Air Products & Chemicals Walks Away From Bid for Yingde Gases

March 24 2017 - 8:06AM

Dow Jones News

By Joshua Jamerson

Industrial gas maker Air Products & Chemicals Inc. backed

away from its bid to buy China's Yingde Gases Group Co.

In a brief securities filing Friday morning, the Allentown,

Penn.-based company said that "it has determined it is not in the

best interests of Air Products' shareholders to continue to pursue

an acquisition" at this time. A representative from Yingde could

not immediately be reached for comment.

Yingde's stock fell 4.4% to HK$6.26 in Hong Kong, while Air

Products shares were inactive in premarket trading ahead of the

opening in New York.

Air Products, in a nonbinding bid, had offered up to $1.5

billion for Yingde, a price that would have made a deal the largest

takeover of a Chinese firm by an American buyer. After a year when

Chinese companies bought record numbers of American firms, Air

Products & Chemicals' offer was a rare shot for a U.S. company

to get a big takeover in China.

The Wall Street Journal early last week reported that Air

Products' might have to give up on making a deal. Hong Kong-based

private-equity company PAG, led by seasoned deal maker Weijian

Shan, swooped in with a rival bid, and Yingde's three biggest

shareholders, owning around 42% of the company, agreed to accept

the offer, unless there is a better bid. PAG offered six Hong Kong

dollars a share for Yingde and its stock has been trading above

that mark since the start of the month.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

March 24, 2017 07:51 ET (11:51 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

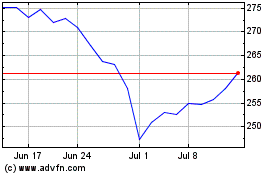

Air Products and Chemicals (NYSE:APD)

Historical Stock Chart

From Mar 2024 to Apr 2024

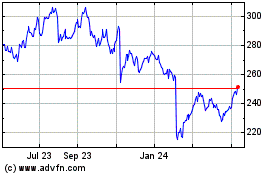

Air Products and Chemicals (NYSE:APD)

Historical Stock Chart

From Apr 2023 to Apr 2024