TIDMALBA

RNS Number : 1357W

Alba Mineral Resources PLC

25 April 2016

25 April 2016

Alba Mineral Resources plc

("Alba" or "the Company")

Final Results for the year ended 30 November 2015

CHAIRMAN'S STATEMENT

The Board of Alba Mineral Resources plc (the "Company" or

"Alba", and collectively with its Subsidiary Companies, the

"Group") is pleased to report the results for the year ended 30

November 2015. They incorporate the results of its subsidiary

companies Aurum Mineral Resources Limited ("AMR"), Mauritania

Ventures Limited ("MVL") and Alba Mineral Resources Sweden AB

("Alba Sweden") (collectively the "Subsidiary Companies").

INTRODUCTION

Alba is an explorer with a commodity focus on oil & gas,

graphite, uranium and base metals. Alba holds interests in the UK

oil & gas exploration sector, plus hard rock exploration assets

in Greenland (Graphite), Ireland (Base Metals) and Mauritania

(Uranium).

The Group's overall technical and corporate strategy is to

identify and acquire natural resource projects it believes to have

good potential and to advance them expediently. This will be

achieved by controlled design and execution of a cost-effective

generative process utilising data acquisition, GIS data analysis

and exploration programme planning, led by our internal technical

team and where appropriate, through the support of external

technical consultants.

On 16 March 2016 Chade van Hatch resigned as the Company's Chief

Financial Officer and Company Secretary. I would like to take the

opportunity to thank Chade for her contribution to the Alba Board

and wish her well in her future career and also to welcome Manuel

Lamboley to the Board as a Non-Executive Director.

REVIEW OF ACTIVITIES

Horse Hill

The Horse Hill-1 well ("HH-1") is located within onshore

exploration licence PEDL 137, on the northern side of the Weald

Basin near Gatwick Airport. Alba owns a 15% direct interest in

Horse Hill Developments Limited ("HHDL"). HHDL is a special purpose

company that owns a 65% participating interest and operatorship of

Licence PEDL137 and the adjacent Licence PEDL246 in the UK Weald

Basin. The remaining 35% participating interests in the PEDL137 and

PEDL246 licences are held by US-based Magellan Petroleum

Corporation.

On 8 April 2015, the Company completed the acquisition of the 5%

shareholding in HHDL held by Regency Mines Plc ("Regency") for a

total cash consideration of GBP300,000. Additionally, on completion

the Company paid the outstanding cash calls issued to Regency by

HHDL, being a total of GBP60,000. During the period to 8 April

2015, a further cash call payment of GBP60,000 to HHDL was made by

the Company to HHDL pursuant to the terms of the HHDL shareholders'

agreement.

On 9 April 2015, US-based Nutech estimated that the HH-1 well

indicates a total OIP of 158 mmbo per square mile. The amount

excluded the previously reported Upper Portland Sandstone oil

discovery. Nutech's report stated that this OIP lies within a 653

feet aggregate net pay section, primarily within three argillaceous

(shale-rich) limestones and interbedded mudstones of the Kimmeridge

Clay Formation, and also mudstones of the Oxford and Lias sections.

Nutech calculated that approximately 72% of the OIP, or 114 mmbo,

lies within the shallower Upper Jurassic Kimmeridge interbedded

limestone and mudstone sequence.

An independent study of the Portland Sandstone reservoir using

petrophysics was conducted for HHDL by Xodus Group, an

international energy consultancy based in the UK, and the results

were published on 11 May 2015. The results showed that the Upper

Portland Sandstone conventional reservoir contains a "Best

Estimate" (P50) gross STOIIP of 21.0 million barrels ("mmbbls")

entirely within PEDL137 and encompasses both the HH-1 well and the

historic CF-1 well. This had previously been calculated at 12.8

mmbbls in December 2014.

On 13 May 2015, the Company announced that it had been informed

by HHDL that the exploration stage of the PEDL137 licence had been

extended by the Oil & Gas Authority ("OGA", formerly the

Department of Energy & Climate Change) to 30 September 2016.

The exploration stage of the PEDL246 licence expires on 30 June

2019.

On 5 June 2015 Schlumberger (one of the leading suppliers of

technology, integrated project management and information solutions

to customers working in the global oil and gas industry), acting in

an advisory capacity to HHDL, independently evaluated the

unconventional oil potential of HH-1 and estimated approximately

271 mmbbls per square mile for the Jurassic section. A total of 255

mmbbls gross OIP was estimated to lie within the low-porosity

limestone and mudstone plays of the Kimmeridge, Oxford Clay and

Lias (Upper Portland Sandstone discovery).

Nutech provided an additional independent report of the

estimated OIIP contained within the Horse Hill licences (PEDL 137

and PEDL 246) on 18 June 2015. The new study calculated a best

estimate (P50) OIIP of 9,245 mmbbls within the Kimmeridge, Oxford

and Lias formations, with a calculated best estimate total

Kimmeridge OIP of 5,230 mmbbls. The calculated OIIP figures

estimated by Nutech do not include the OIIP for the Portland

Sandstones. It is stressed that these values should not be

construed as contingent resources or reserves.

On 26 August 2015, Schlumberger provided HHDL with an

independent report of the estimated oil in place contained within

the HHDL Licence Area. The calculated gross OIIP at Horse Hill was

10,993 mmbbls, and is composed of 8,262 mmbbls within tight

limestones and shales of the Kimmeridge Clay Formation, and 2,731

mmbbls associated with the shales of the Oxford Clay and Lias

Formations.

On 23 October 2015 the Company announced the completion of the

acquisition from Angus Energy Limited ("Angus") of:

-- 5 per cent of the issued share capital of HHDL, being 50

fully paid ordinary shares in HHDL (the "Sale Shares"). Alba has

accordingly increased its interest in HHDL from 10% to 15%; and

-- an option to farm into 5 per cent of Production Licence 235

("PEDL 235"), which comprises the producing onshore Brockham Oil

Field ("Brockham") (the "Brockham Option"). The Brockham Option

shall be on a "two for one promote" basis, such that if Alba elects

to exercise the Brockham Option, it must fund 10 per cent of the

cost of the next well (from spudding to first oil) in order to earn

its 5 per cent interest.

The Company settled the consideration payable by Alba for the

Sale Shares and the Brockham Option as follows:

-- by the issue of 137,729,178 new ordinary shares in Alba;

-- by the payment of GBP365,000 in cash; and

-- by the issue of 45,909,726 warrants to subscribe for new

ordinary shares in Alba at a price of 0.5p per share. These

warrants are exercisable on or before the date falling 18 months

from Completion.

Greenland Graphite

On 6 October 2015 the Company announced the signing of an

agreement with Artemis Resources Ltd ("Artemis"), an Australian

Securities Exchange quoted company (ASX:ARV), which grants Alba an

option to earn up to 70% of a graphite project near Nanortalik in

southern Greenland ("Agreement"). The licence area comprises the

historic Amitsoq graphite mine and is prospective not only for

graphite but also for gold, copper, nickel and platinum group

elements.

Alba is in the process of re-negotiating its earn-in terms with

Artemis under the agreement announced on 6 October 2015, and a

further announcement on this will be made in due course.

On 30 November 2015 the Company announced that a field visit had

been completed at the Amitsoq graphite project. Samples taken from

historic workings at the Amitsoq mine were subjected to graphitic

carbon analysis and a petrographic determination of flake size by

the British Geological Survey ("BGS") at their laboratory in

Keyworth, near Nottingham.

Several of the samples were dispatched to an independent assay

laboratory to determine the presence of deleterious elements and to

quantify the presence of sulphides.

Quotations are currently being reviewed for a high-resolution

modern airborne electromagnetic (EM) and magnetic survey to

identify graphitic horizons and sulphide bodies associated with

ultramafic intrusions. It is anticipated that this work will

commence in the summer of 2016. Follow-up work, if warranted, will

consist of diamond drilling to provide a resource estimation.

Ireland

The exploration licence in the Limerick Basin is highly

prospective for zinc, lead and silver and is only 10 km away from

and part of the same target unit as the Pallas Green zinc

discovery. The Board intends to make an application to renew this

licence. It is intended that when the renewal is granted, the

Company will initially undertake a geophysical survey, either

Gravity or Induced Polarisation or both to help better understand

the structural elements of the licence area that may be controlling

the known sulphide mineralisation that is present within the

licence boundaries.

Mauritania

The Group is in the process of submitting a new application to

the Mauritanian Authorities to take out a new permit over a reduced

area within the original permit area, which includes the centre of

the previously discovered and announced high-tenor uranium

anomalies. Alba and its joint venture partner will then consider

their options with regards to funding the next stage of

exploration.

The continued development of the Mauritania exploration

activities is dependent on the grant of a new licence. An emphasis

of matter has been included in the auditor's report on this

point.

Other Development Projects

Alba continues to review and discuss other opportunities, which

have been brought to us by contacts that may have value-enhancing

potential.

Corporate

Our financial activities in the year have been primarily focused

on securing additional funding for the Group.

On 16 February 2015 the Group raised GBP270,000 (before

expenses) through the subscription of 108,000,000 new ordinary

shares at a subscription price of 0.25 pence per share.

(MORE TO FOLLOW) Dow Jones Newswires

April 25, 2016 02:00 ET (06:00 GMT)

On 16 March 2015 the Group raised a further GBP500,000 (before

expenses) through the subscription of 200,000,000 new ordinary

shares at a price of 0.25 pence per ordinary share.

On 1 May 2015, the Company announced that it issued 18,000,000

new ordinary shares at a price of 0.50 pence per ordinary share in

settlement of fees for professional services.

On 12 June 2015 the Group raised a further GBP355,000 (before

expenses) through the subscription of 71,000,000 new ordinary

shares at a price of 0.50 pence per ordinary share.

On 19 October 2015 the Group raised a further GBP385,000 (before

expenses) through the subscription of 154,000,000 new ordinary

shares at a price of 0.25 pence per ordinary share. The Company

also granted to the subscribers in the Placing warrants to

subscribe for further ordinary shares on the basis of one ordinary

share for every three new ordinary shares subscribed, resulting in

the issue of warrants to subscribe for a total of 51,333,331

Ordinary Shares to the subscribers. The new warrants are

exercisable at a price of 0.50 pence per share within 18 months

following the date of grant.

On 5 November 2015 the Group raised a further GBP160,000 (before

expenses) through the issue of 64,000,000 new ordinary shares at a

price of 0.25 pence per ordinary share. The Company also granted to

subscribers in the Placing warrants to subscribe for further

ordinary shares on the basis of one ordinary share for every three

new ordinary shares subscribed, resulting in the issue to the

subscribers of warrants to subscribe for a total of 21,333,333

Ordinary Shares. The new warrants are exercisable at a price of 0.5

pence per share within 18 months following the date of grant.

EVENTS AFTER THE REPORTING PERIOD

A general meeting was held on 16 December 2015 seeking

shareholder approval to grant additional authorities to issue new

ordinary shares, at which all resolutions were unanimously

passed.

On 4 January 2016 the Company announced that it had been

notified by Horse Hill Developments Limited that the Oil and Gas

Authority had granted consent for an extended flow test over three

separate zones in the Horse Hill-1 oil discovery well. On 4 January

2016 Alba announced that all necessary permissions had been granted

in order for the Horse Hill-1 well to be flow tested. On 8 February

2016 Alba announced that flow tests had commenced. The final flow

test results were announced by Alba on 21 March 2016. The final

total aggregate stable dry oil flow rate from two Kimmeridge

limestones plus the overlying Portland sandstone was measured at

1688 bopd.

On 4 February 2016 the Company announced that it had completed

an iron oxide (FeO) alteration remote sensing (satellite) study on

the Amitsoq graphite project (the "Project") near Nanortalik in

southern Greenland. The interpreted results are highly encouraging

and provide numerous target areas for follow-up ground work and

geophysics, highlighted as follows:

-- Numerous and continuous graphitic horizons suggested along

strike and proximal to the Amitsoq graphite mine.

-- FeO anomalies are coincident with known graphite occurrences

at the former Amitsoq graphite mine.

-- Two zones contain multiple lenses of interpreted bedded

graphite along strike 2.5 km and 5.8 km to the northeast of the

Amitsoq mine.

-- Additional FeO anomalies are interpreted to be favourable

targets for platinum group metals, orogenic lode gold and intrusion

related copper-zinc mineralization.

-- Anomalies identified with geology similar to economic gold

mineralization at the nearby Nalunaq gold mine (circa 340,000

ounces of gold produced to date).

OUTLOOK

During the past financial year, the Alba Board, determined to

increase the Company's exposure to the highly prospective Horse

Hill oil & gas project, acquired two further stakes in the

project, giving it a 15 per cent interest in HHDL, and making it

HHDL's second largest shareholder. In addition, we identified and

acquired an option over what we believe to be a highly prospective

graphite project in Greenland. These acquisitions, and Alba's

funding of its commitments both at Horse Hill and its other

projects, were achieved by a series of successful recent capital

raisings completed by the Company during the year, despite what has

been a consistently challenging investment market. This is a

testament to the dedication and resourcefulness of the management

team at Alba. In the coming year, your Board will continue to seek

out further opportunities to build on the solid foundations

established during the past financial year.

George Frangeskides

Chairman

Glossary of technical terms:

argillaceous a limestone containing a significant

limestone proportion of clay minerals

------------------------ -------------------------------------------

clastic rocks composed of broken pieces

of older rocks

------------------------ -------------------------------------------

core a cylindrical sample of rock, obtained

during drilling of wells and removed

for inspection at surface

------------------------ -------------------------------------------

discovery a discovery is a petroleum accumulation

for which one or several exploratory

wells have established through

testing, sampling and/or logging

the existence of a significant

quantity of potentially moveable

hydrocarbons

------------------------ -------------------------------------------

electric logs tools used within the wellbore

to measure the rock and fluid properties

of surrounding rock formations

------------------------ -------------------------------------------

fault block a very large subsurface block of

rock, created by tectonic and localised

stresses

------------------------ -------------------------------------------

limestone a carbonate sedimentary rock predominantly

composed of calcite of organic,

chemical or detrital origin. Minor

amounts of dolomite, chert and

clay are common in limestones.

Chalk is a form of fine-grained

limestone

------------------------ -------------------------------------------

Geographic a system designed to capture, store,

Information manipulate, analyse, manage, and

System or Geographical present all types of spatial or

Information geographical data

System (GIS)

------------------------ -------------------------------------------

MICP mercury injection capillary pressure,

a measure of rock porosity and

permeability, from rock cores or

cuttings, and a calibration of

porosity logs

------------------------ -------------------------------------------

mudstone an extremely fine-grained sedimentary

rock consisting of a mixture of

clay and silt-sized particles

------------------------ -------------------------------------------

oil initially the quantity of oil or petroleum

in place ("OIIP") that is estimated to exist originally

or oil in place in naturally occurring accumulations

("OIP") before any extraction or production

------------------------ -------------------------------------------

petrophysical the study of physical and chemical

evaluation rock properties and their interactions

with fluids; studies typically

use well logs, well cores and seismic

data

------------------------ -------------------------------------------

recoverable those quantities of petroleum estimated,

resources as of a given date, to be potentially

recoverable from known accumulations

------------------------ -------------------------------------------

reservoir a subsurface rock formation containing

an individual natural accumulation

of moveable petroleum that is confined

by impermeable rock/formations

------------------------ -------------------------------------------

sandstone a clastic sedimentary rock whose

grains are predominantly sand-sized.

The term is commonly used to imply

consolidated sand or a rock made

of predominantly quartz sand

------------------------ -------------------------------------------

seismic use of sound waves generated by

controlled explosions to ascertain

the nature of the subsurface geological

structures. 2D seismic records

a cross-section through the subsurface

------------------------ -------------------------------------------

STOIIP stock tank oil initially in place

------------------------ -------------------------------------------

TVDSS true vertical depth below a subsea

datum

------------------------ -------------------------------------------

XRD x-ray diffraction; scattering of

(MORE TO FOLLOW) Dow Jones Newswires

April 25, 2016 02:00 ET (06:00 GMT)

x-rays by the atoms of a rock or

crystal that gives information

on the structure, composition and

identity of the rock or crystal

------------------------ -------------------------------------------

Enquiries:

Alba Mineral Resources plc

Michael Nott, CEO +44 20 7907 9328

Cairn Financial Advisers LLP

James Caithie / Liam Murray +44 20 7148 7900

Dowgate Capital Stockbrokers Limited

Jason Robertson / Neil Badger +44 1293 517744

Alba Mineral Resources plc

CONSOLIDATED INCOME STATEMENT

FOR THE YEAR ENDED 30 NOVEMBER 2015

2015 2014

GBP GBP

Revenue - -

Cost of sales - -

------------ ---------

Gross loss - -

----------------------------- ------------ ---------

Administrative expenses (292,705) (235,751)

------------ ---------

Operating loss (292,705) (235,751)

Finance costs - -

Loss before tax (292,705) (235,751)

Taxation - -

Loss for the year (292,705) (235,751)

============ =========

Attributable to:

Equity holders of the parent (291,563) (234,001)

Non-controlling interests (1,142) (1,750)

------------ ---------

(292,705) (235,751)

============ =========

Loss per ordinary share

(0.04) pence (0.07)

Basic and diluted pence

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 30 NOVEMBER 2015

2015 2014

GBP GBP

Loss after tax (292,705) (235,751)

Foreign exchange movements 5,204 49,688

Total comprehensive loss (287,501) (186,063)

========= =========

Total comprehensive loss attributable to:

Equity holders of the parent (286,359) (184,313)

Non-controlling interests (1,142) (1,750)

(287,501) (186,063)

========= =========

Alba Mineral Resources plc

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

30 NOVEMBER 2015

2015 2014

GBP GBP

Non-current assets

Intangible fixed assets 662,874 611,265

Investments 1,838,222 365,000

Total non-current assets 2,501,096 976,265

----------- -----------

Current assets

Trade and other receivables 96,942 16,509

Cash and cash equivalents 288,494 30,676

----------- -----------

Total current assets 385,436 47,185

----------- -----------

Current liabilities

Trade and other payables 80,000 50,355

Financial liabilities 254,073 254,073

Total current liabilities 334,073 304,428

----------- -----------

Net assets 2,552,459 719,022

=========== ===========

Capital and reserves

Called up share capital 1,993,171 1,232,178

Share premium account 2,586,286 1,532,373

Warrant reserve 446,291 129,851

Retained losses (2,883,856) (2,592,293)

Merger reserve 200,000 200,000

Foreign currency reserve 183,969 189,173

----------- -----------

Equity attributable to equity

holders of the parent 2,525,861 691,282

Non-controlling interests 26,598 27,740

Total equity 2,552,459 719,022

=========== ===========

Alba Mineral Resources plc

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEAR ENDED 30 NOVEMBER 2015

2015 2014

GBP GBP

Cash flows from operating activities

Operating loss (292,705) (235,751)

Foreign exchange revaluation adjustment (5,204) 52,152

Decrease in creditors (13,599) (5,041)

Increase / (decrease) in debtors (88,190) 4,791

Net cash used in operating activities (399,698) (183,849)

--------- ---------

Cash flows from investing activities

Payments for deferred exploration expenditure (51,609) (7,773)

Investments (882,690) (365,000)

Net cash used in investing activities (934,299) (372,773)

--------- ---------

Cash flows from financing activities

Net proceeds from the issue of shares and warrants 1,654,315 601,466

Costs of issue (62,500) (28,866)

Proceeds from borrowings - 20,250

Net cash generated from financing activities 1,591,815 587,082

--------- ---------

Net increase in cash and cash equivalents 257,818 30,460

Cash and cash equivalents at beginning of period 30,676 216

Cash and cash equivalents at end of year 288,494 30,676

========= =========

Non-cash transactions

Significant non cash transactions related to the purchase of

investments of GBP539,532 which was settled by way of the issue of

shares and warrants. There were no significant non-cash

transactions in 2014.

NOTES

1. Basis of preparation

The financial information set out in this announcement does not

comprise the Group's statutory accounts for the year ended 30

November 2015 or 30 November 2014. The financial information has

been extracted from the statutory accounts of the Company for the

year ended 30 November 2015 and 30 November 2014. The auditors

reported on those accounts; their report was unqualified and did

not contain a statement under either Section 498 (2) or Section 498

(3) of the Companies Act 2006. The auditor's report for the year

ended 30 November 2014 did include emphasis of matter paragraphs

relating to uncertainty as to whether (a) the Group can raise

sufficient funds to continue to develop the Group's exploration

assets; (b) the Mauritania permit will be renewed beyond May 2015;

(c) the Limerick licence that expires in May 2016 will be renewed;

and (d) the value of the parent company's investment in its

subsidiaries is supported by exploration activities. The auditor's

report for the year ended 30 November 2015 did include emphasis of

matter paragraphs relating to uncertainty as to whether (a) the

Group can raise sufficient funds to continue to develop the Group's

exploration assets; (b) the Mauritania permit will be renewed

beyond May 2016; (c) the Limerick licence that expires in May 2016

will be renewed; and (d) the value of the parent company's

investment in its subsidiaries is supported by exploration

activities.

2. Going Concern

Further to the fund raising completed after the year end, after

making enquiries, the directors have a reasonable expectation that

the Group has adequate resources to meet its current committed

expenditure and recurring outgoings for the foreseeable future,

although the current level of funding is not sufficient to enable

the Company to significantly develop the Group's exploration

assets. Thus, the directors continue to adopt the going concern

basis of accounting in preparing the financial statements

3. Continuation of exploration activities

The Group is dependent on securing further funds to continue to

develop the Group's exploration assets which have a carrying value

of GBP662,874 and which support the value of the Company's

investment in its subsidiaries, which have a carrying value of

GBP1,445,008. If it is not possible to raise sufficient funds, the

carrying value of the exploration assets of the Group and the

investment of the Company in its subsidiaries are likely to be

impaired.

4. Taxation

No charge for corporation tax for the period has been made due

to the expected tax losses available.

5. Earnings per share

Basic loss per share is calculated by dividing the loss

attributed to ordinary shareholders of GBP291,563 (2014: GBP234,001

loss) by the weighted average number of shares of 692,258,595

(2014: 316,438,563) in issue during the year. The diluted earnings

per share calculation is identical to that used for basic loss per

share as warrants are "out of the money" and not considered

dilutive.

6. Report and accounts

(MORE TO FOLLOW) Dow Jones Newswires

April 25, 2016 02:00 ET (06:00 GMT)

The statutory accounts for the year ended 30 November 2014 have

been delivered to the Registrar of Companies, whereas those for the

year ended 30 November 2015 will be sent to shareholders of the

Company in due course and will be delivered to the Registrar of

Companies following the Company's Annual General Meeting. The

report and accounts will also be made available on the Company's

website: www.albamineralresources.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EAKLAADXKEFF

(END) Dow Jones Newswires

April 25, 2016 02:00 ET (06:00 GMT)

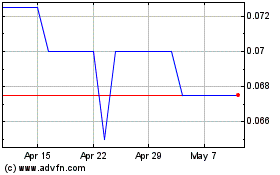

Alba Mineral Resources (LSE:ALBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

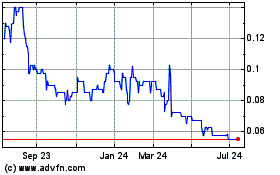

Alba Mineral Resources (LSE:ALBA)

Historical Stock Chart

From Apr 2023 to Apr 2024