Akzo Nobel Says Drop in 3Q Ebit, Revenue Due to Industry Headwinds

October 18 2017 - 2:02AM

Dow Jones News

By Oliver Griffin

Paint and specialty chemicals company Akzo Nobel N.V. (AKZA.AE)

on Wednesday reported a 13% drop in third-quarter adjusted earnings

before interest and tax, citing industry headwinds and unfavorable

foreign-exchange conditions.

The Dutch company, which owns brands including Dulux, Sikkens

and Interpon, said that adjusted Ebit, the company's operating

income excluding certain items, for the quarter ended Sept. 30 was

383 million euros ($450.6 million) down from EUR442 million in the

year earlier period. Revenue rose 1% to EUR3.62 billion.

The company also reported that net profit dropped to EUR216

million from EUR285 million in the year-earlier period.

The company said that Ebit for 2017 is now expected to be in

line with that of 2016, due to adverse foreign-exchange conditions,

industry headwinds, and supply chain disruptions that included the

adverse impact of Hurricane Harvey in the U.S.

The company said sales volumes were up 2%, driven by decorative

paints and performance coatings.

Akzo Nobel said it was implementing various measures to mitigate

current market challenges, including increased selling prices and

additional cost control, and also said it had started phase one of

a transformation plan to deliver EUR110 million annual savings in

2018.

Write to Oliver Griffin at oliver.griffin@dowjones.com

(END) Dow Jones Newswires

October 18, 2017 01:47 ET (05:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

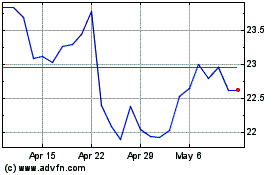

Akzo Nobel NV (QX) (USOTC:AKZOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

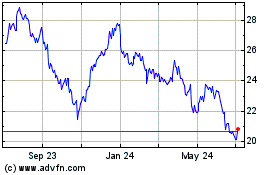

Akzo Nobel NV (QX) (USOTC:AKZOY)

Historical Stock Chart

From Apr 2023 to Apr 2024