Akzo Nobel Rebuffs Raised $24 Billion PPG Takeover Approach -- Update

March 22 2017 - 5:35AM

Dow Jones News

By Ian Walker in London and Christopher Alessi in Frankfurt

Dutch paint and chemicals firm Akzo Nobel NV on Wednesday said

it had rejected a sweetened EUR22.37 billion ($24.19 billion)

takeover proposal from rival PPG Industries Inc., digging in its

heels in a trans-Atlantic standoff between the two industrial

giants.

The Amsterdam-based company said PPG's revised offer worth

EUR88.72 a share, which comes just weeks after its initial

EUR83-a-share offer, undervalues the company and doesn't warrant

engaging with its U.S. suitor.

The standoff comes amid a wave of consolidation in the chemicals

industry, including a $120 billion merger of U.S. giants Dow

Chemical Co. and DuPont Co. and Bayer AG's planned $57 billion

takeover of Monsanto Co., as the industry contends with weak growth

and overcapacity.

PPG's raised offer for Akzo consists of EUR56.22 in cash and

0.331 PPG shares a Akzo share. Its previous offer, announced and

rejected earlier this month, was EUR54 in cash and 0.3 PPG shares

for each Akzo share.

Akzo said a merger would lead to a large number of disposals

because of the major geographical and segment overlap of both

companies across decorative paints and performance coatings, and

would lead to significant job cuts.

The Dutch company also cited a "culture gap" between the two

firms.

"We are convinced that AkzoNobel is best placed to unlock the

value within our company ourselves," Chief Executive Ton Büchner

said, adding that the board is executing its plan, including the

creation of two focused businesses and new cost structure.

Akzo, which counts Dulux, Sikkens, Interpon and Eka among its

brands, said it was exploring separating its special-chemicals

division when it disclosed PPG's initial unsolicited offer.

Since then it has emerged that activist investor Elliott

Management Corp. owns a stake in Akzo and is pushing the company to

engage with PPG, The Wall Street Journal has reported. Elliott has

expressed concerns to Akzo management that it didn't engage with

PPG and that it didn't consult the hedge fund, which owns less than

3% of Akzo -- the reporting threshold in the Netherlands.

PPG, whose brands include Pittsburgh Paints, Olympic and

Glidden, said earlier this month that it continued to believe in

the strategic rationale for the deal despite the initial rejection.

It didn't immediately issue a response to the rejection of its

second proposal.

Write to Ian Walker at ian.walker@wsj.com and Christopher Alessi

at christopher.alessi@wsj.com

(END) Dow Jones Newswires

March 22, 2017 05:20 ET (09:20 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

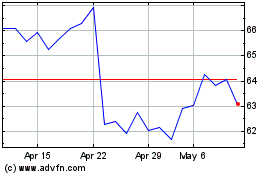

Akzo Nobel NV (EU:AKZA)

Historical Stock Chart

From Mar 2024 to Apr 2024

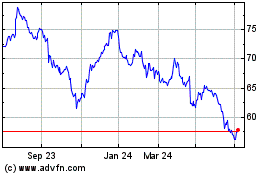

Akzo Nobel NV (EU:AKZA)

Historical Stock Chart

From Apr 2023 to Apr 2024