Company grew profits sequentially on stronger

alumina and aluminum pricing

Alcoa Corporation (NYSE: AA):

1Q 2017 Results1

- Net income of $225 million, or $1.21

per share

- Excluding special items, adjusted net

income of $117 million, or $0.63 per share

- Adjusted earnings before interest, tax,

depreciation, and amortization (EBITDA), excluding special items of

$533 million, up 59 percent sequentially driven by higher alumina

and aluminum pricing

- Revenue of $2.7 billion, up 5 percent

sequentially, reflecting increased alumina and aluminum

pricing

- $804 million cash balance and $1.45

billion of debt, for net debt of $0.65 billion, as of March 31,

2017

- Company continues to expect full-year

2017 adjusted EBITDA, excluding special items, between $2.1 billion

and $2.3 billion2

$M, except per

share amounts

1Q16 4Q16

1Q17 Revenue $ 2,129 $ 2,537 $ 2,655

Net (loss) income attributable to Alcoa Corporation $ (210 ) $ (125

) $ 225 Earnings per share attributable to Alcoa Corporation

$ (1.15 ) $ (0.68 ) $ 1.21 Adjusted (loss) income $

(114 ) $ 26 $ 117 Adjusted earnings per share $ (0.62 )

$ 0.14 $ 0.63 Adjusted EBITDA excluding

special items $ 179 $ 335 $ 533

______________________________________________________________________

1 Prior to November 1, 2016, Alcoa Corporation’s financial

statements were prepared on a carve-out basis, as the underlying

operations of the Company were previously consolidated as part of

Alcoa Corporation’s former parent company’s financial statements.

Accordingly, the financial results of Alcoa Corporation for the

quarter ended March 31, 2016 and for the month of October 2016

included in the quarter ended December 31, 2016 were also prepared

on a carve-out basis. The carve-out financial statements of Alcoa

Corporation are not necessarily indicative of Alcoa Corporation’s

combined results of operations, financial position, and cash flows

had it been a standalone company during the referenced periods. See

the Consolidated Financial Statements included in the Company’s

Form 10-K for the period ended December 31, 2016 filed with the

United States Securities and Exchange Commission on March 15, 2017

for additional information.

2 Based on actual results for 1Q17, outlook for 2Q17 – 4Q17 at

$1,900 LME, $305 API, and updated regional premiums and foreign

currencies.

______________________________________________________________________

Alcoa Corporation (NYSE: AA), a global leader in bauxite,

alumina, and aluminum products, today reported that first quarter

2017 profits grew sequentially on stronger alumina and aluminum

pricing and that it maintained a solid cash position.

In addition, the Company reiterated its expectations of

full-year 2017 adjusted EBITDA, excluding special items, between

$2.1 billion and $2.3 billion, based on April 2017 market

assumptions, and net performance of $50 million for the year.

“Alcoa is off to a strong start with our first full quarter as

an independent company,” said Roy Harvey, Chief Executive Officer

of Alcoa. “In our Bauxite segment, our third-party business

remained strong and we continued to grow profits, while our Alumina

and Aluminum segments captured the benefits of improved market

pricing to increase earnings substantially.”

Harvey continued: “Over the last few months, we also remained

focused on our strategic priorities. To reduce complexity, we

consolidated our business units and administrative locations; we

began to put our return seeking capital to work across our

businesses to drive returns, and we continued to strengthen the

balance sheet by maintaining a healthy level of cash on hand. As we

look forward to the rest of 2017, we are well positioned to deliver

value to our stockholders.”

In first quarter 2017, Alcoa reported net income of $225

million, or $1.21 per share. Results include $108 million of

special items largely due to gains from the sale of the Yadkin

Hydroelectric Project. First quarter 2017 results compare to a net

loss of $125 million, or $(0.68) per share, in fourth quarter 2016,

which included costs to streamline the portfolio.

Excluding the impact of special items, first quarter 2017

adjusted net income was $117 million, or $0.63 per share. In fourth

quarter 2016, Alcoa’s adjusted net income was $26 million, or $0.14

per share, excluding special items.

Alcoa reported first quarter 2017 adjusted EBITDA excluding

special items of $533 million, up 59 percent from $335 million in

fourth quarter 2016. In first quarter 2017, Alcoa reported revenue

of $2.7 billion, up 5 percent sequentially. Both revenue and

adjusted EBITDA excluding special items increased on higher alumina

and aluminum pricing.

In the first quarter, the Company’s cash from operations was $74

million and free cash flow was $3 million. Alcoa ended the first

quarter of 2017 with cash on hand of $804 million after

transferring the net proceeds received from the Yadkin sale to

former parent Arconic Inc. according to terms of the separation

agreement. The Company reported 19 days working capital.

In an ongoing effort to reduce complexity, in the first quarter

Alcoa streamlined its business segments into three, focused on

bauxite, alumina and aluminum. Earlier this month, the Company also

announced a consolidation of its administrative locations.

Market Update

For 2017, Alcoa is projecting 2017 global aluminum demand growth

of 4.5 to 5 percent over 2016. The Company continues to project

relatively balanced global bauxite and alumina markets and a modest

global aluminum surplus of 300 thousand to 700 thousand metric

tons.

Conference Call

Alcoa will hold its quarterly conference call at 5:00 PM

Eastern Daylight Time (EDT) on Monday, April 24, 2017 to present

first quarter 2017 results and discuss its business and

markets.

The call will be webcast via the Company’s homepage on

www.alcoa.com. Presentation materials for the call will

be available for viewing at approximately 4:15 PM EDT on April 24,

2017 on the same website. Call information and related details are

available under the “Investors” section at

www.alcoa.com.

Dissemination of Company Information

Alcoa intends to make future announcements regarding Company

developments and financial performance through its website at

www.alcoa.com.

About Alcoa Corporation

Alcoa (NYSE: AA) is a global industry leader in bauxite,

alumina, and aluminum products, with a strong portfolio of

value-added cast and rolled products and substantial energy assets.

Alcoa is built on a foundation of strong values and operating

excellence dating back nearly 130 years to the world-changing

discovery that made aluminum an affordable and vital part of modern

life. Since inventing the aluminum industry, and throughout our

history, our talented Alcoans have followed on with breakthrough

innovations and best practices that have led to efficiency, safety,

sustainability, and stronger communities wherever we operate. Visit

us online on www.alcoa.com, follow @Alcoa on Twitter and on

Facebook at www.facebook.com/Alcoa.

We have included the above website addresses only as inactive

textual references and do not intend these to be active links to

such websites. Information contained on such websites or that can

be accessed through such websites does not constitute a part of

this press release.

Forward-Looking Statements

This press release contains statements that relate to future

events and expectations and as such constitute forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements include those

containing such words as “anticipates,” “believes,” “could,”

“estimates,” “expects,” “forecasts,” “goal,” “intends,” “may,”

“outlook,” “plans,” “projects,” “seeks,” “sees,” “should,”

“targets,” “will,” “would,” or other words of similar meaning. All

statements by Alcoa Corporation that reflect expectations,

assumptions or projections about the future, other than statements

of historical fact, are forward-looking statements, including,

without limitation, forecasts concerning global demand growth for

bauxite, alumina, and aluminum, and supply/demand balances;

statements, projections or forecasts of future or targeted

financial results or operating performance; and statements about

strategies, outlook, business and financial prospects. These

statements reflect beliefs and assumptions that are based on Alcoa

Corporation’s perception of historical trends, current conditions

and expected future developments, as well as other factors that

management believes are appropriate in the circumstances.

Forward-looking statements are not guarantees of future performance

and are subject to known and unknown risks, uncertainties, and

changes in circumstances that are difficult to predict. Although

Alcoa Corporation believes that the expectations reflected in any

forward-looking statements are based on reasonable assumptions, it

can give no assurance that these expectations will be attained and

it is possible that actual results may differ materially from those

indicated by these forward-looking statements due to a variety of

risks and uncertainties. Such risks and uncertainties include, but

are not limited to: (a) material adverse changes in aluminum

industry conditions, including global supply and demand conditions

and fluctuations in London Metal Exchange-based prices and

premiums, as applicable, for primary aluminum, alumina, and other

products, and fluctuations in indexed-based and spot prices for

alumina; (b) deterioration in global economic and financial market

conditions generally; (c) unfavorable changes in the markets served

by Alcoa Corporation; (d) the impact of changes in foreign currency

exchange rates on costs and results; (e) increases in energy costs;

(f) changes in discount rates or investment returns on pension

assets; (g) the inability to achieve the level of revenue growth,

cash generation, cost savings, improvement in profitability and

margins, fiscal discipline, or strengthening of competitiveness and

operations anticipated from restructuring programs and productivity

improvement, cash sustainability, technology advancements, and

other initiatives; (h) the inability to realize expected benefits,

in each case as planned and by targeted completion dates, from

acquisitions, divestitures, facility closures, curtailments,

restarts, expansions, or joint ventures; (i) political, economic,

and regulatory risks in the countries in which Alcoa Corporation

operates or sells products; (j) the outcome of contingencies,

including legal proceedings, government or regulatory

investigations, and environmental remediation; (k) the impact of

cyberattacks and potential information technology or data security

breaches; and (l) the other risk factors discussed in Item 1A of

Alcoa Corporation’s Form 10-K for the fiscal year ended December

31, 2016 and other reports filed by Alcoa Corporation with the U.S.

Securities and Exchange Commission. Alcoa Corporation disclaims any

obligation to update publicly any forward-looking statements,

whether in response to new information, future events or otherwise,

except as required by applicable law. Market projections are

subject to the risks discussed above and other risks in the

market.

Non-GAAP Financial Measures

Some of the information included in this release is derived from

Alcoa’s consolidated financial information but is not presented in

Alcoa’s financial statements prepared in accordance with accounting

principles generally accepted in the United States of America

(GAAP). Certain of these data are considered “non-GAAP financial

measures” under SEC rules. These non-GAAP financial measures

supplement our GAAP disclosures and should not be considered in

isolation from, or as an alternative to, the GAAP measure.

Reconciliations to the most directly comparable GAAP financial

measures and management’s rationale for the use of the non-GAAP

financial measures can be found in the schedules to this

release.

Alcoa Corporation and subsidiaries Statement of

Consolidated Operations (unaudited) (dollars in millions,

except per-share amounts) Quarter ended March

31,

December 31,

March 31,

2016(2)(3)

2016(2)

2017 Sales $ 2,129 $ 2,537 $ 2,655 Cost

of goods sold (exclusive of expenses below) 1,866 2,123 2,043

Selling, general administrative, and other expenses 85 92 72

Research and development expenses 11 7 7 Provision for

depreciation, depletion, and amortization 177 182 179 Restructuring

and other charges 84 209 10 Interest expense 64 46 26 Other

expenses (income), net

39

1 (100 ) Total

costs and expenses 2,326 2,660 2,237 (Loss) income before

income taxes (197 ) (123 ) 418 Provision for income taxes

18 6

110 Net (loss) income (215 ) (129 ) 308

Less: Net (loss) income attributable to noncontrolling

interest

(5 )

(4 )

83

NET (LOSS) INCOME ATTRIBUTABLE TO ALCOA

CORPORATION

$ (210 )

$ (125

)

$ 225

EARNINGS PER SHARE ATTRIBUTABLE TO ALCOA

CORPORATION COMMON SHAREHOLDERS(1):

Basic: Net (loss) income $ (1.15 ) $ (0.68 ) $ 1.23 Average number

of shares 182,471,195 182,688,806 183,816,083 Diluted: Net

(loss) income $ (1.15 ) $ (0.68 ) $ 1.21 Average number of shares

182,471,195 182,688,806 186,303,547 Shipments of

aluminum products (metric tons) 764,000 852,000

801,000

(1) The respective basic and diluted earnings per share for

the quarter ended March 31, 2016 was calculated based on the

182,471,195 shares of Alcoa Corporation common stock distributed on

November 1, 2016 in conjunction with the completion of Alcoa

Corporation’s separation from its former parent company and are

considered pro forma in nature. Prior to November 1, 2016, Alcoa

Corporation did not have any issued and outstanding common stock.

(2)

Prior to November 1, 2016, Alcoa

Corporation’s financial statements were prepared on a carve-out

basis, as the underlying operations of the Company were previously

consolidated as part of Alcoa Corporation’s former parent company’s

financial statements. Accordingly, the results of operations of

Alcoa Corporation for the quarter ended March 31, 2016 and for the

month of October 2016 included in the quarter ended December 31,

2016 were prepared on such basis. The carve-out financial

statements of Alcoa Corporation are not necessarily indicative of

Alcoa Corporation’s combined results of operations had it been a

standalone company during the referenced periods. See the

Consolidated Financial Statements included in Alcoa Corporation’s

Annual Report on Form 10-K for the period ended December 31, 2016

filed with the United States Securities and Exchange Commission on

March 15, 2017 for additional information.

(3) In preparing the Statement of Consolidated Operations

for the year ended December 31, 2016, management discovered that

the amount of Cost of goods sold previously reported for the

quarter ended March 31, 2016 included an immaterial error due to an

under-allocation of LIFO expense of $7. As a result, management has

revised Cost of goods sold from the $1,859 previously reported to

$1,866 and Net loss attributable to Alcoa Corporation from the

$(203) previously reported to $(210).

Alcoa Corporation and subsidiaries Consolidated Balance

Sheet (unaudited) (in millions) December

31, March 31, 2016 2017 ASSETS Current

assets: Cash and cash equivalents $ 853 $ 804 Receivables from

customers 668 708 Other receivables 166 174 Inventories 1,160 1,294

Prepaid expenses and other current assets

334

424 Total current assets

3,181 3,404

Properties, plants, and equipment 22,550 23,070 Less: accumulated

depreciation, depletion, and amortization

13,225 13,642

Properties, plants, and equipment, net

9,325

9,428 Investments 1,358 1,393

Deferred income taxes 741 814 Fair value of derivative contracts

468 357 Other noncurrent assets

1,668

1,680 Total assets

$

16,741 $ 17,076

LIABILITIES Current liabilities: Accounts payable,

trade $ 1,455 $ 1,434 Accrued compensation and retirement costs 456

425 Taxes, including income taxes 147 176 Other current liabilities

742 568 Long-term debt due within one year

21

20 Total current liabilities

2,821 2,623

Long-term debt, less amount due within one year 1,424 1,431 Accrued

pension benefits 1,851 1,813 Accrued other postretirement benefits

1,166 1,154 Asset retirement obligations 604 635 Environmental

remediation 264 263 Noncurrent income taxes 310 352 Other

noncurrent liabilities and deferred credits

604

642 Total liabilities

9,044 8,913

EQUITY Alcoa Corporation shareholders’ equity: Common stock 2 2

Additional capital 9,531 9,553 Retained (deficit) earnings (104 )

121 Accumulated other comprehensive loss

(3,775

)

(3,800 ) Total Alcoa Corporation

shareholders' equity

5,654

5,876 Noncontrolling interest

2,043 2,287 Total

equity

7,697 8,163

Total liabilities and equity

$

16,741 $ 17,076

Alcoa Corporation and subsidiaries

Statement of Consolidated Cash Flows (unaudited) (in

millions) Three months ended March 31,

2016(3)

2017 CASH FROM OPERATIONS Net (loss)

income $ (215 ) $ 308

Adjustments to reconcile net (loss) income

to cash from operations:

Depreciation, depletion, and amortization 177 179 Deferred income

taxes - 23 Equity income, net of dividends 4 (1 ) Restructuring and

other charges 84 10 Net gain (loss) from investing activities –

asset sales 2 (120 ) Net periodic pension benefit cost 11 28

Stock-based compensation 8

7

Other 6

9

Changes in assets and liabilities, excluding effects of

acquisitions, divestitures, and foreign currency translation

adjustments: (Increase) decrease in receivables (23 ) 7 Decrease

(increase) in inventories 8 (102 ) Decrease in prepaid expenses and

other current assets -

13

(Decrease) in accounts payable, trade (152 ) (45 ) (Decrease) in

accrued expenses (205 ) (181 ) (Decrease) in taxes, including

income taxes (60 ) (17 ) Pension contributions (14 ) (21 ) Decrease

(increase) in noncurrent assets 14 (3 ) (Decrease) in noncurrent

liabilities

(4 )

(20 ) CASH (USED FOR) PROVIDED FROM OPERATIONS

(359 ) 74

FINANCING ACTIVITIES Net transfers from Parent Company 302 -

Cash paid to Arconic related to separation(1) - (238 ) Net change

in short-term borrowings (original maturities of three months or

less) (1 ) 2

Additions to debt (original maturities

greater than three months)

-

2

Payments on debt (original maturities greater than three months) (4

) (5 )

Proceeds from the exercise of employee

stock options

-

18

Contributions from noncontrolling interest - 24 Distributions to

noncontrolling interest (50 ) (57 ) Other

-

(6

) CASH PROVIDED FROM (USED FOR) FINANCING ACTIVITIES

247 (260 )

INVESTING ACTIVITIES Capital expenditures (86 ) (71 )

Proceeds from the sale of assets and

businesses(2)

(13 ) 238 Additions to investments (3 ) (25 ) Net change in

restricted cash

(1 )

(11 )

CASH (USED FOR) PROVIDED FROM INVESTING ACTIVITIES

(103 )

131

EFFECT OF EXCHANGE RATE CHANGES ON CASH

AND CASH EQUIVALENTS

17

6

Net change in cash and cash equivalents (198 ) (49 ) Cash

and cash equivalents at beginning of year

557

853

CASH AND CASH EQUIVALENTS AT END OF

PERIOD

$ 359 $

804

(1)

On November 1, 2016, Alcoa Corporation

separated from its former parent company (now named Arconic Inc.)

into a standalone, publicly-traded company. In

accordance with the terms of the related Separation and

Distribution Agreement, Alcoa Corporation paid to Arconic Inc. the

net after-tax proceeds of $238 from the sale of the Yadkin

Hydroelectric Project.

(2)

Proceeds from the sale of assets and

businesses for the three months ended March 31, 2016 includes a

cash outflow for cash paid as a result of a post-closing adjustment

associated with the December 2014 divestiture of an ownership stake

in a smelter in the United States.

(3)

Prior to November 1, 2016, Alcoa

Corporation’s financial statements were prepared on a carve-out

basis, as the underlying operations of the Company were previously

consolidated as part of Alcoa Corporation’s former parent company’s

financial statements. Accordingly, the cash flows of

Alcoa Corporation for the three months ended March 31, 2016 were

prepared on such basis. The carve-out financial

statements of Alcoa Corporation are not necessarily indicative of

Alcoa Corporation’s consolidated cash flows had it been a

standalone company during the referenced periods. See

the Combined Financial Statements included in Exhibit 99.1 to Alcoa

Corporation’s Form 10 Registration Statement and the Consolidated

Financial Statements included in the Company’s Annual Report on

Form 10-K for the period ended December 31, 2016 filed with the

United States Securities and Exchange Commission on October 11,

2016 and March 15, 2017, respectively, for additional

information.

Alcoa

Corporation and subsidiaries

Segment Information(1),(2)

(unaudited)

(dollars in millions; alumina and aluminum production and

shipments in thousands of metric tons [kmt])

1Q16 2Q16

3Q16 4Q16

2016 1Q17 Bauxite:

Production(3) (million dry metric

tons)

11.3 10.8 11.1 11.8 45.0 11.1

Total shipments (million dry metric

tons)

11.2 11.8 11.7 12.2 46.9 11.6 Third-party sales $ 44 $ 87 $ 93 $ 91

$ 315 $ 70 Intersegment sales $ 175 $ 182 $ 192 $ 202 $ 751 $ 219

Adjusted EBITDA $ 77 $ 99 $ 97 $ 102 $ 375 $ 110 Depreciation,

depletion, and amortization $ 17 $ 19

$ 21 $ 20 $ 77 $

18

Alumina: Production (kmt) 3,330 3,316 3,310

3,295 13,251 3,211 Third-party shipments (kmt) 2,168 2,266 2,361

2,276 9,071 2,255 Intersegment shipments (kmt) 1,257 1,137 1,140

1,169 4,703 947 Third-party sales $ 496 $ 601 $ 585 $ 618 $ 2,300 $

734 Intersegment sales $ 292 $ 321 $ 317 $ 377 $ 1,307 $ 361

Adjusted EBITDA $ 15 $ 114 $ 78 $ 171 $ 378 $ 297 Depreciation and

amortization $ 45 $ 47 $ 47 $ 47 $ 186 $ 49 Equity (loss) income

$ (14 ) $ (7 ) $ (9 ) $ (10 ) $

(40 ) $ 1

Aluminum: Primary aluminum

production (kmt) 600 595 586 587 2,368 559 Third-party aluminum

shipments (kmt) 764 770 761 852 3,147 801 Third-party sales $ 1,552

$ 1,597 $ 1,600 $ 1,782 $ 6,531 $ 1,806 Intersegment sales $ 34 $ 2

$ 2 $ 4 $ 42 $ 4 Adjusted EBITDA $ 165 $ 180 $ 183 $ 152 $ 680 $

206 Depreciation and amortization $ 103 $ 104 $ 103 $ 104 $ 414 $

101 Equity loss $ (7 ) $ (10 ) $ (7 ) $

– $ (24 ) $ (7 )

Reconciliation of

total segment Adjusted EBITDA to consolidated net (loss) income

attributable to Alcoa Corporation: Total segment Adjusted

EBITDA $ 257 $ 393 $ 358 $ 425 $ 1,433 $ 613 Unallocated amounts:

Impact of LIFO 18 (1 ) 1 (28 ) (10 ) (14 ) Metal price lag 2 2 1 4

9 6 Corporate expense (36 ) (50 ) (47 ) (44 ) (177 ) (33 )

Provision for depreciation, depletion, and amortization

(177

)

(178

)

(181

)

(182

)

(718

)

(179

)

Restructuring and other charges (84 ) (8 ) (17 ) (209 ) (318 ) (10

) Interest expense (64 ) (66 ) (67 ) (46 ) (243 ) (26 ) Other

(expenses) income, net (39 ) 23 106 (1 ) 89 100 Other

(74 ) (59 ) (52 ) (42 )

(227 ) (39 ) Consolidated (loss) income

before income taxes (197 ) 56 102 (123 ) (162 ) 418 Provision for

income taxes (18 ) (68 ) (92 ) (6 ) (184 ) (110 ) Net loss (income)

attributable to noncontrolling interest

5

(43

)

(20

)

4

(54

)

(83

)

Consolidated net (loss) income attributable to Alcoa Corporation

$

(210

)

$

(55

)

$

(10

)

$

(125

)

$

(400

)

$

225

The difference between certain segment totals and

consolidated amounts is in Corporate.

(1)

Effective in the first quarter of 2017, management elected to

change the profit and loss measure of Alcoa Corporation’s

reportable segments from After-tax operating income (ATOI) to

Adjusted EBITDA (Earnings before interest, taxes, depreciation, and

amortization) for internal reporting and performance measurement

purposes. This change was made to enhance the transparency and

visibility of the underlying operating performance of each segment.

Alcoa Corporation calculates Adjusted EBITDA as Total sales

(third-party and intersegment) minus the following items: Cost of

goods sold; Selling, general administrative, and other expenses;

and Research and development expenses. Previously, Alcoa

Corporation calculated ATOI as Adjusted EBITDA minus (plus) the

following items: Provision for depreciation, depletion, and

amortization; Equity loss (income); Loss (gain) on certain asset

sales; and Income taxes. Alcoa Corporation’s Adjusted EBITDA may

not be comparable to similarly titled measures of other companies.

Also effective in the first quarter of 2017, management

combined Alcoa Corporation’s aluminum smelting, casting, and

rolling businesses, along with the majority of the energy business,

into a new Aluminum business unit. This new business unit is

managed as a single operating segment. Prior to this change, each

of these businesses were managed separately and comprised the

Aluminum, Cast Products, Energy, and Rolled Products segments. As a

result, Alcoa Corporation’s operating and reportable segments are

Bauxite, Alumina, and Aluminum. Segment information for all

prior periods presented was revised to reflect the new segment

structure, as well as the new measure of profit and loss.

(2) Prior to November 1, 2016, Alcoa Corporation’s financial

statements were prepared on a carve-out basis, as the underlying

operations of the Company were previously consolidated as part of

Alcoa Corporation’s former parent company’s financial statements.

Accordingly, the financial results of Alcoa Corporation for all

periods prior to fourth quarter 2016 were prepared on such basis.

Additionally, the financial results of Alcoa Corporation for the

first month of fourth quarter 2016 were also prepared on a

carve-out basis. The carve-out financial statements of Alcoa

Corporation are not necessarily indicative of Alcoa Corporation’s

consolidated results of operations, financial position, and cash

flows had it been a standalone company during the referenced

periods. See the Combined Financial Statements included in Exhibit

99.1 to Alcoa Corporation’s Form 10 Registration Statement and the

Consolidated Financial Statements included in the Company’s Annual

Report on Form 10-K for the period ended December 31, 2016 filed

with the United States Securities and Exchange Commission on

October 11, 2016 and March 15, 2017, respectively, for additional

information.

(3)

The production amounts do not include

additional bauxite that Alcoa is entitled to receive (i.e. an

amount in excess of its equity ownership interest) from certain

other partners at the mine in Guinea.

Alcoa Corporation and subsidiaries

Calculation of Financial Measures (unaudited) (in

millions, except per-share amounts)

Adjusted (Loss) Income

(Loss) Income Diluted EPS(2) Quarter

ended Quarter ended

March

31,2016(1)

December

31,2016(1)

March

31,2017

March

31,2016(1)

December

31,2016(1)

March

31,2017

Net (loss) income attributable to Alcoa Corporation $

(210

) $ (125 ) $ 225 $ (1.15 ) $ (0.68 ) $ 1.21 Special items:

Restructuring and other charges

84

209

10

Discrete tax items(3)

5

(11

)

(2

)

Other special items(4)

12

30

(124

)

Tax impact(5)

(5

) (22 ) 5 Noncontrolling interest impact(5)

–

(55

)

3

Subtotal

96

151 (108 )

Net (loss) income attributable to Alcoa Corporation – as

adjusted

$

(114

)

$

26

$

117

(0.62

)

0.14

0.63

Net (loss) income attributable to Alcoa Corporation – as adjusted

is a non-GAAP financial measure. Management believes that this

measure is meaningful to investors because management reviews the

operating results of Alcoa Corporation excluding the impacts of

restructuring and other charges, discrete tax items, and other

special items (collectively, “special items”). There can be no

assurances that additional special items will not occur in future

periods. To compensate for this limitation, management believes

that it is appropriate to consider both Net (loss) income

attributable to Alcoa Corporation determined under GAAP as well as

Net (loss) income attributable to Alcoa Corporation – as adjusted.

(1) Prior to November 1, 2016, Alcoa Corporation’s financial

statements were prepared on a carve-out basis, as the underlying

operations of the Company were previously consolidated as part of

Alcoa Corporation’s former parent company’s financial statements.

Accordingly, the results of operations of Alcoa Corporation for the

quarter ended March 31, 2016 and for the month of October 2016

included in the quarter ended December 31, 2016 were prepared on

such basis. The carve-out financial statements of Alcoa Corporation

are not necessarily indicative of Alcoa Corporation’s consolidated

results of operations had it been a standalone company during the

referenced periods. See the Combined Financial Statements included

in Exhibit 99.1 to Alcoa Corporation’s Form 10 Registration

Statement and the Consolidated Financial Statements included in the

Company’s Annual Report on Form 10-K for the period ended December

31, 2016 filed with the United States Securities and Exchange

Commission on October 11, 2016 and March 15, 2017, respectively,

for additional information. (2) In any given period, the

average number of shares applicable to diluted EPS for Net (loss)

income attributable to Alcoa Corporation common shareholders may

exclude certain share equivalents as their effect is anti-dilutive.

However, certain of these share equivalents may become dilutive in

the EPS calculation applicable to Net (loss) income attributable to

Alcoa Corporation common shareholders – as adjusted due to a larger

and/or positive numerator. Specifically, for the quarter

ended December 31, 2016, share equivalents associated with

outstanding employee stock options and awards were dilutive based

on Net income attributable to Alcoa Corporation common shareholders

– as adjusted, resulting in a diluted average number of shares of

184,448,353, and for the quarter ended March 31, 2017, no

additional share equivalents were dilutive based on Net income

attributable to Alcoa common shareholders – as adjusted, resulting

in a diluted average number of shares of 186,303,547. Prior

to November 1, 2016, Alcoa Corporation did not have any issued and

outstanding common stock. As such, the respective basic and diluted

EPS related to both Net loss attributable to Alcoa Corporation and

Net loss attributable to Alcoa Corporation – as adjusted for the

quarter ended March 31, 2016 were calculated based on the

182,471,195 shares of Alcoa Corporation common stock distributed on

November 1, 2016 in conjunction with the completion of Alcoa

Corporation’s separation from its former parent company and are

considered pro forma in nature. (3) Discrete tax items

include the following:

•

for the quarter ended March 31, 2016, a

net charge for a number of small items;

•

for the quarter ended December 31, 2016, a

benefit for the remeasurement of certain deferred tax assets of a

subsidiary in Brazil due to a tax rate change; and

•

for the quarter ended March 31, 2017, a

net benefit for a number of small items.

(4) Other special items include the following:

•

for the quarter ended March 31, 2016,

costs associated with the then-planned separation of Alcoa

Corporation from its former parent company ($9) and a write-down of

inventory related to the permanent closure of a smelter in the

United States ($3);

•

for the quarter ended December 31, 2016,

costs associated with the separation of Alcoa Corporation from its

former parent company ($19), interest expense incurred in October

2016 related to debt that was issued in September 2016 in

preparation for the separation of Alcoa Corporation from its former

parent company (completed on November 1, 2016) ($8), a net

unfavorable change in certain mark-to-market energy derivative

contracts ($2), and an inventory adjustment at a curtailed refinery

in the United States ($1); and

•

for the quarter ended March 31, 2017, a

gain on the sale of the Yadkin Hydroelectric Project in the United

States ($120) and a net favorable change in certain mark-to-market

energy derivative contracts ($4).

(5) The tax impact on special items is based on the

applicable statutory rates in the jurisdictions where the special

items occurred. The noncontrolling interest impact on special items

represents Alcoa’s partners’ share of certain special items.

Alcoa Corporation and subsidiaries Calculation of

Financial Measures (unaudited), continued (in millions)

Adjusted EBITDA

Quarter ended

March 31,

2016(1)

December 31,

2016(1)

March 31,

2017

Net (loss) income attributable to Alcoa

Corporation

$

(210

) $ (125 ) $ 225 Add: Net (loss) income attributable to

noncontrolling interest

(5

)

(4

)

83

Provision for income taxes

18

6 110 Other expenses (income), net

39

1 (100 ) Interest expense

64

46 26 Restructuring and other charges

84

209 10 Provision for depreciation, depletion, and amortization

177

182

179

Adjusted EBITDA

$

167

$ 315 $

533 Special items(2)

12

20 –

Adjusted EBITDA, excluding special items

$

179

$

335

$

533

Alcoa’s Corporation’s definition of Adjusted EBITDA

(Earnings before interest, taxes, depreciation, and amortization)

is net margin plus an add-back for depreciation, depletion, and

amortization. Net margin is equivalent to Sales minus the following

items: Cost of goods sold; Selling, general administrative, and

other expenses; Research and development expenses; and Provision

for depreciation, depletion, and amortization. Adjusted EBITDA is a

non-GAAP financial measure. Management believes that this measure

is meaningful to investors because Adjusted EBITDA provides

additional information with respect to Alcoa Corporation’s

operating performance and the Company’s ability to meet its

financial obligations. The Adjusted EBITDA presented may not be

comparable to similarly titled measures of other companies.

(1) Prior to November 1, 2016, Alcoa Corporation’s financial

statements were prepared on a carve-out basis, as the underlying

operations of the Company were previously consolidated as part of

Alcoa Corporation’s former parent company’s financial statements.

Accordingly, the results of operations of Alcoa Corporation for the

quarter ended March 31, 2016 and for the month of October 2016

included in the quarter ended December 31, 2016 were prepared on

such basis. The carve-out financial statements of Alcoa Corporation

are not necessarily indicative of Alcoa Corporation’s consolidated

results of operations had it been a standalone company during the

referenced periods. See the Combined Financial Statements included

in Exhibit 99.1 to Alcoa Corporation’s Form 10 Registration

Statement and the Consolidated Financial Statements included in the

Company’s Annual Report on Form 10-K for the period ended December

31, 2016 filed with the United States Securities and Exchange

Commission on October 11, 2016 and March 15, 2017, respectively,

for additional information. (2) Special items include the

following (see reconciliation of Adjusted (Loss) Income above for

additional information):

•

for the quarter ended March 31, 2016, costs associated with the

then-planned separation of Alcoa Corporation from its former parent

company ($9) and a write-down of inventory related to the permanent

closure of a smelter in the United States ($3); and

•

for the quarter ended December 31, 2016, costs associated with the

separation of Alcoa Corporation from its former parent company

($19) and an inventory adjustment at a curtailed refinery in the

United States ($1).

Alcoa Corporation and

subsidiaries

Calculation of Financial Measures

(unaudited), continued

(in millions)

Free Cash Flow Quarter ended

December 31,

2016(1)

March 31,

2017

Cash from operations

$

239

$ 74 Capital expenditures

(146

)

(71

)

Free cash flow

$

93

$ 3 Free Cash Flow is a

non-GAAP financial measure. Management believes that this measure

is meaningful to investors because management reviews cash flows

generated from operations after taking into consideration capital

expenditures due to the fact that these expenditures are considered

necessary to maintain and expand Alcoa Corporation’s asset base and

are expected to generate future cash flows from operations. It is

important to note that Free Cash Flow does not represent the

residual cash flow available for discretionary expenditures since

other non-discretionary expenditures, such as mandatory debt

service requirements, are not deducted from the measure. (1)

Prior to November 1, 2016, Alcoa Corporation’s financial statements

were prepared on a carve-out basis, as the underlying operations of

the Company were previously consolidated as part of Alcoa

Corporation’s former parent company’s financial statements.

Accordingly, the cash flows of Alcoa Corporation for the month of

October 2016 included in the quarter ended December 31, 2016 were

prepared on such basis. The carve-out financial statements of Alcoa

Corporation are not necessarily indicative of Alcoa Corporation’s

consolidated cash flows had it been a standalone company during the

referenced periods. See the Combined Financial Statements included

in Exhibit 99.1 to Alcoa Corporation’s Form 10 Registration

Statement and the Consolidated Financial Statements included in the

Company’s Annual Report on Form 10-K for the period ended December

31, 2016 filed with the United States Securities and Exchange

Commission on October 11, 2016 and March 15, 2017, respectively,

for additional information.

Net Debt December 31, March 31, 2016

2017 Short-term borrowings $ 1 $ 3 Long-term debt due

within one year 21 20 Long-term debt, less amount due within one

year

1,424 1,431 Total debt

$ 1,446 $ 1,454 Less: Cash and cash equivalents

853 804 Net debt

$ 593 $ 650 Net

debt is a non-GAAP financial measure. Management believes that this

measure is meaningful to investors because management assesses

Alcoa Corporation’s leverage position after factoring in available

cash that could be used to repay outstanding debt.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170424006400/en/

Alcoa CorporationInvestor Contact:James Dwyer, +1

212-518-5450James.Dwyer@alcoa.comorMedia Contact:Monica Orbe, +1

212-518-5455Monica.Orbe@alcoa.com

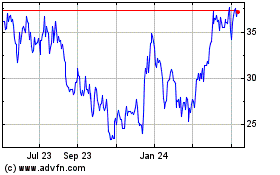

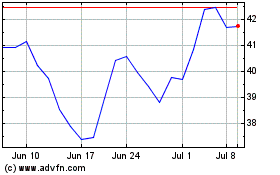

Alcoa (NYSE:AA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alcoa (NYSE:AA)

Historical Stock Chart

From Apr 2023 to Apr 2024