Alaska Air Profit Hit by Merger Costs

October 20 2016 - 7:40AM

Dow Jones News

Alaska Air Group Inc. said profit fell in the third quarter,

hurt by merger-related costs as the company looks to wrap its

tie-up with Virgin America Inc.

Alaska Air late September said it agreed with the Justice

Department to hold off on consummating its planned marriage with

Virgin America, giving regulators more time to review the deal.

Alaska in April announced a $2.6 billion offer to acquire San

Francisco-based Virgin America. On Thursday, Chief Executive Brad

Tilden said the company was "fully focused on completing our merger

with Virgin America."

The company booked $22 million in merger-related costs in the

third quarter. Excluding those costs and other items, earnings

topped Wall Street's expectations.

In the September quarter, Alaska Air's unit revenue—the amount

it takes in per seat flown a mile—fell 5.8% compared with the

prior-year quarter. The metric is closely watched as a sign of

demand and how well an airline is generating sales. Unit revenues

have been declining across the industry because of relatively rapid

expansions. Alaska Air's capacity rose 8.1% year-over-year.

Over all, Alaska Air earned $256 million, or $2.07 a share, down

from $274 million, $2.14, a year ago. Excluding items, such as

merger-related costs and mark-to-market fuel hedge adjustments, the

company earned $2.20 a share. Analysts expected $2.09 on an

adjusted basis, according to Thomson Reuters.

Revenue rose 3% to $1.57 billion, while analysts expected $1.56

billion.

Aircraft fuel expenses, including hedging gains and losses,

declined 8% in the period from a year ago.

Shares were inactive in premarket trading.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

October 20, 2016 07:25 ET (11:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

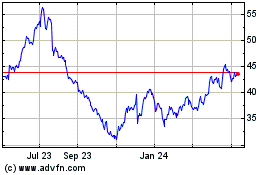

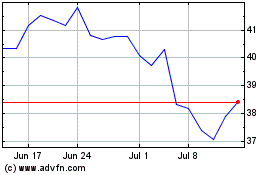

Alaska Air (NYSE:ALK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alaska Air (NYSE:ALK)

Historical Stock Chart

From Apr 2023 to Apr 2024