AkzoNobel announces repurchase of shares to neutralize stock dividends paid in 2016

December 13 2016 - 1:41AM

AkzoNobel will repurchase up to 2.5 million ordinary shares,

which, based on the closing price of AkzoNobel shares on December

12, 2016, would be equivalent to approximately €150 million.

The purpose of the program is to neutralize the dilutive effect

of stock dividends paid in 2016. Subject to shareholder approval it

is intended the shares will be cancelled during the course of

2017.

AkzoNobel has engaged a third party to manage the program and

execute the transactions on its behalf. This share repurchase

program will start on January 2, 2017 and is anticipated to be

concluded by the end of April 2017.

In accordance with regulations, AkzoNobel will inform the market

about the progress made in the execution of this program through

weekly updates at

https://www.akzonobel.com/for-investors/shares/share-buyback-overview

- - -

AkzoNobel creates everyday essentials to make people's lives

more liveable and inspiring. As a leading global paints and

coatings company and a major producer of specialty chemicals, we

supply essential ingredients, essential protection and essential

color to industries and consumers worldwide. Backed by a pioneering

heritage, our innovative products and sustainable technologies are

designed to meet the growing demands of our fast-changing planet,

while making life easier. Headquartered in Amsterdam, the

Netherlands, we have approximately 45,000 people in around 80

countries, while our portfolio includes well-known brands such as

Dulux, Sikkens, International, Interpon and Eka. Consistently

ranked as a leader in sustainability, we are dedicated to

energizing cities and communities while creating a protected,

colorful world where life is improved by what we do.

Not for publication - for more

information

| Corporate Media

Relations |

Corporate Investor

Relations |

| T +31 (0)88 - 969

7833 |

T +31 (0)88 - 969

7590 |

| Contact: Andrew Wood |

Contact: Lloyd

Midwinter |

Safe Harbor StatementThis press

release contains statements which address key issues such as

AkzoNobel's growth strategy, future financial results, market

positions, product development, products in the pipeline and

product approvals. Such statements should be carefully considered,

and it should be understood that many factors could cause

forecasted and actual results to differ from these statements.

These factors include, but are not limited to, price fluctuations,

currency fluctuations, developments in raw material and personnel

costs, pensions, physical and environmental risks, legal issues,

and legislative, fiscal, and other regulatory measures. Stated

competitive positions are based on management estimates supported

by information provided by specialized external agencies. For a

more comprehensive discussion of the risk factors affecting our

business please see our latest annual report, a copy of which can

be found on our website: www.akzonobel.com.

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/c2d33d7c-5d4c-49a2-81c6-72231c2e80d2

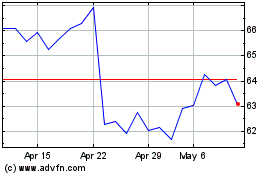

Akzo Nobel NV (EU:AKZA)

Historical Stock Chart

From Mar 2024 to Apr 2024

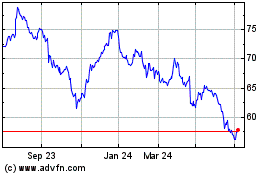

Akzo Nobel NV (EU:AKZA)

Historical Stock Chart

From Apr 2023 to Apr 2024