interim financial information

1. Basis of preparation

The interim financial information has been prepared in

accordance with International Financial Reporting Standards

("IFRSs") in force at the reporting date and their interpretations

issued by the International Accounting Standards Board ("IASB") as

adopted for use within the European Union. The accounting policies,

methods of computation and presentation used in the preparation of

the interim financial information are the same as those used in the

Group's audited financial statements for the year ended 31 December

2016.

The financial information in this statement does not constitute

full statutory accounts within the meaning of Section 434 of the

Companies Act 2006. The financial information for the six months

ended 30 June 2017 and 30 June 2016 is unaudited. The comparative

information for the year ended 31 December 2016 was derived from

the Group's audited financial statements for that period as filed

with the Registrar of Companies. It does not constitute the

financial statements for that period. Those financial statements

received an unqualified audit report, but contained an emphasis of

matter in respect of going concern.

Going Concern

In common with many mining, exploration and intellectual

property development companies, the Company has raised finance for

its activities in discrete tranches to finance its activities for

limited periods. In February 2017 the Company raised GBP750,000,

before expenses, by way of an equity placing. It is anticipated

that further funding will be required in the next twelve months and

the Directors believe that the Company currently has a range of

corporate development opportunities which could give rise to

significant net cash inflows over the next twelve months.

On this basis, the Directors have concluded that it is

appropriate to prepare the interim financial information on the

going concern basis. However, there can be no certainty that the

corporate development opportunities will be secured and give rise

to the further funding in the necessary timescale. This indicates

the existence of a material uncertainty that may cast significant

doubt on the ability of the Company and the Group to continue as a

going concern and therefore, that it may be unable to realise its

assets and discharge its liabilities in the normal course of

business. The financial statements do not include the adjustments

that would result if the Company and Group were unable to continue

as a going concern.

2. Loss per share

The calculation of loss per share is based on the weighted

average number of shares in issue in the six months to 30 June 2017

of 1,161,843,581 (six months to 30 June 2016: 474,547,651 and year

to 31 December 2016: 698,151,985) and computed on the respective

loss figures as follows:

6 months 6 Months Full year

2017 2016 2016

GBP'000 Per GBP'000 Per GBP'000 Per

share share share

(Loss) - continuing (0.02)

operations (261) p (324) (0.07)p (583) (0.08)p

There is no difference between the diluted loss per share and

the basic loss per share presented. Share options granted to

employees, consultants and directors could potentially dilute basic

earnings per share in the future, but were not included in the

calculation of diluted earnings per share as they were

anti-dilutive for the period presented.

At 30 June 2017, there were 56,200,000 (at 30 June 2016:

12,900,000; at 31 December 2016: 56,200,000) share options in issue

that could have a potentially dilutive effect on the basic earnings

per share in the future.

At 30 June 2017, there were 42,359,373(at 30 June 2016:

186,436,945; at 31 December 2016: 107,101,856) share warrants in

issue that could have a potentially dilutive effect on the basic

earnings per share in the future.

3. Share Capital

Changes in issued share capital and share premium during the

reporting period occurred as follows:

Ordinary shares Number of shares Share Share

capital premium

Balance at 1 January 2017 941,245,377 941,245 13,771,710

01 February- shares issued for cash

at 0.2p each 1,769,772 1,770 1,770

01 February- shares issued for cash

at 0.1p each 10,000,000 10,000 -

15 February- shares issued for cash

at 0.14p each 359,000,000 359,000 143,600

28 February- shares issued for cash

at 0.14p each 176,715,000 176,715 70,686

15 & 28 February - Cost of share issue (53,655)

30 June - Subscriber Warrant charge (1,677)

Balance at 30 June 2017 1,488,730,149 1,488,730 13,932,434

======================================= ================ ========== ==================

Deferred shares Deferred

share

Number of shares capital

Balance at 1 January 2017 135,986,542 13,462,667

--------------------------------------- ---------------- ----------

Balance at 30 June 2017 135,986,542 13,462,667

======================================= ================ ==========

4. Share options and Warrants

All Share Option costs incurred are allocated to Accumulated

Losses.

The Company had a total of 56,200,000 Share Options in issue

during the period (12,900,000 with exercise prices of 4.92p per

share, 43,300,000 with and exercise price of 0.22p per share),

representing 1.22 per cent of the issued share capital of the

Company on a fully diluted basis. Share option charges for the six

months to 30 June 2017 amounted to GBP8,265 (2016: GBP8,021).

The Company had a total of 20,959,375 warrants in issue during

the period for the provision of Broker services (3,600,000 with an

exercise price of 0.5p per share - now expired, 7,359,375 with an

exercise price of 0.4p per share and 10,000,000 with an exercise

price of 0.1p per share - now exercised. Warrant charges for the

six months to 30 June 2016 amounted to GBP3,546 (2016:

GBP18,726).

The Company had a total of 34,999,998 warrants in issue during

the period granted to subscribers of the 2 October 2015 placing

with an exercise price of 0.45 pence per share.

The Company had a total of 51,142,483 warrants in issue granted

to existing shareholders of the Company at 4.30 pm on the 24 May

2016 on the basis of 1 warrant per every 4 qualifying shares held

by shareholders (1,769,772 - now exercised, 49,372,711- now

expired. A charge of GBP1,677 was made to equity for the six months

ending 30 June 2017 (2015: GBP8,109).

5. Post balance sheet events:

The Executive Chairman, Matt Sutcliffe resigned his position as

Executive Chairman on the 29 August 2017.

Mr Alan Clegg was appointed the Non-Executive Chairman of the

Company on the 29 August 2017.

On the 8 September 2017, Alexander announced that it had agreed

a significant new R&D joint venture project to investigate the

potential recovery of vanadium from amenable ores ("Vanadium

Leaching Technology"). The Project is between Alexander, Australian

company Multicom Resources Pty Ltd, and John Webster Innovations

Proprietary Limited.

Copies of these announcements are available to view on the

Company's website at www.alexandermining.com.

Disclaimers

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

This news release contains forward looking or future-oriented

financial information, being information, which is not historical

fact, including, without limitation, statements regarding potential

results of metallurgical testwork, anticipated applications for the

Company's intellectual property and discussions of future plans and

objectives. Although the Company believes that the expectations

reflected by such information are reasonable, these statements are

based on assumptions and factors concerning future events that may

prove to be inaccurate. Such statements are necessarily based upon

a number of estimates and assumptions based on information

available to the Company about itself and the business in which it

operates. Information used in developing forward-looking

information has been acquired from various sources including third

party consultants, suppliers, regulators and other sources and is

subject to numerous risks and uncertainties that could cause actual

results and future events to differ materially from those

anticipated or projected. Important factors that could cause actual

results to differ materially from the Company's expectations are

the continuing availability of capital resources to fund the

commercialisation of Alexander's technologies; continued positive

results from trials and applications of Alexander's AmmLeach(R) and

HyperLeach(R) technologies and other factors as disclosed in

Company documents filed from time to time. Management uses

forward-looking statements because it believes they provide useful

information to the shareholders with respect to proposed

transactions involving Alexander, and cautions readers that the

information may not be appropriate for other purposes and should

not be read as guarantees of future performance or results. The

Company disclaims any intention or obligation to revise or update

such statements unless required by law.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BSGDCUBDBGRL

(END) Dow Jones Newswires

September 26, 2017 10:23 ET (14:23 GMT)

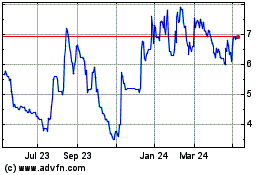

Eenergy (LSE:EAAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

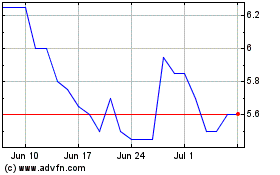

Eenergy (LSE:EAAS)

Historical Stock Chart

From Apr 2023 to Apr 2024