Alcoa Signs Contracts to Supply Boeing

December 17 2015 - 10:40AM

Dow Jones News

LONDON—Alcoa Inc. on Thursday said it signed two contracts

valued at more than $2.5 billion to supply airplane maker Boeing

Co. with parts for next-generation airliners.

One contract is for New York-based Alcoa to provide aerospace

fasteners to Boeing, the world's biggest plane maker, in the

largest deal ever of its type, Chief Executive Klaus Kleinfeld

said. The fasteners, used to hold together plane parts, would be

made from a range of materials, including aluminum, advanced

titanium, and nickel-based superalloys.

Boeing is introducing new models of its 737 single-aisle plane

and 777 long-range jets and has been renegotiating supplier

contracts as part of the process. "We are pretty much, with our

fasteners, on every Boeing platform and this contract secures that

also going forward onto their new and revamped platforms," Alcoa's

Mr. Kleinfeld said in an interview.

Alcoa signed a similar deal in October to supply Airbus Group

SE, the world's No. 2 plane maker, with $1 billion worth of bolts,

rivets and other plane parts.

Additionally, Alcoa said Thursday it secured a contract to be

the sole supplier of titanium seat track assemblies for Boeing's

787-10, the latest model of the Chicago-based planemaker's

Dreamliner. Alcoa already provides the component, which are used to

secure passenger seats to a plane's floor, for existing versions

Dreamliner models.

The two contracts come after Alcoa said in September that it

would split its mining, processing and smelting divisions and the

higher-margin activities that make parts and pieces for airplanes

and cars.

The split remains on track to be completed in the second half of

next year, Mr. Kleinfeld said, calling the separation "a lot of

work." The company has set up a dedicated team to manage the

separation to avoid distractions to the existing businesses, he

said.

Mr. Kleinfeld, who will lead the higher-margin activities, built

up Alcoa's aerospace portfolio through a series of acquisitions. It

bought U.K. jet-engine-parts maker Firth Rixson Ltd. in 2014, and

this year acquired Pittsburgh-based RTI International Metals Inc.,

one of the world's biggest makers of fabricated titanium products

for the aerospace industry.

The deal with Boeing for Dreamliner seat-tracks builds was won

thanks to the RTI purchase, Mr. Kleinfeld said.

Alcoa's spinoff will compete with Precision Castparts Corp. of

Portland, Ore. Warren Buffett's Berkshire Hathaway Inc. bought

Precision Castparts in August for $37.2 billion, including debt, in

Mr. Buffett's biggest acquisition yet.

Mr. Kleinfeld wouldn't directly address the prospect for further

acquisitions while it works on the split, though he said "we do not

lose sight of catering to our customers at any minute during

separation or after separation."

After Alcoa announced plans to split, hedge fund Elliott

Management Corp. said it had become one of the company's largest

shareholders. Mr. Kleinfeld said all the discussions with the

investor have been "extremely constructive." He added that Alcoa

isn't expecting Elliott, the New York hedge fund founded by Paul

Singer, to seek a board representation.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

December 17, 2015 10:25 ET (15:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

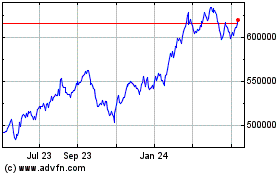

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

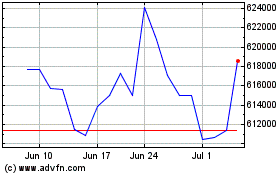

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Apr 2023 to Apr 2024