Alere Sues Abbott to Force Merger -- Update

August 26 2016 - 1:11PM

Dow Jones News

By Austen Hufford

Alere Inc. escalated its fight with reluctant buyer Abbott

Laboratories by filing a lawsuit against its potential acquirer to

push it to move forward with the deal.

Abbott agreed to buy Alere in February for nearly $5 billion.

Since then, Alere disclosed it has received a subpoena regarding a

foreign corruption investigation over payments in Africa, Asia and

Latin America and it said separately that federal investigators are

seeking information about government-billing practices. The company

was also late in filing its 2015 annual report.

Since agreeing to the deal, Abbott has signaled it might not

want to ultimately go through with it. Earlier this month Abbott

said the deal might not be completed "on a timely basis, or at

all." Alere rejected an offer of up to $50 million to terminate the

deal.

On Thursday, Alere said it filed a lawsuit in Delaware's

Chancery Court to compel Abbott to "promptly" obtain antitrust

approvals for the deal. Alere also said it would "take all actions

necessary" to make Abbott complete the deal.

Abbott said the lawsuit was without merit. "Abbott is compliant

with its obligations under the merger agreement and continues to

work toward regulatory approvals, despite Alere's nearly six-month

delay in filing its" annual report, a spokeswoman for Abbott

said.

Abbott shares rose 0.2% as Alere shares fell 2.2% in midday

trading Friday. Alere shares are now trading at $39.80, well below

the deal price of $56, indicating investors may believe the deal

won't go through.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

August 26, 2016 12:56 ET (16:56 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

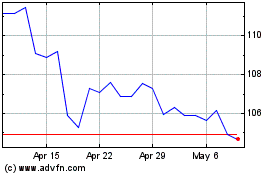

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Mar 2024 to Apr 2024

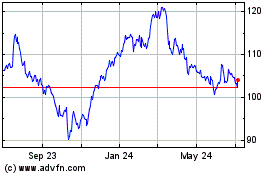

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Apr 2023 to Apr 2024