TIDMAIEA

RNS Number : 3748X

Airea PLC

21 February 2017

AIREA PLC

Interim report for the six months ended 31 December 2016

The principal activity of the group is the manufacturing,

marketing and distribution of floor coverings.

Chairman's Statement

Airea is pleased to report earnings are significantly ahead of

the corresponding period.

- Operating profit up 51%

- Basic earnings per share up 76%

- EBITDA up 28%

New product launches targeted at the residential market have

driven growth in this sector. On the contract side however, delays

in projects led to a slow down in growth and as indicated in the

annual report sales in the Euro zone took some time to recover.

Exports grew steadily in the period and we are seeing sales ahead

of last year as we enter the second six months of the accounting

period.

Investment in new technology during the second half of the last

financial year will facilitate the further extension of our product

range with several new designs currently being finalised for

launch.

The site consolidation exercise is largely complete with

discussions concerning our last leasehold operation in Wakefield

reaching an advanced stage. The business continues to reap the

benefits of shorter lead times, cost synergies and reduced

waste.

Group Results

Revenue for the period was GBP12.8m (2015: GBP12.7m). The

operating profit was GBP1,149,000 (2015: GBP759,000).

After charging pension related finance costs of GBP305,000

(2015: GBP246,000) and incorporating the appropriate tax charge the

net profit for the period was GBP696,000 (2015: GBP372,000). Basic

earnings per share were 1.51p (2015: 0.86p)

Operating cash flows before exceptional items and movements in

working capital were GBP1.5m (2015: GBP1.1m). Working capital

increased in the period by GBP1.2m mainly as a result of timing of

payments to trade creditors. Contributions to the defined benefit

pension scheme were GBP200,000 (2015: GBP200,000) in line with the

agreement reached with the scheme trustees following the last

triennial valuation as at 1(st) July 2014. Capital expenditure of

GBP1,009,000 (2015: GBP518,000) was made in renewing and enhancing

manufacturing plant and equipment.

The increase in the pension deficit of GBP579,000 resulted from

a deterioration in corporate bond yields. It is an accounting

standards requirement that the reported pension valuation is based

on corporate bond yields even though this does not reflect the

investment strategy of the plan. In reality the plan is now largely

hedged against interest rate movements and inflation, which,

combined with a diversified growth asset base, has produced an

improved underlying position.

Outlook

Recent experience suggests that current exchange rate conditions

will, in overall terms, prove to be beneficial for the company but

in recent months there has been significant input price pressure

resulting from commodity price rises. It is therefore difficult at

this point in time to predict the longer term effect on our

competitive position. As ever our margins remain the subject of

careful management as we look to exploit any advantage.

Of far greater concern is the medium to long term impact of

economic uncertainty on market demand. Our position is not unique

of course but there has been a notable increase in volatility in an

already cyclical market.

The Board intends to maintain the recent pattern of dividend

payments, and taking into consideration the changes in accounting

period announced in December, will determine the level of interim

dividend on the basis of the twelve month period ended 30 June

2017. Therefore there will not be a dividend payment at this

interim stage.

Martin Toogood

Chairman

20th February 2017

Enquiries:

Neil Rylance 01924 266561

Chief Executive Officer

Roger Salt 01924 266561

Group Finance Director

Richard Lindley 0113 388 4789

N+1 Singer

Consolidated Income

Statement

6 months ended 31st

December 2016

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

31st 31st 30th

December December June

2016 2015 2016

GBP000 GBP000 GBP000

Revenue 12,771 12,674 24,577

Operating costs (11,622) (11,915) (22,535)

------------------------------- ---------- ---------- ------------

Operating profit

before exceptional

items 1,149 730 2,013

Exceptional items:

Exceptional costs - (1,271) (1,271)

Pension credit - 1,300 1,300

------------------------------- ---------- ---------- ------------

Operating profit 1,149 759 2,042

Finance income - - -

Finance costs (305) (246) (651)

---------- ---------- ------------

Profit before taxation 844 513 1,391

Taxation (148) (141) (114)

----------

Profit attributable

to shareholders of

the group 696 372 1,277

========== ========== ============

Earnings per share

(basic and diluted) 1.68p 0.86p 3.01p

All amounts relate

to continuing operations

Consolidated Statement of

Comprehensive Income

6 months ended 31st

December 2016

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

31st 31st 30th

December December June

2016 2015 2016

GBP000 GBP000 GBP000

Profit attributable

to shareholders of

the group 696 372 1,277

Actuarial loss recognised

in the pension scheme (480) (218) (291)

Related deferred taxation 96 44 (83)

---------- ---------- ------------

(384) (174) (374)

---------- ---------- ------------

Unrealised valuation

gain - - 3,009

Related deferred taxation - - (240)

---------- ---------- ------------

- - 2,769

---------- ---------- ------------

Total comprehensive

income attributable

to shareholders of

the group 312 198 3,672

========== ========== ============

Consolidated Balance

Sheet

as at 31st December Unaudited Unaudited Audited

2016

31st 31st 30th

December December June

2016 2015 2016

GBP000 GBP000 GBP000

Non-current assets

Property, plant and

equipment 6,164 5,447 5,489

Investment property 2,701 - 2,701

Deferred tax asset 1,326 1,350 1,264

10,191 6,797 9,454

---------- ---------- ------------

Current assets

Inventories 9,017 8.313 9,338

Trade and other receivables 4,076 3,451 4,601

Cash and cash equivalents 2,499 2,561 3,114

---------- ---------- ------------

15,592 14,325 17,053

---------- ---------- ------------

Total assets 25,783 21,122 26,507

---------- ---------- ------------

Current liabilities

Trade and other payables (3,656) (3,503) (5,505)

Provisions (125) (325) (125)

---------- ---------- ------------

(3,781) (3,828) (5,630)

---------- ---------- ------------

Non-current liabilities

Obligation under finance

leases (854) - -

Pension deficit (7,264) (6,406) (6,685)

Deferred tax (241) (1) (241)

(8,359) (6,407) (6,926)

---------- ---------- ------------

Total liabilities (12,140) (10,235) (12,556)

---------- ---------- ------------

13,643 10,887 13,951

========== ========== ============

Equity

Called up share capital 10,339 10,851 10,339

Share premium account 504 504 504

Capital redemption

reserve 3,617 3,105 3,617

Revaluation reserve 3,009 - 3,009

Retained earnings (3,826) (3,573) (3,518)

13,643 10,887 13,951

========== ========== ============

Consolidated Cash

Flow Statement

6 months ended 31st Unaudited Unaudited Audited

December 2016

6 months 6 months year

ended ended ended

31st 31st 30th

December December June

2016 2015 2016

GBP000 GBP000 GBP000

Cash flow from operating

activities

Profit attributable

to shareholders of

the group 696 372 1,277

Tax charged 148 141 114

Finance costs 305 246 651

Depreciation 334 404 837

Profit on disposal

of property plant

and equipment - - (6)

Pension credit - (1,300) (1,300)

Inventory impairment - 468 468

---------- ---------- ------------

Operating cash flows

before exceptional

items & movements

in working capital 1,483 331 2,041

Decrease in inventories 321 1,866 841

Decrease / (increase)

in trade and other

receivables 525 961 (189)

(Decrease) / increase

in trade and other

payables (2,015) (1,696) 232

Increase in provisions

for liabilities and

charges - 325 125

---------- ---------- ------------

Cash generated from

operations 314 1,787 3,050

Income tax received 52 - 61

Contributions to defined

benefit pension scheme (200) (200) (400)

---------- ---------- ------------

Net cash generated

from operations 166 1,587 2,711

---------- ---------- ------------

Investing activities

Purchase of property,

plant and equipment (1,009) (518) (704)

Proceeds on disposal

of property, plant

and equipment - - 25

---------- ---------- ------------

(1,009) (518) (679)

---------- ---------- ------------

Financing activities

Interest (6) - -

Obligations under

finance leases 854 - -

Share repurchase - - (410)

Equity dividends paid (620) (391) (391)

---------- ---------- ------------

228 (391) (801)

---------- ---------- ------------

Net increase/(decrease)

in cash and cash equivalents (615) 678 1,231

Cash and cash equivalents

at start of period 3,114 1,883 1,883

Cash and cash equivalents

at end of period 2,499 2,561 3,114

========== ========== ============

Consolidated Statement of

Changes in Equity

6 months ended 31st

December 2016

Share Share Capital Revaluation Profit Total

capital premium redemption reserve and equity

account reserve loss

account

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1st July 2015 10,851 504 3,105 - (3,380) 11,080

Comprehensive income

for the period

Profit for the period - - - - 372 372

Other comprehensive

income for the period - - - - (174) (174)

----------- ---------- ------------ ------------ --------- --------

- - - - 198 198

Contributions by

and distributions

to owners

Dividend Paid - - - - (391) (391)

----------- ---------- ------------ ------------ --------- --------

At 31st December

2015 10,851 504 3,150 - (3,573) 10,887

Comprehensive income

for the period

Profit for the period - - - - 905 905

Other comprehensive

income for the period - - - 3,009 (440) 2,569

----------- ---------- ------------ ------------ --------- --------

- - - 3,009 465 3,474

Contributions by

and distributions

to owners

Share repurchase (512) - 512 - - -

Consideration paid

on share purchase - - - - (410) (410)

----------- ---------- ------------ ------------ --------- --------

(512) - 512 - (410) (410)

----------- ---------- ------------ ------------ --------- --------

At 30(th) June 2016 10,339 504 3,617 3,009 (3,518) 13,951

Comprehensive income

for the period

Profit for the year - - - - 696 696

Other comprehensive

income for the year - - - - (384) (384)

----------- ---------- ------------ ------------ --------- --------

- - - - 312 312

Contributions by

and distributions

to owners

Dividend Paid - - - - (620) (620)

=========== ========== ============ ============ ========= ========

At 31(st) December

2016 10,339 504 3,617 3,009 (3,826) 13,643

=========== ========== ============ ============ ========= ========

Note

BASIS OF PREPARATION AND

ACCOUNTING POLICIES

The financial information for the six month periods

ended 31(st) December 2016 and 31(st) December 2015

has not been audited and does not constitute full

financial statements within the meaning of Section

434 of the Companies Act 2006.

The financial information relating to the year ended

30th June 2016 does not constitute full financial

statements within the meaning of Section 434 of the

Companies Act 2006. This information is based on the

group's statutory accounts for that period. The statutory

accounts were prepared in accordance with International

Financial Reporting Standards as adopted by the European

Union ("IFRS") and received an unqualified audit report

and did not contain statements under Section 498(2)

or (3) of the Companies Act 2006. These financial

statements have been filed with the Registrar of Companies.

These interim financial statements have been prepared

using the recognition and measurement principles of

International Financial Reporting Standards as adopted

by the European Union ("IFRS"). The accounting policies

used are the same as those used in preparing the financial

statements for the year ended 30th June 2016. These

policies are set out in the annual report and accounts

for the year ended 30th June 2016 which is available

on the company's website www.aireaplc.co.uk.

Further copies of this report are available from the

Company Secretary at the registered office at Victoria

Mills, The Green, Ossett, Wakefield, West Yorkshire

WF5 0AN.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SEUFASFWSEDE

(END) Dow Jones Newswires

February 21, 2017 02:00 ET (07:00 GMT)

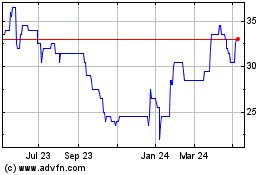

Airea (LSE:AIEA)

Historical Stock Chart

From Mar 2024 to Apr 2024

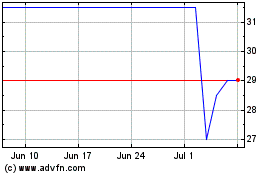

Airea (LSE:AIEA)

Historical Stock Chart

From Apr 2023 to Apr 2024