TIDMALBA

RNS Number : 6678M

Alba Mineral Resources PLC

01 August 2017

1 August 2017

Click on or paste the following link into your website browser

to view the associated PDF document (including maps and

images):

http://www.rns-pdf.londonstockexchange.com/rns/6678M_-2017-7-31.pdf

Alba Mineral Resources plc

("Alba" or the "Company")

Alba Awarded Exclusive Exploration Licence

in Thule Black Sand Province, Greenland

Alba Mineral Resources plc (AIM: ALBA) is pleased to announce

that it has been granted an exclusive mineral exploration licence

over a significant proportion of the coastline in the Thule black

sand province in north-west Greenland. The licence area is

prospective for heavy mineral sands, especially ilmenite.

HIGHLIGHTS

-- Alba has been granted an exclusive mineral exploration

licence covering 384 km(2) of prospective coastline in the Thule

province of north-west Greenland.

-- Black heavy mineral sands have been recorded in the region

for many decades. The sands are enriched with ilmenite and/or

magnetite.

-- The grade of the active beaches in the region is high - up to

60% - with a historic average of about 43% TiO(2) . Raised beaches

have a larger tonnage potential but lower titanium values - up to

23% TiO(2) with an average around 12%.

-- According to the Geological Survey of Denmark and Greenland

("GEUS"), "the beaches around the former settlement Moriusaq and

along the adjacent south-east trending coastline are the most

promising black sand occurrences from an economic point of view".

The most economically promising heavy mineral sands occur on active

and raised beaches of the Steensby Land ilmenite showing.

-- Alba has secured a 104 km stretch of this coast (including

inlet areas) being approximately 70 per cent of the total length of

this prospective coastline.

-- Bluejay Mining Plc (AIM: JAY) ("Bluejay"), which owns 100% of

the neighbouring Pittufik ilmenite project (just 9 km from Alba's

licence area and on the same south-east trending coastline), has

announced an Inferred Resource of 23.6Mt at 8.8% ilmenite (in

situ), including a high-grade zone equal to 7.9Mt at 14.2% ilmenite

(in situ) at Moriusaq which is the focus of feasibility and

production studies.

-- GEUS has recently estimated that 10 billion tonnes of

ilmenite exist in the original rock within the entire region, with

a further 7 billion tonnes of ilmenite present in the form of

placer ilmenite. While non-JORC compliant, this highlights the

potential of the province to host economic detrital ilmenite on

Alba's licence.

-- Alba has secured 100 per cent ownership of this project at no

cost to shareholders other than modest due diligence review costs

and the fee for licence grant.

-- Alba is in the process of settling an exploration programme

for this year with a view to confirming grade and extent of

mineralization within the Alba licence area. Exploration will

primarily involve surface sampling and trenching and use of ground

penetrating radar, together with relatively inexpensive shallow

augur drilling of the beach zones.

George Frangeskides, Alba's Executive Chairman, commented:

"We are delighted to have secured an extensive foothold within

this significant emerging global ilmenite province. We are very

grateful for the support shown by the Mineral Licence and Safety

Authority and the Government of Greenland in awarding this licence

to Alba, which we regard as an endorsement of the work we have

carried out to date at our other principal exploration project, the

high grade Amitsoq graphite project in southern Greenland."

"Alba's application for this licence area results from a

thorough due diligence review of available exploration ground in

Greenland which we carried out in conjunction with our technical

team. Alba's management is always on the search for significant new

project opportunities as we strive to create value for

shareholders, and we believe we have unearthed significant

potential with this Project."

"Ilmenite is the primary source of titanium dioxide, which is

used as pigment in several industries including plastic, paints,

coatings and paper, among others. Increasing demand for titanium

dioxide is among the major factors driving demand for

ilmenite."

"We believe that securing this new, 100 per cent owned project

at a negligible entry cost, is a potentially valuable addition to

Alba's project portfolio which now consists of significant assets

in both the mineral and oil and gas sectors. We look forward to

demonstrating that value to shareholders in the weeks and months

ahead."

Project Location

Alba's new heavy mineral sands project (the "Black Sands

Project" or "Project") is situated on the Steensby Land peninsular

in the north-west of Greenland, approximately 80 km south of the

regional settlement of Qaanaaq. The location is well placed for

infrastructure, being close to a deep-water port and international

airport at Thule Air Base operated by the United States Air Force

to the south-east, as well as Qaanaaq domestic airport to the

north. Both airports have regular flights from several airlines,

including Air Greenland.

Thule Black Sand Province

The Thule black sand province in north-west Greenland consists

of several hundred kilometres of coastline containing ilmenite- and

magnetite-rich sands. According to GEUS, elevated ilmenite

concentrations - up to 60 wt% (weight percentage) ilmenite with an

average of 37 wt% - are recorded on both active and raised beaches.

The main source of the ilmenite sands, per GEUS, is a regional

Neoproterozoic basaltic sill and dyke complex that intrudes the

Mesoproterozoic basement. The sills have unusually high titanium

content; up to 5.25 wt% in whole-rock analysis. Per GEUS, earlier

commercial studies on the black sand deposits have concluded that a

high titanium dioxide ("TiO(2) ") content slag ilmenite concentrate

could be produced because the level of other oxides is lower than

most ilmenite smelted (GEUS, Thule Black Sand Province and Regional

Geology, 2015/61).

Black heavy mineral sands have been recorded in the region for

some decades. The sands are enriched in ilmenite and/or magnetite,

derived from Neoproterozoic titanium-rich dolerite sills and dykes

in the immediate hinterland of the beaches.

According to historic reports, the thickest stratigraphic

section of the sills is in the Moriusaq half-graben where in

southern Steensby Land the clastic strata hosts about 15 master

sills that make up between 30 and 40% of the section; this is also

referred to as the Steensby Land sill complex. The current

mineralization sought by Alba is placer in nature, and is present

mainly in raised beaches (up to 40 m above sea level) and active

beach environments.

The deposits in the region are of two principal types:

- "Raised" and "Active" Beaches: these contain ilmenite

accumulations of unknown depths. The "active" beaches are those

areas seaward of the frontal dunes, including the beach, tidal

zones and surf zones. The "raised" beaches mean those areas of

frontal dunes set back from the beach. Alba's Black Sands Project

consists of approximately 104 km of total coastline, including both

the outer coast and inlet areas. The largest width of raised

beaches within Steensby Land is up to 3 km, around Booth Sund. This

is within Alba's licence area.

- "Off-shore" beaches: this refers to the areas seaward of the

active beaches, in the shallow marine environment in up to

approximately 20 metres of water.

According to historic reports, the grade of the active beaches

in the Steensby Land is high - up to 60% - with a historic average

of about 43% TiO(2) . Raised beaches have a larger tonnage

potential but lower titanium values - up to 23% TiO(2) with an

average around 12%. These historic sampling results were taken from

areas outside of the Company's licence area, albeit on the same

geological trend.

In a 2017 regional study by GEUS, covering the entire Thule

black sand province, GEUS estimated that 10 billion tonnes of

ilmenite exist in the original rock with a further 7 billion tonnes

present in the form of placer ilmenite within the project region

(covering an area of some 300 km x 150 km). This potential tonnage

of ilmenite is non-JORC compliant, but does highlight the potential

of the province to host economic detrital ilmenite on Alba's

licence. Alba has secured the great majority of the most

prospective areas of known raised and active beach deposits

identified in historic reports and which were not already under

licence to Bluejay Mining plc.

Note: a "placer" deposit means an accumulation of minerals

formed by gravity separation during sedimentary processes, in this

case natural erosion caused by the sea. It is this placer ilmenite

- located within the active, raised and off-shore beaches, which

will be Alba's primary target for exploration and development.

Project Plans

While this heavy mineral sands project represents a new venture

for Alba, the Company benefits from a large volume of historic work

and studies that have been undertaken in the Thule region in

respect of the potential for the exploitation of its mineral

sands.

Most recently, the Company is aware of the significant progress

made by Bluejay Mining Plc (AIM: JAY) at its Pituffik Project, only

9 km from Alba's Black Sands Project and on the same south-east

trending coastline which has been identified by GEUS as the most

highly prospective area in the entire region. Bluejay has defined

an initial JORC resource, has recently announced (per its RNS of 10

July 2017) that Pituffik is the highest graded mineral sand

ilmenite project globally and is pushing forward with its plans for

the development of the deposit. This gives the Company huge

encouragement as Alba seeks to progress work on its neighbouring

project area. The prospective Steensby Land coastline is now

dominated by just two mining companies.

The early objectives of Alba's work at the Project will be

likely to involve the completion of the following field work

activities, with the main focus initially being on the active

beaches:

- Contour mapping using satellite images.

- Ground penetrating radar ("GPR") to find the highest accumulations of black sand.

- Ground magnetic survey to identify areas where the sand has been concentrated.

- Sampling and assaying in order to confirm grade.

- Trenching at the best targets in order to confirm the results of the GPR and magnetic study.

- Auger drilling or push drilling to prove the continuity of

thickness and grade and confirm an initial JORC resource.

- Testing for ilmenite-bearing sediments within the shallow, off-shore beaches.

In Alba's view, this work can be carried out relatively

inexpensively when compared to traditional hard rock exploration

and drilling.

We intend to submit a work programme to the Mineral Licensing

and Safety Authority (MLSA) in Greenland shortly and to undertake

much of this work in the forthcoming field season, with the

objective that by the close of the present field season we will

have significantly progressed the Company's understanding of the

grade and extent of the mineralization at the Project.

Ilmenite and the Titanium Dioxide Market

Ilmenite is the primary source of titanium dioxide, TiO(2) .

Titanium dioxide is mined as ilmenite, rutile or, in lesser

quantities, leucoxene. It is a dark coloured mineral which, with

processing, becomes white and opaque. It is primarily used as a

whitening pigment in paints, plastics and paper. Other uses include

the manufacture of titanium metal.

Titanium dioxide feedstocks are graded by their titanium dioxide

content. Feedstocks are either sold as raw minerals (rutile and

chloride or sulphate ilmenite) or as processed or upgraded

feedstocks, whereby ilmenite is processed to increase its titanium

dioxide content. Upgraded feedstocks are synthetic rutile, chloride

and sulphate slag and upgraded slag.

Titanium dioxide feedstocks are used predominately for the

manufacture of pigment due to its opacity, UV resistance and

non-toxic properties. This pigment is in turn used in paints, paper

and plastics. Use in pigment accounts for approximately 80 to 90

per cent of total global demand for titanium feedstocks. Titanium

metal and welding flux cord wire jointly account for the remaining

10 to 20 per cent of demand. Historically, demand for titanium

feedstock has grown broadly in line with global GDP growth (source:

Iluka Resources Ltd).

According to Lucintel, the global titanium dioxide market is

expected to reach an estimated $18.2 billion by 2021 and is

forecast to grow at a compound annual growth rate (CAGR) of 3.4%

from 2016 to 2021. The major growth drivers for this market are

growing demand for titanium dioxide in end use industries like

paint, coatings and plastics. The Asia Pacific region is expected

to remain the largest market due to growth of those end use

industries, economic expansion in India and China and growing

consumption of paints and coatings particularly in the automotive

and construction industry (source: Lucintel, January 2017).

Licence Details

Exclusive mineral exploration licence 2017/29 has been granted

to Alba's wholly-owned subsidiary, White Eagle Resources Limited.

The licence covers all mineral resources except hydrocarbons,

radioactive elements and hydro-power. The Company's focus will be

on exploration for heavy mineral sands, principally ilmenite. The

licence is granted for a period of five years, and renewal

thereafter for a further period of five years is subject to

fulfilment of licence conditions including minimum expenditure

obligations.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For further information, please contact:

Alba Mineral Resources plc

George Frangeskides (Executive Chairman) Tel: +44 20 7264 4366

Cairn Financial Advisers LLP (Nomad)

James Caithie/Liam Murray Tel: +44 20 7213 0880

Dowgate Capital Stockbrokers Ltd (Broker)

Jason Robertson / Neil Badger Tel: +44 1293 517744

Competent Person's Declaration

The information in this announcement that relates to the

geology, exploration results and work programme is based on

information compiled by and reviewed by EurGeol Dr Sandy M.

Archibald, PGeo, Aurum Exploration Services, who is a Professional

Geologist and Member of the Institute of Geologists of Ireland, and

a Fellow of the Society of Economic Geologists. He is a geologist

with fifteen years' experience in the exploration industry, and ten

years post-graduate studies.

Sandy M. Archibald is a Technical Advisor to Alba Mineral

Resources plc and has sufficient experience which is relevant to

the style of mineralization and type of deposit under

consideration, and to the type of activity which he is undertaking

to qualify as a Competent Person as defined in the June 2009

Edition of the AIM Note for Mining and Oil & Gas Companies.

Sandy M. Archibald consents to the inclusion in the announcement of

the matters based on the information in the form and context in

which it appears and confirms that this information is accurate and

not false or misleading.

Alba's Project Portfolio

Oil & Gas

Horse Hill (Oil & Gas, UK): Alba holds a 15 per cent

interest in Horse Hill Developments Limited, the company which has

a 65 per cent participating interest and operatorship of the Horse

Hill oil and gas project (licences PEDL 137 and PEDL 246) in the UK

Weald Basin.

Brockham (Oil & Gas, UK): Alba has a direct 5 per cent

interest in Production Licence 235, which comprises the previously

producing onshore Brockham Oil Field.

Mining

Amitsoq (Graphite, Greenland): Alba owns a 90 per cent interest

in the Amitsoq Graphite Project in Southern Greenland and has an

option over the remaining 10 per cent.

Black Sands (Ilmenite, Greenland): Alba owns 100 per cent of

mineral exploration licence 2017/29 in the Thule region, North-West

Greenland.

Limerick (Base Metals, Ireland): Alba has 100 per cent of the

Limerick base metal project in the Republic of Ireland.

El Mreiti (Uranium, Mauritania): Alba has applied for the

reissue of a uranium permit in northern Mauritania, centred on

known uranium-bearing showings.

Alba continues actively to review numerous other project

opportunities which have value-enhancing potential for the Company

whether by bolt-on or stand-alone acquisition, farm in or joint

venture.

Web: www.albamineralresources.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCOKDDQDBKBDON

(END) Dow Jones Newswires

August 01, 2017 02:01 ET (06:01 GMT)

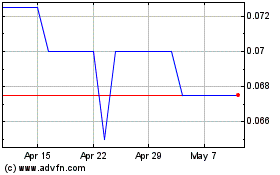

Alba Mineral Resources (LSE:ALBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

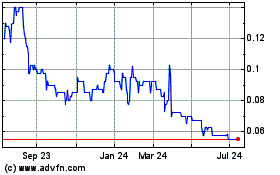

Alba Mineral Resources (LSE:ALBA)

Historical Stock Chart

From Apr 2023 to Apr 2024