Akzo Nobel 4Q Ebitda Rises 29% But Misses Forecasts; Sees Challenging 2016

February 10 2016 - 2:09AM

Dow Jones News

By Ian Walker

Paints and specialty chemicals firm Akzo Nobel N.V. (AKZA.AE) on

Wednesday said fourth-quarter earnings before interest, taxes,

depreciation and amortization rose 29%, missing analysts consensus

forecasts, and the company expects 2016 will be a challenging

year.

The Amsterdam-based company which lists Dulux, Sikkens, Interpon

and Eka among its brands, added that difficult market conditions

continue in Brazil, China and Russia, while no significant

improvement is anticipated in Europe, particularly in its buildings

and infrastructure segment.

However, deflationary pressures continue and currency tailwinds

are moderating, the company said.

For the quarter ended Dec. 31, 2014 Akzo said Ebitda rose to 426

million euros ($462.65 million) from EUR330.0 million a year

earlier, on revenue of EUR3.56 billion. This compares with

consensus forecasts of EUR438.1 million and EUR3.51 billion,

respectively, taken from the company's website and based on 22

analysts forecasts.

Net profit rose to EUR203 million from EUR7 million.

The board declared a final dividend of EUR1.20 a share, taking

the total dividend for the year to EUR1.55 a share, up from EUR1.45

in 2014.

-Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

(END) Dow Jones Newswires

February 10, 2016 01:54 ET (06:54 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

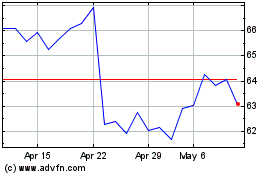

Akzo Nobel NV (EU:AKZA)

Historical Stock Chart

From Mar 2024 to Apr 2024

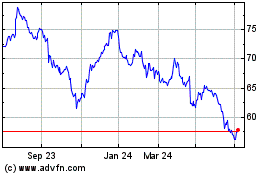

Akzo Nobel NV (EU:AKZA)

Historical Stock Chart

From Apr 2023 to Apr 2024