Akzo Sits Tight in Face of PPG Bid -- WSJ

April 26 2017 - 3:03AM

Dow Jones News

By Christopher Alessi

FRANKFURT -- Dutch paints and chemicals maker Akzo Nobel NV on

Tuesday rejected a request by Elliott Management Corp. and other

investors to hold an extraordinary shareholder meeting to oust the

company's supervisory board chairman.

Akzo's dismissal of the request comes a day after paint giant

PPG Industries Inc. submitted its third bid for the Dutch company,

raising its offer to EUR24.6 billion ($26.4 billion), or EUR96.75 a

share. That is up from a sweetened bid of EUR88.72 a share last

month. PPG called the new proposal "one last invitation" for Akzo's

board to engage in talks.

Activist investor Elliott's call for an extraordinary general

meeting "does not meet the required standards under Dutch law," the

company said in a statement. The company also reiterated its full

backing of Chairman Antony Burgmans.

"The request is irresponsible, disproportionate, damaging and

not in the best interests of the company," Akzo said.

Elliott called for the EGM two weeks ago, as it was pressuring

Akzo to engage in sale talks with rival PPG. Mr. Burgmans is seen

as an obstacle to a PPG takeover of the Dutch firm.

Elliott and other investors including U.S.-based Causeway

Capital Management LLC -- Akzo's largest shareholder with about a

6.7% stake -- have been pressuring Akzo's management to negotiate

with PPG since the Pittsburgh-based company first made an initial

takeover approach of EUR83 per Akzo share at the start of

March.

"We will take a very careful look at this bid," Mr. Burgmans

said Tuesday of the latest offer, presiding over Akzo's annual

general meeting of shareholders in Amsterdam.

Elliott on Monday warned Akzo that this could be the company's

last chance to engage in "friendly discussions" with PPG,

suggesting the U.S. firm could then launch a hostile takeover.

"There can be no assurance that a hostile bid -- if one were to

materialize -- would include the same or improved protections and

undertakings for Akzo Nobel stakeholders," Elliott said in a

statement.

The latest offer appeared to address some of Akzo's concerns

over how a takeover could affect its stakeholders, including

commitments to maintain Dutch jobs and a promise not to relocate

any of the firm's European Union production facilities to the U.S.

PPG also said it would agree to a "significant reverse" breakup

fee, as well as a pledge that a future combined company would be

listed on both the New York and Amsterdam stock exchanges.

"Akzo Nobel has no more room for excuses now and must enter into

proper discussions with PPG," said a spokesman for Akzo shareholder

Columbia Threadneedle Investments.

Analysts at Evercore Partners said that if Akzo were to reject

PPG's latest offer, the U.S. company could come back with a hostile

approach by the start of June.

PPG said the most recent bid values Akzo at a premium of 24%

over its closing price of EUR78.20 a share on April 21, the last

full day of trading before the revised offer.

That was just days after Akzo unveiled the details of a new

strategy to separate its specialty chemicals unit, which is part of

Chief Executive Ton Büchner's continuing effort to ward off PPG.

Mr. Büchner has repeatedly refused to engage with PPG, calling the

first two takeover offers inadequate.

The company told investors on April 19 that it plans to pursue a

dual-track process to have the option to either spin off the

specialty chemicals business as a separate listed entity or sell it

outright, to be completed within the next 12 months.

The Dutch company first announced last month that it planned to

separate its chemicals business, when it disclosed PPG's interest,

and has said the plan would create more value for shareholders than

PPG's offer.

Write to Christopher Alessi at christopher.alessi@wsj.com

(END) Dow Jones Newswires

April 26, 2017 02:48 ET (06:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

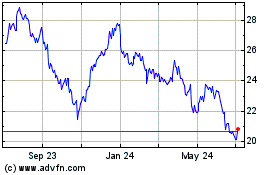

Akzo Nobel NV (QX) (USOTC:AKZOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

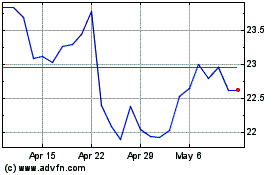

Akzo Nobel NV (QX) (USOTC:AKZOY)

Historical Stock Chart

From Apr 2023 to Apr 2024