TIDMALBA

RNS Number : 7443F

Alba Mineral Resources PLC

01 August 2016

ALBA MINERAL RESOURCES PLC

HALF-YEARLY REPORT

CHAIRMAN'S STATEMENT

The Board of Alba Mineral Resources plc (the "Company" or "Alba"

or collectively with its Subsidiary Companies, the "Group") is

pleased to report the Company's interim results for the six months

ended 31 May 2016. They incorporate the results of its subsidiary

companies Aurum Mineral Resources Limited ("AMR"), Mauritania

Ventures Limited ("MVL") and Alba Mineral Resources Sweden AB

("Alba Sweden") (collectively the "Subsidiary Companies").

INTRODUCTION

Alba is an explorer with a commodity focus on oil & gas,

graphite, gold, uranium and base metals. Alba holds interests in

the UK oil & gas exploration sector, plus hard rock exploration

assets in Greenland (Graphite and Gold), Ireland (Base Metals and

Gold) and Mauritania (Uranium). The Group's overall technical and

corporate strategy is to identify and acquire natural resource

projects it believes to have good potential and to advance them

expediently. This will be achieved by controlled design and

execution of a cost-effective generative process utilising data

acquisition, GIS data analysis and exploration programme planning,

led by our internal technical team and, where appropriate, through

the support of external technical consultants.

RESULTS FOR THE PERIOD

The Group made a loss attributable to equity holders of the

parent for the period, after taxation, of GBP198,803. The basic and

diluted loss per share was 0.03 pence.

REVIEW OF ACTIVITIES

Corporate

On 26 February 2016, the Company announced that it had raised

GBP525,000 (before expenses) in an oversubscribed placing, through

the issue of 131,250,000 new ordinary shares at a price of 0.4

pence per ordinary share.

On 16 March 2016, the Company announced the appointment of Mr.

Manual Lamboley to the Board as a Non-Executive Director. Mr. Ben

Harber of Shakespeare Martineau was appointed as Company

Secretary.

Horse Hill (UK)

The Horse Hill-1 well ("HH-1") is located within onshore

exploration licence PEDL 137, on the northern side of the Weald

Basin near Gatwick Airport. Alba owns a 15% direct interest in

Horse Hill Developments Limited ("HHDL"). HHDL is a special purpose

company that owns a 65% participating interest and operatorship of

Licence PEDL137 and the adjacent Licence PEDL246 in the UK Weald

Basin. The remaining 35% participating interests in the PEDL137 and

PEDL246 licences are held by US-based Magellan Petroleum

Corporation.

On 4 January 2016 the Company announced that it had been

notified by HHDL that the Oil and Gas Authority ("OGA") had granted

consent for an extended flow test over three separate zones in the

Horse Hill-1 oil discovery well and, as such, that all necessary

permissions had been granted in order for the Horse Hill-1 well to

be flow tested. On 8 February 2016 Alba announced that flow tests

had commenced. The final flow test results were announced by Alba

on 21 March 2016. The final total aggregate stable dry oil flow

rate from two Kimmeridge limestones plus the overlying Portland

sandstone was measured at 1,688 barrels of oil per day.

Amitsoq (Greenland)

On 4 February 2016 the Company announced that it had completed

an iron oxide (FeO) alteration remote sensing (satellite) study on

the Amitsoq graphite project near Nanortalik in southern Greenland.

The interpreted results were highly encouraging and provide

numerous target areas for follow-up ground work and geophysics,

highlighted as follows:

- Numerous and continuous graphitic horizons suggested along

strike and proximal to the Amitsoq graphite mine.

- FeO anomalies are coincident with known graphite occurrences

at the former Amitsoq graphite mine.

- Two zones contain multiple lenses of interpreted bedded

graphite along strike 2.5 km and 5.8 km to the northeast of the

Amitsoq mine.

- Additional FeO anomalies are interpreted to be favourable

targets for platinum group metals, orogenic lode gold and intrusion

related copper-zinc mineralization.

- Anomalies identified with geology similar to economic gold

mineralization at the nearby Nalunaq gold mine (circa 340,000

ounces of gold produced to date).

-

On 26 May 2016 the Company announced that it had elected to earn

into the Amitsoq project and had agreed a variation to the terms of

its earn in, such that Alba will earn an initial 49 per cent

interest in the Project through the issue of GBP100,000 of Alba

shares to Artemis (calculated at a 20 trading day volume-weighted

average price) and by funding a minimum of a further DKK 1,476,740

(approximately GBP146,000) of exploration costs on the Project by

31 December 2016.

Limerick Basin Project - Ireland

The exploration licence in the Limerick Basin is highly

prospective for zinc, lead gold and silver and is only 10 km away

from and part of the same target unit as the Pallas Green zinc

discovery. On 28 April 2016 an application to renew this licence

was made. Following the grant of the renewal (see "Post Period

End", below), the Company will initially undertake a geophysical

survey, either Gravity or Induced Polarisation or both, to help

better understand the structural elements of the licence area that

may be controlling the known sulphide mineralisation that is

present within the licence boundaries.

El Mreiti Project - Mauritania

An application has been submitted to the Mauritanian Authorities

to take out a new licence over a reduced area within the original

licence area, which includes the centre of the previously

discovered and announced high-tenor uranium anomalies. Alba and its

joint venture partner will then consider their options with regards

to funding the next stage of exploration. The continued development

of the Mauritania exploration activities is dependent on the grant

of the new licence. An emphasis of matter has been included in the

auditor's report on this point which can be found in the annual

report for the year ended 30 November 2015.

Other Development Projects

Alba continues to review and discuss other project or investment

opportunities, which have been brought to us by the Board,

management, advisers or other contacts that may have

value-enhancing potential.

Post Period End

Horse Hill

On 5 July 2016 the Company announced that the OGA had granted a

licence conversion to new model terms for Horse Hill PEDL137 and

PEDL246. At the election of the Operator, HHDL, the licences will

adopt 2016 14th Round licence terms permitting the Horse Hill

licences to continue without further relinquishment. A Retention

Area ("RA") covering the entire 55 square mile licence area and an

outline work programme has been agreed with the OGA. The RA will

continue throughout the agreed work programme period currently due

to expire on June 30, 2018 for PEDL137 and June 30, 2017 for

PEDL246. The Horse Hill licences forward work plan includes

long-term production testing of three Kimmeridge Limestone zones

plus the overlying Portland, two contingent appraisal/development

wells and 3D seismic.

On 19 July 2016 the Company announced that a new petrophysical

analysis by Nutech, incorporating the findings of the successful

Horse Hill-1 ("HH-1") flow test, demonstrates a threefold increase

in calculated total oil in place (OIP) per square mile at the HH-1

well within the Upper Portland pay zone. As reported in May 2015, a

total Horse Hill Portland P50 OIP of 21 Million Barrels ("MMbbl")

was calculated utilising Nutech's petrophysical analyses. Nutech's

May 2015 evaluation assigned a Portland OIP value of 7.7 MMbbl per

square mile at the HH-1 well. Nutech's current evaluation upgrades

the Portland OIP at HH-1 to 22.9 MMbbl per square mile, a 200%

increase. As previously stated by the Company, the calculated OIP

per square mile should not be construed as recoverable resources,

contingent or prospective resources or reserves.

In its announcement on 19 July 2016, the Company also gave an

indication of the future plans for the development of the Horse

Hill onshore oil field which involve new permitting applications

and additional commercial flow testing. The applications will seek

permission to conduct a programme consisting of the production flow

testing of three Kimmeridge Limestone zones plus the overlying

Portland over a total flow period of up to 360 days, plus two

further appraisal/development wells and the acquisition of 3D

seismic data. Engineering studies to examine the range of possible

flow rates from a planned horizontal sidetrack well are ongoing.

Data to further calibrate these studies will be acquired during the

further planned extended flow tests.

Ireland

On 26 July 2016, Alba announced that it has received

confirmation from the Irish Department of Communications, Energy

& Natural Resources (Exploration and Mining Division) that the

Company's prospecting licence in County Limerick, Ireland (Area No.

3824) has been renewed for a further two years until 26 May 2018,

for Base Metals, Gold,Silver and Barytes.

Outlook

The positive developments in relation to the Horse Hill project

over the past several months - most notably the very successful

flow test results completed in the first quarter of 2016 - have

provided further justification for Alba's decision to invest in the

project and to increase its interest successively from an initial 5

per cent to its current 15 per cent interest in HHDL.

Aside from Horse Hill, the Board intends to carry out work

programmes in the remainder of 2016 in both Greenland and Ireland.

In addition, we continue actively to consider other projects and

investment opportunities which may bolster the Company's portfolio

of assets and provide further value and interest for our

shareholders.

George Frangeskides

1 August 2016

Executive Chairman

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For further information please visit the Company's website,

www.albamineralresources.com, or contact:

Alba Mineral Resources plc George Frangeskides, Chairman Tel: +44 (0) 20 7264 4366

Mike Nott, CEO

Cairn Financial Advisers LLP (Nominated Advisers) James Caithie/Liam Murray Tel: +44 (0) 20 7148 7900

UNAUDITED CONSOLIDATED INCOME STATEMENT

FOR THE SIX MONTHS ENDED 31 MAY 2016

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31 May 31 May 30 Nov

2016 2015 2015

Revenue - - -

Cost of sales - - -

Gross loss - - -

--------------------------- ---------- ---------- ----------

Other administrative

expenses (200,118) (232,594) (292,705)

Exceptional items - - -

--------------------------- ---------- ---------- ----------

Administrative expenses (200,118) (232,594) (292,705)

---------- ---------- ----------

Operating (loss)/profit (200,118) (232,594) (292,705)

Finance costs - - -

---------- ---------- ----------

(Loss)/profit before

tax (200,118) (232,594) (292,705)

---------- ---------- ----------

Taxation - - -

---------- ---------- ----------

(Loss)/profit for the

year (200,118) (232,594) (292,705)

---------- ---------- ----------

Attributable to:

Equity holders of the

parent (198,803) (232,118) (291,563)

Non-controlling interests (1,315) (476) (1,142)

---------- ---------- ----------

(200,118) (232,594) (292,705)

---------- ---------- ----------

Loss per ordinary share

Basic and diluted (0.03) (0.04) (0.04)

pence pence pence

UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 MAY 2016

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31 May 31 May 30 Nov

2016 2015 2015

Non-current assets

Intangible fixed assets 668,330 613,787 662,874

Investments 2,114,222 786,500 1,838,222

------------ ------------ ------------

Total non-current assets 2,782,552 1,400,287 2,501,096

------------ ------------ ------------

Current assets

Trade and other receivables 108,962 11,541 96,942

Cash and cash equivalents 336,050 255,042 288,494

------------ ------------ ------------

Total current assets 445,012 266,583 385,436

------------ ------------ ------------

Current liabilities

Trade and other payables (121,503) (88,920) (80,000)

Financial liabilities (254,074) (254,074) (254,073)

------------ ------------ ------------

Total current liabilities (375,577) (342,994) (334,073)

------------ ------------ ------------

Net assets 2,851,987 1,323,876 2,552,459

------------ ------------ ------------

Capital and reserves

Called up share capital 2,124,421 1,558,178 1,993,171

Share premium account 2,953,786 2,046,624 2,586,286

Warrant reserve 446,291 129,851 446,291

Retained losses (3,082,659) (2,824,411) (2,883,856)

Merger reserve 200,000 200,000 200,000

Foreign currency reserve 184,867 186,370 183,969

------------ ------------ ------------

Equity attributable to

equity holders of the

parent 2,826,706 1,296,612 2,525,861

Non-controlling interests 25,281 27,264 26,598

------------ ------------ ------------

Total equity 2,851,987 1,323,876 2,552,459

------------ ------------ ------------

UNAUDITED CONSOLIDATED CASH FLOW STATEMENT

FOR THE SIX MONTHS ENDED 31 MAY 2016

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31 May 31 May 30 Nov

2016 2015 2015

Cash flows from operating

activities

Operating loss (200,118) (232,594) (292,705)

Non cash settlement of fees - 90,000 -

for professional services

Foreign exchange revaluation

adjustment 896 1,984 (5,204)

Decrease/ increase in

creditors 41,503 38,566 (13,599)

(Increase)/ decrease

in debtors (12,019) 4,968 (88,190)

---------- ---------- ----------

Net cash used in operating

activities (169,738) (97,076) (399,698)

---------- ---------- ----------

Cash flows from investing

activities

Payments for deferred

exploration expenditure (5,456) (7,309) (51,609)

Investments (petroleum

exploration) (276,000) (421,500) (882,690)

---------- ---------- ----------

Net cash used in investing

activities (281,456) (428,809) (934,299)

---------- ---------- ----------

Cash flows from financing

activities

Net proceeds from issue

of shares and warrants 525,000 750,251 1,654,315

Proceeds from borrowings (26,250) - (62,500)

---------- ---------- ----------

Net cash generated from

financing activities 498,750 750,251 1,591,815

---------- ---------- ----------

Net increase in cash

and cash equivalents 47,556 224,366 257,818

Cash and cash equivalents

at beginning of period 288,494 30,676 30,676

---------- ---------- ----------

Cash and cash equivalents

at end of year 336,050 255,042 288,494

---------- ---------- ----------

NOTES TO THE HALF-YEARLY FINANCIAL INFORMATION

1. Basis of preparation

The Group consolidates the financial statements of the Company

and its subsidiary undertakings.

The financial information has been prepared under the historical

cost convention in accordance with International Financial

Reporting Standards ("IFRS"), International Accountant Standards

("IAS") and IFRS Interpretations Committee ("IFRIC")

interpretations as adopted by the European Union. The financial

information set out in this half-yearly report does not constitute

statutory accounts as defined in Section 434 of the Companies Act

2006. The same accounting policies, presentation and methods of

computation are followed in this interim condensed consolidated

report as were applied in the Group's annual financial statements

for the year ended 30 November 2015. The auditor's report on those

financial statements was unqualified and did not contain any

statements under section 498(2) or section 498(3) of the Companies

Act 2006. The auditor's report for the year ended 30 November 2015

did include emphasis of matter paragraphs relating to the

uncertainty as to whether the Group can raise sufficient funds to

continue to develop the Group's exploration assets.

2. Taxation

No charge for corporation tax for the period has been made due

to the expected tax losses available.

3. Loss per share

Basic loss per share is calculated by dividing the loss

attributable to ordinary shareholders of GBP198,803 (May 2015:

GBP232,118; November 2015: GBP291,564) by the weighted average

number of shares of 742,971,557 (May 2015: 542,338,783; November

2015: 692,258,595) in issue during the period. The diluted loss per

share calculation is identical to that used for basic loss per

share as the exercise of warrants would have the effect of reducing

the loss per ordinary share and therefore is not dilutive under the

terms of Financial Reporting Standard 22 "Earnings Per Share".

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR AKCDPPBKDCOB

(END) Dow Jones Newswires

August 01, 2016 02:00 ET (06:00 GMT)

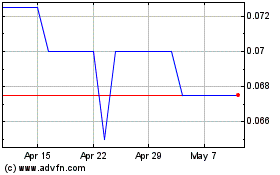

Alba Mineral Resources (LSE:ALBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

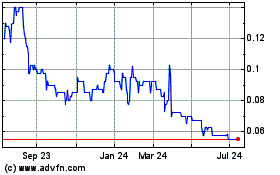

Alba Mineral Resources (LSE:ALBA)

Historical Stock Chart

From Apr 2023 to Apr 2024