TIDMAIEA

RNS Number : 9625G

Airea PLC

10 March 2015

AIREA PLC

Interim report for the six months ended 31 December 2014

The principal activity of the group is the manufacturing,

marketing and distribution of floor coverings.

Chairman's statement

It is pleasing to report that the success achieved in the second

half of the last financial year has been maintained and the dip in

sales seen in the first half of last year has been reversed.

The retail market in the UK continues to be challenging, however

there have been some signs of improved consumer confidence.

Statistics for the UK non-residential construction sectors that we

serve showed modest growth in refurbishment and maintenance work, a

flat picture on private new build, and public sector new build

remaining in negative territory. This picture of market conditions

in the UK, combined with strengthening sterling and continuing

difficulties in the Eurozone economies, meant that we continue to

operate in a fiercely competitive and difficult environment.

It is therefore encouraging that our strategy of strengthening

our product portfolio, investing in our sales resource and the

relentless pursuit of service improvements and efficiency gains has

delivered a promising advance in financial performance.

Group results

Revenue for the period was GBP13.5m (2013: GBP11.6m). The

operating profit was GBP700,000 (2013: GBP222,000). After charging

pension related finance costs of GBP215,000 (2013:GBP200,000) and

the appropriate tax charge the net profit for the period was

GBP371,000 (2013: GBP16,000). Basic earnings per share were 0.80p

(2013: 0.03p).

Operating cash flows before movements in working capital were

GBP1.1m (2013: GBP0.6m). Working capital increased by GBP400,000

(2013: GBP373,000) due to timing of payments to suppliers. Payment

of GBP115,000 was made in line with the provision made at the year

end in full and final settlement of a dilapidations dispute

concerning properties vacated in 2011. Contributions to the defined

benefit pension scheme were GBP200,000 (2013 GBP200,000), in line

with the agreement reached with the scheme trustees following the

last triennial valuation as at 1(st) July 2011. Capital expenditure

of GBP136,000 (2013: GBP113,000) was focussed on productivity

improvements and supporting new product launches.

Outlook

The Board does not detect any fundamental changes in the outlook

for the markets that we serve, and competition for business is

likely to remain intense. As a result the board has resolved to

determine the level of dividend at the year end, and there will not

be a dividend payment at the interim stage.

Martin Toogood

Chairman

10 March 2015

Enquiries:

Neil Rylance 01924 266561

Chief Executive Officer

Roger Salt 01924 266561

Group Finance Director

Richard Lindley 0113 388 4789

N+1 Singer

Consolidated Income

Statement

6 months ended 31st

December 2014

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

31st 31st 30th

December December June

2014 2013 2014

GBP000 GBP000 GBP000

Revenue 13,514 11,555 23,342

Operating costs (12,814) (11,333) (22,736)

Operating profit 700 222 606

Finance income 1 2 3

Finance costs (215) (200) (279)

---------- ---------- ------------

Profit before taxation 486 24 330

Taxation (115) (8) (29)

----------

Profit attributable

to shareholders of

the group 371 16 301

========== ========== ============

Earnings per share

(basic and diluted) 0.80p 0.03p 0.65p

All amounts relate

to continuing operations

Consolidated Statement of

Comprehensive Income

6 months ended 31st

December 2014

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

31st 31st 30th

December December June

2014 2013 2014

GBP000 GBP000 GBP000

Profit attributable

to shareholders of

the group 371 16 301

Actuarial loss recognised

in the pension scheme - - (189)

Related deferred

taxation - - (73)

Total comprehensive

income attributable

to shareholders of

the group 371 16 39

========== ========== ============

Consolidated Balance

Sheet

as at 31st December Unaudited Unaudited Audited

2014

31st 31st 30th

December December June

2014 2013 2014

GBP000 GBP000 GBP000

Non-current assets

Property, plant and

equipment 5,427 6,165 5,704

Deferred tax asset 1,288 1,476 1,323

6,715 7,641 7,027

---------- ---------- ------------

Current assets

Inventories 10,358 8,723 10,220

Trade and other receivables 3,832 3,205 4,313

Cash and cash equivalents 1,915 2,406 1,930

---------- ---------- ------------

16,105 14,334 16,463

---------- ---------- ------------

Total assets 22,820 21,975 23,490

---------- ---------- ------------

Current liabilities

Trade and other payables (4,457) (3,797) (5,121)

Provisions - - (115)

---------- ---------- ------------

(4,457) (3,797) (5,236)

---------- ---------- ------------

Non-current liabilities

Pension deficit (5,776) (5,668) (5,761)

Deferred tax (1) (41) (1)

(5,777) (5,709) (5,762)

---------- ---------- ------------

Total liabilities (10,234) (9,506) (10,998)

---------- ---------- ------------

12,586 12,469 12,492

========== ========== ============

Equity

Called up share capital 11,561 11,561 11,561

Share premium account 504 504 504

Capital redemption

reserve 2,395 2,395 2,395

Retained earnings (1,874) (1,991) (1,968)

12,586 12,469 12,492

========== ========== ============

Consolidated Cash

Flow Statement

6 months ended 31st Unaudited Unaudited Audited

December 2014

6 months 6 months year

ended ended ended

31st 31st 30th

December December June

2014 2013 2014

GBP000 GBP000 GBP000

Operating activities

Profit attributable

to shareholders of

the group 371 16 301

Tax charged 115 8 29

Finance costs 214 198 276

Depreciation 413 377 877

---------- ---------- ------------

Operating cash flows

before movements

in working capital 1,113 599 1,483

Increase in working

capital (400) (373) (1,633)

(Decrease) / increase

in provisions for

liabilities and charges (115) 115

Contributions to

defined benefit pension

scheme (200) (200) (375)

---------- ---------- ------------

Cash generated from

operations 398 26 (410)

---------- ---------- ------------

Investing activities

Purchase of property,

plant and equipment (136) (113) (153)

---------- ---------- ------------

Financing activities

Equity dividends

paid (277) (254) (254)

---------- ---------- ------------

Net decrease in cash

and cash equivalents (15) (341) (817)

Cash and cash equivalents

at start of period 1,930 2,747 2,747

Cash and cash equivalents

at end of period 1,915 2,406 1,930

========== ========== ============

Consolidated Statement of

Changes in Equity

6 months ended 31st

December 2014

Share Share Capital Retained Total

capital premium redemption Earnings equity

account reserve

GBP000 GBP000 GBP000 GBP000 GBP000

At 1st July 2013 11,561 504 2,395 (1,753) 12,707

Profit attributable

to shareholders of

the group - - - 16 16

Dividend paid - - - (254) (254)

---------- ---------- ------------ ---------- --------

At 1st January 2014 11,561 504 2,395 (1,991) 12,469

Profit attributable

to shareholders of

the group - - - 285 285

Other comprehensive

income for the period - - - (262) (262)

At 1st July 2014 11,561 504 2,395 (1,968) 12,492

Profit attributable

to shareholders of

the group - - - 371 371

Dividend paid - - - (277) (277)

At 31st December

2014 11,561 504 2,395 (1,874) 12,586

========== ========== ============ ========== ========

Note

BASIS OF PREPARATION

AND ACCOUNTING POLICIES

The financial information for the six month periods

ended 31(st) December 2014 and 31(st) December 2013

has not been audited and does not constitute full financial

statements within the meaning of Section 434 of the

Companies Act 2006.

The financial information relating to the year ended

30th June 2014 does not constitute full financial statements

within the meaning of Section 434 of the Companies Act

2006. This information is based on the group's statutory

accounts for that period. The statutory accounts were

prepared in accordance with International Financial

Reporting Standards as adopted by the European Union

("IFRS") and received an unqualified audit report and

did not contain statements under Section 498(2) or (3)

of the Companies Act 2006. These financial statements

have been filed with the Registrar of Companies.

These interim financial statements have been prepared

using the recognition and measurement principles of

International Financial Reporting Standards as adopted

by the European Union ("IFRS"). The accounting policies

used are the same as those used in preparing the financial

statements for the year ended 30th June 2014. These

policies are set out in the annual report and accounts

for the year ended 30th June 2014. The interim and annual

reports are available on the company's website at www.aireaplc.co.uk.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR MMGGFRLZGKZM

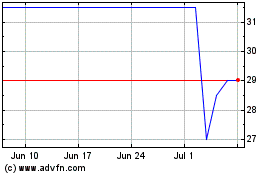

Airea (LSE:AIEA)

Historical Stock Chart

From Mar 2024 to Apr 2024

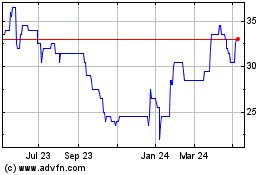

Airea (LSE:AIEA)

Historical Stock Chart

From Apr 2023 to Apr 2024